NYSEARCA:QYLD: A Comprehensive Analysis of Income Potential, Strategy, and Performance

Understanding NYSEARCA:QYLD's Covered Call Strategy and Income Appeal

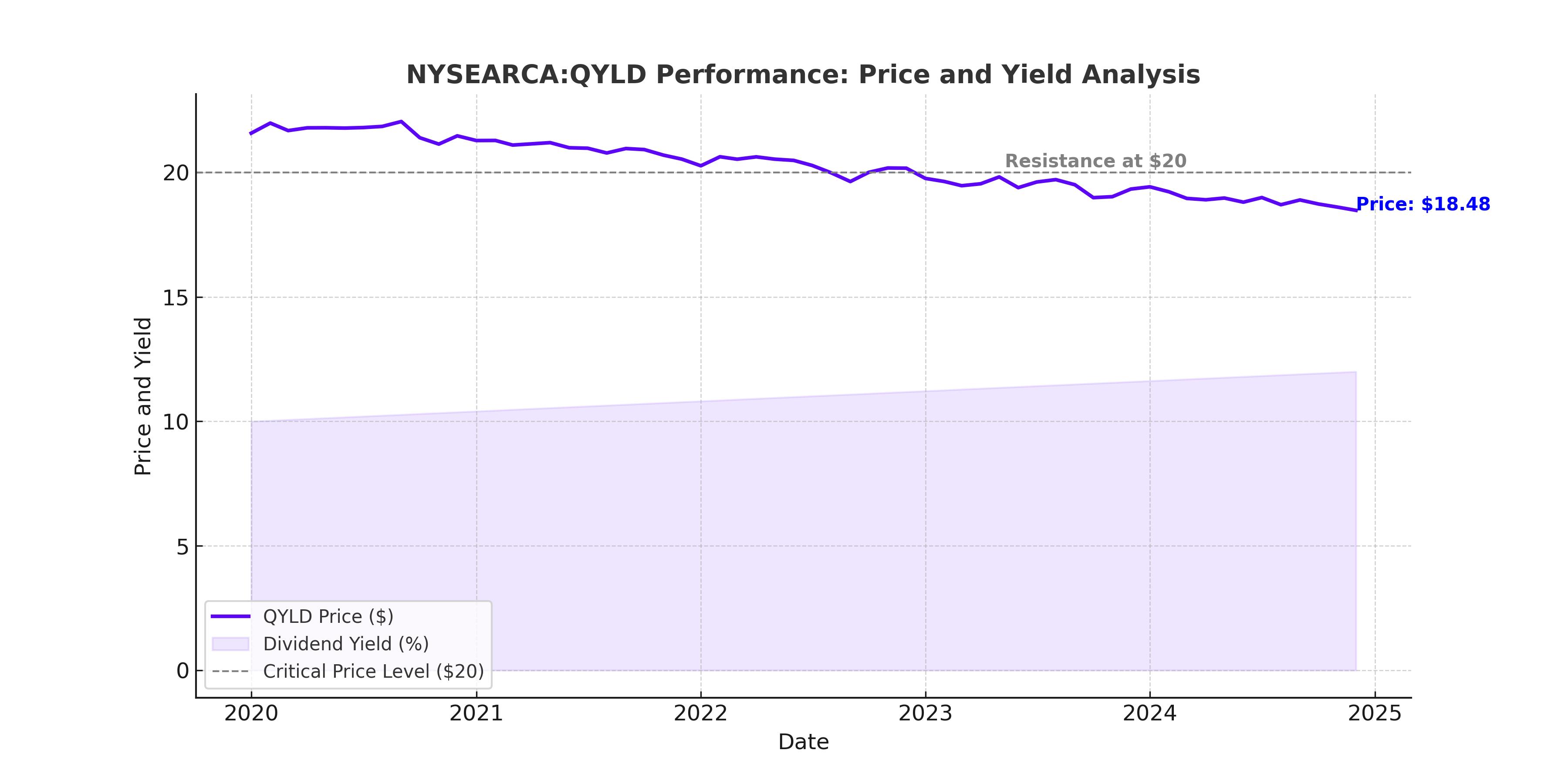

The Global X NASDAQ 100 Covered Call ETF (NYSEARCA:QYLD) has been a staple for income-focused investors seeking consistent monthly dividends. With a current share price of approximately $18.80 and a double-digit yield exceeding 12% annually, it offers an enticing proposition for those prioritizing income over capital appreciation. By writing covered call options against its NASDAQ 100 portfolio, QYLD generates option premiums that fund its attractive dividend payouts. This strategy, while effective in generating steady cash flow, places a cap on the ETF's upside potential, limiting its ability to benefit from market rallies.

Since its inception in 2013, QYLD has distributed over $25.25 per share in dividends, surpassing its initial offering price of $25. Despite this impressive payout history, the ETF’s share price has declined by 24.80% over the same period. This erosion underscores the trade-off between immediate income and long-term capital preservation, which has become more evident in recent years as newer ETFs with more sophisticated strategies have entered the market.

Performance Comparison: NYSEARCA:QYLD vs. Broader Market Indices

QYLD’s performance pales when compared to broader indices like the NASDAQ 100 (tracked by QQQ) and the S&P 500 (tracked by SPY). Over the past 11 years, QYLD has delivered a total return of 140%, or about 8% annually, while the NASDAQ 100 has soared by over 500%, averaging 19% annually. This disparity highlights the cost of capping upside potential through covered call strategies, especially during periods of strong market growth. Even in a year characterized by heightened market volatility, QYLD’s total return of 8.66% in 2024, including dividends, lagged behind the S&P 500's 7.63% price gain.

Despite these challenges, QYLD remains a compelling choice for income-focused investors. Its monthly distributions, averaging nearly 1% of the share price, provide reliable cash flow, making it particularly attractive to retirees and those prioritizing liquidity. However, for total return investors, the ETF’s inability to capture the full benefits of a bullish market makes alternatives like the Invesco QQQ Trust (QQQ) or newer ETFs like JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) more appealing.

The Mechanics of NYSEARCA:QYLD’s Covered Call Strategy

QYLD employs an at-the-money (ATM) covered call strategy, writing options against its portfolio to collect premiums. This approach ensures consistent income but inherently caps upside potential. For instance, if Apple (AAPL), a top holding comprising 9.36% of QYLD's portfolio, appreciates significantly, gains beyond the call’s strike price are forfeited. While this strategy mitigates downside risk in flat or moderately bearish markets, it underperforms during bull markets, as evidenced by QYLD’s struggles to rebound past the $20 mark since the 2022 bear market.

The ETF’s 0.61% expense ratio reflects the complexity of managing its option overlay strategy, yet its historical underperformance raises questions about value for money. By comparison, alternatives like JEPQ offer similar income strategies with stronger total return profiles, thanks to more flexible option-writing approaches.

Market Volatility and Its Impact on QYLD’s Income Generation

Heightened market volatility, as measured by the VIX index, directly influences QYLD’s ability to generate premium income. As of early 2025, the VIX hovers near 20.37, marking a 60.39% increase year-over-year. This elevated volatility boosts option premiums, enhancing QYLD’s monthly distributions. However, volatility alone cannot address the ETF’s structural limitations, as its capped upside prevents it from fully capitalizing on post-retracement rebounds.

QYLD’s reliance on volatility makes it a tactical tool for navigating uncertain markets but limits its appeal as a long-term growth vehicle. Its largest holdings, including NVIDIA (8.7%) and Microsoft (8.14%), represent high-growth tech names, yet the covered call strategy undermines the potential for significant capital appreciation.

Comparing NYSEARCA:QYLD to Alternatives

Competitors like JEPQ and the NEOS Nasdaq 100 High Income ETF (QQQI) have emerged as strong contenders, offering better balance between income and upside potential. For instance, JEPQ uses out-of-the-money call options, allowing for greater participation in market gains while still delivering high yields. In 2024, JEPQ achieved a total return nearly double that of QYLD, highlighting its superior strategy. Similarly, QQQI has demonstrated resilience in volatile markets by incorporating dual-leg strategies, further setting it apart from QYLD’s more rigid approach.

A Call for Strategy Overhaul

As competition intensifies, QYLD risks losing relevance without significant strategy updates. Its inability to rebound during strong bull markets underscores the need for innovation, such as incorporating out-of-the-money options or dual-leg strategies. With $8.67 billion in assets under management (AUM), QYLD remains a major player, but its diminishing competitiveness could lead to capital outflows toward better-performing alternatives.

The Case for NYSEARCA:QYLD: A Balanced Perspective

Despite its flaws, QYLD continues to attract investors with its consistent monthly payouts and high yield. Its 12% annual yield offers a compelling case for income-focused investors willing to accept limited upside. However, the ETF’s long-term underperformance and inability to adapt to changing market dynamics warrant caution. As the landscape for covered call ETFs evolves, QYLD must innovate to maintain its position as a leader in this space.

For real-time updates on NYSEARCA:QYLD’s performance and insights, visit NYSEARCA:QYLD Real-Time Chart.