NASDAQ:AMZN Stock Drops After Earnings – Is Amazon on the Verge of a Major Rally?

Amazon Reports an 86% Operating Profit Growth – Why Is the Market Still Selling Off? | That's TradingNEWS

Why Is NASDAQ:AMZN Falling Despite Strong Earnings?

Amazon (NASDAQ:AMZN) posted a stellar Q4 2024 earnings report, yet the stock is trading lower, down 3% post-earnings as cautious guidance for Q1 2025 sparked investor concerns. Despite the short-term market reaction, Amazon’s core fundamentals remain stronger than ever, with operating income surging 86% YoY to $68.6 billion. The company continues to prove its ability to scale profits aggressively, particularly with Amazon Web Services (AWS) contributing $39.8 billion in operating profits, a 62% YoY increase. Investors are now left wondering: Is this dip a prime buying opportunity, or are more headwinds ahead?

Amazon Web Services (AWS) Powers Growth – Will Cloud Profits Push AMZN Stock Higher?

AWS remains Amazon’s crown jewel, driving nearly 50% of total operating profits. While Amazon’s North American eCommerce segment saw a strong 10% YoY sales increase, it was AWS that dominated, growing 19% YoY and expanding margins to 37%. The cloud division’s growth is largely fueled by AI-driven services, including the recent launch of Amazon Nova, an enterprise-focused AI foundation model for image and video generation. AWS continues to expand globally, adding new cloud regions in Mexico and Thailand, ensuring sustained revenue acceleration. The key question for investors: Can AWS maintain its aggressive growth trajectory, or is a cloud computing slowdown looming?

Amazon’s E-Commerce Division Faces Cost Pressures – Will Margins Keep Expanding?

Amazon’s North American eCommerce division delivered $115.6 billion in sales, up 10% YoY, while international sales grew 8% YoY to $43.4 billion. However, the company’s focus on cost optimization and automation has been the real driver of profitability. Amazon’s operating margin jumped to 11.9% in Q4, reflecting the company’s ability to cut costs while maintaining growth. With logistics and fulfillment improvements, Amazon’s eCommerce profitability has increased by 68% YoY, a massive shift from prior years when margins were razor-thin. But with global economic uncertainty, can Amazon sustain its eCommerce profit expansion, or will rising costs and competition impact future results?

Amazon’s Advertising Business Becomes a Powerhouse – Is AMZN Now a Blue Chip Stock?

One of Amazon’s fastest-growing segments is advertising, which generated $17.3 billion in Q4 2024, reflecting an 18% quarterly growth rate. Amazon’s ad revenue is now larger than Google’s YouTube, proving its dominance in the digital ad space. With a highly engaged consumer base and unmatched data from its platform, Amazon’s advertising business is positioned to continue its rapid expansion. Alongside $11.5 billion in subscription revenue, including Prime memberships, the company is diversifying beyond traditional eCommerce. Given its multiple high-margin revenue streams, is Amazon evolving into a "Blue Chip 2.0" stock that offers both stability and explosive growth potential?

Why Did Amazon Issue Weak Q1 2025 Guidance? Is the Market Overreacting?

Amazon projected Q1 2025 revenue between $151.0 billion and $155.5 billion, reflecting 5%-9% YoY growth—below Wall Street’s estimate of $158.56 billion. However, management highlighted two major factors impacting guidance:

- A $2.1 billion foreign exchange headwind due to a strong U.S. dollar.

- A $1.5 billion impact from the prior year's leap year, creating an artificial comparison issue.

Neither factor reflects a fundamental weakness in Amazon’s core business. In fact, Amazon’s long-term growth remains intact, with double-digit sales increases across multiple segments. The market’s initial sell-off appears to be a short-term reaction, rather than a reflection of any structural slowdown. Is this an overreaction that presents a buying opportunity before the next leg higher?

Insider Transactions – Are Amazon Executives Buying or Selling?

Amazon’s latest insider transaction data provides key insights into how executives view the stock’s valuation. Recent trends show a mix of buying and selling, with some insiders taking profits after a massive 86% operating income increase in 2024. Investors can track the latest Amazon insider trades here to assess whether management sees further upside in AMZN stock.

Is NASDAQ:AMZN Stock a Buy, Sell, or Hold? Key Price Levels to Watch

Amazon’s price-to-earnings (P/E) ratio currently stands at 33x forward earnings, compared to Apple’s 31x and Microsoft’s 35x. Despite its high valuation, Amazon is growing much faster than Apple, with double-digit revenue growth and operating income skyrocketing 86% YoY. Analysts forecast Amazon’s EPS to rise to $7.59 by 2026, implying a 21% YoY profit growth acceleration.

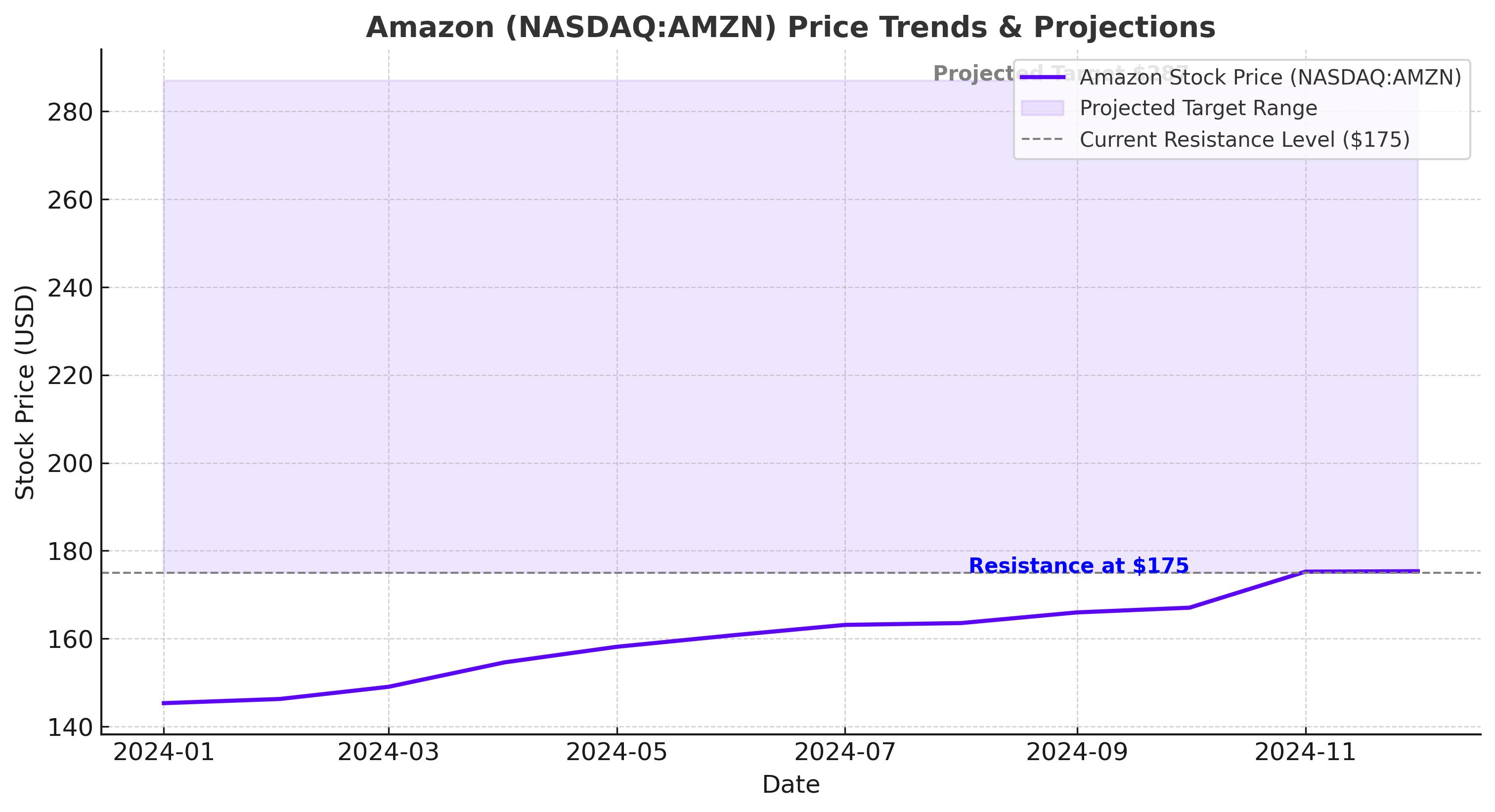

- Key support level: $145 – A breakdown could trigger a deeper correction.

- Major resistance level: $175 – A breakout above this level could push AMZN to new highs.

- Projected upside: Analysts see a 12-month target of $287, reflecting a potential 25%+ upside from current levels.

With AWS leading profitability, advertising and subscription services expanding, and cost efficiencies improving eCommerce margins, Amazon remains one of the strongest long-term investments in the tech sector. Investors must now decide: Is this dip the perfect buying opportunity before Amazon surges past $175, or will short-term macro concerns keep pressure on the stock?

Final Verdict – Is Amazon (NASDAQ:AMZN) a Buy Before the Next Big Rally?

Despite the post-earnings dip, Amazon remains one of the most compelling long-term investments in the market. AWS continues to generate massive profits, eCommerce margins are expanding, and advertising is now a dominant revenue driver. While weak Q1 2025 guidance initially spooked investors, the factors behind it appear temporary rather than a signal of deeper trouble. With analysts forecasting $287 per share within the next year, this pullback may be one of the last great buying opportunities before Amazon resumes its uptrend. Investors willing to look beyond short-term volatility may find NASDAQ:AMZN stock undervalued at current levels.

That's TradingNEWS

Read More

-

CGDV ETF at $44.17 Targets $52 as Dividend Value and AI Leaders Drive 2026 Upside

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: $2.20 XRP and $1.6B Inflows Drive 2026’s Hottest Crypto Trade

07.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Rebounds to $3.48 as Market Eyes EIA Storage Shock

07.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.6 as BoJ Hawkish Shift Collides With Fed Cut Expectations

07.01.2026 · TradingNEWS ArchiveForex