NYSEARCA:JETS – Will Airline Stocks Continue to Soar in 2025?

NYSEARCA:JETS Eyes $28.98 Resistance – Can Airline Stocks Break Out?

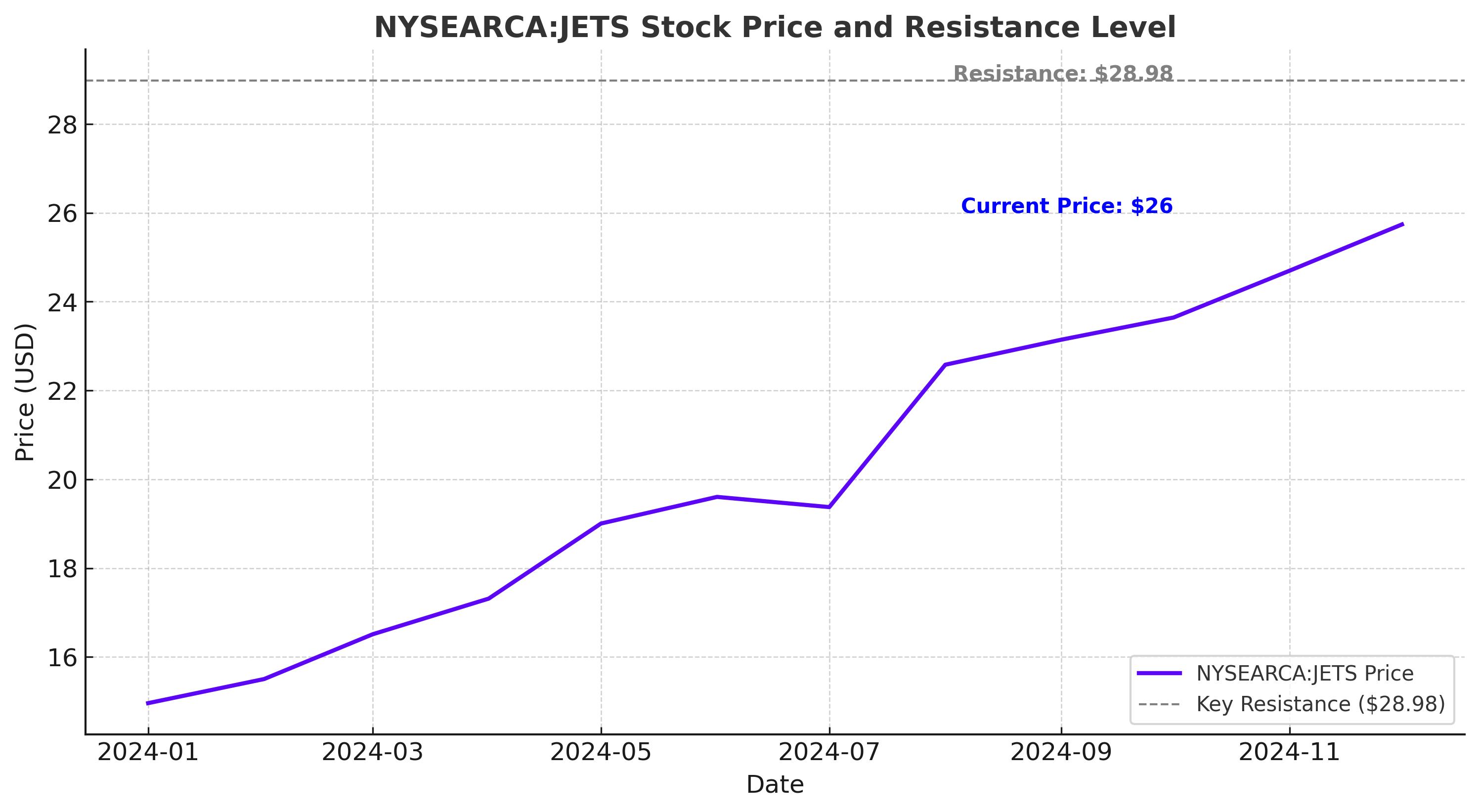

The U.S. Global Jets ETF (NYSEARCA:JETS) is moving aggressively toward a crucial $28.98 resistance level, signaling a potential breakout in airline stocks. With a 6.7% increase in global passenger demand expected in 2025, airlines are positioned for strong revenue growth. The ETF, currently trading around $26 per share, has gained momentum since bottoming out at $14.69 in late 2023. While the bullish trend is clear, investors are watching for regulatory changes, airline consolidation, and global economic shifts that could shape the future of airline stocks.

Will NYSEARCA:JETS Benefit from Airline Industry Consolidation?

The airline industry is known for its volatility, but mergers and acquisitions (M&A) could be a game-changer in 2025. With the Trump administration pushing for fewer regulations, the possibility of airline consolidation is increasing. Major carriers like American Airlines (AAL), Delta Air Lines (DAL), United Airlines (UAL), and Southwest Airlines (LUV) dominate the JETS ETF, and any potential M&A activity among these players could create massive economies of scale.

The historical trend supports this idea. The airline sector has seen significant consolidation over the past two decades, with mergers such as Delta-Northwest, United-Continental, and American-US Airways shaping today’s market structure. If another wave of consolidation materializes, it could provide upside catalysts for JETS, as investors often reward cost-cutting and increased pricing power in the industry.

How Does Travel Demand in 2025 Impact NYSEARCA:JETS?

Global air travel demand is set to reach a record 5.2 billion passengers in 2025, according to the International Air Transport Association (IATA). This represents a 6.7% year-over-year increase, reflecting the continued post-pandemic recovery and a growing appetite for international travel. Domestic travel in the U.S. has already rebounded strongly, but international markets are catching up, especially with China’s reopening.

Premium cabin demand is at an all-time high, as airlines capitalize on business and luxury travelers willing to pay for better experiences. Airlines are raising ticket prices, expanding route networks, and investing in fleet upgrades to accommodate this growing demand. These factors directly support the performance of NYSEARCA:JETS, as higher revenues and improved margins drive stock prices higher for major airlines within the ETF.

Is NYSEARCA:JETS a Good Investment Given Its Momentum and Liquidity?

The JETS ETF currently has $1.03 billion in assets under management, with an average daily trading volume of over one million shares. The ETF has been rallying since late 2023, forming higher lows and higher highs, a clear sign of a bullish trend.

Looking at momentum indicators, JETS has an A+ momentum grade, meaning it’s outperforming most ETFs in its category. Liquidity is another strength, as it holds an A liquidity rating, ensuring investors can easily enter and exit positions without significant price impact. However, dividends remain a weak spot, as the airline industry is notorious for low payouts and high reinvestment strategies.

Are Tariffs and Fuel Costs a Threat to NYSEARCA:JETS?

While airlines are in a strong growth phase, potential risks remain. The Trump administration’s new tariff policies could impact airlines, especially if trade tensions escalate and disrupt supply chains. Aircraft manufacturers like Boeing (BA) and Airbus (EADSY), which supply jets to major airlines, could face higher input costs if tariffs increase. This could drive up aircraft prices, forcing airlines to delay new orders or increase ticket prices to offset costs.

Jet fuel prices are another factor to consider. In 2022, high oil prices crushed airline profits, but in 2025, fuel costs have stabilized. If oil remains below $85 per barrel, airlines can continue benefiting from strong operating margins. However, any spike in oil prices could pressure airline stocks and NYSEARCA:JETS in the short term.

Technical Outlook: Can NYSEARCA:JETS Break Above $28.98?

From a technical perspective, JETS is approaching a key resistance level at $28.98, which was last tested in March 2021. A breakout above this level could lead to a rally toward the 2018 all-time high of $34.75. If travel demand remains strong and M&A activity materializes, JETS could see a sustained move higher in the coming months.

On the downside, if the ETF fails to break resistance, it could retrace to support levels at $23 and $20. However, as long as JETS continues to form higher lows, the long-term trend remains bullish.

Final Verdict – Is NYSEARCA:JETS a Buy in 2025?

The airline industry is positioned for a strong 2025, with record travel demand, potential industry consolidation, and strong stock momentum pushing NYSEARCA:JETS higher. Despite risks such as tariffs and fuel price fluctuations, the bullish setup remains intact.

With a 6.7% increase in global passengers, airline revenues are set to rise, supporting higher stock prices for American Airlines, Delta, United, and Southwest, all of which are top holdings in the ETF. At $26 per share, JETS is trading near resistance, but if it clears $28.98, the upside target shifts to $34.75, offering a potential 30% gain.

For long-term investors looking to capitalize on the continued strength in airline stocks, NYSEARCA:JETS remains a compelling buy, especially if it sustains its momentum and breaks through key resistance levels.