Oil Market: Investment Surges, Hurricane Impacts and OPEC+ Cuts

Analyzing the Effects of Pakistan’s $5 Billion Investment, Hurricane Beryl, and OPEC+ Strategies on Global Oil Prices and Market Sentiment | That's TradingNEWS

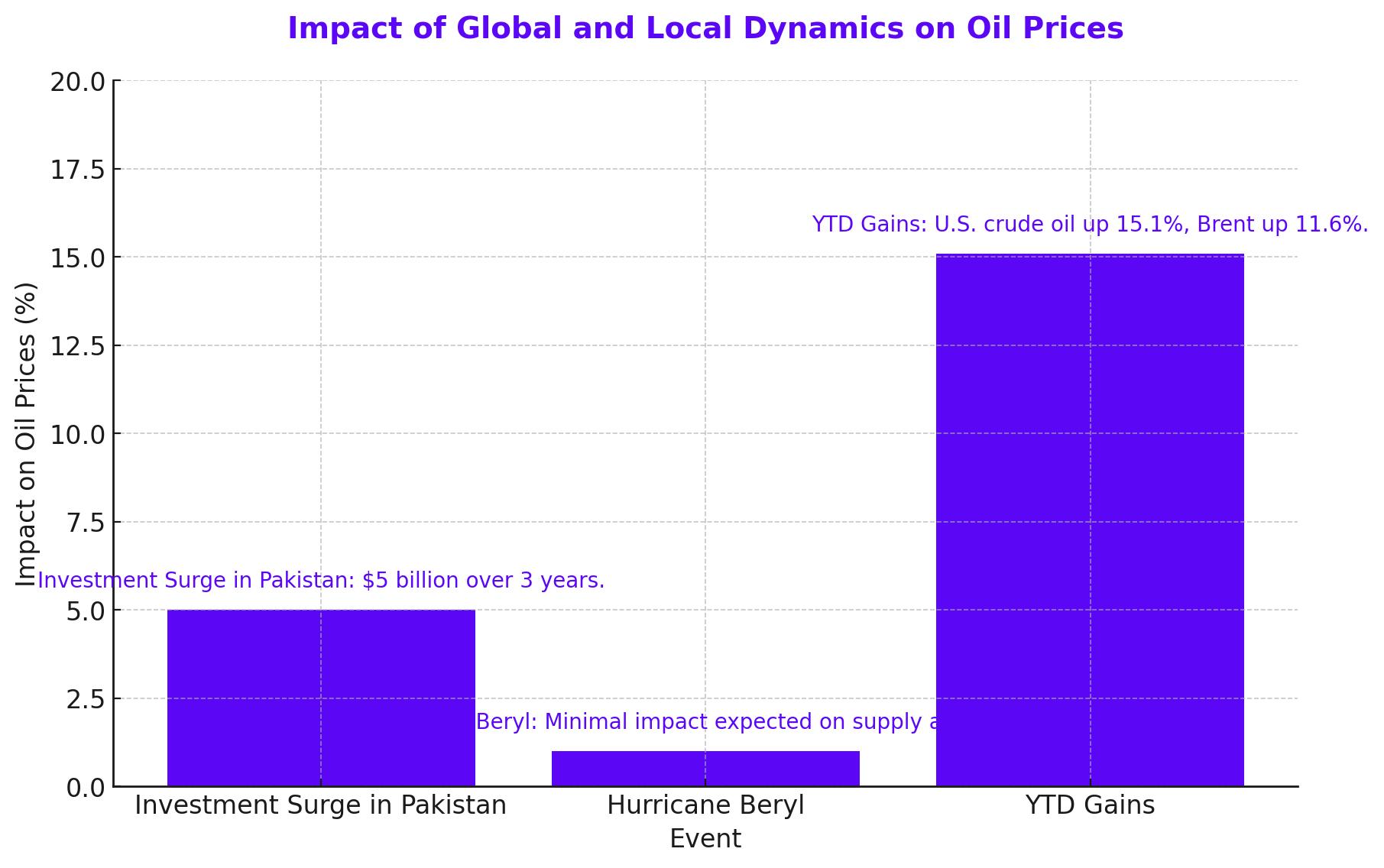

Impact of Global and Local Dynamics on Oil Prices

Investment Surge in Pakistan’s Oil and Gas Sector

Pakistan is gearing up for a significant investment influx in its oil and gas sector, with companies planning to inject $5 billion over the next three years. The announcement came from Pakistan’s Prime Minister Shehbaz Sharif, highlighting a strategic move to boost domestic energy exploration and reduce dependency on imports. This substantial investment aims to drill approximately 240 sites, tapping into the country’s hydrocarbon potential. The focus on increasing oil imports from Russia further underscores Pakistan's strategic pivot to secure more cost-effective energy sources, which is crucial given the country’s dwindling foreign exchange reserves.

Hurricane Beryl's Impact on U.S. Oil Markets

The recent landfall of Hurricane Beryl near Matagorda, Texas, has stirred concerns about the potential disruption to Gulf Coast refining and export infrastructure. The hurricane, classified as Category 1 with winds of 80 miles per hour, prompted companies like Shell to shut down production and evacuate personnel from platforms like Perdido, which produces about 100,000 barrels per day. Despite these precautions, experts like Andy Lipow of Lipow Oil Associates suggest that the storm's overall impact on supply and prices will be minimal. However, the temporary halt in operations could lead to slight increases in gasoline prices post-storm, driven by recent crude futures' rise.

Current Energy Prices and Market Sentiment

As of the latest trading session, U.S. crude oil futures for the August contract fell by 0.79% to $82.51 per barrel, while Brent crude for September was down 0.61% to $86.02 per barrel. Despite these declines, the year-to-date gains for U.S. oil stand at 15.1%, with Brent up by 11.6%. RBOB gasoline futures dropped by 0.47% to $2.54 per gallon, reflecting a 21% increase for the year, whereas natural gas futures rose slightly by 1.03% to $2.34 per thousand cubic feet, although they are down by 6.9% year-to-date.

Geopolitical and Seasonal Influences on Oil Prices

Oil prices have experienced fluctuations due to geopolitical developments and seasonal demand patterns. The talks over a U.S.-mediated ceasefire in Gaza and the potential impact of Hurricane Beryl on U.S. refining capacity are key factors influencing current market dynamics. The closure of major ports in Texas as a precautionary measure against the hurricane has raised concerns about short-term disruptions in crude and liquefied natural gas exports. Additionally, the summer driving season in the U.S., typically a period of peak demand, is expected to sustain the drawdown in oil inventories, thereby supporting prices.

Technical Analysis and Market Forecasts

From a technical perspective, WTI crude oil has shown resilience, rebounding from the $81.50 level and eyeing a potential move towards $85 per barrel. Brent crude, similarly, has found support around $85 and appears poised for further gains. Analysts are closely monitoring key support and resistance levels, with Brent potentially targeting $90 per barrel if current momentum persists. The weekly settlement prices suggest positive investor sentiment, notwithstanding the profit-taking seen before the weekend.

OPEC+ Production Cuts and Market Tightening

OPEC+ members under production cuts have continued to reduce output, contributing to a tightening of the global oil market. In June, OPEC+ production fell by 90,000 barrels per day to 33.98 million barrels per day, marking the lowest output in three years. This reduction has supported the recent rally in oil prices, which have increased by $7-8 per barrel over the past month. The planned unwinding of some production cuts starting in October by key OPEC+ members will be closely watched for its impact on market balances.

Outlook for Oil Prices

The outlook for oil prices remains bullish, with factors such as geopolitical tensions, seasonal demand, and strategic production cuts playing crucial roles. Analysts expect U.S. data to show another significant weekly draw in oil inventories, reinforcing the view of a tight market. While hurricane season poses risks to supply chains, the overall market sentiment is buoyed by the expectation of sustained demand and constrained supply. Investors are advised to stay vigilant to these dynamics as they navigate the complex landscape of the global oil market.

That's TradingNEWS

Read More

-

CGDV ETF at $44.17 Targets $52 as Dividend Value and AI Leaders Drive 2026 Upside

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: $2.20 XRP and $1.6B Inflows Drive 2026’s Hottest Crypto Trade

07.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Rebounds to $3.48 as Market Eyes EIA Storage Shock

07.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.6 as BoJ Hawkish Shift Collides With Fed Cut Expectations

07.01.2026 · TradingNEWS ArchiveForex