NASDAQ: NVDA Surges with AI Breakthroughs, Eyeing a $204 Target – A Game-Changer in Tech

NVIDIA's record earnings and groundbreaking AI chips drive huge price growth. Can NVDA hit $204? Here’s what’s fueling this massive upside! | That's TradingNEWS

NVIDIA’s Robust Growth Trajectory: AI Leadership and Record-Breaking Financials

AI Dominance and GPU Evolution Fuel NASDAQ: NVDA’s Explosive Growth

NVIDIA Corporation (NASDAQ: NVDA) has positioned itself as a pivotal force in the AI and semiconductor market, achieving groundbreaking advancements that solidify its place at the forefront of tech innovation. Driven by a surge in demand for high-performance GPUs, especially in artificial intelligence and data processing, NVDA’s recent fiscal performance reflects not only the company’s market leadership but also the accelerating adoption of AI and machine learning applications across sectors.

NVDA’s upcoming earnings report for Q3 FY25 has investors closely watching for further indicators of growth, with internal revenue forecasts predicting a leap to $32.5 billion, an impressive 81.8% year-over-year increase. This aligns with Wall Street’s estimated revenue forecast of $32.94 billion. A primary contributor to this massive revenue boost is the increasing demand for NVIDIA’s advanced GPU architectures—Hopper and Blackwell—which are central to its data center and AI operations. Blackwell units alone, priced between $30,000 and $40,000 per unit, are anticipated to bring in significant revenue as production ramps up in Q4 2024.

For a real-time look at NVDA stock performance, visit NVIDIA Stock Real-Time Chart.

Financial Outperformance: Expanding Margins and Strategic R&D Investment

NVIDIA’s financial performance has been nothing short of exceptional. With an operating margin of 68%, up from 34% in FY20, the company has demonstrated its capacity to generate substantial profits. In H1 FY25 alone, revenue reached $56.08 billion, underlining NVDA's capacity to scale profitably. Additionally, the company has invested significantly in research and development, with R&D expenses up by 35% year-over-year, signaling an emphasis on driving innovation in AI and high-performance computing.

Notably, NVIDIA's data center segment, which contributed to 78% of FY24 revenue, has achieved a 5-year CAGR of 75%, driven by its high-margin data center and AI products. NVDA’s focus on R&D highlights its commitment to sustaining its competitive edge, particularly in the production of new-generation GPUs like Hopper and Blackwell, expected to further fuel its growth trajectory.

Supply Chain Challenges and Strategic Diversification

A recent supply chain vulnerability was revealed as NVIDIA encountered issues with Super Micro Computer (SMCI), a key supplier in its AI server components pipeline. SMCI’s financial instability raised concerns, prompting NVIDIA to diversify its suppliers to include Gigabyte and ASRock. However, reliance on these alternate suppliers introduces new operational risks. Super Micro’s potential delisting due to delayed financial reporting and auditor resignation has created ripples, signaling possible future disruptions for NVDA’s production timelines and supply chain stability.

While NVIDIA’s proactive shift to new suppliers reflects strategic agility, the increased dependency on Gigabyte and ASRock, who may lack Super Micro’s initial capacity, could translate to costlier and slower production adjustments, potentially impacting NVIDIA’s capability to meet escalating demand for its GPUs.

For more details on NVDA’s insider transactions and corporate profile, view the NVIDIA Insider Transactions or NVIDIA Stock Profile.

Technicals and Stock Price Forecast: Bullish Indicators and $204 Target

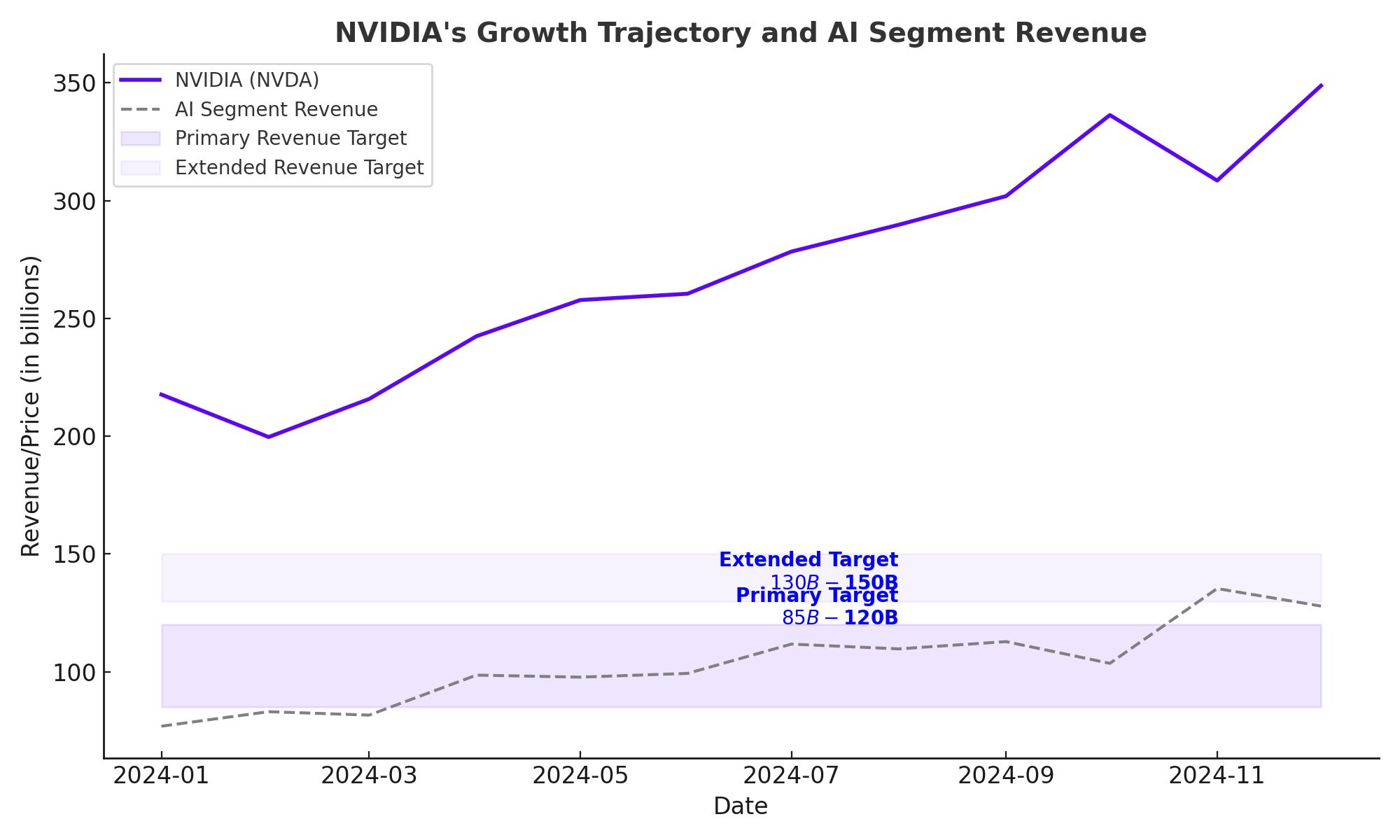

Currently trading around $145.3, NVDA exhibits strong technical momentum, with a Relative Strength Index (RSI) of 64.56, indicating bullish sentiment that is not yet in overbought territory. Volume Price Trend (VPT) readings at 22.48 billion also support this uptrend, suggesting that growing trading volume backs the current price momentum. Based on Fibonacci levels, NVIDIA’s bullish trajectory could push the stock price towards a 1.236 Fibonacci extension level of $204, presenting an attractive upside potential. However, should volatility increase, a retracement to the 0.5 Fibonacci level of $143 could provide a stable floor.

Analysts at Mizuho have set a price target of $165, citing NVDA’s dominance in AI-capable semiconductors and the likely expansion in AI server penetration from 1% in 2023 to over 10% by 2027. The mid-term outlook remains optimistic, supported by NVDA’s planned production ramp-up and expansion into diverse markets.

Strategic Growth in AI and Data Center Segments: A $100 Billion Market Opportunity

NVIDIA’s investments in AI infrastructure and its unwavering dominance in GPU technology position it well to capture a significant share of the projected $100 trillion AI market. The launch of the Blackwell GPU architecture aims to provide up to a 6x performance boost over prior iterations, coupled with only a 25–30% price increase. Furthermore, demand from major clients like Meta and Microsoft underscores NVIDIA’s entrenchment in the AI space, as hyperscalers accelerate capital expenditures on data infrastructure.

In the AI-driven transformation of sectors such as healthcare and national security, NVIDIA has successfully showcased the capabilities of its GPUs. Partnerships, such as the national AI supercomputer project in Denmark, underscore NVIDIA’s role in facilitating sovereign AI development—a trend gaining momentum globally, particularly within the Middle East and EMEA regions.

Valuation Metrics: Balanced Amid High Demand and Growth Prospects

Valuation-wise, NVDA’s forward adjusted EBITDA multiple stands at 33.6x, only marginally above its 10-year average of 32.9x, suggesting that the market has not fully priced in an excessive premium, leaving room for potential valuation uplift. Despite substantial growth, NVIDIA’s prudent capital allocation strategy, including a $50 billion stock repurchase authorization in H1 FY25, further enhances shareholder value through equity reduction, which will likely support per-share earnings growth.

Given NVDA’s expansive growth trajectory, both in the core AI market and across emerging verticals, this valuation level appears justifiable. In light of its robust financials, continued R&D investment, and steady demand in AI, NVDA holds a favorable position for long-term growth.

Conclusion: NVDA’s Strategic Position and Potential Market Gains in AI

In summary, NASDAQ: NVDA showcases a compelling growth narrative, bolstered by solid revenue forecasts, expanding margins, and a strategic focus on R&D. The challenges posed by supply chain issues underscore the importance of diversified supplier networks, which NVDA is actively pursuing to minimize risk. With anticipated gains in the data center and AI segments, NVIDIA is positioned to capitalize on the demand surge for high-performance computing solutions.

Technical indicators, bullish market sentiment, and strong seasonality trends point toward potential short-term gains and enduring value in NVDA’s stock. As NVIDIA approaches its next earnings release, the alignment of positive financial metrics and a clear growth strategy reinforces its status as a leading force in the AI and semiconductor sectors.

That's TradingNEWS

Read More

-

Broadcom Stock Price Forecast - AVGO 13% Post-Earnings Slide vs. $73B AI Backlog at ~$350

13.01.2026 · TradingNEWS ArchiveStocks

-

Solana Price Forecast - SOL-USD Holds Around $143 as $135–$145 Zone Decides the Next Big Move

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex