NYSE:FIS Shines with Stellar Q3 Earnings and Strategic Focus on Shareholder Returns

FIS Delivers Strong Q3 Results, Reduces Debt, Boosts Buybacks, and Realigns Strategy for Sustained Growth | That's TradingNEWS

Fidelity National Information Services (NYSE:FIS): A Comprehensive Analysis of Financial Performance and Strategic Shifts

Third Quarter Financial Performance (NYSE:FIS)

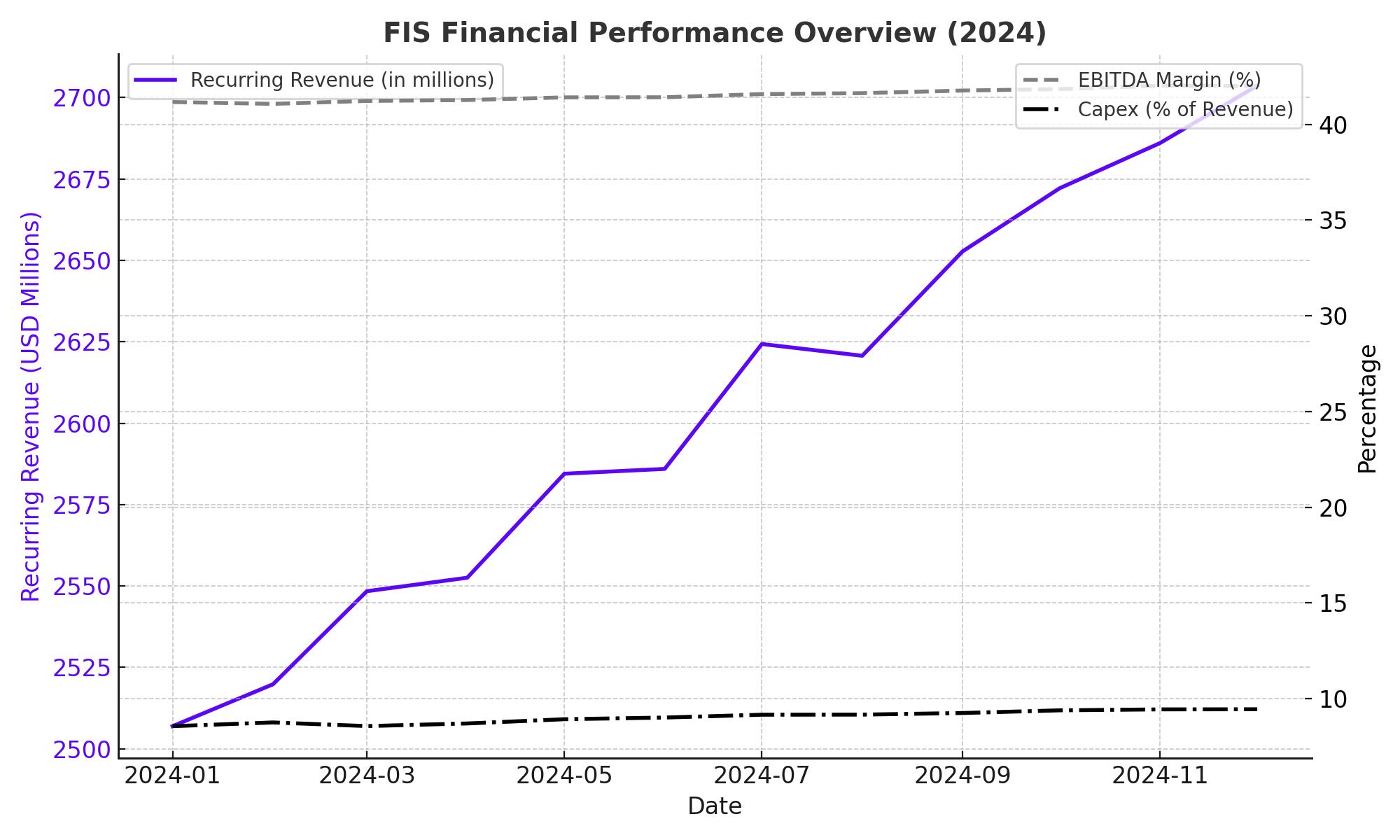

Fidelity National Information Services, Inc. (NYSE:FIS) delivered a solid performance in its Q3 2024 earnings report, beating analyst expectations with earnings per share (EPS) at $1.40—$0.11 higher than anticipated. The company generated revenue of $2.6 billion, reflecting a 4% year-over-year increase. The recurring revenue growth, which expanded by 6%, was a key driver, underpinning the company’s long-term strategy focused on stable cash flow generation. The EBITDA margin came in at 41.3%, showing a 50 basis points improvement compared to the same period last year, driven by stringent cost controls and strategic business simplification.

FIS has effectively capitalized on its business restructuring, evident in the company’s ability to streamline costs while improving revenue growth. The sale of a majority stake in Worldpay has allowed FIS to sharpen its focus on its core business, contributing to margin improvements. Although capital expenditure increased to 9% of revenue—higher than the long-term target of 7-8%—this uptick in spending is likely temporary as the company addresses underinvestment from prior years. Despite the elevated capex, FIS generated a robust free cash flow of $530 million, translating to an 85% cash conversion rate relative to net income.

Capital Allocation Strategy: Shareholder Returns and Debt Reduction

In Q3, NYSE:FIS returned $700 million to shareholders, including $500 million in share repurchases. The company has been proactive in its capital returns, with a $4 billion target for the year, of which $3 billion has already been distributed. The buybacks have reduced the share count by approximately 7.5% year-over-year. FIS’s commitment to rewarding shareholders is underscored by its consistent buyback program and dividends, yielding a current annualized dividend of $1.44 per share, with a dividend yield of 1.62%.

The divestiture of Worldpay not only streamlined FIS’s operations but also provided substantial cash, which has been directed toward debt reduction. Debt levels have been cut significantly from $18 billion at the start of the year to $10.9 billion, decreasing the debt-to-EBITDA leverage ratio to 2.6x. FIS still holds around $1.3 billion in cash and equivalents, supporting expectations of further buybacks or strategic investments in the upcoming quarter.

Segment Performance: Banking Solutions and Capital Markets

Within its banking solutions segment, NYSE:FIS reported a 3% revenue growth, with margins expanding to 45.2%. The recurring revenue in this segment saw a robust 6% growth, while one-time revenue decreased by 24%, largely due to the fading impact of pandemic-related programs like PPP processing. FIS’s strategic partnerships, such as those with Apple Pay on rewards programs, and its traction with community banks, position the company well for future growth within this segment.

The capital markets segment has been a standout performer, with a 7% increase in revenue and a 6% rise in recurring revenue. Notably, one-time revenue surged by 20%, contributing to a 90 basis point margin expansion, reaching 49.9%. This growth in high-margin one-time licensing revenue bolstered overall profitability within the segment. Given the sustained buoyancy in financial markets, FIS is likely to maintain solid results in this area, though a moderation in one-time revenue growth is anticipated.

Strategic Cross-Selling Initiatives and the Impact on Growth

One of the crucial growth strategies for (NYSE:FIS) has been its increased focus on cross-selling, which rose by 20% year-over-year. By expanding its offerings to existing clients, FIS maximizes customer value and diversifies its revenue streams. The company’s recent acquisition of Dragonfly, although small with an expected revenue contribution of under $10 million, exemplifies FIS’s strategy of enhancing its technology stack to meet evolving client demands in the banking sector. However, this acquisition will be margin-dilutive for a year or two as FIS works to scale it.

Financial Adjustments and Updated Guidance for FY2024

FIS recently made non-cash accounting adjustments to prior financials, reducing 2022 EPS by $0.06, 2023 by $0.03, and H1 2024 by $0.02. These adjustments do not impact cash flow but indicate minor discrepancies in past financial reporting. FIS has stated that these adjustments are unlikely to recur. Additionally, FIS raised the low end of its revenue and EBITDA guidance for FY2024, and significantly increased its EPS outlook due to reduced M&A-related interest expenses and improved equity income from Worldpay.

For Q4, (NYSE:FIS) anticipates an EPS of approximately $1.35, slightly down sequentially despite an expected 3% revenue rise. This forecast reflects the timing of below-EBITDA expenses and increased Worldpay costs, as the entity transitions to independent operations. Worldpay’s dependency on FIS infrastructure has extended beyond initial expectations, benefitting current earnings but posing a potential comparative headwind in 2025.

Insider Activity and Institutional Support

Institutional investors remain heavily invested in (NYSE:FIS), with recent holdings updates showing that Verdence Capital Advisors LLC increased its stake by 309.5% in Q3. Similarly, GSA Capital Partners LLP, Empowered Funds LLC, and Sei Investments Co. have expanded their positions, reinforcing institutional confidence in FIS’s strategic direction and financial stability. Insider transactions also indicate confidence, with director Jeffrey Goldstein acquiring additional shares, adding to his long-term holdings in the company. For detailed insights into insider activities, refer to FIS Insider Transactions.

Options Market Activity and Implied Volatility

The options market reveals high implied volatility for (NYSE:FIS) , particularly for the Jan 2025 $125.00 put, suggesting that traders are anticipating significant stock movement in the coming months. This heightened volatility could signal expectations of either a substantial rally or a sharp decline, potentially tied to market reactions to broader economic conditions or corporate developments. High implied volatility can attract options traders looking to capitalize on premium decay through strategic positions.

Valuation and Forward Earnings Potential

FIS’s recent rally has pushed its share price to what some consider fair value, trading around $88, near its recent high of $91.98. With forward 12-month earnings projected at approximately $4.40, the stock trades at an estimated 17-17.5x forward price-to-earnings (P/E) ratio, aligned with market valuations for companies with stable recurring revenue growth. FIS’s stake in Worldpay remains valued at around $11 per share, but any adjustments in this valuation are conservatively held due to potential one-time expense timing benefits.

Investment Outlook: Hold Rating with Cautious Optimism

After a strong year with a 66% increase in share value, (NYSE:FIS) appears to have largely priced in the benefits of its business simplification. The company’s robust recurring revenue growth, strategic divestitures, debt reduction, and aggressive shareholder returns are positive indicators. However, given that shares are trading near fair value, the potential for significant upside may be limited unless there is a notable catalyst, such as further revenue acceleration or an unexpected decrease in expenses.

The company’s focus on smaller, strategic acquisitions and a leaner capital structure suggests stability, but the looming expense normalization in Worldpay for 2025 could present a comparative challenge. For investors considering new positions, FIS may be best approached as a “hold” at current levels. However, any pullback closer to the $84-86 range could offer a more attractive entry point, particularly for those looking to capitalize on its commitment to shareholder returns. For real-time updates, access the FIS Real-Time Chart.

That's TradingNEWS

Read More

-

SCHD ETF at $27.64: High Dividend, Low Multiple and a 2026 Comeback Setup

28.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Trade Near Cycle Lows While $1.25B Flows and $1.87 XRP Position for Q1 2026

28.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Jumps From $3.47 to $3.88 as NG=F Tracks Cold Weather and LNG Flows

28.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY 2026 Price Forecast: Dollar–Yen Near 160.60 With BOJ Shift Threatening Carry Trade

28.12.2025 · TradingNEWS ArchiveForex