NYSEARCA:SCHD Vs. NYSEARCA:VIG Dividend ETF Comparison: Dividend Yield, Growth, and Sector Strength

Evaluating Dividend Yield, Sector Allocation, and Performance in Two Leading ETFs – Which Offers the Best Balance of Growth and Stability for Your Portfolio? | That's TradingNEWS

Overview: NYSEARCA:SCHD and NYSEARCA:VIG

Dividend Yield and Growth: Income Versus Appreciation

NYSEARCA:SCHD: Yield and Dividend Stability

With a dividend yield of approximately 3.41%, SCHD is designed to deliver strong income for investors. Its dividend growth rate over the past five years is an impressive 12%, indicating a robust commitment to shareholder returns. This ETF focuses on income generation by holding companies with strong balance sheets and stable cash flows, ensuring consistent dividends. The fund's dividend is also supported by its selection criteria, which only includes companies with at least 10 years of dividend payments, free cash flow to total debt, return on equity (ROE), forward yield, and a five-year dividend growth rate.

NYSEARCA:VIG : Dividend Growth Focus

In contrast, VIG has a lower yield of 1.7% but emphasizes long-term dividend growth. With a five-year dividend growth rate near 40%, VIG targets firms that have grown dividends for at least a decade, reflecting financial health and a commitment to shareholder returns. While its yield is lower than SCHD, VIG’s dividend growth approach makes it appealing to investors looking for steady appreciation over time. It screens out the top 25% of high-yielding companies, thus avoiding yield traps and potential financial distress.

Sector Allocation: Defensive Versus Growth Tilt

SCHD: Defensive Allocation with Limited Tech Exposure

SCHD is strategically diversified, leaning towards defensive sectors. Financials (18%), Consumer Defensive (13.74%), and Health Care (15.92%) make up significant portions, positioning the ETF to weather economic downturns. Information Technology only represents around 10.38% of its holdings, allowing some exposure to tech-driven growth without overconcentration. Notably, SCHD lacks significant exposure to Real Estate and Utilities, focusing more on stable, income-generating sectors.

VIG: Growth with a Strong Technology Focus

On the other hand, VIG allocates a notable 24.1% to Information Technology, capitalizing on the sector’s growth potential, particularly in emerging areas like AI and cloud computing. Financials (20%) and Health Care (15.5%) follow closely, creating a balanced exposure between growth and defensive sectors. This higher tech weighting enables VIG to capture upside in bullish markets, while its avoidance of high-yield sectors helps limit volatility in downturns. With this focus, VIG has outperformed SCHD in recent years, thanks in part to tech’s strong performance.

Key Holdings and Portfolio Concentration

SCHD: Balanced with Equal-Weight Caps

SCHD’s top holdings include Amgen (AMGN), Merck (MRK), and PepsiCo (PEP), reflecting its focus on mature, high-quality companies. No single holding represents more than 4% of the portfolio, limiting concentration risk. This approach helps ensure that SCHD maintains income stability, as its top 10 holdings make up 41% of its total assets. This balanced exposure mitigates downside risk and supports income reliability, even in volatile markets.

VIG: Top-Heavy with Growth Bias

VIG follows a slightly different concentration strategy, with tech leaders like Apple (AAPL) and Microsoft (MSFT) among its largest holdings. Its top 10 holdings comprise about 30.2% of the fund, a more concentrated approach than SCHD. This focus allows VIG to benefit from the growth potential of major tech companies, positioning it well for capital appreciation, especially in bullish cycles. However, this allocation can lead to increased volatility compared to SCHD, especially during tech sector downturns.

Volatility and Performance: Risk-Adjusted Returns

SCHD: Stability and Lower Volatility

With a beta of 0.93, SCHD shows slightly lower volatility than VIG. This characteristic makes SCHD more suitable for conservative investors prioritizing income stability and capital preservation. During bearish markets, SCHD’s defensive allocation can offer a buffer against steep drawdowns, aligning with the needs of those seeking consistent returns over pure capital gains.

VIG: Higher Growth Potential with Modest Volatility

While VIG also maintains a relatively low beta of 0.87, its higher tech allocation introduces more volatility, especially during tech-heavy downturns. However, in bullish markets, VIG has outperformed SCHD due to its growth-oriented holdings. Investors who can tolerate moderate risk may find VIG’s potential for capital appreciation appealing, though it may lag in periods of market stress.

Technical Indicators: Support Levels and Price Momentum

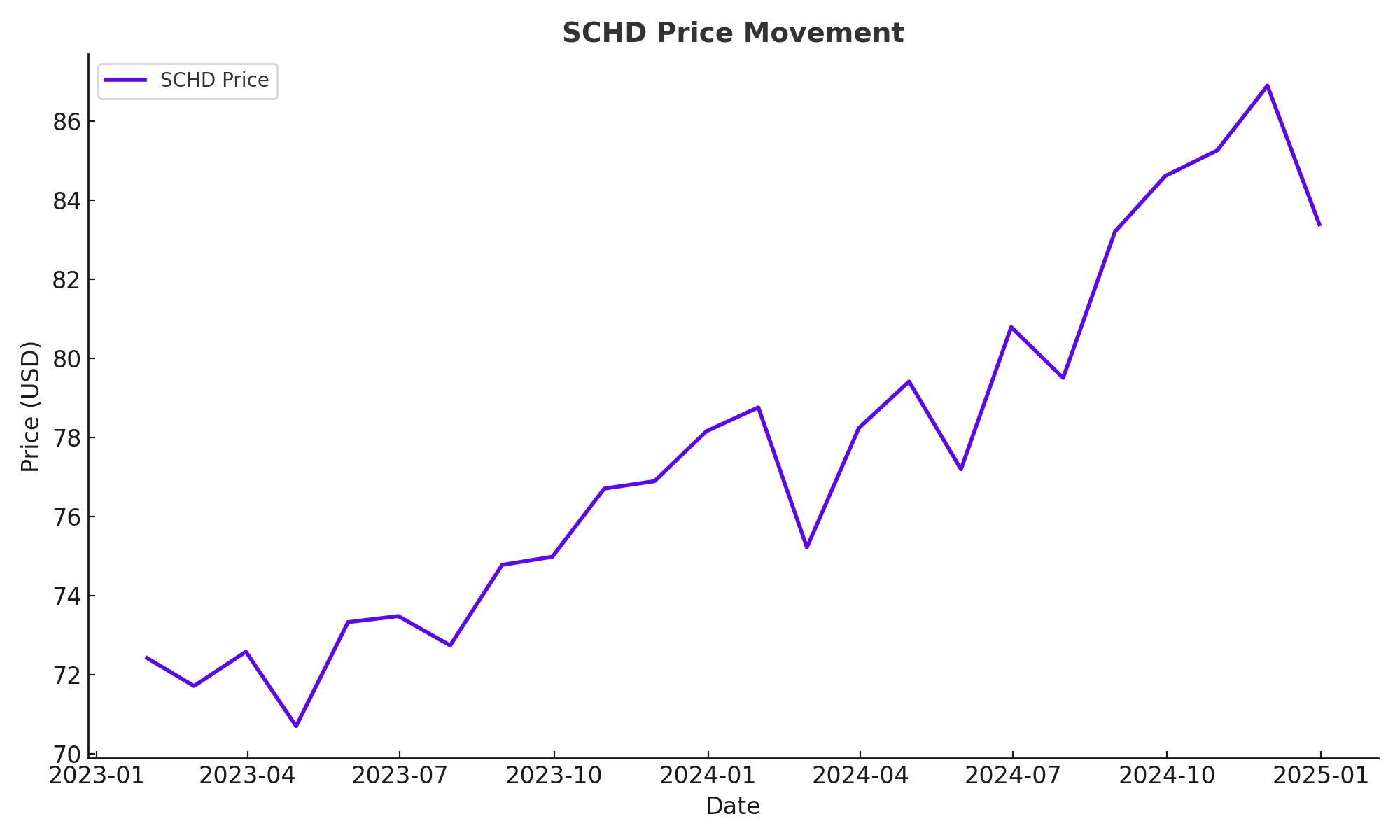

SCHD: Bullish Momentum Post-Split

Following its 3-for-1 split on October 10, 2024, SCHD’s share price was reduced to around $28, making it more accessible to retail investors and likely increasing its trading volume. Historically, stock splits can enhance liquidity and attract new investors, often leading to short-term price appreciation. Currently, SCHD is trading above its 200-day moving average, reflecting bullish sentiment, with support around $27.50 and resistance at $30. These levels indicate SCHD’s price stability, appealing to income-focused investors seeking both dividend yields and moderate growth.

VIG: Steady Uptrend Supported by RSI and Moving Averages

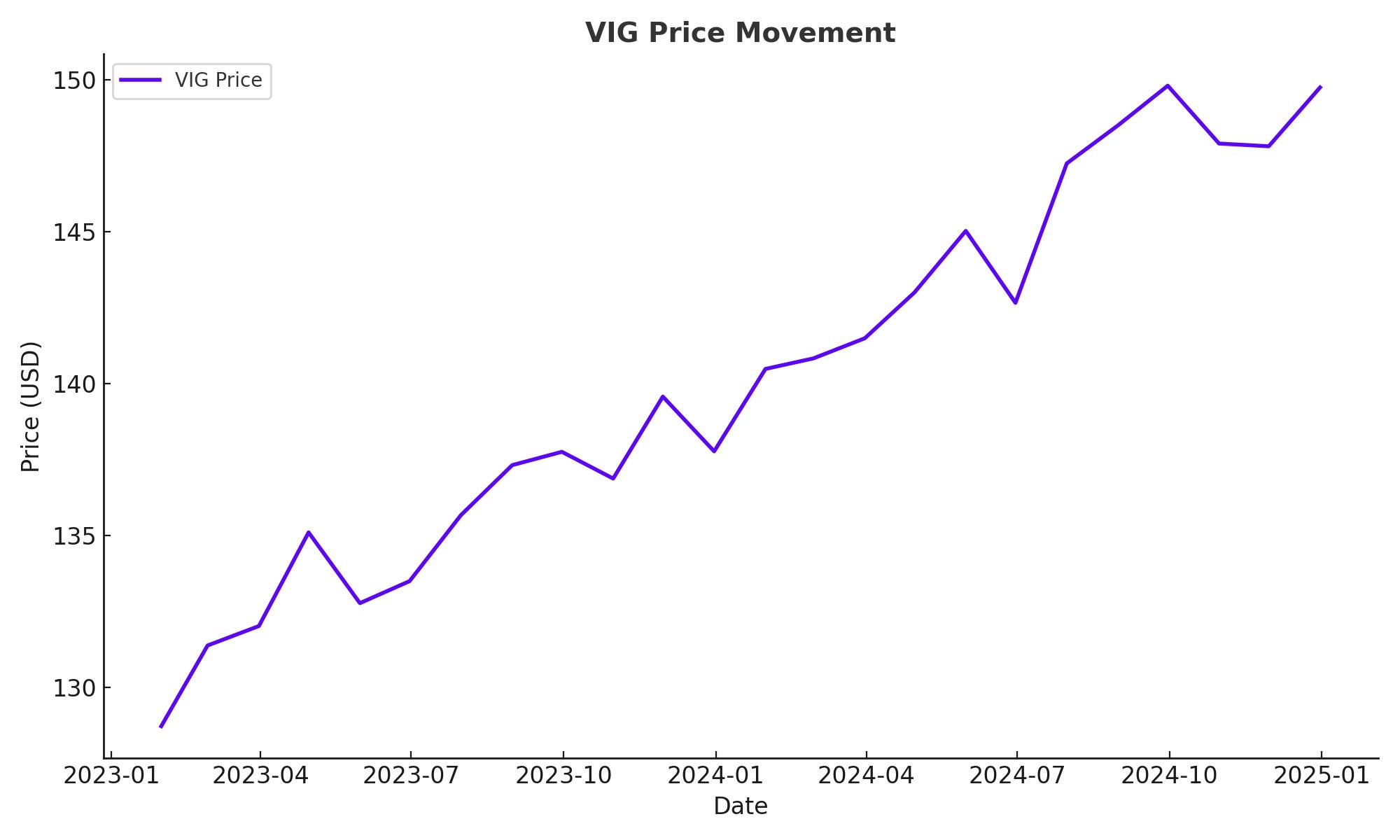

VIG is also exhibiting positive technical indicators, trading above its 200-day moving average. With an RSI in the bullish zone, VIG is supported at $190, suggesting a steady uptrend. However, with resistance around $200, VIG may encounter near-term price challenges. For growth-oriented investors, this support level provides an attractive entry point, particularly for those seeking exposure to high-growth sectors without extreme volatility.

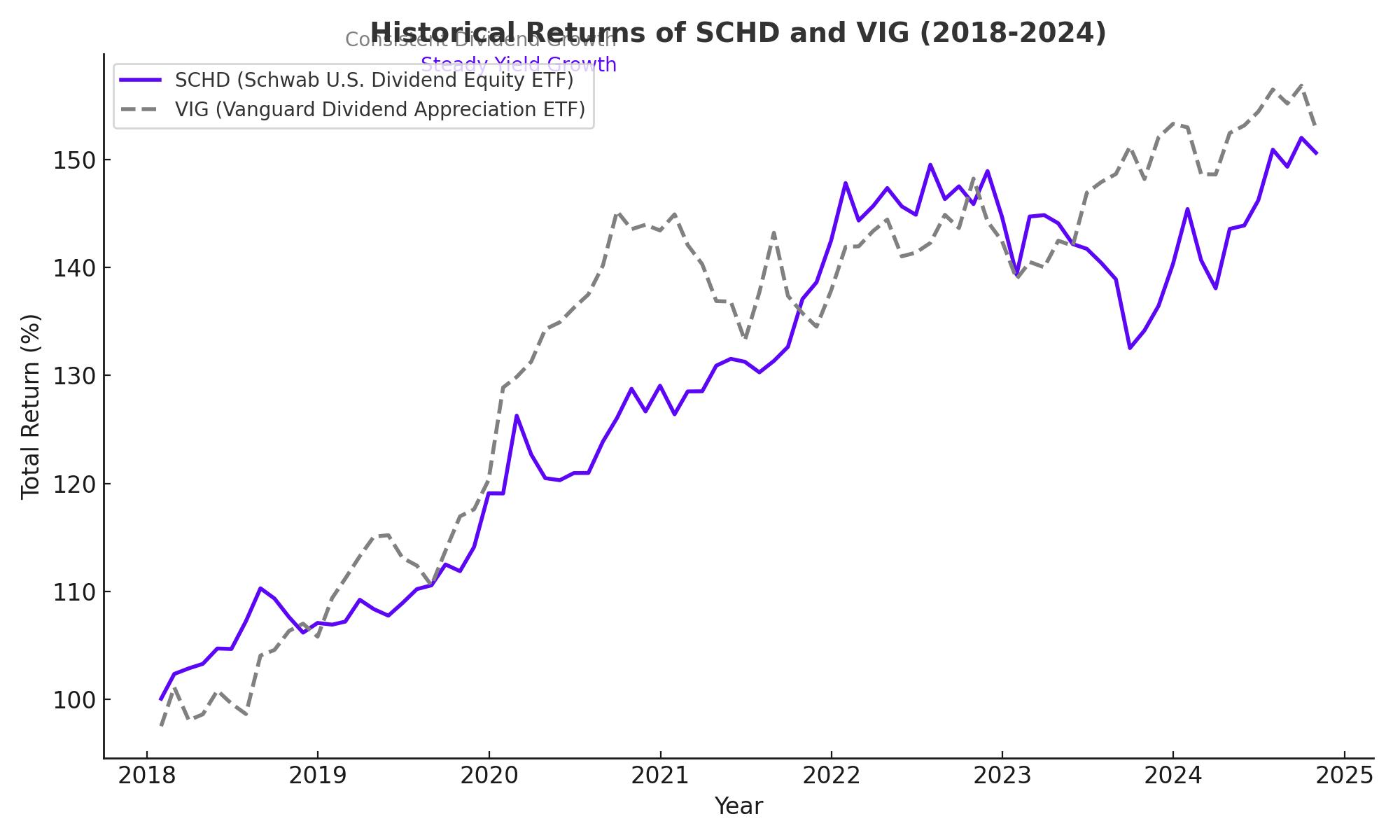

Comparison of Returns and Long-Term Growth Potential

Over the past 10 years, VIG has achieved an annualized return of approximately 11.85%, slightly surpassing SCHD’s 11.59%. While this difference may seem modest, it underscores VIG’s advantage in bull markets, thanks to its tech exposure. SCHD, however, remains more resilient in bearish phases due to its defensive sector allocation, proving advantageous for investors seeking stability and yield.

In terms of dividend growth, SCHD has outpaced VIG with a five-year dividend CAGR of 12%, compared to VIG’s 8.57%. This makes SCHD particularly appealing for investors prioritizing income growth, especially during periods of interest rate volatility where reliable income becomes more valuable.

Conclusion: A Closer Look at the Best ETF Choice—NYSEARCA:SCHD vs. NYSEARCA:VIG

NYSEARCA:SCHD : Stability, Income, and Accessibility with Defensive Strength

For investors prioritizing reliable income and long-term stability, NYSEARCA:SCHD offers a highly attractive option, particularly in today’s uncertain economic environment. With a strong dividend yield currently at approximately 3.41% and a history of consistent dividend growth at a five-year compounded rate of 12%, SCHD is well-positioned for income-focused investors. This fund's recent 3-for-1 share split, which reduced its share price from around $86 to about $28.60, significantly enhances its accessibility for retail investors and bolsters liquidity. Historical data on share splits often show positive price movement post-split, which could further increase SCHD’s appeal and trading volume in the months ahead.

Valuation metrics reinforce SCHD’s appeal as a lower-volatility income vehicle. It trades at a price-to-earnings (P/E) ratio of 17.56, notably lower than the S&P 500’s 24.2. The fund's price-to-cash flow ratio of 10.3 and price-to-book ratio of 3.3 underscore a discounted valuation relative to broader markets. Meanwhile, SCHD maintains a high return on equity (ROE) of 28.8%, demonstrating the profitability and financial stability of its holdings. In sector allocation, SCHD leans towards defensive areas—Financials (18%), Consumer Defensive (13.74%), and Health Care (15.92%)—providing resilience against market downturns, while its limited 10.38% exposure to Information Technology ensures some growth potential without excessive volatility.

Given these factors, SCHD is particularly suitable for conservative, income-oriented investors seeking a core holding that balances income stability with moderate growth potential. For those navigating a high-rate environment, SCHD provides steady returns with a robust dividend and lower valuation, making it an excellent defensive option.

NYSEARCA:VIG : Capital Appreciation with Tech-Driven Dividend Growth

For growth-oriented investors with a focus on dividend appreciation, NYSEARCA:VIG presents an attractive alternative. Unlike SCHD, VIG concentrates on companies with a proven history of dividend growth, which adds a dynamic growth element. With a dividend yield of 1.7%—lower than SCHD but complemented by a five-year dividend growth rate nearing 40%—VIG offers potential for capital gains alongside income growth. The fund’s strategy of selecting companies that have increased dividends for at least ten consecutive years, while excluding the top 25% of high-yielding companies, prioritizes stable growth over high but potentially risky yields.

VIG stands out with a significant allocation to the Information Technology sector, representing 24.1% of its portfolio. Top holdings include tech leaders like Apple (AAPL) and Microsoft (MSFT), both of which have benefited from advancements in AI, cloud computing, and digital transformation. This tech exposure positions VIG favorably for capital appreciation, particularly in bullish market conditions. In addition, VIG’s sector mix includes Financials (20%) and Health Care (15.5%), offering a balanced approach that combines growth with defensive characteristics.

While VIG’s lower yield and slightly higher volatility compared to SCHD may deter conservative income-seekers, its growth-oriented structure is ideal for investors willing to embrace moderate risk for greater potential returns. VIG’s tech-focused allocation allows it to capture significant gains during market upswings, especially as demand for technology, AI, and digital infrastructure continues to rise.

Final Decision: Buy, Hold, or Hold Back?

For investors with a long-term horizon focused on capital appreciation, NYSEARCA:VIG stands as a compelling Buy. Its emphasis on dividend growth, tech-driven sector exposure, and lower valuation appeal to those seeking a blend of income and capital gains potential. VIG’s unique balance between growth sectors and reliable dividend payers positions it well for an economic environment favoring innovation and sustained growth.

Conversely, investors prioritizing steady income, lower volatility, and defensive sector strength should find NYSEARCA:SCHD better aligned with their goals. Its robust dividend yield, consistent income growth, and defensive portfolio structure make SCHD a strategic choice for those looking to secure reliable income while mitigating exposure to market volatility.

In essence, NYSEARCA:VIG is optimal for growth-driven, long-term investors, while NYSEARCA:SCHD serves as a core income-generating holding for conservative portfolios seeking stability and yield. For real-time tracking of each ETF, investors can view SCHD here and VIG here to stay informed on performance and market dynamics.

That's TradingNEWS

Read More

-

Broadcom Stock Price Forecast - AVGO 13% Post-Earnings Slide vs. $73B AI Backlog at ~$350

13.01.2026 · TradingNEWS ArchiveStocks

-

Solana Price Forecast - SOL-USD Holds Around $143 as $135–$145 Zone Decides the Next Big Move

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex