Oil Prices Rally on Supply Disruptions and Fed Rate Cut Speculations

WTI and Brent Crude Bounce Back, but Global Demand Worries and Geopolitical Tensions Keep Investors on Edge | That's TradingNEWS

Oil Market Under Pressure as Global Demand Declines and Fed Rate Cuts Loom

WTI Crude (CL=F) and Brent Crude (BZ=F) Analysis

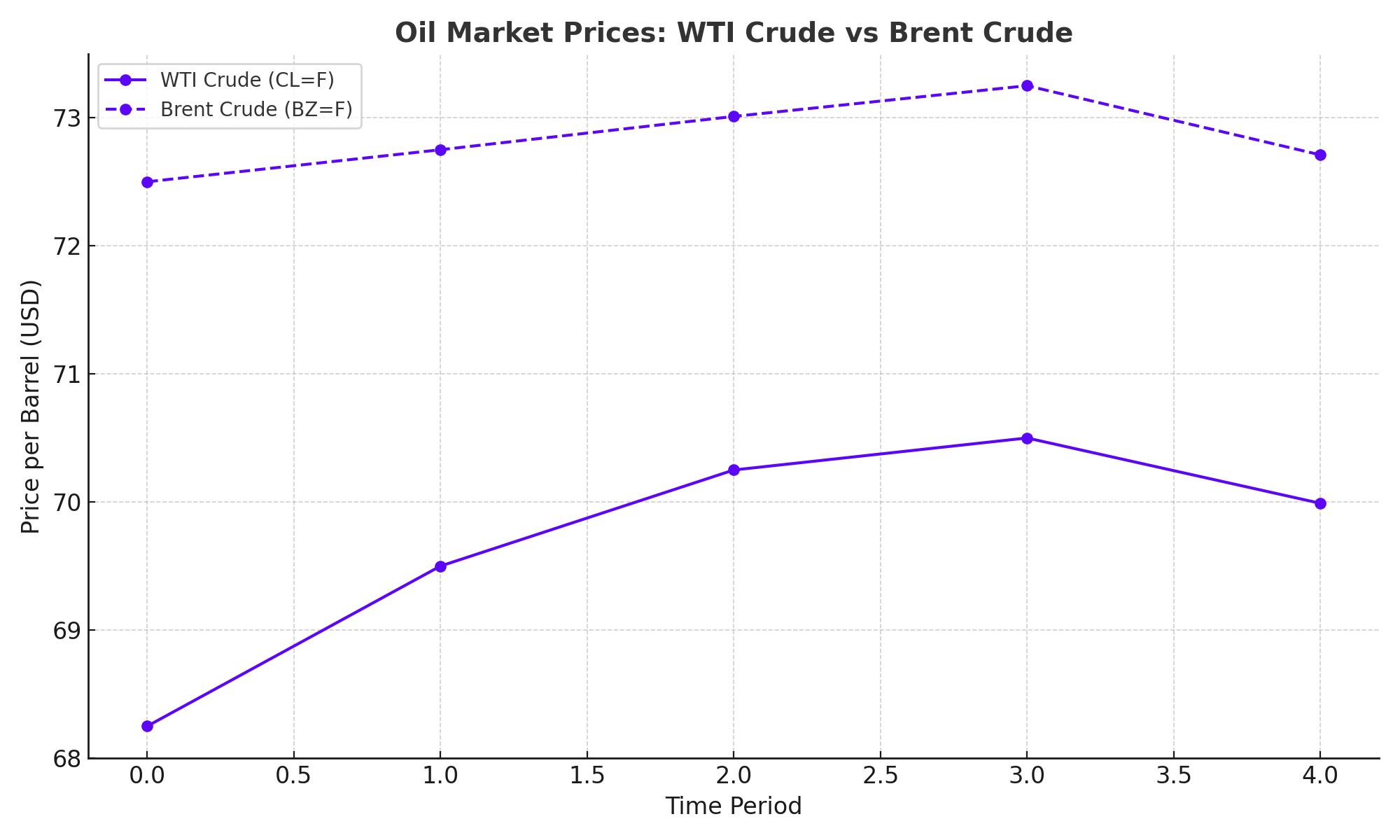

The oil market is experiencing significant fluctuations, with both West Texas Intermediate (WTI) and Brent crude struggling to find solid ground. As WTI trades near $70.25 and Brent hovers around $73.01, investors are grappling with conflicting forces—supply disruptions in the U.S. Gulf of Mexico due to Hurricane Francine, weakening global demand, and the looming Federal Reserve decision on interest rates.

WTI has shown some support around $67.50, sparking speculation of a possible rebound. A potential rally could target $71.50 if momentum builds, while Brent is facing resistance around $72.50, with hopes of breaking past $75. However, global demand concerns, especially from China, weigh heavily on the market.

Global Demand Concerns and Economic Headwinds

Demand for oil is falling across major economies, with China, the world's largest oil importer, reporting a slowdown in industrial output and retail sales. These figures, along with reduced oil refinery output, are driving concerns about long-term global demand. China's industrial output grew at its slowest pace in five months, a troubling sign for global oil markets already dealing with weak fuel demand.

Further complicating the demand outlook is India, another major consumer of oil. While India's energy consumption continues to grow, the country is making aggressive moves toward expanding its renewable energy capacity. The Indian government aims to install 500 GW of renewable energy capacity by 2030, which will lessen its reliance on oil. Such a shift could significantly affect long-term demand for fossil fuels in the region.

U.S. Supply Disruptions and Geopolitical Tensions

In the U.S., nearly 20% of oil production in the Gulf of Mexico remains offline due to Hurricane Francine. This disruption, along with ongoing geopolitical risks in the Middle East, has provided some short-term support for prices. Israeli tensions with Yemen's Houthi group and broader instability in the region are adding a layer of uncertainty, which tends to increase the appeal of oil as a risk-hedging asset.

Impact of the Federal Reserve's Interest Rate Decision

The Federal Reserve's upcoming interest rate decision is another critical factor influencing oil prices. Investors are currently divided on whether the Fed will cut rates by 25 or 50 basis points. Lower interest rates could support oil prices by boosting economic activity and reducing the cost of borrowing. However, a more aggressive rate cut could signal deeper economic troubles, which would dampen demand for oil.

The market is likely to remain in a state of caution until the Fed's decision is announced on Wednesday. Should the Fed lean towards a 50 bps cut, it could offer temporary relief to oil prices, though concerns about the broader U.S. economy would remain.

Technical Analysis and Key Levels to Watch

From a technical perspective, WTI crude has found some support around $67.50. If it can break through the $71.50 resistance, it may continue towards $75. On the downside, a break below $67.50 could see it testing the next support level at $65. Brent crude, meanwhile, faces key resistance at $73. A breakout could send it towards $75, while failure to hold above $72 could push it back towards $70.

India's Shift Toward Renewable Energy

Adding another layer of complexity to the oil market is India's strategic push towards renewable energy. The country has received $386 billion in investment commitments from global financial institutions to boost its clean energy capacity. India, which currently has around 153 GW of renewable energy capacity, plans to increase this to 500 GW by 2030. This transition, while positive for environmental goals, presents a challenge for long-term oil demand in one of the world’s fastest-growing economies.

Nigeria's Fuel Price Hike and the Role of the Dangote Refinery

In Africa, Nigeria's state oil firm, NNPC, raised petrol prices by 11%, marking the second price hike in two weeks. The increase comes as NNPC begins sourcing fuel from the newly operational Dangote refinery, which is expected to reduce Nigeria's dependence on imported fuel. However, this move is likely to exacerbate inflation in Nigeria, where households and businesses rely heavily on gasoline for power generation.

NNPC's shift to sourcing gasoline from Dangote in U.S. dollars, with plans to switch to naira payments by October, adds another dimension to the oil market's complexities. The refinery, with a capacity of 650,000 barrels per day, is a game-changer for Nigeria's energy landscape, but the transition period may lead to price volatility in the domestic market.

Conclusion

The oil market is facing a delicate balancing act, influenced by supply disruptions, weak demand signals from key economies like China, and looming Federal Reserve rate cuts. While short-term factors such as geopolitical risks and Gulf of Mexico production outages provide some support, the longer-term outlook remains uncertain. The potential for a rebound exists, but much depends on the Fed's decision and global economic recovery.

For now, oil traders will need to watch key technical levels and remain mindful of broader economic signals that could either stabilize or further disrupt the market. With Brent and WTI prices struggling to find firm footing, the oil market is likely to remain volatile in the weeks ahead.

Buy, Hold, or Sell?

Given the current state of the market, a cautious approach seems prudent. While supply disruptions and potential rate cuts provide some upside potential, the weakening demand outlook is hard to ignore. Short-term traders may find opportunities in the volatility, but for long-term investors, a hold stance appears more appropriate as the market awaits clearer signals on economic growth and demand recovery.

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex