Oil Markets Face Uncertainty with Sanctions and Regional Conflicts

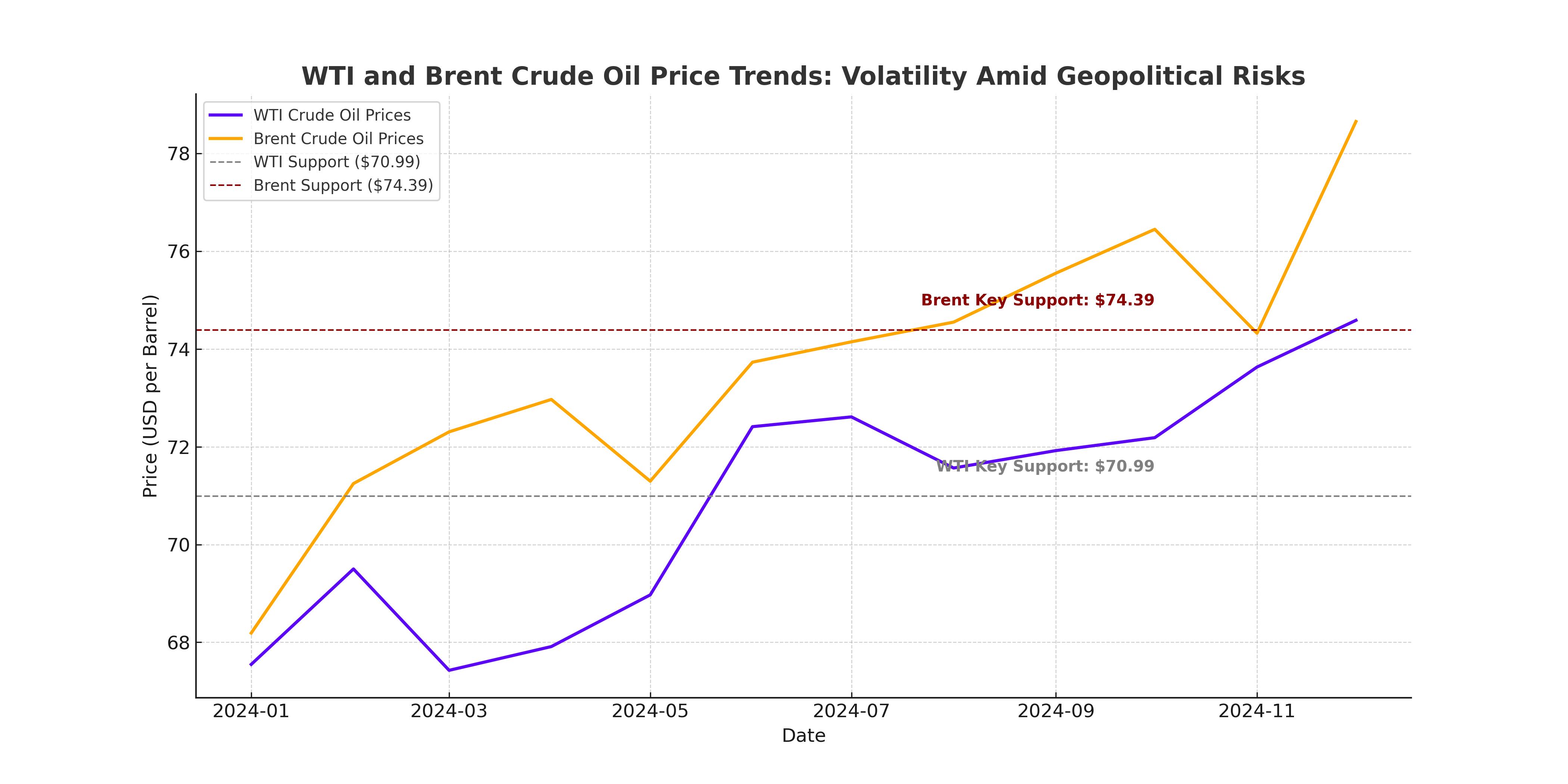

WTI climbs to $70.99, Brent hits $74.39 as sanctions, Kurdish disputes, and winter demand fuel market dynamics | That's TradingNEWS

Oil Prices Face Uncertainty Amid Trump’s Policies and Geopolitical Risks

Donald Trump’s potential crackdown on Iranian oil exports looms as a critical factor in oil market stability. If sanctions intensify, they could effectively cut over 1 million barrels per day (bpd) from global supply, further tightening a market already constrained by geopolitical risks. Such a significant reduction would likely push Brent crude (BZ=F) above $80 per barrel, while West Texas Intermediate (WTI) could surge past $75 per barrel. However, the potential for retaliatory actions from Iran, including threats to disrupt shipping lanes like the Strait of Hormuz, poses a significant risk to global supply chains and could send prices skyrocketing. These developments add a layer of unpredictability to the already fragile oil market.

Geopolitical Risks Intensify

The ongoing dispute between Iraq's Federal Government and the Kurdistan Regional Government (KRG) over oil revenues and export rights continues to escalate. The recent legal rulings favoring the KRG temporarily revived hopes for increased production, but the Federal Government in Baghdad remains determined to centralize control over oil operations. This conflict has already impacted export volumes, reducing output from the Kurdistan region by nearly 400,000 bpd. A protracted stalemate could further erode confidence in Iraq's oil production stability, pressuring WTI and Brent to react sharply to any disruptions. Conversely, a resolution might stabilize regional production but could also flood the market with Kurdish crude, suppressing prices.

Trump's Energy Policies: Opportunity or Risk?

The year ahead is set to challenge the oil market with an intricate mix of geopolitical risks, economic policies, and unpredictable weather patterns. WTI crude (CL=F) currently trades at $70.99, supported by a recent inventory drawdown of 4.2 million barrels, which exceeded expectations of 700,000 barrels. Meanwhile, Brent crude hovers at $74.39 per barrel, buoyed by colder-than-expected winter conditions in the U.S. and Europe that have increased demand for heating fuels.

While Trump’s energy policies, including potential tariffs on Canada and Mexico, aim to bolster domestic production, they risk destabilizing North American trade relations and could inadvertently push oil prices higher. Analysts suggest tariffs could add 30 to 70 cents per gallon to U.S. retail gasoline prices, raising the national average above $3.00 per gallon and increasing costs for consumers.

Colder Weather Boosts Demand

A colder-than-expected winter across the U.S. and Europe has driven increased demand for heating fuels, providing short-term support for oil prices. Diesel futures rose 2.5%, reaching their highest levels since early November. Similarly, natural gas futures surged 17%, reflecting heightened demand for heating fuels. Analysts expect this trend to continue into early 2025, with heating degree days—a measure of energy demand—projected to rise significantly in the coming weeks.

China’s Role in Global Oil Dynamics

China’s economic health remains a crucial factor for oil demand. Recent stimulus measures, including a record issuance of $411 billion in special treasury bonds, aim to stabilize growth in the world's second-largest economy. However, bearish forecasts from Chinese state oil firms suggesting a near-term demand peak have tempered market optimism. If these projections hold, they could weigh heavily on global oil prices in 2025.

U.S. Inventory Declines and Market Sentiment

The U.S. Energy Information Administration reported a significant 4.2 million-barrel drop in crude oil inventories, far exceeding expectations of a 700,000-barrel decline. This unexpected reduction has provided a bullish catalyst for WTI, keeping prices above the critical $70 threshold. Analysts suggest that such inventory declines, coupled with restrained production increases, could offer continued support for prices in the near term.

Speculation on Iranian Sanctions

The potential reinstatement of severe sanctions on Iran under the incoming Trump administration could dramatically shift the global oil market. Current estimates suggest that such measures might remove over 1 million barrels per day (bpd) of Iranian crude from international supply chains. This development could lead to Brent crude (BZ=F) surpassing $85 per barrel, while West Texas Intermediate (WTI) could climb above $80 per barrel. The sanctions would likely amplify existing supply tightness, especially as global inventories remain relatively low following significant drawdowns in 2024. However, the repercussions extend beyond price impacts—retaliatory measures by Iran, including threats to block the Strait of Hormuz, a chokepoint for nearly 20% of global oil shipments, could escalate geopolitical tensions. Such instability could push crude prices even higher while adding volatility to global markets.

Kurdistan Oil Disputes and Regional Stability

The longstanding feud between Iraq’s Federal Government and the Kurdistan Regional Government (KRG) over oil revenues and export rights has resurfaced with heightened intensity. While recent legal rulings have temporarily granted the KRG autonomy to continue independent exports, Baghdad’s unwavering commitment to centralizing oil operations casts doubt on the sustainability of this progress. Currently, Kurdistan's output, which previously exceeded 400,000 bpd, has dropped by nearly 25% due to the export halt. This disruption has pressured overall Iraqi production, which typically contributes over 4.5 million bpd to global markets. A protracted stalemate could suppress Iraqi exports further, putting upward pressure on oil prices. Conversely, a resolution might unleash Kurdish oil onto the market, potentially driving Brent crude below the $70 per barrel threshold in a supply-heavy environment. The stakes are high, as any escalation could destabilize the region and ripple through global markets.

The Path Ahead: Balancing Risks and Opportunities

The oil market is poised for a turbulent year as a confluence of factors, including Trump’s policy decisions, regional disputes, and macroeconomic trends, shapes its trajectory. Short-term bullish factors, such as colder winter conditions, have lifted WTI to $70.99 and Brent to $74.39 per barrel, supported by reduced inventories, with U.S. stockpiles recently falling by 4.2 million barrels—a figure well above forecasts. However, longer-term risks remain prominent. Potential oversupply from recovering Middle Eastern production or weakened demand from China’s economic slowdown could suppress prices. Meanwhile, geopolitical tensions, particularly in the Middle East, hold the potential to trigger sharp price spikes. Navigating this complex environment will require agility from traders and policymakers alike, as the balance between risks and opportunities will dictate market stability and growth prospects.

That's TradingNEWS

Read More

-

SCHG ETF Near $33 High As AI Giants Drive 19% 2025 Rally

01.01.2026 · TradingNEWS ArchiveStocks

-

XRP-USD Stuck At $1.87 As XRPI Near $10.57 And XRPR Around $14.98 Despite $1.16B ETF Wave

01.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward Key $3.57 Support As Ng=F Extends 33% Drop

01.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Near 156 As Fed Cuts Meet Boj Hawkish Turn

01.01.2026 · TradingNEWS ArchiveForex