NVIDIA (NASDAQ: NVDA) Stock: Volatility Amid DOJ Probe and AI Growth

Despite a 9.5% drop in stock value, NVIDIA remains a long-term AI leader. We explore the impact of recent market turbulence, legal scrutiny, and the company’s future in AI-driven growth | That's TradingNEWS

Stock Performance Amid Recent Market Turbulence

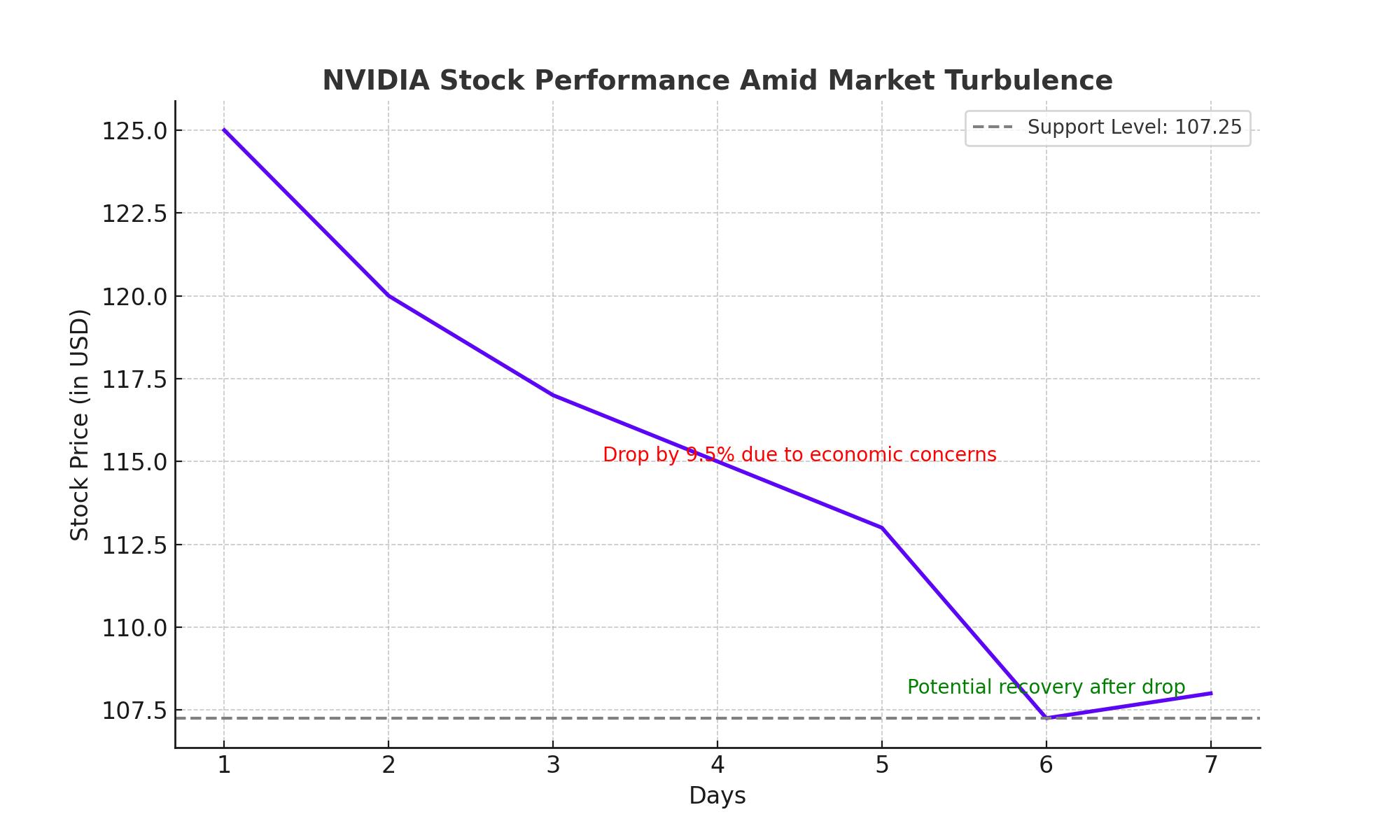

The stock performance of NVIDIA (NASDAQ: NVDA) has been nothing short of volatile over the past week, as shares dropped sharply by 9.5% in a single session, erasing nearly $279 billion from its market capitalization. Despite this significant pullback, it’s crucial to note that NVIDIA's stock remains up 118% year-to-date, showcasing the enormous growth the company has seen in the AI-driven market.

The sell-off came amidst growing fears about the U.S. economy's health following disappointing manufacturing data. The Institute for Supply Management reported weaker-than-expected factory activity, raising concerns about a broader slowdown. As a result, tech giants such as NVIDIA, alongside Apple, Intel, and AMD, all saw a notable decline, with NASDAQ:NVDA leading the drop.

NVIDIA’s Market Position and AI Dominance

NVIDIA has cemented itself as a leader in the AI and data center space, with its AI chips driving massive revenue growth. In the most recent quarter, NVIDIA reported $30 billion in revenue, largely fueled by the demand for its AI processors. This represents a staggering 154% year-over-year growth in its data center business, which is dominated by AI processing chips sold to cloud and internet giants.

The company is on track to generate $11 billion from AI chip sales in 2024, reflecting the deep integration of AI technologies into enterprise operations. Yet, the recent decline in NVIDIA’s stock price indicates market concerns around the sustainability of this growth. Some investors worry that the tens of billions of dollars being poured into AI may take longer to materialize into substantial returns. Additionally, NVIDIA forecasted 80% sales growth for the current quarter, a slight deceleration from the 122% growth in the second quarter, which led some to temper their expectations.

Key Risks: DOJ Investigation and Market Sentiment

Adding to NVIDIA's troubles, reports surfaced that the U.S. Department of Justice issued subpoenas to NVIDIA as part of an antitrust investigation. The investigation centers on concerns that NVIDIA may have made it difficult for clients to switch to other suppliers, raising questions about anti-competitive practices in the AI chip market. This legal scrutiny compounds the already jittery sentiment around NVIDIA, as investors evaluate the potential impact of a prolonged investigation on its market position.

This legal challenge, coupled with a broader market sell-off driven by macroeconomic data, could spell near-term headwinds for NASDAQ:NVDA, particularly in light of the company’s significant exposure to global demand fluctuations in technology and semiconductors.

Global Impact: Sell-Off Spreads Across Semiconductor Stocks

NVIDIA’s influence extends beyond U.S. markets, with its global supply chain reaching major semiconductor companies such as TSMC, Samsung Electronics, and SK Hynix. All of these firms experienced significant declines following NVIDIA’s stock drop. Samsung shares were down 3.45%, while SK Hynix, a key supplier of high bandwidth memory chips for NVIDIA’s AI processors, slumped by 8%.

The fallout continued in European markets, where ASML, ASMI, and Infineon all saw their stocks slide on fears of a broader slowdown in semiconductor demand. These declines highlight NVIDIA’s far-reaching impact on the global semiconductor industry, which has been riding high on AI optimism but now faces uncertainty.

Technical Analysis: Key Support Levels for NASDAQ:NVDA

From a technical perspective, NASDAQ:NVDA is navigating critical support levels. The stock is trading around $107.25 as of mid-week, down from its recent highs. Market strategists are closely watching the $100 level, which represents a key psychological and technical support point. A break below this level could trigger further selling, pushing the stock towards its August lows.

For now, NVIDIA’s stock remains highly volatile, with 30-day volatility levels reaching their highest point since mid-2022. Investors are wary of entering a “trading vacuum,” where lack of positive catalysts could lead to additional short-term sell-offs.

Long-Term Outlook: The Case for Staying Bullish

Despite these near-term challenges, many analysts remain bullishon NVIDIA (NASDAQ:NVDA).

The company’s long-term prospects remain intact due to its dominance in the AI market, a rapidly expanding field with massive potential. Analysts at BlackRock Investment Institute and JPMorgan continue to highlight the importance of staying invested in AI stocks, with both noting that the infrastructure build-out for AI is a long-term play.

The AI revolution, while still in its early stages, is expected to drive growth for years to come. NVIDIA is well-positioned to capitalize on this trend, and analysts believe that its dominance in AI chips will only strengthen as more enterprises and data centers adopt its high-performance processors.

Moreover, Harlan Sur, an analyst at JPMorgan, estimates that NVIDIA’s total AI revenue opportunity over the next 4-5 years could reach $150 billion, further fueling growth in the company’s semiconductor division. Even with some short-term volatility, the long-term outlook for NVIDIA remains strong as the AI market matures.

Financial Overview and Valuation

NVIDIA’s current price-to-earnings (P/E) ratio stands at 72, reflecting the market's high expectations for its future growth. However, the forward P/E is expected to drop to 27, based on projected earnings growth. For the fiscal year 2024, NVIDIA is forecasted to generate $51 billion in revenue, with $4.75 in earnings per share (EPS), marking a modest improvement from the $4.22 EPS reported last year.

Even though the company’s valuation remains elevated compared to historical averages, its position as a leader in AI and data centers justifies the premium. Investors are also keeping a close eye on NVIDIA’s cash flow, which exceeded $4.45 billion last quarter, or 36% of sales. This robust financial position enables NVIDIA to continue investing in R&D and expand its AI capabilities.

The Bottom Line: Buy, Sell, or Hold?

Given the recent drop in NASDAQ:NVDA

, some investors may be tempted to sell, but the company’s strong fundamentals and leadership in AI suggest a long-term buying opportunity. While the stock remains volatile in the short term, the broader market for AI and NVIDIA’s position in the sector make it a solid bet for those willing to weather the storm. Analysts remain confident that NVIDIA will rebound as its AI processors continue to drive revenue growth, and legal hurdles are navigated.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex