TikTok Ban: A Strategic Opportunity for NASDAQ:META

The impending TikTok ban, slated for January 19, 2025, represents a seismic shift in the U.S. social media landscape. With TikTok generating over $12.3 billion in U.S. ad revenue in 2024, Meta stands as the primary benefactor of this potential void. Analysts project that Meta’s Instagram and Facebook platforms could capture 39.5% of this revenue, translating into $4.86 billion to $6.4 billion in incremental ad revenue.

Instagram Reels, in particular, is positioned to absorb TikTok’s traffic. Recent metrics indicate that Instagram commands an audience overlap of over 75% with TikTok users in the U.S. Meta’s robust advertising infrastructure and AI-driven content curation make it the prime choice for advertisers reallocating spend. Moreover, the company’s economies of scale ensure that Meta remains a cost-efficient, dominant platform for short-form video content.

NASDAQ:META’s Performance Metrics and Financial Strength

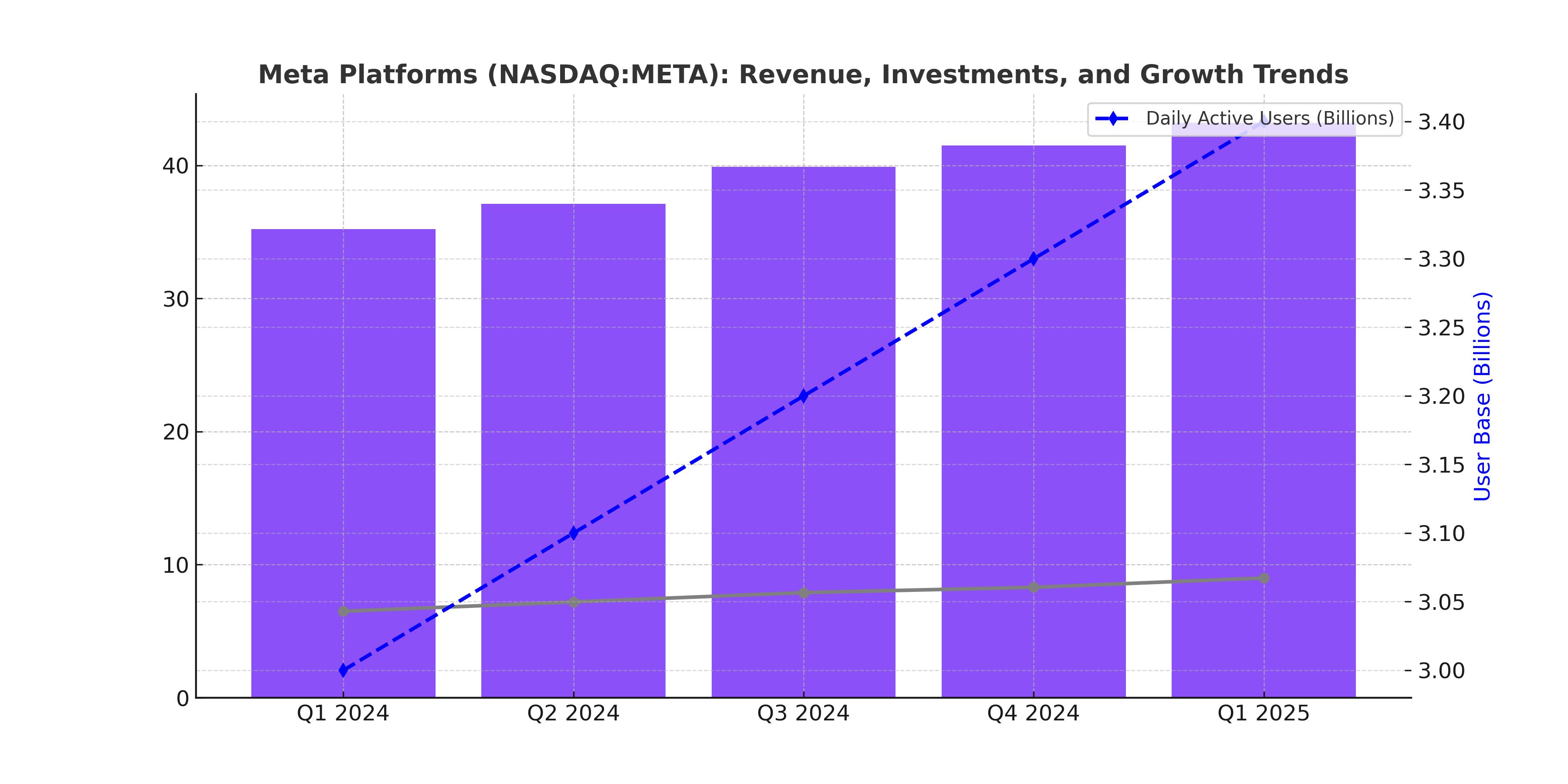

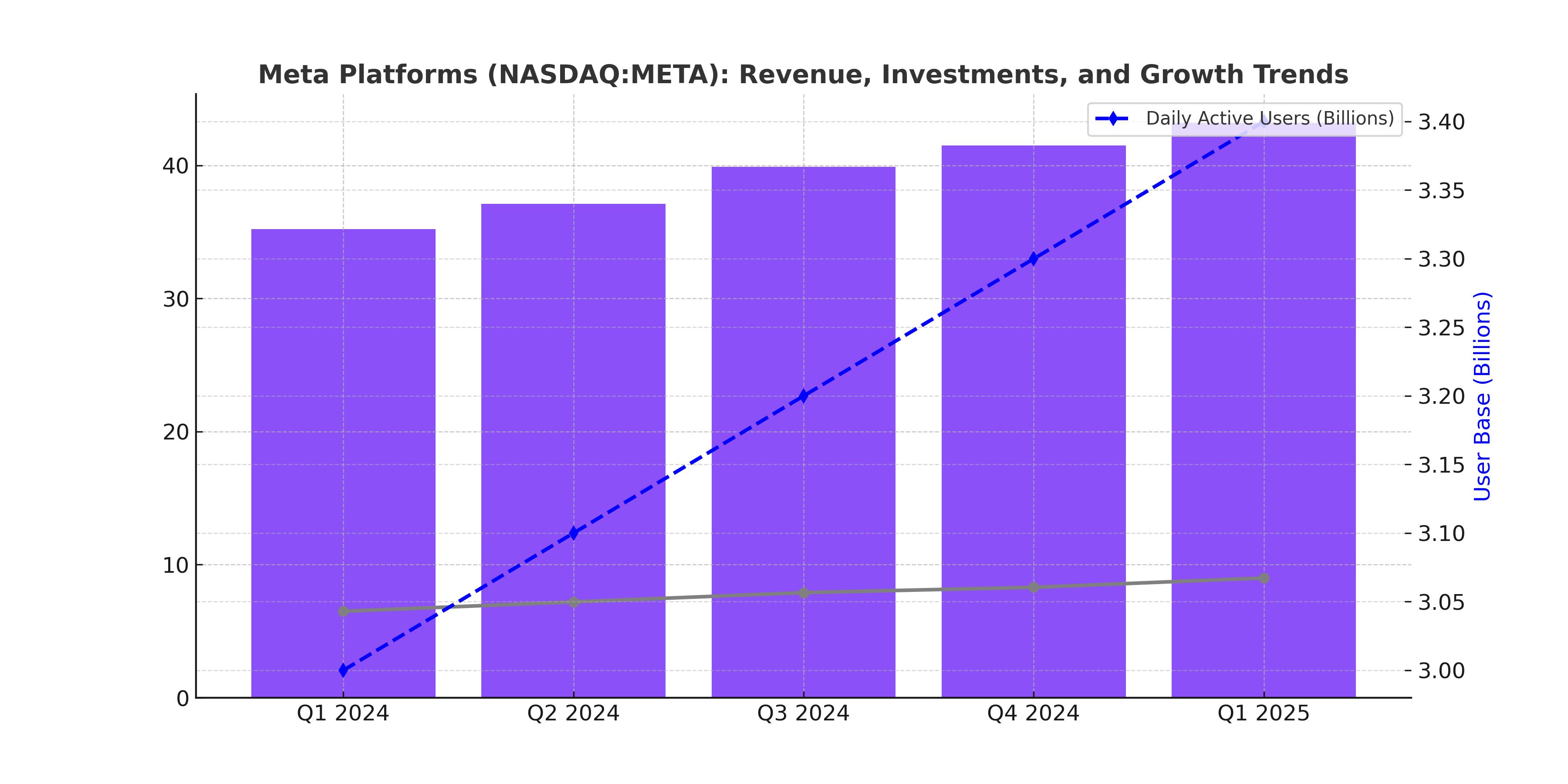

Meta’s Q3 2024 earnings revealed impressive numbers, with revenue growing 19% year-over-year to $40.59 billion. Ad revenue contributed $39.9 billion, showcasing the effectiveness of AI-enhanced ad delivery systems. The company’s net income margin stands at an industry-leading 36%, significantly higher than Google’s 28%, reflecting Meta’s efficient cost management and monetization capabilities.

The company ended the quarter with $70.9 billion in cash and marketable securities, providing a solid foundation for its ambitious AI and infrastructure investments. Despite heavy expenditures, Meta's free cash flow remains robust, enabling it to self-fund growth initiatives.

AI-Driven Growth Through Large Concept Models

Meta's groundbreaking Large Concept Model (LCM) represents a potential paradigm shift in generative AI. Unlike traditional Large Language Models (LLMs) that predict the next token in a sequence, LCMs operate at a conceptual level, mimicking human-like reasoning by predicting the next "concept." This innovation not only enhances efficiency but also has applications across Meta’s platforms, from improved ad targeting to richer user experiences on Instagram Reels and Facebook.

Meta’s LCM could outpace competitors like OpenAI, Microsoft, and Google in advanced reasoning tasks. While these rivals focus on scaling token-based LLMs, Meta’s top-down approach may redefine AI's future, particularly in areas requiring complex planning or multi-step reasoning.

Regulatory Risks and Competition

Despite its promising prospects, NASDAQ:META faces several challenges. Regulatory scrutiny remains a key concern, especially with global debates around data privacy and competition. The European Union’s Digital Markets Act and potential U.S. legislation could impose restrictions on Meta’s advertising practices, limiting its growth potential.

Additionally, while the TikTok ban presents an opportunity, it is not without uncertainties. The Supreme Court could intervene, delaying or altering the ban, and competitors like YouTube Shorts, Snapchat, and emerging platforms could capture portions of TikTok’s displaced user base.

Valuation and Market Position

Meta trades at a forward P/E of 28.65, higher than Alphabet’s 21.4x but justified by its superior growth prospects and profitability. The stock has risen over 62.4% in the past 52 weeks, reflecting strong investor confidence in Meta’s strategic vision. With EBITDA growth of 50% year-over-year, Meta outperforms its peers in profitability metrics, underscoring its resilience and operational efficiency.

Investment Outlook for NASDAQ:META

Meta Platforms, Inc. (NASDAQ:META) offers a robust investment case for long-term growth, driven by its dominant position in social media, cutting-edge AI advancements, and the looming opportunity to capture market share from TikTok’s potential U.S. exit. The stock, currently trading at $312.75 as of the latest close, reflects investor optimism, with a 62% gain over the past 52 weeks. Meta's ability to capitalize on its 3.2 billion daily active users across platforms like Facebook, Instagram, WhatsApp, and Threads underscores its unparalleled reach and revenue potential.

Financially, the company’s ad revenue, which reached $39.9 billion in Q3 2024, highlights its proficiency in monetizing its ecosystem. Its free cash flow of $12.5 billion in the same quarter showcases the strength to self-fund AI and infrastructure initiatives, including the groundbreaking Large Concept Model (LCM). However, it’s worth noting that 98% of Meta’s revenue stems from advertising, leaving the company vulnerable to shifts in regulatory policies or market dynamics. While Meta’s P/E ratio of 28.65 may appear elevated compared to Alphabet’s 21.4x, its superior margin of 36% and consistent double-digit growth in EPS justify the valuation.

Final Thoughts

NASDAQ:META is navigating a pivotal moment, poised to capitalize on transformative opportunities like the TikTok ban and innovative AI developments, including the LCM. These could solidify its position as a leader in the tech sector, driving both user engagement and ad revenue growth. Analysts estimate that Instagram Reels alone could generate an additional $1.9 billion annually if TikTok is banned, with Facebook adding another $1.4 billion. The combined potential upside makes Meta a standout in the Magnificent Seven.

Nevertheless, investors should approach with measured optimism. Challenges such as regulatory scrutiny, reliance on ad revenue, and competition from Amazon, Google, and emerging platforms remain significant. Meta's proven ability to adapt and innovate positions it well for the future, but the path forward will require strategic execution and resilience.

For a closer look at real-time performance and stock movements, visit NASDAQ:META Real-Time Chart.

That's TradingNEWS

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?