Nvidia (NASDAQ: NVDA) Stock Drop: Causes and Strategic Buy Opportunity

Understanding Nvidia's Recent Market Volatility and Why Now Is the Time to Consider Buying | That's TradingNEWS

Comprehensive Analysis of Nvidia Corporation (NASDAQ: NVDA)

Current Market Performance

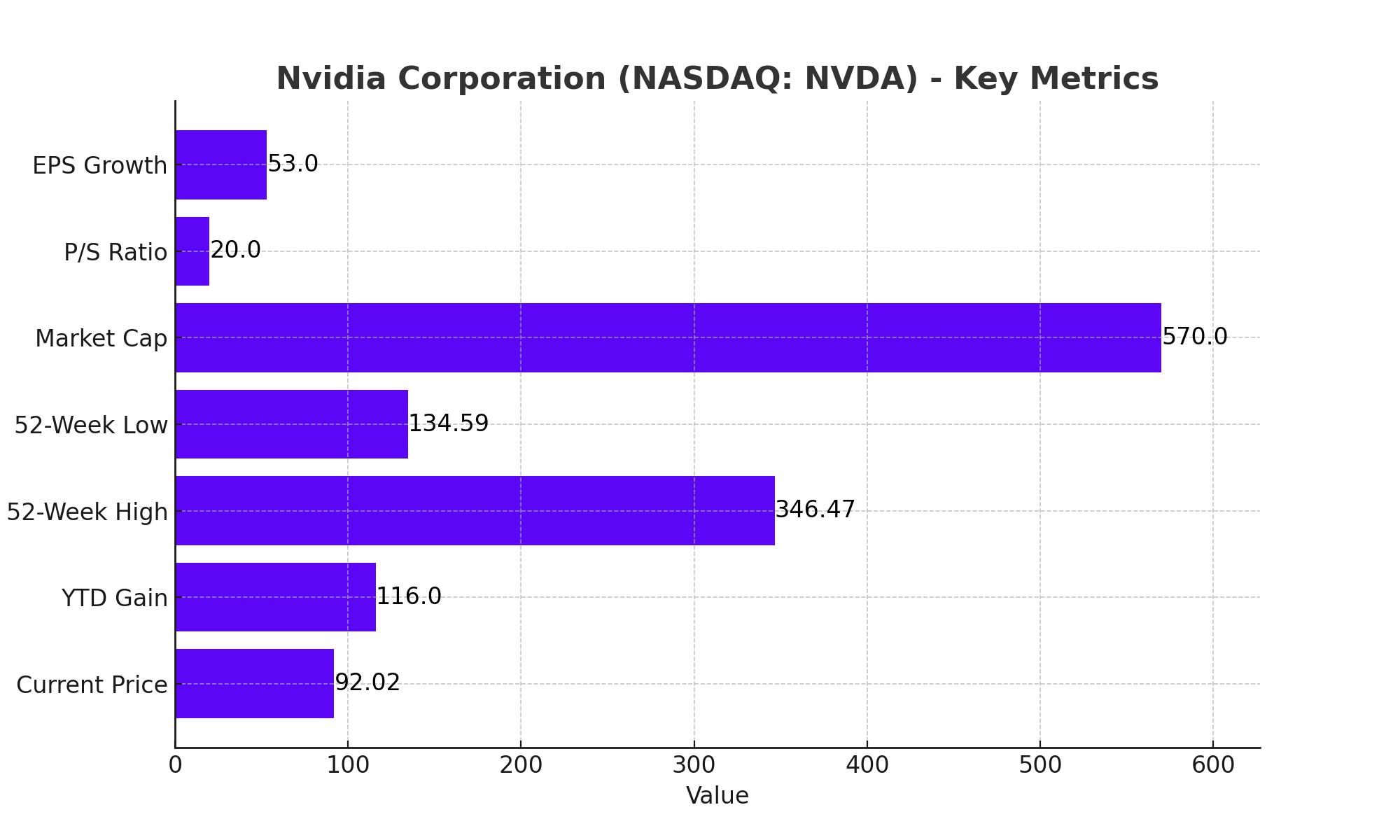

Nvidia Corporation (NASDAQ: NVDA) recently experienced significant volatility, with its stock dropping over 9% during premarket trading on Monday. This decline occurred amid a global market sell-off triggered by fears of a potential US recession. As markets from Asia to Europe suffered substantial losses, investors moved towards safe-haven assets, causing bond yields to decline. At the latest check, NVDA was trading at $92.02, a sharp decline of 14.21% from its prior close of $107.27. This drop has led to increased speculation that the US Federal Reserve might need to implement interest rate cuts to stimulate economic growth.

Brief Relief Rally and Sector Impact

Nvidia's brief rally on Wednesday was short-lived, as the stock hit its lowest level since May, falling by up to 7% on Friday, effectively erasing gains made earlier in the week. This broader decline in the tech sector pushed the Nasdaq (^IXIC) into correction territory, fueled by both economic slowdown concerns and fears of excessive AI spending by major tech firms. However, the long-term commitment to AI investments remains a positive driver for Nvidia and its peers in the AI chip market.

Sustained AI Investments

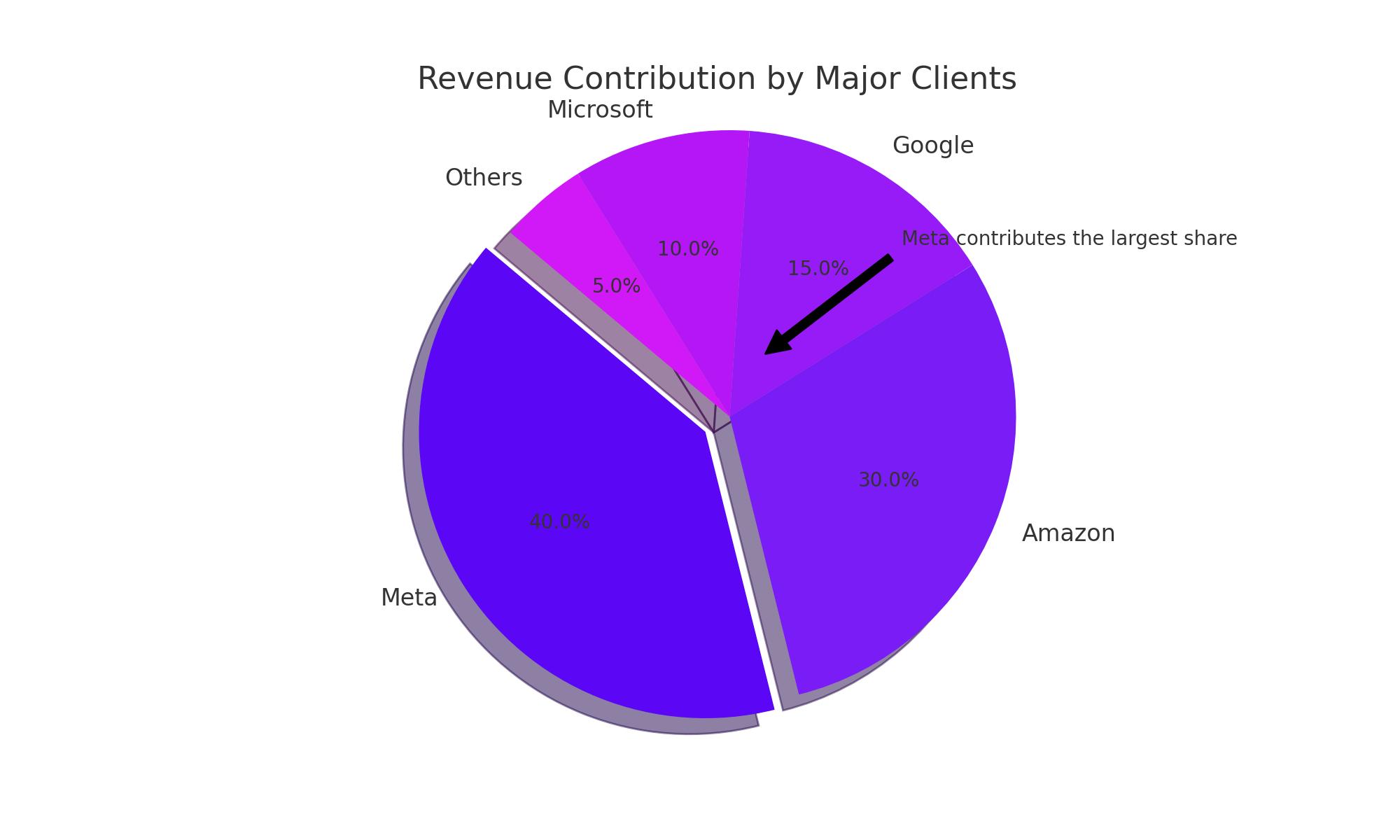

Despite market jitters, industry experts assert that AI investments are far from over. Major technology companies such as Meta (META), Alphabet (GOOG, GOOGL), and Microsoft (MSFT) have continued to allocate substantial funds towards AI, with Meta spending over $40 billion and Amazon (AMZN) planning to exceed its $30 billion expenditure in the first half of the year. These investments are expected to significantly benefit Nvidia, given its leadership position in AI chip production.

Revenue and Market Position

Nvidia's top-line growth is projected to be bolstered by major clients like Meta, Amazon, Google, and Microsoft, which collectively account for over 40% of Nvidia’s revenue. Analysts, including CFRA’s Angelo Zino, are optimistic about Nvidia’s revenue prospects, suggesting strong performance could serve as a catalyst for the sector. Morgan Stanley's Joseph Moore also indicated that the recent sell-off presents a "good entry point," emphasizing the market’s overly pessimistic view on AI investment commitments.

Competitive Advantage and Strategic Investment

Dan Morgan from Synovus Trust compared investing in Nvidia to selling tools during a gold rush, highlighting Nvidia's strategic advantage in the AI infrastructure market. Despite closing the week down by 5% and being approximately 26% below its record high, Nvidia shares remain up 116% year-to-date, underscoring the stock's robust long-term growth potential.

Production and Supply Chain Updates

Nvidia's upcoming Blackwell chips, set to replace the popular H100 chips, have faced production scrutiny. Reports indicated potential delays due to design issues, necessitating additional test runs with Taiwan Semiconductor Manufacturing Co. (TSM). An Nvidia spokesperson stated that production is on track to ramp up later this year, although any delays could impact Nvidia's revenue and stock performance.

Market Reactions and Insider Transactions

Early Monday trading saw Nvidia (NASDAQ: NVDA) stock plummet by 12%, following a 5.1% decline the previous week. This significant drop positioned NVDA well below key moving averages, reflecting broader market struggles and exacerbated by reports of a Justice Department probe into Nvidia's dominance in the AI sector. As of the latest session, NVDA was trading at $92.02, down 14.21% from its previous close of $107.27. This steep decline has increased speculation about potential Federal Reserve interest rate cuts aimed at stimulating economic growth. The broader market downturn, combined with specific concerns about Nvidia, highlights the current volatility in tech stocks. For detailed insider transactions, click here.

Triple Hit: Correction, Antitrust Probe, and Shipment Delays

Nvidia faced a trio of challenges this week, starting with a stock price correction driven by concerns overvaluation. This was compounded by delays in the proposed acquisition of Run.ai and shipment issues with key customers such as Microsoft, Alphabet, and Meta due to reported design flaws in Nvidia's upcoming Blackwell chips. Although these shipment delays are based on unverified reports, Nvidia CEO Jensen Huang has assured that Blackwell chips are in full production and significant revenue is expected this year. The correction, antitrust concerns, and shipment delays collectively pose short-term hurdles, but Nvidia's robust long-term growth prospects are underpinned by its strong R&D profile, operational efficiency, and unique human capital structure. These elements suggest resilience and continued market leadership despite temporary setbacks.

Correction and Valuation Analysis

The recent correction in Nvidia (NASDAQ: NVDA) stock, though substantial, is seen by some analysts as an overreaction. On Monday, NVDA shares dropped by 12%, following a 5.1% decline the previous week. This pullback has positioned the stock well below key moving averages. As of the latest trading session, NVDA was priced at $92.02, a significant drop of 14.21% from its prior close of $107.27.

Despite this volatility, Nvidia’s forward price-to-sales (P/S) ratio has remained relatively stable. Historically, Nvidia has traded at a high P/S ratio due to its dominant position in the GPU market and strong growth prospects. For context, even with the recent decline, Nvidia's forward P/S ratio hovers around 20, which is considered high but justified given the company's robust revenue growth and market leadership.

The company's revenue generation continues to support its valuation. For the fiscal year 2024, Nvidia reported revenues of $26.91 billion, marking a 53% year-over-year increase. The non-GAAP earnings per share (EPS) were $5.16, reflecting an impressive growth from $0.88 in the previous year. These strong financials underscore Nvidia's ability to capitalize on the increasing demand for AI and advanced computing technologies.

Over the last month, NVDA has corrected by more than 12%, bringing its market capitalization down to approximately $570 billion from its peak. Analysts argue that this correction offers a strategic buying opportunity for investors, especially those looking to gain exposure to the burgeoning AI and semiconductor sectors.

Why NVidia NASDAQ:NVDA is a Buy Opportunity ?

This pullback, although steep, aligns Nvidia’s valuation closer to its historical forward price-to-sales ratio, making it an attractive entry point. The ongoing substantial investments in AI by tech giants such as Meta, Alphabet, and Microsoft, with Meta alone spending over $40 billion, underscore the sustained demand for Nvidia's AI chips. This diversified and growing customer base is likely to drive Nvidia's revenue growth further, solidifying its market dominance.

Moreover, concerns about potential shipment delays of Nvidia’s new Blackwell chips are based on unverified reports. Nvidia CEO Jensen Huang has confirmed that these chips are in full production with significant revenue expected this year, mitigating fears of a substantial impact on financial performance. Additionally, while the Justice Department's antitrust probe into Nvidia’s AI dominance poses a regulatory risk, it remains in its early stages and is not expected to disrupt the market immediately.

Given these factors, the correction in NVDA's stock price can be seen as an overreaction, providing a strategic buying opportunity for investors. Nvidia’s strong R&D profile, operational efficiency, and unique human capital structure ensure its resilience and continued leadership in the AI and semiconductor sectors. Investors are encouraged to leverage this attractive valuation to build or expand their positions, capitalizing on Nvidia’s long-term growth trajectory.

AI Market Potential and Valuation

Despite some claims that Nvidia (NASDAQ: NVDA) is in "bubble land," the company's position in the AI market remains robust and poised for continued growth over the coming decades. Nvidia’s AI capabilities and the demand for its chips are expected to expand significantly. This growth is driven by large tech firms and an increasing number of smaller companies investing in AI technology. Major technology companies like Meta, Alphabet, and Microsoft have continued to allocate substantial funds towards AI, with Meta spending over $40 billion and Amazon planning to exceed its $30 billion expenditure in the first half of the year. These investments are expected to significantly benefit Nvidia, given its leadership position in AI chip production. This diversified customer base is likely to bolster Nvidia's long-term growth and solidify its market dominance.

Conclusion: Strategic Investment Decision

As NASDAQ: NVDA nears the $100 mark, the recent market correction presents a strategic entry point for investors. Nvidia’s strong fundamentals, significant growth potential in the AI sector, and continued dominance in the GPU market position the company as a compelling buy. The recent decline in NVDA stock, due to broader market sell-offs and sector-specific challenges, has brought the stock to an attractive valuation for long-term investors. Given the robust demand for AI technologies and Nvidia’s leading position in this space, investors are encouraged to leverage this opportunity to build or expand their positions in Nvidia, capitalizing on the company's long-term growth trajectory.

For real-time updates and detailed analysis, refer to Nvidia's real-time chart and insider transactions.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex