Nvidia (NASDAQ:NVDA) Stock Rallies: Is $500 Just the Beginning?

Can Nvidia’s AI and Robotics Expansion Push the Stock Beyond New Highs? | That's TradingNEWS

NASDAQ:NVDA Stock Analysis: AI-Driven Growth, Future Challenges, and Opportunities

Nvidia’s Dominance in the AI Sector

Nvidia Corporation (NASDAQ:NVDA, real-time chart) has solidified its reputation as a technological powerhouse, achieving unparalleled growth in recent years, primarily driven by AI innovation. Its GPUs, the backbone of AI and high-performance computing, have played a crucial role in the success of platforms like ChatGPT and other generative AI technologies. This dominance has catapulted Nvidia’s revenue and stock price to new heights, with NVDA stock recently hovering near $460, a significant rise from its levels two years ago. However, the stock now faces headwinds, ranging from evolving customer needs to regulatory challenges, that could moderate future returns.

AI Revolution and Revenue Growth

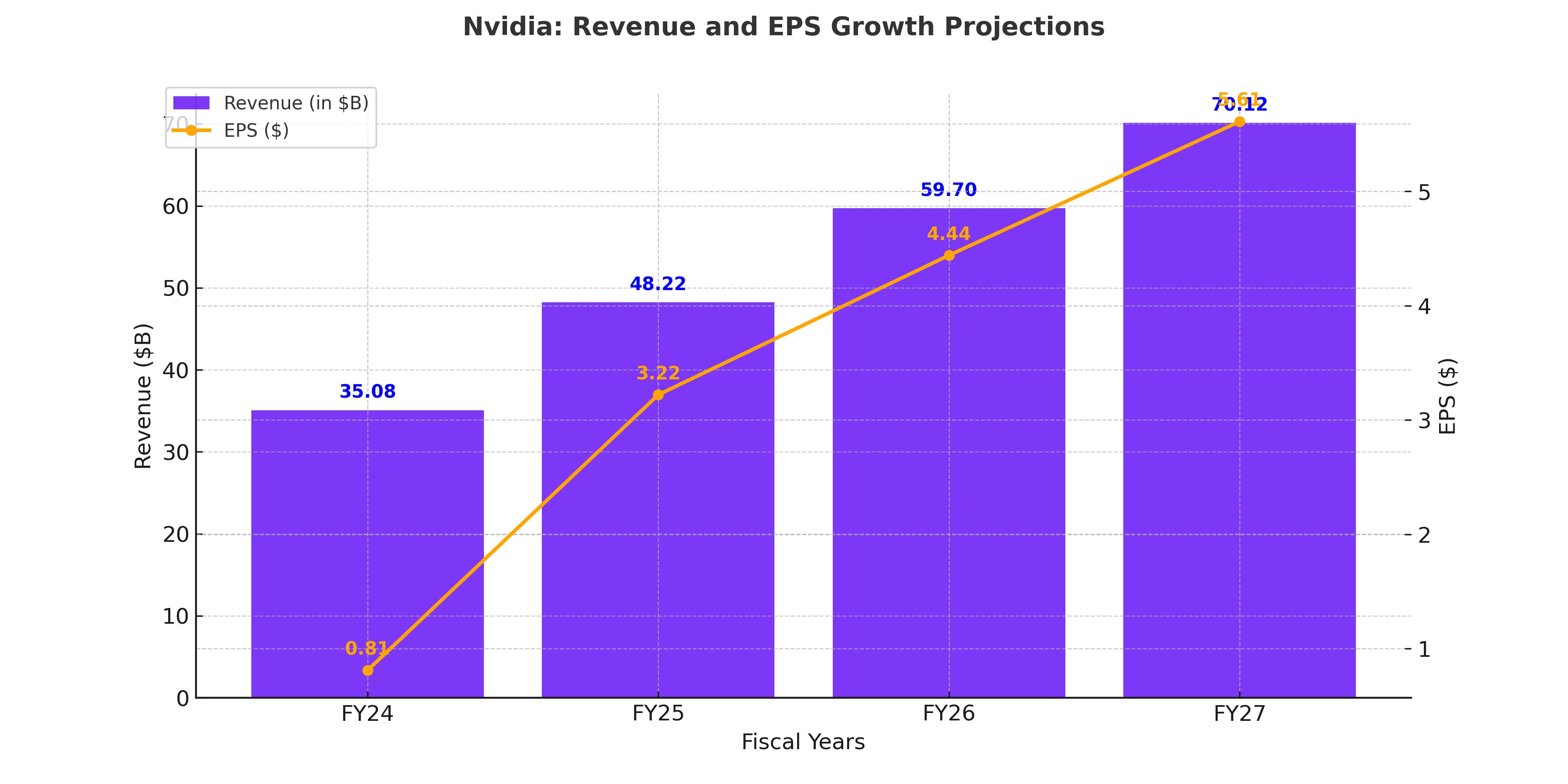

The AI boom has been a pivotal factor in Nvidia’s meteoric rise. The company reported $35.08 billion in sales in its most recent fiscal year, representing a staggering 90% year-over-year increase. Demand for Nvidia’s Hopper GPU systems drove record-breaking revenue, with hyperscalers like Microsoft investing heavily in AI infrastructure. This growth translated to NVDA delivering EPS of $0.81, exceeding Wall Street estimates by 4.6%. The newly launched Blackwell platform, designed for generative AI and large language models, further cements Nvidia’s market leadership.

Shifting Customer Demands

While Nvidia’s current dominance in AI hardware remains unchallenged, the landscape is evolving. Enterprises are shifting their focus from raw computational power to more efficient AI architectures. Nvidia’s Hopper systems, once the cornerstone of AI development, are now competing against alternative solutions tailored to efficiency rather than brute-force performance. This trend has led to a diversification in hyperscaler capital expenditure, with investment extending beyond GPUs to areas such as XPUs, retimers, and networking switches.

Despite these changes, Nvidia has managed to secure a 55-60% projected annual growth rate through FY26. The company’s ability to adapt to these shifts will determine whether it can sustain its leadership or if it will face margin pressure in the long term.

Regulatory Challenges and Global Implications

A significant hurdle for Nvidia lies in the regulatory domain. The U.S. government recently implemented stricter controls on AI chip exports to certain regions, including China. This regulation directly impacts several Nvidia products, including the A100, H100, and Blackwell GPUs. The restrictions could limit Nvidia’s access to lucrative markets, potentially slowing revenue growth. However, there remains optimism that the new administration may ease these policies, providing a window for Nvidia to recover lost opportunities.

Valuation and Growth Potential

Despite its recent rally, NVDA stock appears undervalued relative to its future earnings potential. Analysts forecast EPS growth to $4.44 and $5.61 in FY26 and FY27, respectively, supported by a robust pipeline of orders for Blackwell GPUs. At its current price-to-earnings (P/E) ratio of ~45x FY25 earnings, Nvidia trades at a premium, but this valuation is justified given its leadership in a high-growth sector.

Using a forward P/E multiple of 33x, Nvidia’s stock has a 20-24% upside potential, with a 12-month price target of approximately $560. This valuation aligns with expectations of sustained revenue growth and operational efficiencies.

The Robotics Opportunity

Nvidia’s push into robotics represents a transformative opportunity. The company’s development of physical AI systems, powered by its advanced GPUs and software ecosystems, positions it to capture a significant share of the $350 billion robotics market projected by 2032. This expansion could diversify Nvidia’s revenue base, reducing its reliance on the cyclical GPU market and providing a smoother growth trajectory in the long term.

Risks and Challenges

Despite its strong fundamentals, Nvidia faces risks. The competitive landscape is intensifying, with rivals like AMD and Intel introducing competitive products. Additionally, the high costs associated with robotics R&D could pressure margins in the short term. Finally, geopolitical tensions and regulatory uncertainties could disrupt Nvidia’s global supply chain and market access.

Conclusion: Buy, Hold, or Sell?

Considering Nvidia’s leadership in AI, its robust financial performance, and its promising ventures into robotics, NASDAQ:NVDA remains a compelling investment. While the stock’s hyperbolic growth may moderate, its 21-24% upside potential and expanding total addressable market make it a strong buy for long-term investors. Investors should monitor regulatory developments and customer trends closely, but Nvidia’s innovation-driven strategy positions it well for sustained success.

For more real-time updates, visit Nvidia Stock Profile.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex