Oil Market Analysis: Production Boosts, Sanctions, and Shifting Inventories

Exploring the Impact of Geopolitical Events and Inventory Changes on Oil Prices and Production Trends | That's TradingNEWS

Oil Market Dynamics: An In-Depth Analysis

Russian Oil Production and Sanctions Impact

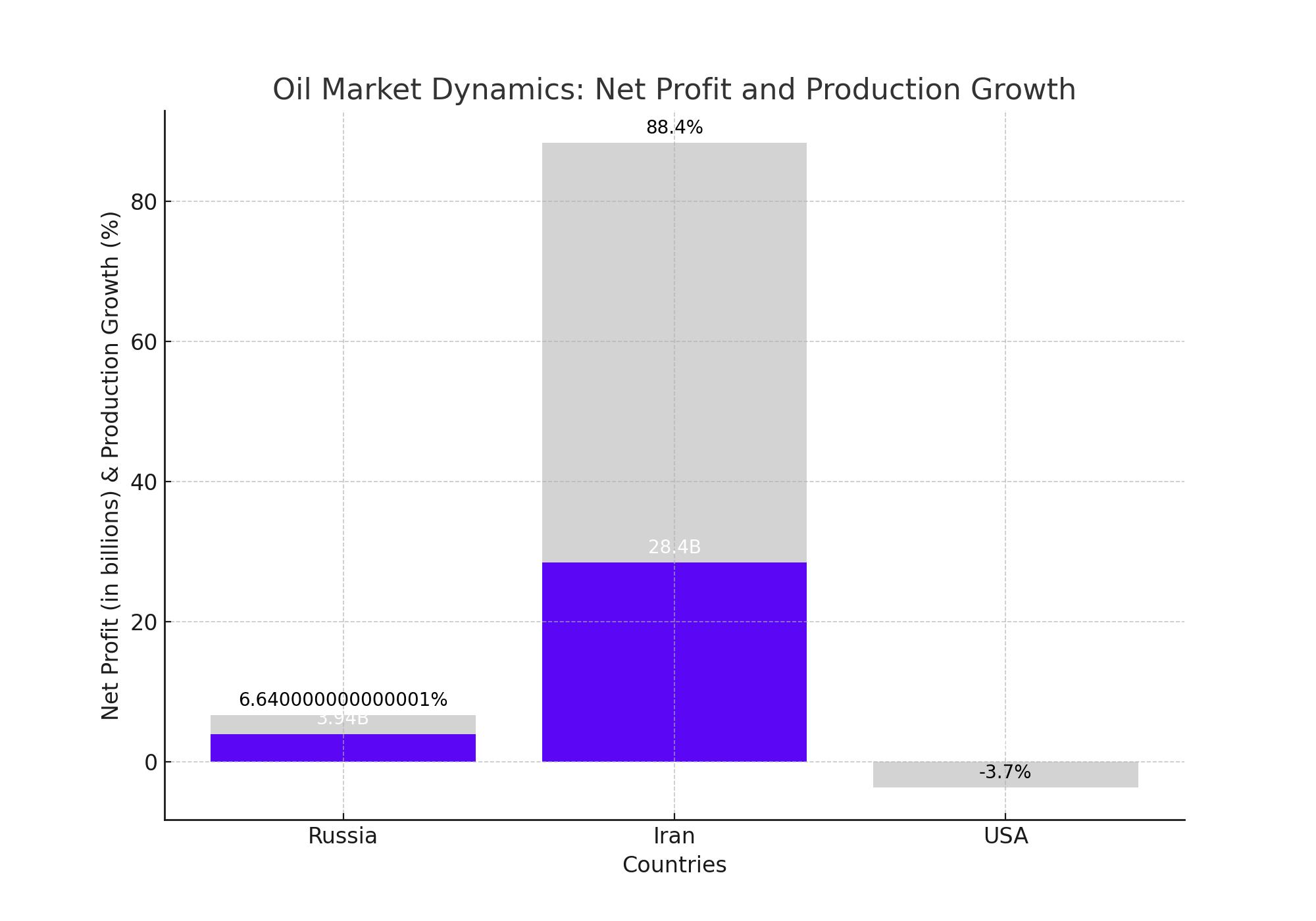

Novatek, Russia's leading gas producer and LNG exporter, reported substantial growth in earnings for the first half of 2024. The company’s net profit soared to $3.94 billion, more than doubling from $1.79 billion in the same period of 2023. This impressive increase was driven by higher production levels, which rose to 1.82 million barrels of oil equivalent per day (boepd), up from 1.78 million boepd in the previous year. Despite facing lower sales volumes and challenges with its Arctic LNG 2 project, Novatek managed to increase its oil and gas output by 2.7%, with natural gas and liquids production growing by 1.2% and 11.9%, respectively.

Western sanctions have significantly impacted Novatek's operations, particularly the Arctic LNG 2 project. Foreign shareholders withdrew from the project following sanctions from the Biden Administration and the EU's ban on new investments in Russian LNG projects. These geopolitical tensions are forcing Russia to seek new markets and adapt to a rapidly changing global landscape.

Iranian Oil Production and Sanctions

Iran has effectively mitigated the impact of U.S.-led sanctions on its gas condensate exports. The Iranian Petroleum Minister, Javad Owji, reported that gas condensate exports have been neutralized, with the country increasing its oil production by 60% to 3.6 million barrels per day (bpd) from 2.2 million bpd in 2021. Iran's oil revenues surged to $28.4 billion annually, up from $9 billion in 2020. This growth is attributed to enhanced export strategies and an increase in production capacity, with plans to further boost output to 4 million bpd.

U.S. Crude Oil Inventories and Market Reactions

The U.S. Energy Information Administration (EIA) reported a decline in crude oil inventories by 3.7 million barrels for the week ending July 19, following a previous draw of 4.9 million barrels. The American Petroleum Institute (API) estimated a similar draw of 3.9 million barrels. In fuels, gasoline stocks dropped by 5.6 million barrels, while middle distillates saw a decline of 2.8 million barrels. This reduction in inventories, coupled with ongoing wildfires in Canada’s Alberta region impacting production, has driven oil prices higher.

At the time of reporting, Brent crude traded at $81.35 per barrel, and West Texas Intermediate (WTI) was at $77.37 per barrel. Analysts from ING highlighted the supply risks from Canadian wildfires and the market's near oversold territory, suggesting a potential for prices to rise further in the third quarter due to a deficit environment.

Russia's Export Restrictions

The Russian government is reinstating a ban on gasoline exports from August 1 to stabilize domestic fuel prices, following similar measures in the past. These restrictions come as diesel demand and prices increase, with potential future bans depending on market conditions. This move is part of Russia's broader strategy to manage its energy resources amidst fluctuating global prices and geopolitical pressures.

Global Oil Price Movements

Oil prices edged higher on recent trading sessions, snapping a three-day decline. Brent crude futures rose by 0.81% to $81.67 a barrel, while WTI increased by 1.01% to $77.74 per barrel. The price recovery is attributed to falling U.S. crude inventories and supply risks from Canadian wildfires. Despite these gains, concerns over weak demand in China, the world's largest crude importer, and ongoing geopolitical tensions continue to weigh on the market. U.S. oil refiners are expected to report lower earnings for the second quarter due to a sluggish summer driving season affecting refining margins.

Wildfires and Supply Concerns

The wildfires in Canada have forced some oil producers to curtail production, adding to supply risks. This situation, coupled with inventory declines in the U.S., supports a bullish outlook for oil prices in the near term. Analysts predict that the fundamentals will drive prices higher for the remainder of the third quarter, despite potential oversupply concerns.

Conclusion

The oil market is navigating a complex landscape of production increases, geopolitical tensions, and fluctuating demand. Russian and Iranian production strategies highlight efforts to counteract Western sanctions and boost revenues. U.S. inventory data and Canadian wildfires contribute to price volatility, with analysts maintaining a cautiously optimistic outlook for the third quarter. The reinstatement of Russian export bans and ongoing geopolitical developments will continue to shape the market dynamics. Investors should stay informed about insider transactions and broader economic indicators to make well-informed decisions in this volatile environment.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex