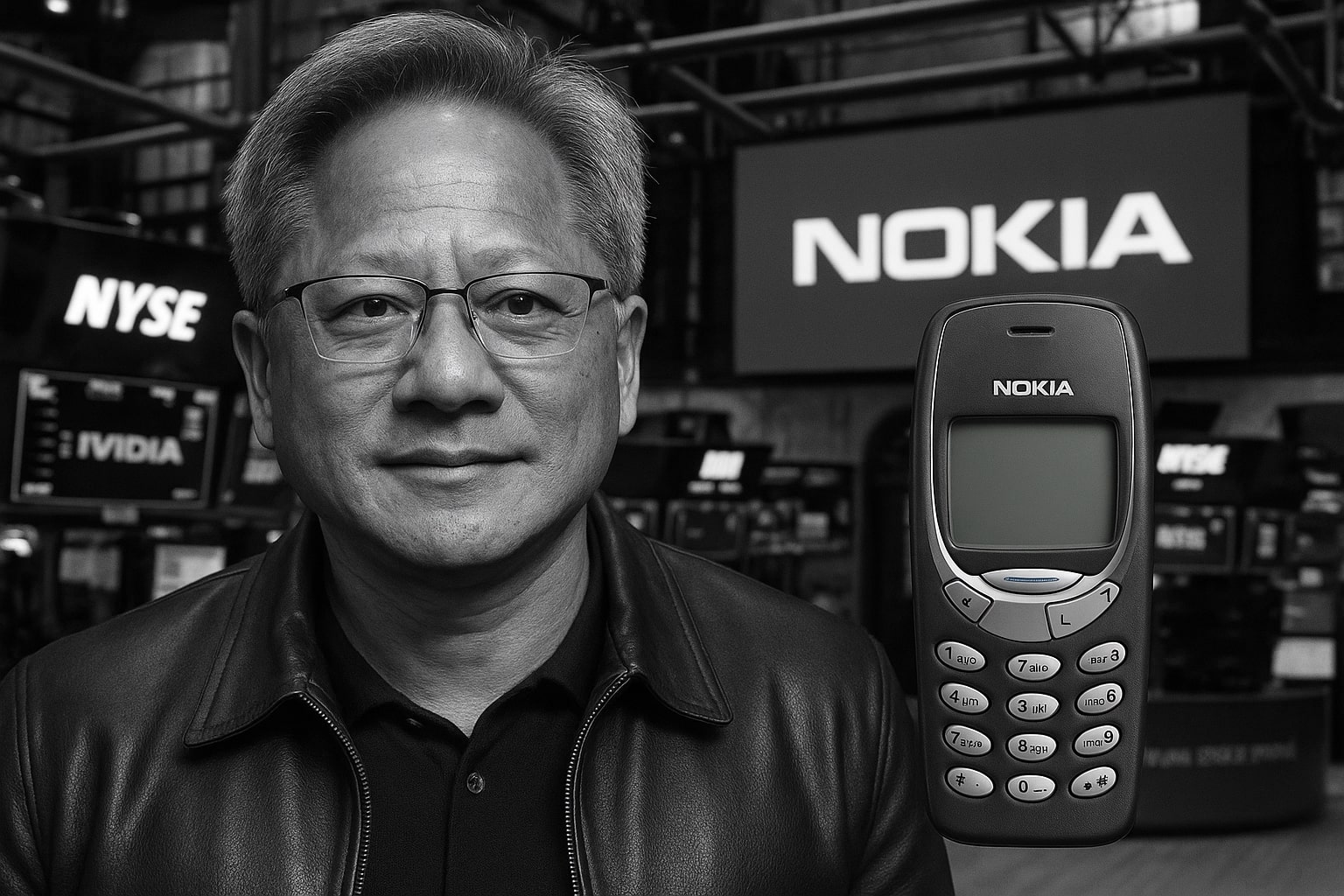

Nokia’s Stock Price Forecast - NOK Shares Explosive Breakout Marks a Turning Point for AI-Driven Telecom Expansion

NYSE:NOK surged to $8.11, climbing an extraordinary 28.14% in a single trading day, its steepest one-day gain in nearly a decade. The catalyst—Nvidia’s $1 billion equity investment for a 2.9% stake—immediately repositioned Nokia from a traditional 5G supplier to a key player in AI network infrastructure. With a day range between $6.40 and $8.19, a market cap of $45.18 billion, and volume exceeding 43 million shares, institutional participation surged, signaling a revaluation phase for the Finnish firm. The partnership announcement not only reshaped Nokia’s market perception but also ignited momentum that could redefine the company’s multi-year growth trajectory as AI and 6G architectures converge.

Nvidia’s $1 Billion Stake Reinforces a Strategic Shift Toward Network Integration

Nvidia’s decision to invest $1 billion by purchasing 166 million new Nokia shares at $6.01 per share reflects more than financial support—it’s a long-term strategic pivot. This move integrates Nvidia’s AI computation layer into Nokia’s 5G and 6G software architecture, bridging the gap between data centers and global telecom infrastructure. Nvidia gains access to advanced connectivity pipelines crucial for AI training data, while Nokia benefits from leveraging Nvidia’s GPU ecosystems within its Radio Access Network (RAN) solutions. Together, they will develop AI-optimized 6G systems, reshaping the telecom industry’s efficiency curve. Nvidia’s previous strategic moves—including $5 billion into Intel, $667 million into Nscale, and $500 million into Wayve—show a clear pattern: vertical integration across AI, cloud, and communications. The Nokia alliance extends this expansion into a new domain—telecom intelligence, a frontier largely untapped by chipmakers.

AI Infrastructure Push Under CEO Justin Hotard Elevates Nokia’s Growth Vision

Under the leadership of CEO Justin Hotard, who formerly led Intel’s Data Center and AI division, Nokia’s transition toward AI infrastructure has accelerated sharply. The company’s Q3 2025 results underscore this pivot: revenue rose 11.6% year-over-year to €4.83 billion ($5.6B), driven by strong AI-related demand, while net income fell 53.8% to €78 million amid restructuring expenses. Operating costs climbed 16.9% to €1.87 billion, reflecting reinvestment in R&D and integration costs following its acquisition of Infinera Corp. Still, EBITDA stood at €525 million, and free cash flow reached €429 million, underlining a resilient liquidity base supported by €3 billion in net cash. These numbers prove Nokia’s financial flexibility even as it shifts its model from conventional telecom supply to AI-enabled connectivity.

Data Center And Cloud Growth Establish Nokia As A Key AI Infrastructure Provider

Nokia’s Optical Networks segment expanded 19% year-over-year, fueled by hyperscale demand and large AI computing clients. The Cloud and Network Services division rose 13%, as operators upgraded their 5G cores to handle AI-intensive workloads. Partnerships with Super Micro Computer (NASDAQ:SMCI) and Nscale integrated Nokia deeper into the AI data pipeline, while its $2.3 billion Infinera acquisition strengthened its ability to deliver end-to-end solutions for AI data centers. Nokia now supplies components capable of 800G ZR/ZR+ transmission speeds, essential for AI data flow between global supercomputing centers. Hotard’s background ensures a tighter alignment between semiconductors, network software, and connectivity—transforming Nokia into an essential backbone of the AI infrastructure chain that Nvidia seeks to dominate.

Global Expansion Momentum Reinforces AI-Driven Revenue Stability

Regional growth shows Nokia’s diversification strategy is working. North America sales grew 13%, India 24%, and the broader APAC region 23%, while Europe held steady. These gains were accompanied by a strengthened AI-driven order backlog, with coverage entering Q4 surpassing previous years. The long-term VodafoneThree partnership—spanning 7,000 sites over eight years—anchors stable recurring revenue, while enterprise adoption expands Nokia’s customer base beyond traditional telecom carriers. These results show Nokia’s success in shifting focus toward enterprise-grade, AI-integrated network clients. As a result, Nokia’s growth now parallels trends seen across Nvidia’s ecosystem: both companies are building the digital infrastructure that supports the global AI supercycle.

Financial Strength Underscores Nokia’s Valuation Gap And Recovery Potential

Despite the stock’s 28% surge, NYSE:NOK remains undervalued compared to peers in AI infrastructure. Using projected free cash flow of €1.27 billion for 2025 and €1.7 billion for 2026, the stock’s fair value stands near €8.87 ($10.28), offering an estimated 27% upside. The P/B ratio of 1.35, combined with 1.93% dividend yield, signals attractive value for long-term investors. Nokia’s net profit margin of 1.62%—currently compressed by restructuring—is expected to recover to 4–5% post-Infinera integration. The balance sheet remains robust, supported by €3 billion in net cash and strong free cash conversion between 50% and 80%, making the firm one of the most financially secure players in the telecom hardware segment.

6G Development Aligns Nokia And Nvidia For The Next AI Frontier

The cooperation between Nokia and Nvidia extends beyond 5G to early 6G testing, which aims to create AI-native communication standards. Nokia has already begun pre-standard 6G radio trials, focusing on spectral efficiency, AI coordination, and ultra-low latency. In partnership with Berlin’s Fraunhofer Heinrich Hertz Institute, Nokia is contributing to next-generation video coding and immersive technologies that will define mobile connectivity in the 2030s. Nvidia’s parallel computing hardware, integrated into Nokia’s network stack, allows AI inference to occur within the network layer itself—a breakthrough expected to radically enhance real-time data transfer and automation. This positions both firms at the forefront of an AI-networking hybrid market that will reshape global communication infrastructure.

Macroeconomic Tailwinds Boost Investment In AI Connectivity

The macro backdrop now favors Nokia’s expansion. The Federal Reserve’s rate cuts, easing borrowing costs, and record AI capital expenditure cycles are driving renewed telecom investments worldwide. Operators that scaled back during the high-rate environment are reopening capital budgets, benefiting Nokia’s supply chain for 5G and 6G hardware. At the same time, governments in Europe and North America are prioritizing AI sovereignty, channeling subsidies toward domestic infrastructure providers like Nokia. As Ericsson’s 9.1% revenue decline exposed ongoing volatility, Nokia emerged as the stronger, more diversified competitor. The industry-wide AI adoption wave is projected to lift global network infrastructure spending beyond $500 billion by 2028, and Nokia’s alliance with Nvidia ensures it participates directly in that acceleration.

Implications For Nvidia’s Stock Price Forecast

Nvidia’s current price of $195.30, just below its $196.57 52-week high, reflects a 1-year gain of 37% and market cap $4.74 trillion. The Nokia partnership provides Nvidia with a new structural growth driver — AI networking revenue — estimated to contribute $4–6 billion annually by 2027 through hardware sales, licensing, and co-developed network solutions. Analysts expect this diversification to sustain Nvidia’s top-line growth above 60% YoY into 2026, even as data-center GPU margins normalize. The deal also de-risks Nvidia’s concentration in hyperscaler clients by adding telcos and governments to its customer base. That broader exposure enhances earnings stability and supports a re-rating toward $215–$225 per share within 12 months if execution continues. Fundamentally, this investment transforms Nvidia from a chip supplier into an AI-connectivity platform company, extending its dominance into a trillion-dollar telecom transition.

Reciprocal Market Impact Between Nokia And Nvidia

For NYSE:NOK, Nvidia’s capital and credibility accelerate its valuation cycle; for Nvidia (NASDAQ:NVDA), Nokia becomes a gateway to real-time AI data. Nokia’s price forecast now targets $10.20–$10.50 over 12 months as free-cash recovery aligns with AI revenue, while Nvidia’s forecast moves toward $220, representing roughly 13% upside. The correlation between both equities will tighten: each network deployment using Nvidia chips contributes incremental hardware sales for Nvidia and recurring service revenue for Nokia. This feedback loop magnifies profitability across both firms — one supplying intelligence, the other carrying it

Final Perspective: Dual Acceleration In Valuation And Strategy

The Nvidia–Nokia alliance marks a structural evolution in global connectivity. Nokia gains scale, capital, and relevance in the AI supercycle; Nvidia gains distribution, influence, and recurring infrastructure demand. The deal redefines both firms’ price trajectories — Nokia shifting from cyclical telecom value to AI infrastructure growth, Nvidia expanding from chip dominance to network ownership. As of now, Nokia remains a Buy targeting $10+, supported by AI backlog and margin expansion, while Nvidia’s forecast stays Bullish, with momentum toward $220–$230 per share driven by cross-sector integration, new revenue verticals, and unmatched leadership in AI hardware and networking synergy.

That's TradingNEWS