Oil Market Future - Trends, Predictions and Strategic Insights

Delve into the latest oil price forecasts, the role of OPEC, and upcoming market shifts that stakeholders need to watch in the evolving global energy landscape | That's TradingNEWS

Analysis of Current Oil Market Dynamics and Future Projections

Overview of Oil Price Trends

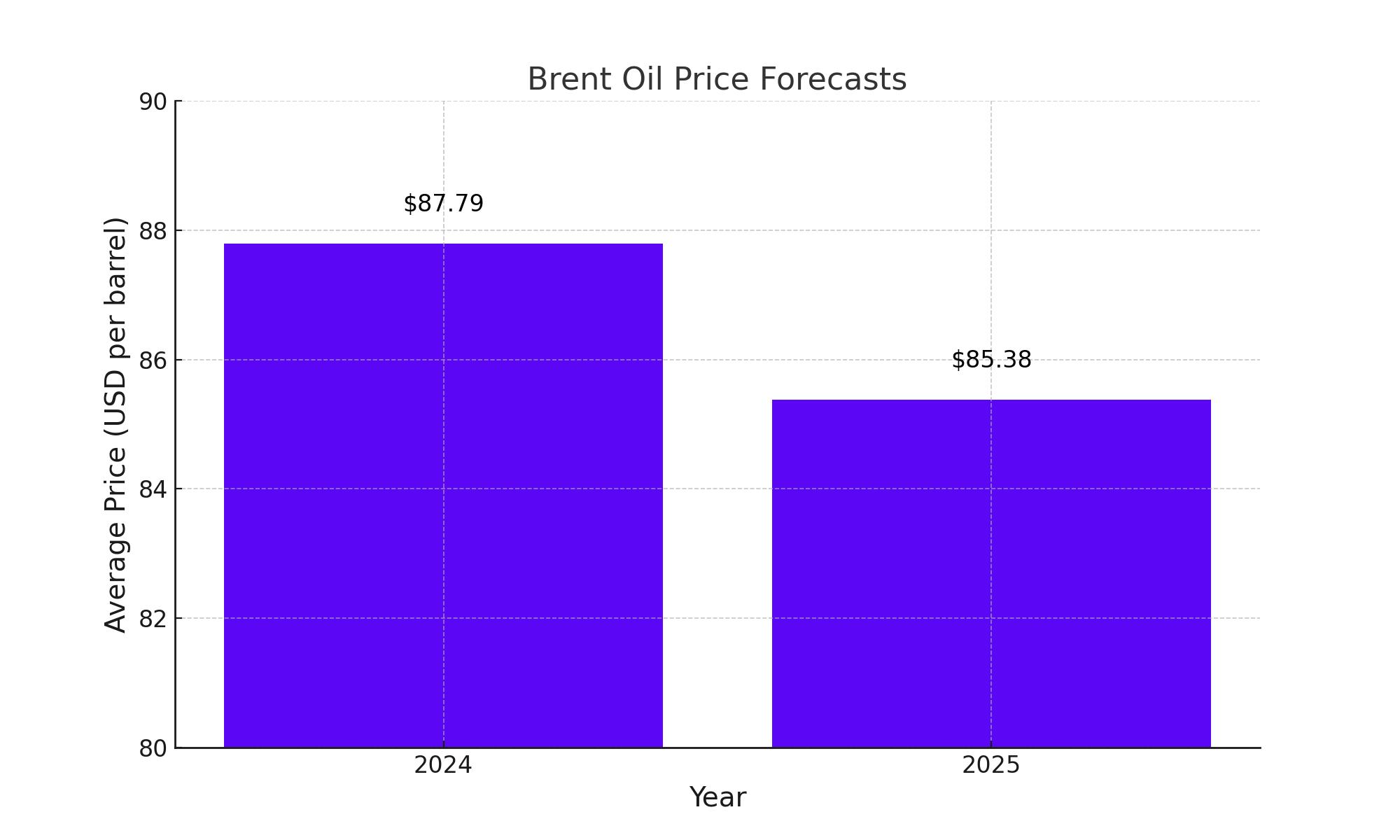

In recent updates from the U.S. Energy Information Administration (EIA), there has been a notable adjustment in the Brent oil price forecasts for the coming years. The latest Short-Term Energy Outlook (STEO) predicts that Brent oil prices will average $87.79 per barrel in 2024, descending slightly to $85.38 in 2025. These figures represent a slight decrease from previous forecasts, indicating potential shifts in the oil market dynamics.

Geopolitical Influences and Market Responses

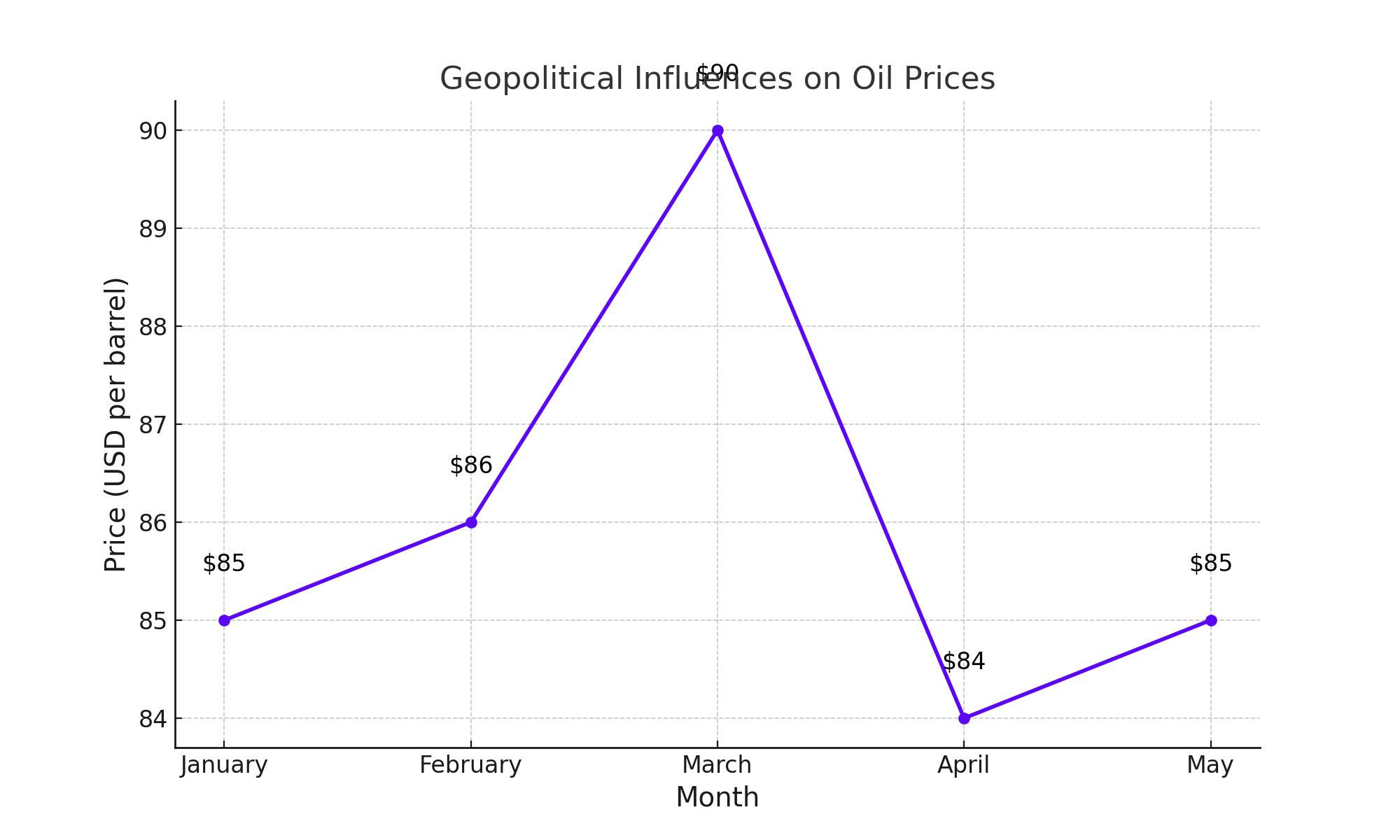

April witnessed Brent crude reaching $90 per barrel, a $5 increase from March, marking the fourth consecutive monthly rise. However, a dip was observed by May 2, with prices settling at $84 per barrel. This fluctuation is attributed to a combination of decreasing global oil inventories and heightened geopolitical tensions, particularly between Iran and Israel. These factors introduce a layer of uncertainty that could potentially amplify price volatility in the near term.

OPEC's Role and Production Strategies

The EIA report underscores the substantial spare production capacity held by OPEC, estimated at about four million barrels per day through 2025. This reserve capacity is a critical element in stabilizing the market against sudden supply disruptions. Moreover, ongoing voluntary production cuts by OPEC+ are anticipated to keep the market relatively balanced throughout the second half of 2024, supporting oil prices around $90 per barrel.

Anticipated Market Adjustments

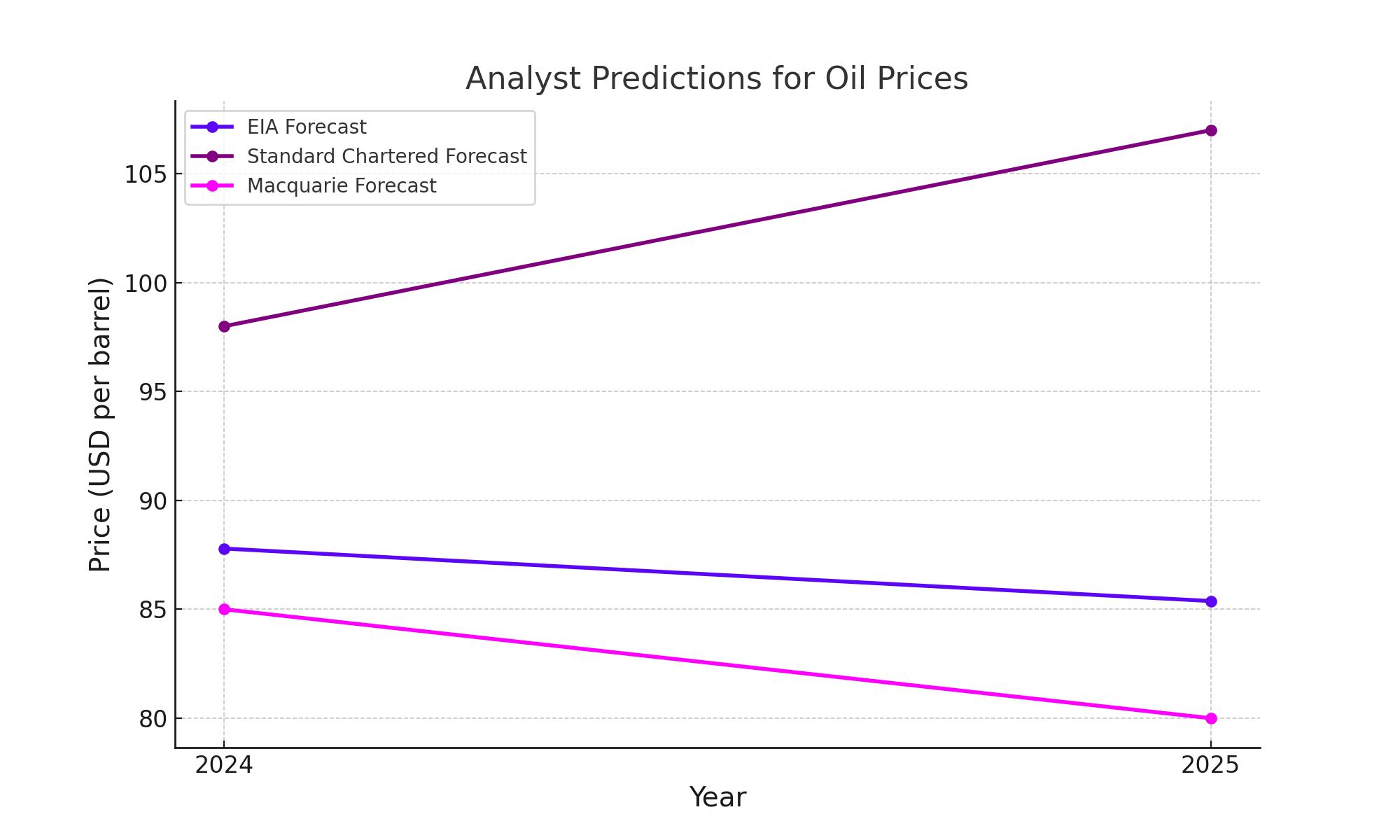

Despite the present balance, the EIA forecasts a shift in 2025 where increased supply growth could lead to a build-up in global oil inventories, potentially reducing the average price to $85 per barrel. This projection aligns with views from other market analysts, including those from Standard Chartered and Macquarie, who suggest that oil prices might face downward pressure due to various factors including escalating production and evolving market fundamentals.

Analysts' Insights and Predictions

Standard Chartered speculates a robust average of $98 per barrel in Q3 2024, escalating to $107 by early 2025, reflecting a more optimistic stance compared to the EIA. Conversely, Macquarie suggests a more constrained range of $80-$90 per barrel in the near term, cautioning that prices might dip below $80 post-Q2 2024 due to increasing NOPEC supply and potential demand setbacks.

Legal and Regulatory Considerations

The sector is also navigating through legal complexities as major shale oil producers like ExxonMobil, Occidental Petroleum, and Diamondback Energy face allegations of colluding to manipulate production levels to elevate prices. These legal challenges, underscored by recent FTC actions against industry figures, could introduce further uncertainty and potential disruptions in the operational strategies of these major players.

Conclusion: Strategic Considerations for Stakeholders

Stakeholders in the oil market must remain vigilant and adaptive to these diverse influences. The balance of geopolitical tensions, OPEC's strategic decisions, regulatory actions, and market sentiment will play pivotal roles in shaping the trajectory of oil prices. Investors and industry players should prepare for potential volatility while considering strategic positions that align with both current trends and future market forecasts. Ensuring a comprehensive understanding of these dynamics will be crucial for navigating the complexities of the global oil market.

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex