NYSEARCA:VUG - A Bullish Outlook on Vanguard Growth ETF in 2025

The Vanguard Growth ETF (NYSEARCA:VUG) stands out as a leading investment vehicle for growth-oriented investors seeking exposure to the largest and most innovative companies in the U.S. equity market. With over $153 billion in assets under management, VUG is anchored by its heavy allocation to the Magnificent 7 (Mag 7)—Apple, Nvidia, Microsoft, Amazon, Meta Platforms, Alphabet, and Tesla—making up over 50% of its portfolio. In 2025, these tech giants continue to drive VUG's outperformance, capitalizing on megatrends like artificial intelligence (AI) and cloud computing.

Heavyweight Holdings Driving Performance

The Mag 7, collectively valued at over $18 trillion, dominate the technology sector and maintain a significant presence in global markets. Apple, the largest holding at 11.5%, remains a cash flow powerhouse with annual operational cash exceeding $100 billion, driven by its high-margin ecosystem of hardware and services. Nvidia, with its cutting-edge GPUs, commands leadership in AI hardware, while Microsoft and Amazon continue to solidify their dominance in cloud computing, representing over $200 billion in combined cloud revenues annually.

The Mag 7’s profitability metrics are unparalleled, boasting gross margins exceeding 46% for most companies and return on equity (ROE) metrics that outpace the broader S&P 500. Nvidia, for instance, achieved ROE figures above 35%, while Apple continues to set benchmarks with its cash flow and operational efficiency.

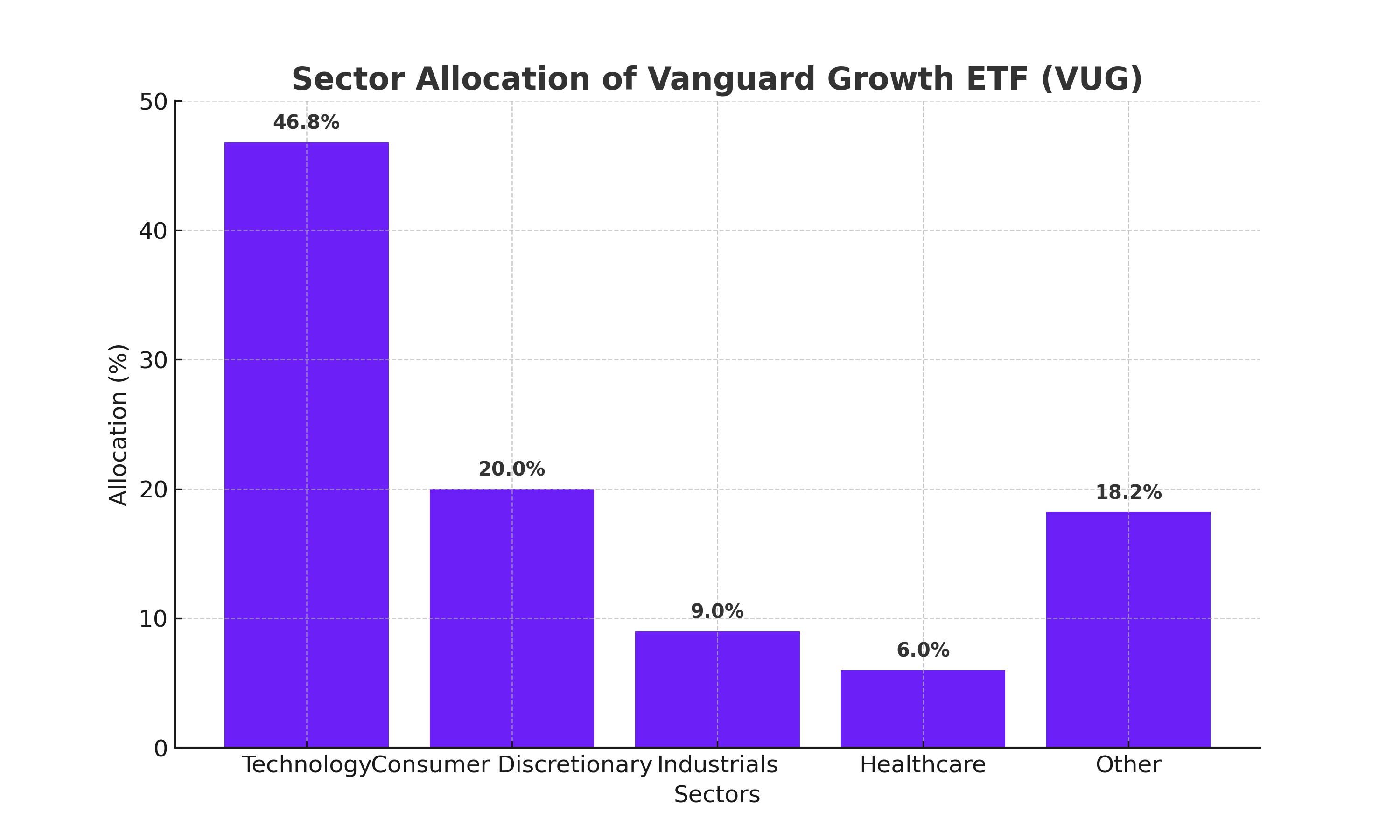

A Strategic Allocation to Technology

VUG's 46.8% allocation to technology cements its position as a tech-heavy ETF. This sector exposure reflects a strategic focus on companies leading the charge in AI, automation, and cloud computing. The global AI market, projected to grow at a 42% compound annual growth rate (CAGR) over the next decade, offers a significant tailwind for VUG's top holdings.

In particular, Nvidia’s dominance in AI chips ensures its continued relevance in sectors ranging from data centers to autonomous vehicles. Meanwhile, Microsoft’s AI-enhanced offerings, such as Azure’s integration of OpenAI models, position it as a leader in enterprise cloud solutions. These factors collectively support the bullish case for VUG’s technology-driven portfolio.

Historical Outperformance and Expense Efficiency

VUG has consistently outperformed broader benchmarks, delivering a 36.87% return over the past year, outpacing the S&P 500’s 25.6% gain. Over the last five years, VUG has delivered 44% higher returns than Vanguard's S&P 500 ETF (NYSEARCA:VOO), making it a standout choice for growth investors.

Despite its robust performance, VUG maintains an industry-leading expense ratio of just 0.04%, ensuring that investors retain a significant portion of their returns. The ETF’s high liquidity, averaging 1.19 million shares traded daily, adds to its appeal as a flexible and cost-effective investment vehicle.

Valuation and Concentration Risks

While VUG’s valuation metrics are elevated, with a current P/E ratio of 38.8x, its forward P/E ratios for the Mag 7 suggest significant earnings growth through 2026. Nvidia, for example, is projected to reduce its P/E ratio by over 30%, signaling strong forward-looking earnings potential.

The ETF’s heavy concentration in a few large-cap technology stocks introduces risks, particularly during periods of tech market volatility. However, the robust fundamentals of its top holdings provide a buffer against sector-specific downturns. Diversification across 185 holdings ensures exposure to other sectors, including consumer discretionary (20%), industrials (9%), and healthcare (6%).

AI and Cloud: VUG’s Growth Engines

The intersection of AI and cloud computing represents one of the most compelling growth stories for VUG. Nvidia’s GPUs remain the gold standard for training large AI models, while Microsoft and Amazon continue to expand their cloud offerings with AI integration. The rise of AI-driven applications across industries, from healthcare to finance, underscores the relevance of VUG’s portfolio.

Meta Platforms and Alphabet also play pivotal roles, leveraging AI to enhance advertising platforms and consumer engagement. Tesla, with its advancements in autonomous driving technology, complements this narrative, adding diversity to VUG’s tech-heavy holdings.

A Comparison with VOO: Why VUG Stands Out

While VOO provides broader diversification with over 500 holdings and a dividend yield of 1.24%, VUG’s heavier allocation to growth-oriented sectors ensures superior long-term capital appreciation. The Mag 7, which comprise 30% of VOO’s portfolio, account for over 50% of VUG, making it a targeted bet on the dominant players shaping the global economy.

Risks and Considerations

Despite its bullish outlook, VUG is not without risks. A potential slowdown in earnings growth for the Mag 7 could weigh on its performance. Additionally, macroeconomic factors such as rising interest rates or geopolitical tensions could impact tech valuations. However, expected rate cuts in late 2025 provide a supportive backdrop for growth stocks, mitigating these risks to some extent.

Final Thoughts on NYSEARCA:VUG

The Vanguard Growth ETF (NYSEARCA:VUG) remains an excellent vehicle for investors seeking exposure to high-growth, large-cap U.S. equities. Its focus on the Magnificent 7 ensures participation in the most transformative sectors of the global economy, including AI and cloud computing. Despite elevated valuations and concentration risks, VUG’s historical outperformance, cost efficiency, and strong fundamentals make it a compelling choice for long-term investors looking to capitalize on innovation and growth. At current levels, VUG is well-positioned to deliver significant returns in 2025 and beyond.