NASDAQ:MSTR at $98,536 – A Genius Bitcoin Play or Financial Gamble?

MicroStrategy’s 471,107 BTC Hoard: Can It Justify the Stock’s Wild Valuation? | That's TradingNEWS

NASDAQ:MSTR's High-Stakes Bitcoin Bet: The Ultimate Risk-Reward Play?

How Has MicroStrategy (NASDAQ:MSTR) Built the Largest Bitcoin Treasury on Wall Street?

MicroStrategy (NASDAQ:MSTR) has cemented itself as the largest corporate holder of Bitcoin, with an aggressive accumulation strategy that now boasts a staggering 471,107 BTC, valued at approximately $46 billion. Under the leadership of Michael Saylor, the company has transformed from a software firm into a de facto Bitcoin investment vehicle, leveraging innovative financial engineering techniques to amass its holdings. Unlike traditional companies that rely on organic growth or M&A for expansion, MicroStrategy has used a mix of at-the-market (ATM) share sales, nearly 0%-interest convertible notes, and now an entirely new class of preferred shares to continuously add to its Bitcoin reserves.

The company’s latest move introduces STRK preferred shares, which provide an 8% dividend and a conversion price of $1,000 per common share—a massive 198.5% premium over MSTR’s current trading price. This financing method enables the company to minimize dilution while maximizing BTC-per-share accretion, effectively allowing it to acquire more Bitcoin without drastically increasing its outstanding common shares. The aggressive expansion continues, and the company’s model hinges on the belief that Bitcoin will continue to appreciate, making this approach highly lucrative if BTC prices climb but equally catastrophic if a significant downturn occurs.

See real-time NASDAQ:MSTR stock movements here

Can MicroStrategy's Preferred Shares Unlock More Bitcoin at Minimal Dilution?

MicroStrategy's recent financial maneuver introduces a new long-term financing vehicle that benefits both existing and new investors. The STRK preferred shares are priced at $100 each, offering a perpetual dividend of 8% while granting the option to convert into one-tenth of a common share. This structure allows the company to tap into additional capital markets without immediately diluting its common shareholders.

To put this into perspective:

- $250 million in preferred stock issuance = 2.5 million preferred shares

- Each converts to 1/10th of a common share → 250,000 total common shares if fully converted

- At $1,000 per common share conversion price, investors are paying nearly triple MSTR’s current stock price

MicroStrategy has positioned this as a low-risk, yield-generating alternative for investors who want Bitcoin exposure but aren’t comfortable with outright BTC volatility. These shares allow dividend payments in either cash or MSTR stock, ensuring flexibility in how the company manages its obligations. Even if MSTR’s common stock declines, STRK holders still receive their 8% dividend, making it a relatively lower-risk play compared to the common shares.

If demand for STRK grows, MicroStrategy will likely scale this offering, further increasing its ability to buy Bitcoin at minimal dilution to existing shareholders. The key takeaway is that STRK allows MicroStrategy to raise capital at an effective valuation significantly above its current trading price, a move that could supercharge BTC acquisitions while preserving equity value.

Will Bitcoin’s Price Dictate NASDAQ:MSTR’s Next Move?

Despite its innovative fundraising mechanisms, MicroStrategy's valuation is still inextricably linked to Bitcoin’s performance. NASDAQ:MSTR’s correlation with Bitcoin has weakened in 2025, with some investors questioning whether the stock still serves as a viable BTC proxy. Historically, MSTR's share price moved almost in tandem with Bitcoin, but recent trading patterns show divergence, potentially due to dilution concerns or shifting investor sentiment.

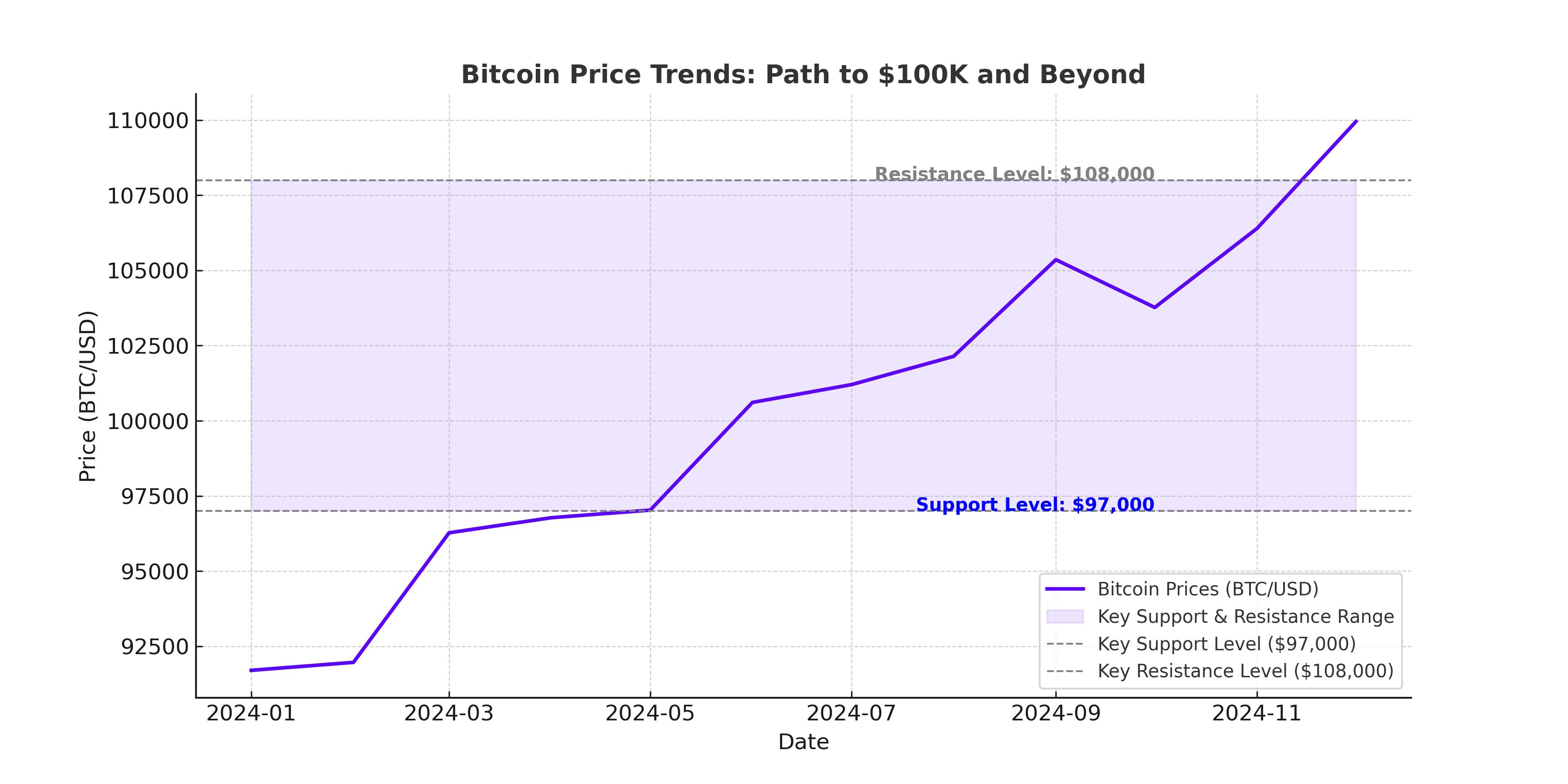

Bitcoin has been hovering around $98,536, struggling to hold above the critical $100,000 level, with recent volatility linked to geopolitical uncertainty and ETF market fluctuations. If BTC surges past $110,000-$120,000, MSTR could experience an explosive upside as confidence in its leveraged Bitcoin strategy returns. However, if BTC falters below $90,000, investors may begin questioning the sustainability of MicroStrategy’s debt-driven accumulation model.

Another factor at play is the influx of Bitcoin ETFs, which provide institutional investors with regulated exposure to BTC without the risks associated with MSTR’s debt-heavy structure. The launch of these ETFs in early 2024 saw $39 billion in inflows, and with BlackRock’s iShares Bitcoin Trust (IBIT) leading the charge, some investors may opt for direct BTC exposure via ETFs instead of holding MSTR stock.

Has the Decoupling Between Bitcoin and NASDAQ:MSTR Made Direct BTC Investment a Better Play?

Historically, investors saw NASDAQ:MSTR as the best way to gain Bitcoin exposure on the stock market. However, that narrative is now being challenged. The company’s financial structure, including its $7.6 billion in liabilities and continued stock dilution, means that its valuation is no longer directly tracking BTC price movements.

For context:

- MicroStrategy currently holds 471,107 BTC worth $46 billion

- The company’s Bitcoin holdings were acquired at an average cost of $64,511 per BTC

- Total liabilities stand at $7.6 billion, creating a complex financial structure that some investors find risky

A major concern is that if Bitcoin enters another bear cycle, MicroStrategy could be forced to liquidate BTC holdings at a loss to service its debts. Unlike a Bitcoin ETF or spot BTC investment, MSTR carries risks associated with equity dilution, convertible debt obligations, and potential margin calls if Bitcoin prices collapse.

At its core, MicroStrategy is a leveraged Bitcoin hedge fund disguised as a public company. While this model has been extremely lucrative in bull markets, its sustainability during prolonged downturns remains unproven.

See insider transactions for NASDAQ:MSTR here

Is NASDAQ:MSTR a Buy, Hold, or Sell?

MicroStrategy’s financial engineering has allowed it to build an unmatched corporate Bitcoin treasury, but this approach is not without risk. Investors must weigh the upside potential of leveraged BTC exposure against the structural risks tied to debt and dilution.

Here’s the case for each stance:

- Buy: If Bitcoin is heading for $150,000+, MSTR remains the most explosive way to play the rally. The company’s ability to continuously raise capital at a premium could supercharge BTC-per-share accretion, making MSTR a high-risk, high-reward bet on Bitcoin’s future.

- Hold: Investors who already hold MSTR may want to watch BTC’s price movements closely. If Bitcoin consolidates above $100,000-$110,000, MSTR could see renewed upside momentum. However, dilution concerns and the decoupling from BTC prices make holding a more cautious approach.

- Sell: If Bitcoin fails to break higher and enters another bear cycle, MSTR’s debt-fueled strategy could unravel. With liabilities stacking up and the market shifting toward ETFs, investors may find direct BTC investment or ETFs like IBIT a more stable alternative.

Final Thoughts

MicroStrategy (NASDAQ:MSTR) remains one of the most highly debated stocks on Wall Street, with a business model that thrives in Bitcoin bull markets but carries severe downside risks in prolonged bear cycles. The introduction of STRK preferred shares allows the company to continue its BTC acquisition spree with minimal immediate dilution, but questions remain about the long-term viability of this approach.

As Bitcoin’s price dictates MSTR’s fate, investors need to weigh their risk tolerance carefully. If Bitcoin surges, MSTR will likely outperform, but if BTC stumbles, the stock’s leverage could quickly turn against it.

For those seeking exposure to Bitcoin with a potential equity upside, MSTR remains an intriguing, albeit volatile, option. However, for investors prioritizing stability, direct BTC ownership or ETFs might be the smarter play.

See real-time NASDAQ:MSTR stock price updates

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex