NASDAQ:AVGO – Is Broadcom’s Sell-Off a Massive Buying Opportunity or a Warning Sign?

Broadcom (NASDAQ:AVGO) Faces Heavy Selling—Is the Market Overreacting?

Broadcom Inc. (NASDAQ:AVGO) just witnessed one of its worst sell-offs in recent memory, plunging 17% in a single session, mirroring the broader tech pullback driven by fears over DeepSeek AI’s impact on the semiconductor industry. Yet, despite the panic, the underlying fundamentals remain exceptionally strong. The company is on track to generate over $61 billion in revenue for 2025, growing at 12% year-over-year, driven by AI-related demand and robust infrastructure software growth.

This pullback raises a crucial question—is Broadcom’s dominance in AI hardware truly under threat, or is this a rare opportunity to scoop up AVGO at a discount?

AI Demand Remains Broadcom’s Growth Engine—Is DeepSeek Really a Threat?

The DeepSeek AI revelation, which demonstrated that a low-cost AI model could challenge U.S.-developed platforms, sent shockwaves through the market. But the reality is that DeepSeek was trained using Nvidia’s (NASDAQ:NVDA) H800 GPUs, not some alternative Chinese-manufactured solution. That means companies like Broadcom, which provide custom AI chips and networking solutions to hyperscalers, remain absolutely essential.

With Meta (NASDAQ:META) increasing its AI-related CapEx to $65 billion in 2025 and other cloud giants rapidly scaling their AI infrastructure, Broadcom is in prime position to capitalize on this growth, not suffer from it. The company’s custom AI chip solutions, networking products, and AI-driven semiconductor demand remain critical for scaling AI workloads efficiently.

This is not a threat to Broadcom’s business model—it’s an opportunity.

Broadcom’s Financial Strength: AI Revenue Set to Surge 65% in 2025

Despite the market panic, Broadcom’s core business is booming. The company’s semiconductor revenue, which makes up nearly 58% of total sales, continues to expand. AI-related revenues alone are expected to grow 65% year-over-year, reaching $3.8 billion in Q1 2025.

In 2024, Broadcom reported:

- Total revenue: $51.6 billion (+44% YoY, driven by the VMware acquisition)

- Organic revenue growth: 9% (excluding VMware, still a strong number)

- Gross margins: 77%–78% expected for 2025, showcasing pricing power

- Infrastructure software revenue: +181% YoY, proving the VMware integration is a major growth driver

Broadcom’s core revenue mix is also shifting towards high-margin subscription revenue, reducing volatility and providing more predictable cash flows.

Technical Analysis: Oversold and Ready to Rebound?

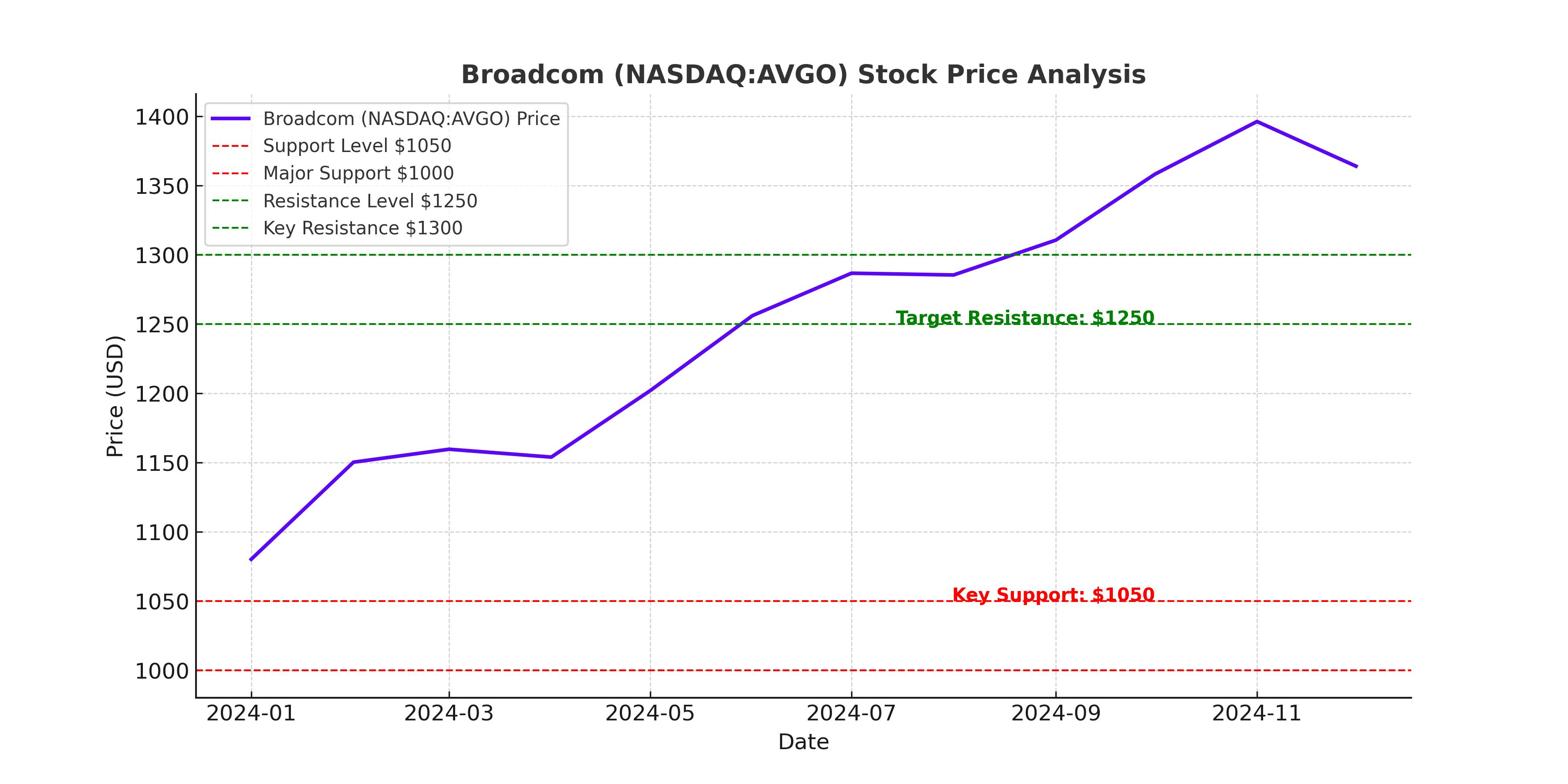

Broadcom’s stock crashed straight into its 50-day moving average, a level that has historically acted as strong support. The Relative Strength Index (RSI) fell to 41, a drastic decline from near 70 just a few days ago, indicating a rapid sentiment shift.

This kind of deep sell-off in a fundamentally strong stock often presents an excellent buying opportunity. The stock has rebounded 10% off its lows, showing that buyers are stepping in.

If the stock holds above $1,100, a recovery toward $1,250–$1,300 is likely. If it breaks below $1,050, the next major support level is around $1,000.

Valuation: Broadcom Is Now Cheaper Than Nvidia

Broadcom’s recent price drop has made it one of the more attractively priced semiconductor giants in the AI space. Its forward P/E ratio sits at 27x, lower than Nvidia’s 28x, despite Nvidia’s higher volatility and greater risk of margin compression.

Other valuation metrics also show Broadcom is undervalued:

- Forward PEG ratio: 1.5, compared to the tech sector median of 1.81 (indicating it’s undervalued relative to growth)

- EV/EBITDA: 26.6x, slightly higher than the five-year average but justified by the AI-driven revenue expansion

Simply put, the stock’s current valuation doesn’t reflect the company’s robust growth, expanding margins, and dominance in AI infrastructure.

The VMware Factor: Long-Term Growth Beyond Semiconductors

Broadcom’s $61 billion VMware acquisition in 2023 has drastically transformed its business model. The company’s infrastructure software segment, which grew 181% YoY, is now a major revenue driver.

Unlike semiconductor sales, which can be cyclical, VMware’s software subscriptions provide Broadcom with recurring revenue, boosting long-term stability. This shift is significantly improving margins and diversifying the company’s income streams.

Investors worried about Broadcom being "just another AI chipmaker" are missing the bigger picture—this is now a hybrid semiconductor + enterprise software company with a growing moat.

Stock Buybacks and Cash Reserves Add More Upside

Broadcom’s cash pile is set to hit $63.5 billion in 2025, providing flexibility for further share buybacks. Historically, the company has aggressively returned cash to shareholders, and another major buyback program could be on the horizon.

With free cash flow growing 25% annually, Broadcom has plenty of room to fund acquisitions, increase dividends, and execute more buybacks.

Is Broadcom a Buy, Sell, or Hold?

The market panic around DeepSeek is overblown, and Broadcom’s fundamentals remain exceptionally strong. AI-driven demand isn’t slowing—it’s accelerating, and Broadcom is a critical piece of that growth.

At a 27x forward P/E, 65% AI revenue growth, and strong support at the 50-day moving average, this sell-off looks like a massive buying opportunity.

Price Target:

- Base case: $1,250–$1,300 in 2025 (+20% upside)

- Bull case: $1,400 if AI demand accelerates (+35% upside)

- Bear case: $1,000 if macro conditions worsen (-10% downside)

Verdict: BUY THE DIP. Broadcom’s AI business is booming, and the sell-off presents an opportunity, not a risk.