Crude Oil Prices and Market Dynamics

Crude oil prices have seen significant fluctuations recently, with West Texas Intermediate (WTI) trading just above $75 per barrel and Brent crude slipping below $80 per barrel. These declines come amidst growing concerns about the economic slowdown in China, the world's largest oil importer. Economists predict that China's manufacturing activity will contract for the third consecutive month, with Citi lowering its GDP growth forecast for China to 4.8% from 5%.

Geopolitical Influences on Oil Prices

The recent election results in Venezuela could also impact global oil supply. Nicolas Maduro's victory might prompt the United States to tighten sanctions on Caracas, potentially reducing Venezuelan oil output by 100,000 to 120,000 barrels per day. This geopolitical tension adds another layer of complexity to the oil market, which is already facing supply and demand challenges.

Technical Analysis of WTI and Brent Crude

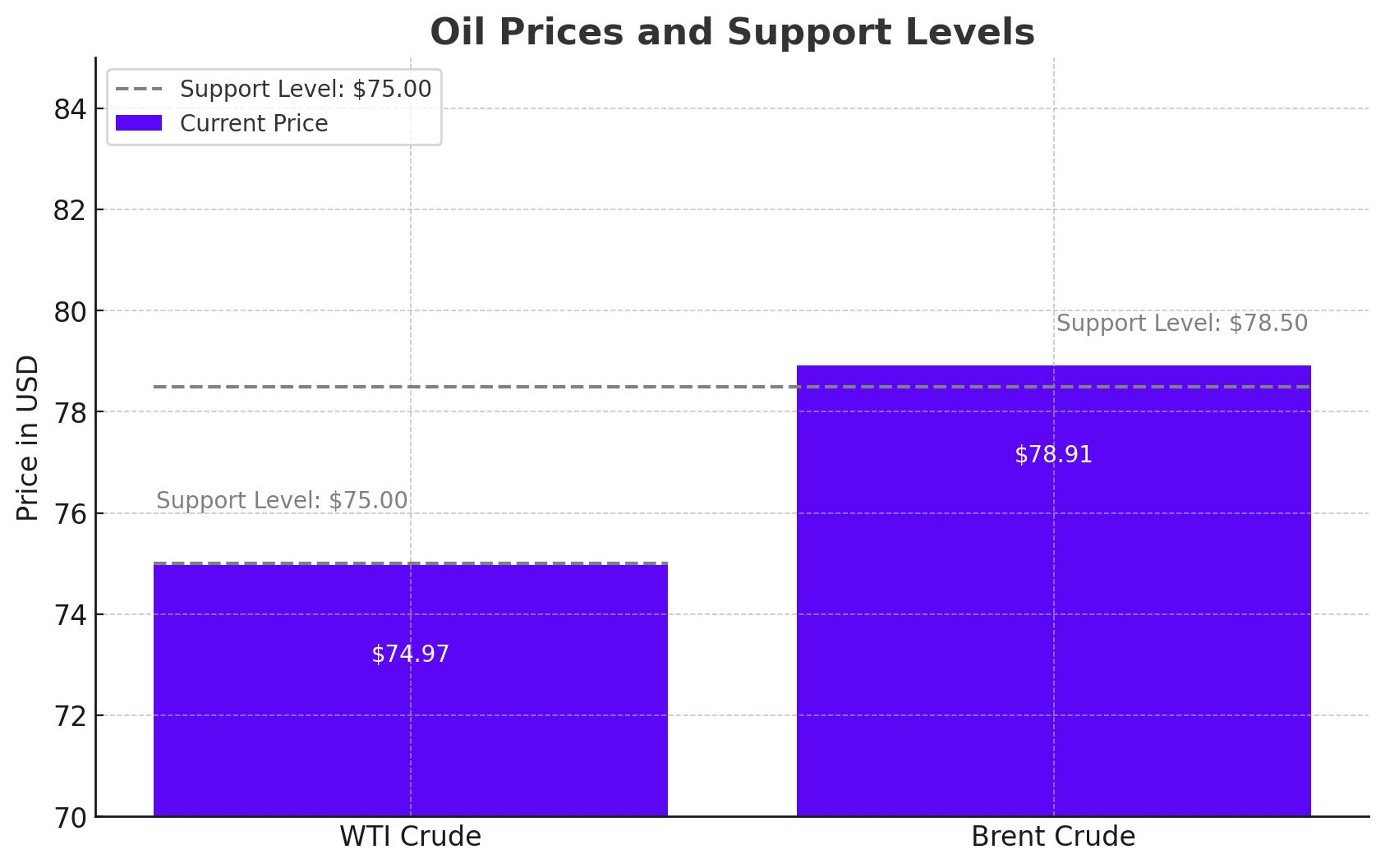

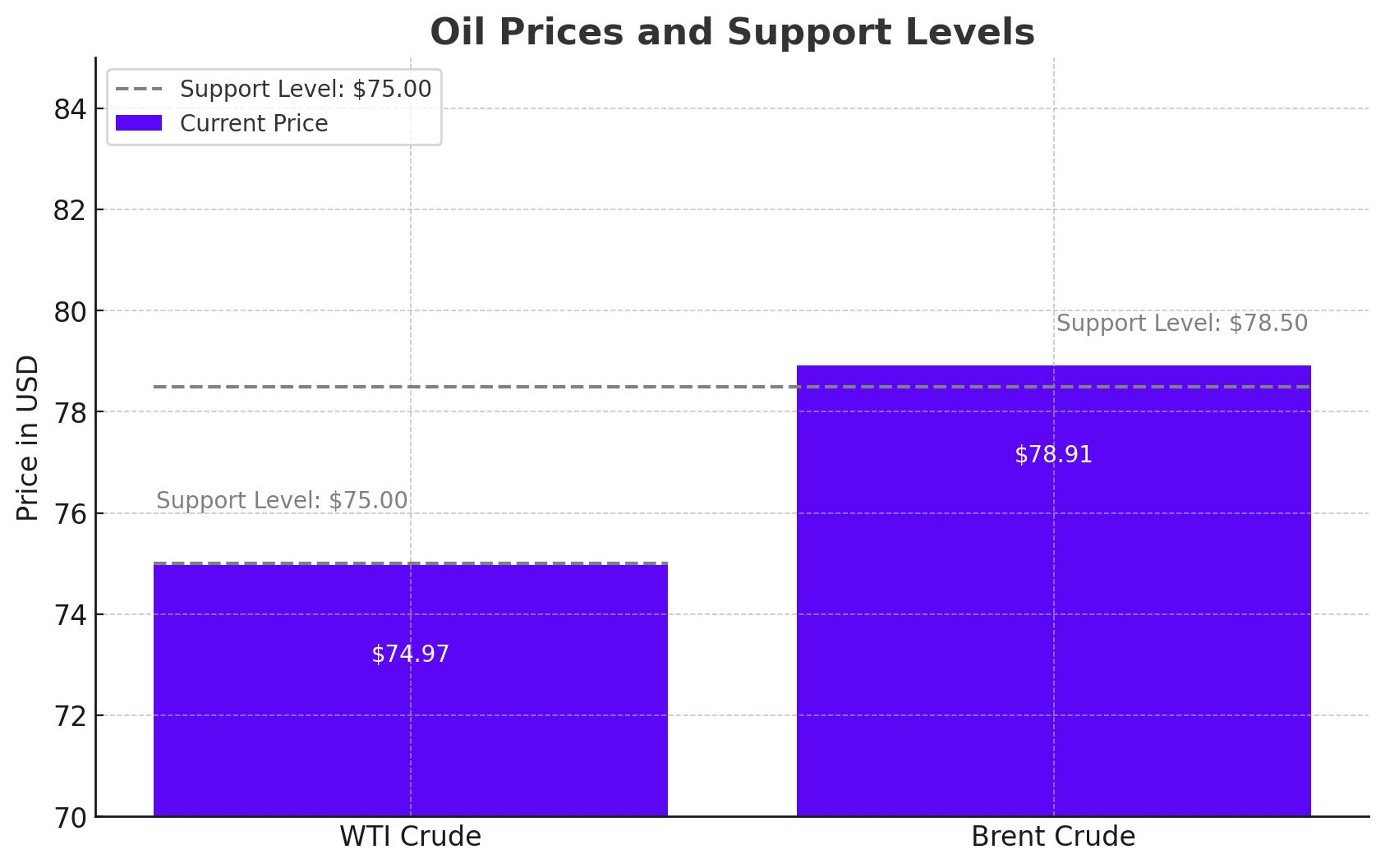

From a technical perspective, WTI crude oil is testing the $75 level, a critical support area that may offer some buying interest. Similarly, Brent crude is hovering around $78.50, near the bottom of a significant symmetrical triangle on the charts. Both benchmarks are currently in a precarious position, with potential for either a bounce or further declines based on upcoming economic data and geopolitical developments.

The Role of the U.S. Federal Reserve and OPEC

The Federal Reserve's upcoming meeting could significantly influence oil prices. While there is speculation about potential interest rate cuts, any decisions will likely have a ripple effect on economic activity and oil demand. Additionally, OPEC's monitoring meeting later this week could lead to market shifts, although it is unlikely that production cuts will be rolled back in the current price environment.

U.S. Shale Sector and M&A Activity

The U.S. shale sector has seen a wave of transactions, indicating strategic shifts among industry players. Recent deals include ConocoPhillips' $22.5 billion acquisition of Marathon Oil and Occidental Petroleum's sale of assets in Texas and New Mexico for $818 million. These moves highlight the industry's focus on consolidating resources and optimizing production in a maturing market.

Impact of Chinese Economic Data on Oil Demand

China's economic data continues to weigh heavily on oil prices. The country's total fuel oil imports dropped by 11% in the first half of 2024, raising concerns about global demand. This decline has been a significant factor in the recent price retreat, overshadowing other market influences such as U.S. shale production and geopolitical tensions.

Future Outlook for Oil Prices

Despite the current bearish sentiment, some analysts see potential for recovery. Factors such as tightening supply from geopolitical events, robust U.S. demand, and possible OPEC actions could provide upward pressure on prices. However, the market remains cautious, with a focus on key support levels and upcoming economic indicators.

Key Metrics and Market Indicators

As of the latest trading data, WTI crude is priced at $74.97 per barrel, while Brent crude is trading at $78.91 per barrel. These prices reflect the market's response to a complex mix of factors, including Chinese economic concerns, geopolitical risks, and strategic moves within the U.S. shale sector.

Conclusion

The oil market is currently navigating through a period of heightened volatility and uncertainty. While there are signs of potential recovery, driven by geopolitical developments and strategic industry actions, the overall sentiment remains cautious. Investors and analysts will closely monitor upcoming economic data, Federal Reserve decisions, and OPEC meetings to gauge the market's future direction. As such, the outlook for oil remains mixed, with both bullish and bearish scenarios possible depending on how these various factors unfold.

That's TradingNEWS