Oil Price Forecast: Analyzing Global Market Trends and Economic Influences

Unveiling detailed predictions for oil prices in 2024, with a focus on supply-demand dynamics, geopolitical risks, and economic indicators | That's TradingNEWS

Oil Market Dynamics: A Comprehensive Analysis for 2024

Introduction to Current Market Trends

In the complex world of commodities, oil prices remain a critical barometer of global economic health. As of mid-2024, the landscape of the oil market has been shaped by a confluence of factors ranging from geopolitical tensions to shifting demand dynamics in major economies like China and the United States.

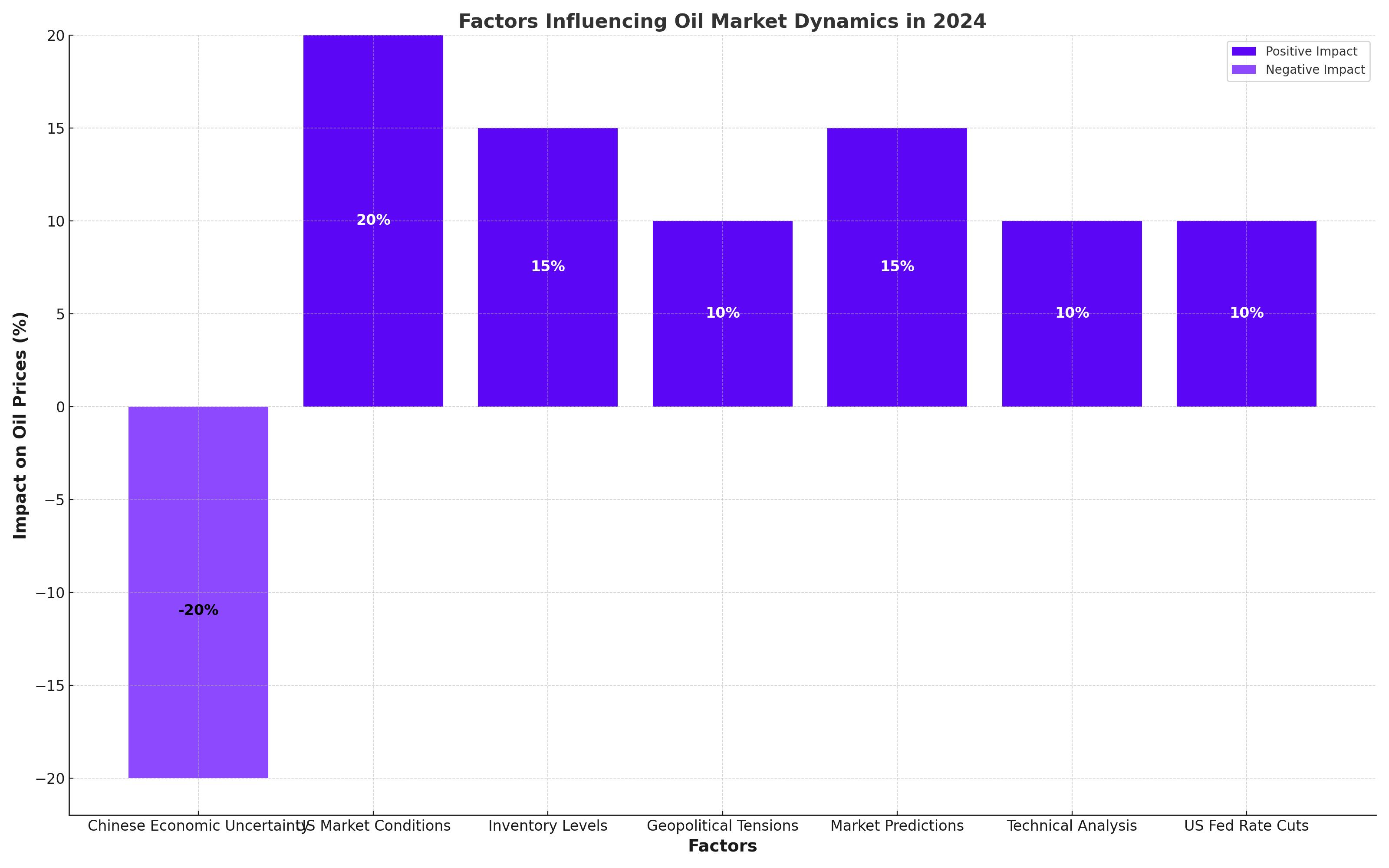

Declining Oil Prices Amidst Chinese Economic Uncertainty

The international benchmark Brent crude recently traded at $83.56 per barrel, reflecting a modest decline of 0.2%, while the American benchmark West Texas Intermediate (WTI) dipped slightly to $79.60 per barrel. These adjustments are largely attributable to weaker than expected economic indicators from China, which grew at a slower pace of 4.7% in Q2 2024, coupled with a mere 2% increase in retail sales—the slowest since December 2022. Such statistics have stoked fears of diminished oil demand from the world's largest crude importer, exerting downward pressure on prices.

U.S. Market Conditions and Inventory Levels

Contrasting the Asian giant's economic woes, the U.S. presents a more robust demand outlook. A significant drawdown in U.S. commercial crude oil reserves, with a recent report showing a decrease of 4.4 million barrels, suggests a stronger domestic demand. This reduction in inventories typically serves as a bullish signal for oil markets, indicating healthy consumption rates.

Geopolitical Tensions and Their Impact

Adding complexity to the global oil narrative are ongoing geopolitical tensions in the Middle East, particularly the recent Israeli actions in Gaza. Such conflicts invariably lead to speculations about potential disruptions in oil supply, given the region’s pivotal role in global oil production. This has historically led to spikes in oil prices due to perceived risks to stable supply routes.

Market Sentiments and Predictions

Analysts from JP Morgan have projected that the equilibrium price for WTI might be higher than current levels, positing that a price of $60 per barrel is insufficient to incentivize production, potentially setting the stage for a surge to $100 per barrel if supply remains constrained.

Technical Analysis and Future Outlook

On the technical front, Brent crude's recovery from a one-month low, followed by a bullish engulfing pattern on the daily chart, suggests that prices might soon test the $85.81 level. Such movements underscore the market's volatility and the critical influence of inventory and production dynamics.

Moreover, with the U.S. Federal Reserve hinting at possible rate cuts, there could be an ensuing decrease in the dollar's value, potentially making oil cheaper for foreign buyers and thus driving up demand.

Conclusion: Navigating Through Uncertainties

While the current landscape presents a mixed bag of bullish and bearish signals, the overarching sentiment leans slightly towards optimism, primarily due to the robust demand in the U.S. and potential geopolitical escalations that might disrupt supply. Investors and market watchers will do well to keep a close eye on forthcoming economic data and central bank policies, which will play pivotal roles in shaping the oil market's trajectory as we move further into 2024.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex