NASDAQ:FOX Analysis - Fox Financial Health and Market Position in 2024

Exploring FOX's Market Performance, Financial Fundamentals, and Strategic Investments Amid Evolving Media Dynamics | That's TradingNEWS

Analyzing Fox Corporation's Financial Health and Market Position

In the rapidly evolving media landscape, Fox Corporation (NYSE:FOX) stands as a notable entity, navigating through challenges and seizing growth opportunities. This analysis delves into FOX's recent performance, market dynamics, and strategic positioning, backed by comprehensive data and insights to understand its future trajectory.

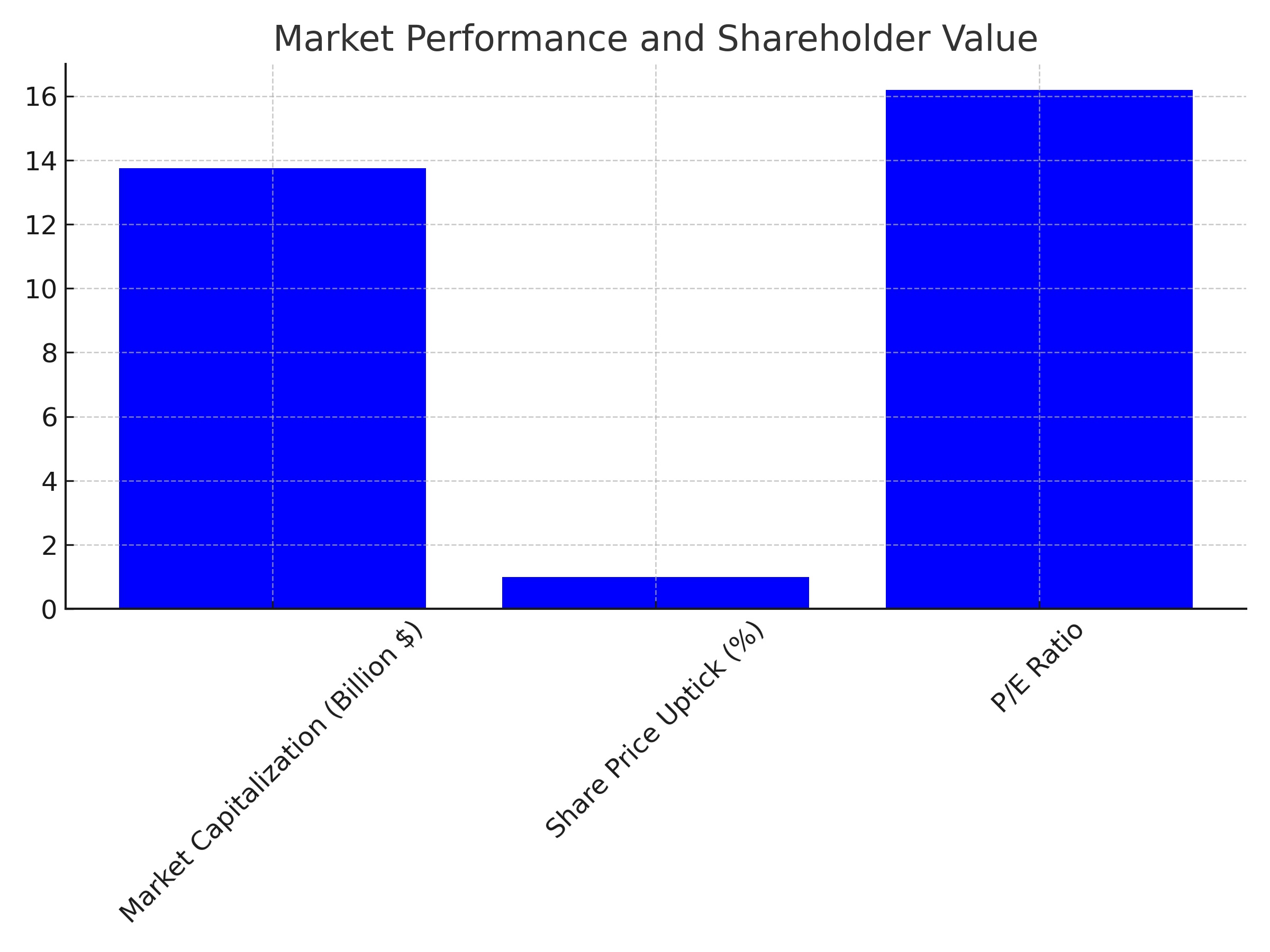

Market Performance and Shareholder Value

Recently, FOX has shown resilience in the face of market fluctuations, with its share price witnessing a modest uptick of 0.99% to close at $27.68. This movement reflects investor confidence and the company's robust strategies to maintain its market position. As of the latest figures, FOX boasts a market capitalization of $13.755 billion, a testament to its significant presence in the media industry.

Institutional investors have demonstrated their faith in FOX's strategic direction, with notable entities like Vanguard Group Inc. and BlackRock Inc. increasing their holdings, signaling strong market belief in FOX's long-term value. Such movements underscore the company's ability to attract and retain discerning institutional stakeholders.

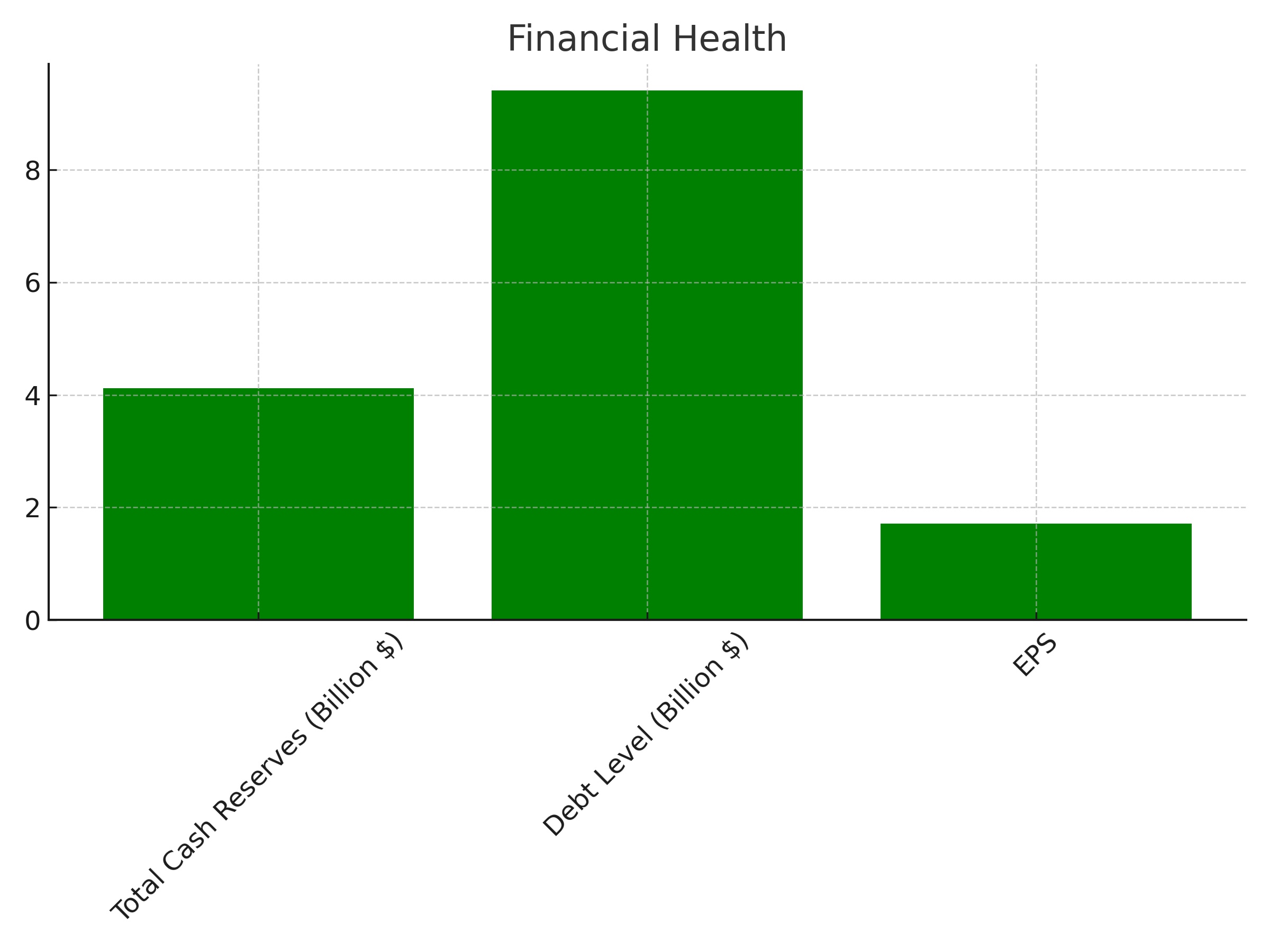

Financial Fundamentals: A Closer Look

FOX's financial health is a critical aspect of its overall assessment. With a trailing Price-to-Earnings (P/E) ratio of 16.19, FOX is positioned as a potentially attractive investment compared to its industry peers. This metric, coupled with an EPS (Earnings Per Share) of 1.71, provides insights into the company's profitability and earnings quality.

The company's balance sheet further reveals a solid liquidity position, with total cash reserves amounting to $4.12 billion. This liquidity is crucial for FOX to navigate short-term obligations and invest in growth opportunities. However, a debt level of $9.41 billion necessitates a nuanced understanding of its financial leverage and its impact on future profitability and operational flexibility.

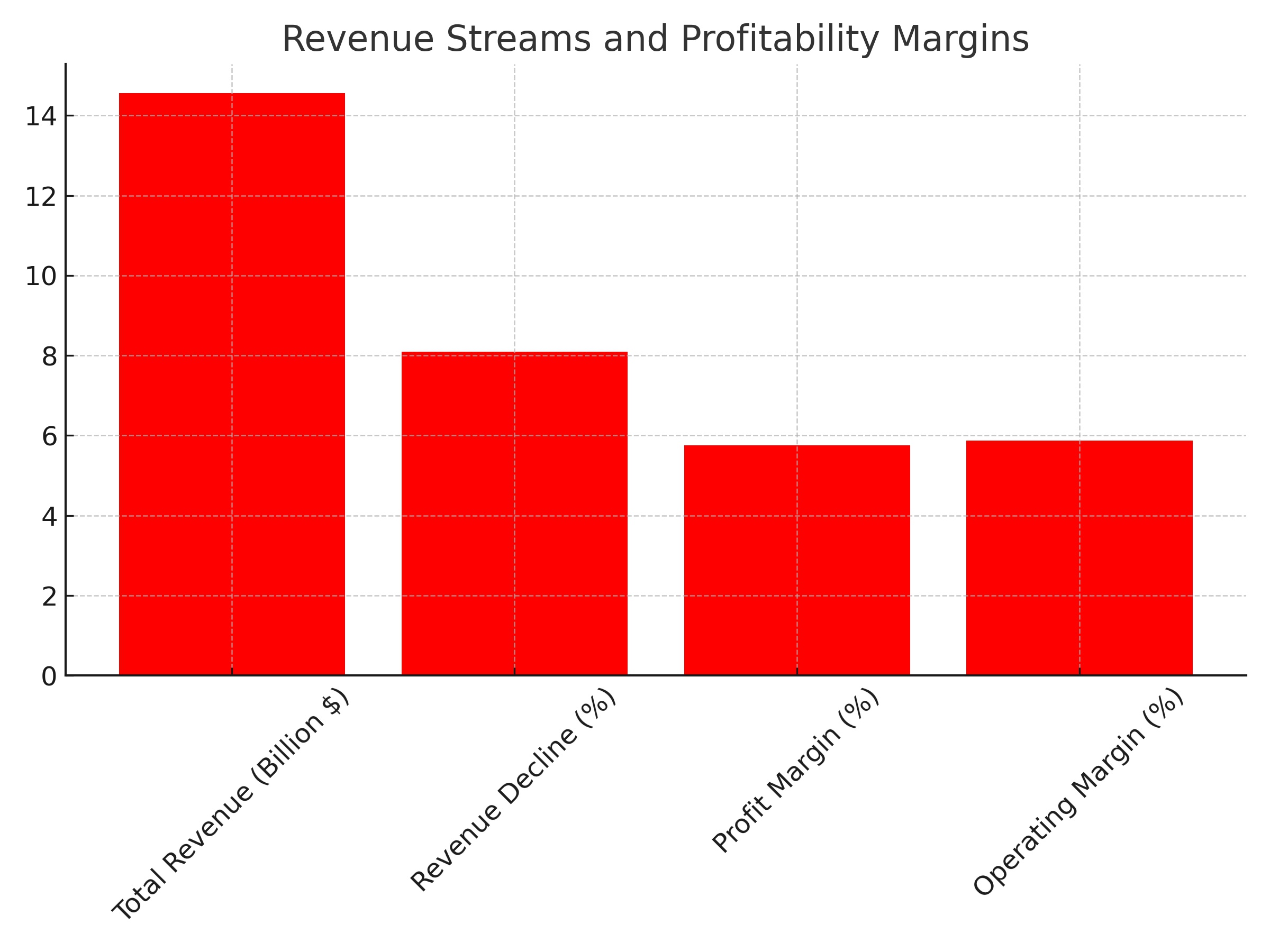

Revenue Streams and Profitability Margins

FOX's revenue generation capabilities and profitability margins are central to its financial analysis. The company reported a total revenue of $14.56 billion in the trailing twelve months, with a noted quarterly revenue decline of 8.10%. This decline prompts a deeper exploration of the revenue streams and market conditions affecting FOX's performance.

Despite the revenue dip, FOX's profitability margins remain a highlight. With a profit margin of 5.75% and an operating margin of 5.88%, FOX demonstrates its ability to convert revenue into net income efficiently. These figures are indicative of effective cost management and operational efficiency.

Strategic Investments and Insider Transactions

The strategic decisions made by FOX's management are pivotal to its future growth. Institutional investments have been increasing, signifying confidence in the company's strategic direction. For those looking to delve deeper into FOX's strategic moves and insider transactions, resources like TradingNews.com offer detailed insights, allowing investors to gauge the confidence of those closest to the company's operational helm.

Future Outlook: Challenges and Opportunities

Looking ahead, FOX faces a complex media landscape marked by rapid technological changes and shifting consumer preferences. The company's ability to adapt to digital transformation and capitalize on emerging content consumption trends will be crucial. Furthermore, the strategic management of its debt and leveraging its strong cash position for growth initiatives will determine its long-term success and ability to deliver shareholder value.

In summary, Fox Corporation (NYSE:FOX) presents a nuanced investment opportunity, marked by solid financial fundamentals, strategic institutional backing, and a challenging yet opportunistic market environment. Investors and stakeholders will do well to monitor FOX's strategic initiatives and market positioning closely, as these factors will significantly influence its trajectory in the dynamic media sector.

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex