NASDAQ:INTC Faces a Crossroads – AI Disruption, ARM Threats & CEO Shakeup

Intel battles AI market shifts, investor uncertainty, and its own foundry struggles. Can it recover and reclaim its status, or is the rise of ARM and NVIDIA sealing its fate? | That's TradingNEWS

NASDAQ:INTC Faces a Crossroads – AI Disruption, ARM Threats & CEO Shakeup

Intel’s Leadership Crisis: The Impact of CEO Shakeup on NASDAQ:INTC

Intel (NASDAQ:INTC) finds itself at a turning point, grappling with internal leadership shifts and external competitive threats that could define its trajectory for years to come. The forced departure of CEO Pat Gelsinger has left investors uncertain about the company's future direction. Gelsinger's departure signals potential restructuring moves, with many speculating whether Intel will spin off its unprofitable foundry business to focus purely on product development. However, this comes with a significant caveat—Intel’s integrated strategy of developing both cutting-edge semiconductor products and maintaining its foundry operations has historically been the core of its identity. The challenge now lies in whether Intel can sustain both or if investors will push for a breakup.

Senior analyst Alvin Nguyen highlights that Intel’s strength has always been in the synergy between its product development and foundry operations. However, with both struggling, that synergy is failing to materialize, leaving Intel vulnerable. The company's recent exclusion from the Dow Jones Industrial Average in favor of NVIDIA (NASDAQ:NVDA) is another blow, highlighting just how much the market has shifted away from Intel’s once-dominant position.

The Rise of AI Inference & Intel's AI Strategy

While Intel has made strides in AI, the company has failed to capture the momentum enjoyed by NVIDIA and AMD (NASDAQ:AMD). AI training has been the primary driver of the AI semiconductor market, with NVIDIA’s CUDA ecosystem dominating. However, a shift is occurring in AI compute needs, as inference—the process of running trained AI models—becomes more critical. This shift presents an opportunity for Intel, but also a massive challenge as NVIDIA and AMD are already making significant inroads.

Intel’s Gaudi AI accelerators were supposed to be the company’s answer to the AI boom, yet they have failed to gain serious market traction. Meanwhile, DeepSeek, a Chinese AI firm, has demonstrated how AI models can run efficiently with lower compute costs, further raising doubts about whether the industry needs massive AI compute clusters at the scale initially projected. If AI inference continues gaining traction over training, Intel could see some upside, but its execution must be flawless.

ARM-Based CPUs Are Reshaping the Market: The Threat to x86 Dominance

Intel’s core business—x86 CPUs—faces existential threats from ARM-based processors. Apple (NASDAQ:AAPL) has successfully transitioned to its M-series chips, while Qualcomm (NASDAQ:QCOM) and NVIDIA are both developing ARM-based PC chips. The PC market is still largely dependent on x86, but ARM’s increasing efficiency and cost-effectiveness are shifting the landscape.

Intel still dominates the server CPU market with a 75% share, but AMD is rapidly closing in with its EPYC Turin chips, while ARM-based alternatives from Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOG), and Microsoft (NASDAQ:MSFT) are expanding. According to Mercury Research, ARM’s market share in the PC CPU space grew from 3.4% in 2020 to 10.3% in 2024. While x86 still holds a commanding position, Intel's grip is weakening.

Intel’s Foundry Business: The Cash Drain or a Hidden Asset?

The future of Intel’s foundry operations is a major point of debate. The company has invested heavily in its 18A process, which is expected to begin serious production in late 2025. This technology promises industry-leading transistor density and efficiency, but TSMC (NYSE:TSM) remains the undisputed leader in semiconductor manufacturing.

Intel has secured over $3 billion in government funding through the CHIPS Act, giving it some breathing room. However, the foundry business remains a financial drain, with billions in capital expenditures and losses dragging down margins. If Intel can attract major clients beyond its own products, the foundry could become a long-term asset. Otherwise, pressure will mount for a spinoff or divestiture.

Intel’s Q4 2024 Earnings & The Road Ahead

Investors are eagerly awaiting Intel’s Q4 2024 earnings report, set for release on January 30. Analysts expect revenue to grow 4.1% in 2025, marking the first significant recovery after nearly three years of declines. However, the stock remains down nearly 60% from its 2021 peak, reflecting lingering concerns about execution.

Key metrics to watch include:

-

PC CPU sales: Intel’s Lunar Lake and Arrow Lake chips are rolling out, but competition is fierce.

-

Data center segment: AI server demand is surging, but Intel is losing market share to AMD and custom silicon from hyperscalers.

-

Margins & cash flow: Intel needs to show it can rein in costs, particularly as it transitions to its 18A process.

Buy, Sell, or Hold? The Verdict on NASDAQ:INTC

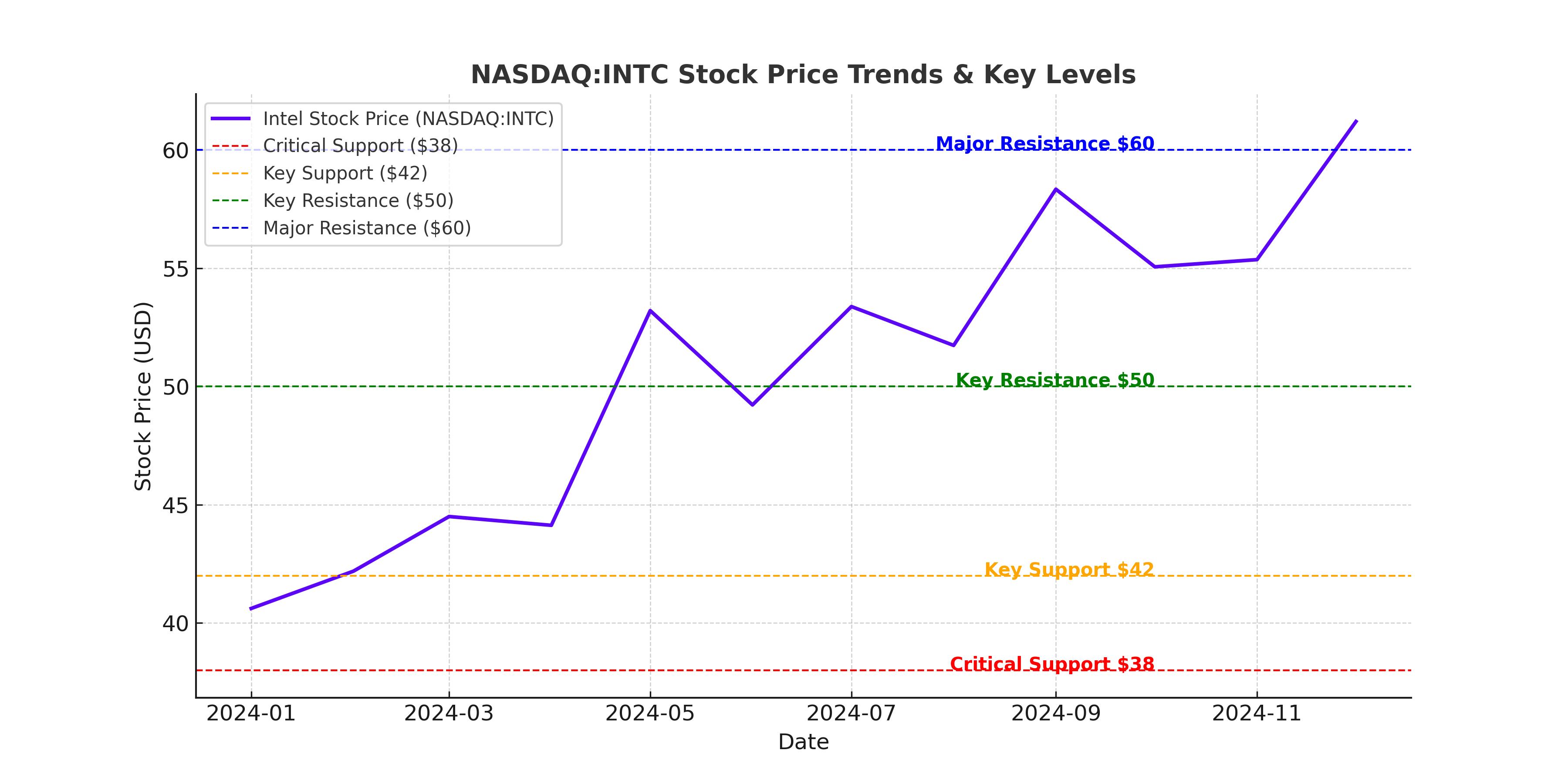

Intel remains a high-risk, high-reward stock at its current price of around $42. On the bullish side, the company still commands massive market share in x86 CPUs and has significant government backing for its foundry ambitions. The AI inference shift could give Intel a lifeline, particularly if demand for AI training slows.

However, the risks are substantial. ARM is gaining ground, NVIDIA dominates AI, and Intel’s foundry business remains a financial black hole unless major clients come aboard. Execution missteps have plagued the company for years, and the recent CEO shakeup adds more uncertainty.

For risk-tolerant investors, Intel could offer upside if it successfully executes on its roadmap. However, until tangible progress is seen in AI, foundry profitability, and x86 competitiveness, NASDAQ:INTC is a Hold, with caution.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex