Oil Market Trends: Analyzing Global Demand and Supply Dynamics

Dive into the complexities of the oil market with insights on consumer sentiment, strategic reserves, and geopolitical influences that are shaping the pricing and supply landscape for 2024 | That's TradingNEWs

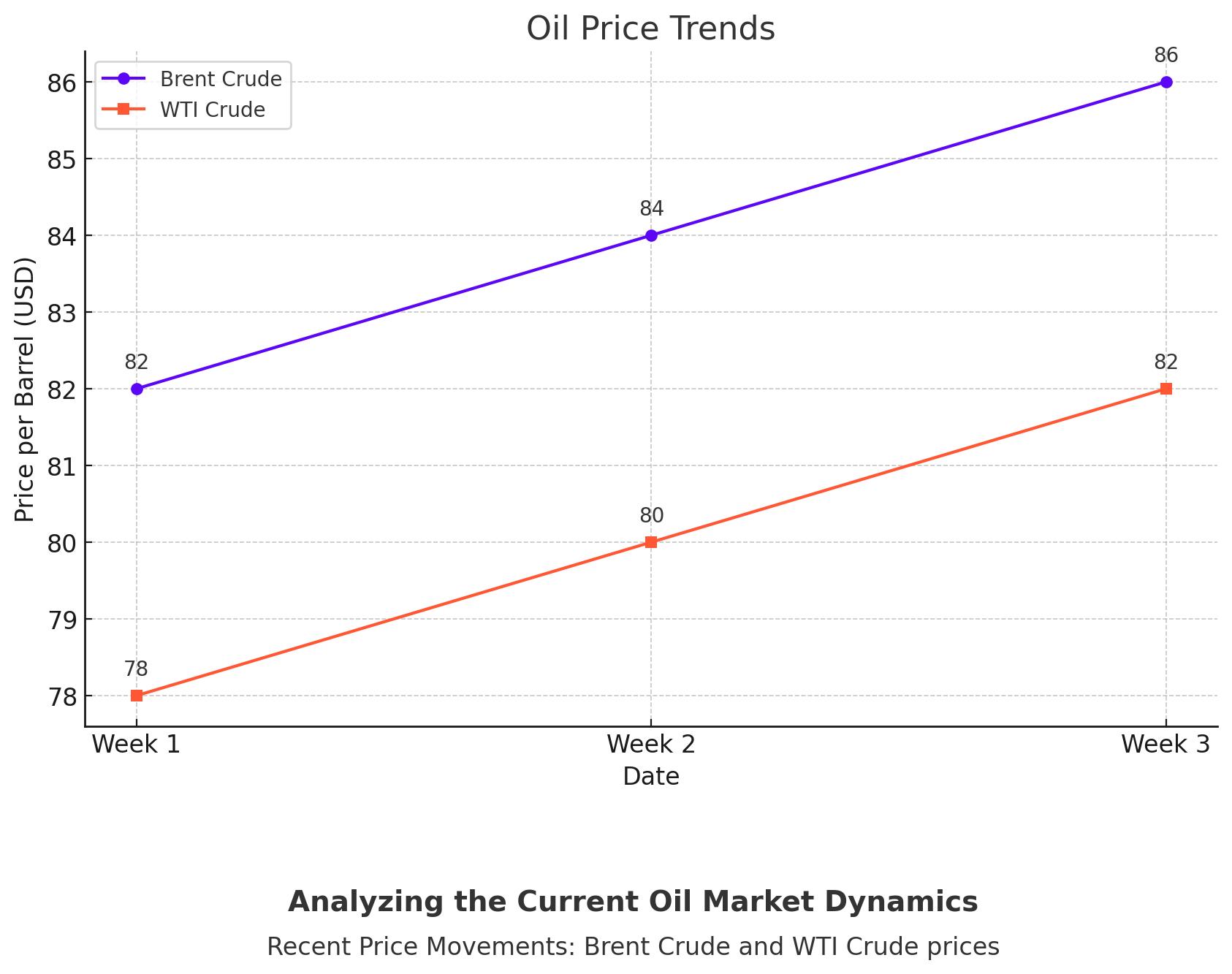

Analyzing the Current Oil Market Dynamics

Recent Price Movements and Demand Concerns

This week, the oil markets experienced a downturn, with Brent crude approaching $82 per barrel and West Texas Intermediate (WTI) nearing $78 per barrel. This shift comes on the heels of last week's strong performance, driven by optimistic demand forecasts from OPEC+ and the International Energy Agency (IEA). However, a recent U.S. consumer sentiment survey indicated a drop to 65.6 from 69.1, sparking concerns about potential declines in consumer spending and its subsequent impact on oil demand.

OPEC and IEA Forecasts: Diverging Perspectives

OPEC maintains its demand growth forecast at over 2 million barrels per day (bpd), aligning with its positive long-term outlook. Conversely, the IEA's latest report forecasts a substantial supply overhang, predicting a spare production capacity of 8 million bpd by 2030. This stark difference in outlook between OPEC and the IEA has introduced uncertainty, potentially increasing market volatility.

China's Economic Indicators and Their Impact

China's economic data continues to play a critical role in shaping global oil demand perceptions. Recent statistics showed a 3.7% increase in retail sales, yet industrial output figures fell short of expectations at 5.6% growth versus the anticipated 6%. These mixed signals contribute to the complex decision-making matrix for oil traders, reflecting the nuanced impact of Chinese economic health on oil markets.

U.S. Strategic Petroleum Reserve and Political Implications

The Biden administration has signaled readiness to tap into the Strategic Petroleum Reserve (SPR) to stabilize gasoline prices, particularly as the U.S. approaches critical elections. This move, aimed at curbing inflation, has sparked political debate, with opposition parties criticizing the potential political motivations behind the use of the SPR. Current U.S. gasoline prices average $3.45 a gallon, significantly higher than pre-administration levels, highlighting the ongoing public and political sensitivity to fuel costs.

Geopolitical Tensions and Market Speculations

Amidst the market dynamics, geopolitical tensions continue to influence oil prices. Recent escalations involving cross-border conflicts in the Middle East have heightened concerns about potential disruptions to oil supply chains. Additionally, market speculations persist about OPEC+'s future strategies following their recent decision to extend oil supply cuts, which have supported a price increase to $82.62 a barrel.

Looking Ahead: Market Predictions and Strategies

Goldman Sachs anticipates Brent crude reaching $86 per barrel in the upcoming quarter, reflecting a cautiously optimistic market outlook. However, analysts from Bank of America highlighted the risks associated with weak supply and demand balances, suggesting potential volatility ahead. As the market navigates these uncertain waters, stakeholders remain vigilant, closely monitoring global economic indicators, geopolitical developments, and OPEC+ decisions to strategize their next moves in the complex global oil landscape.

In summary, the oil market currently faces a multifaceted array of influences ranging from economic data and geopolitical tensions to strategic petroleum reserves and political factors, each playing a significant role in shaping the trajectory of oil prices and market stability.

That's TradingNEWs

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex