Oil Prices 2024: Are WTI (CL=F) and Brent (BZ=F) Positioned for a Comeback?

Navigating the Geopolitical and Economic Forces Driving Oil Market Trends—Is Now the Time to Buy? | That's TradingNEWS

Oil Market Analysis: Navigating Volatility with WTI (CL=F) and Brent (BZ=F) at Critical Crossroads

The global oil market is at an intriguing juncture, marked by a convergence of geopolitical tensions, shifting production dynamics, and evolving demand patterns. Both West Texas Intermediate (WTI), represented by CL=F, and Brent Crude (BZ=F) are grappling with pressures from production cuts, demand fluctuations in China, and strategic moves by major oil producers.

Saudi Arabia’s Strategic Price Cuts and Increased Exports to China

Saudi Arabia, the world’s largest crude oil exporter, has aggressively adjusted its oil pricing strategy to regain market share in Asia, particularly in China. January crude shipments from Saudi Arabia to China are projected at 46 million barrels, marking the highest volume since October and a significant leap from December’s 36.5 million barrels. This increase aligns with recent price cuts on Saudi’s flagship Arab Light crude, now offered at a $0.90 premium to the Oman/Dubai average—a sharp reduction from December’s $1.70 premium.

The demand surge from Chinese state refiners such as Sinopec and PetroChina, along with private entities like Rongsheng Petrochemical, highlights a tactical response to weakening demand for Iranian crude amidst geopolitical uncertainties. Saudi Arabia’s pricing flexibility underscores its dominance in the Asian market, aiming to counteract disappointing global oil demand growth.

EIA’s Adjusted Forecasts and the Implications for Brent and WTI

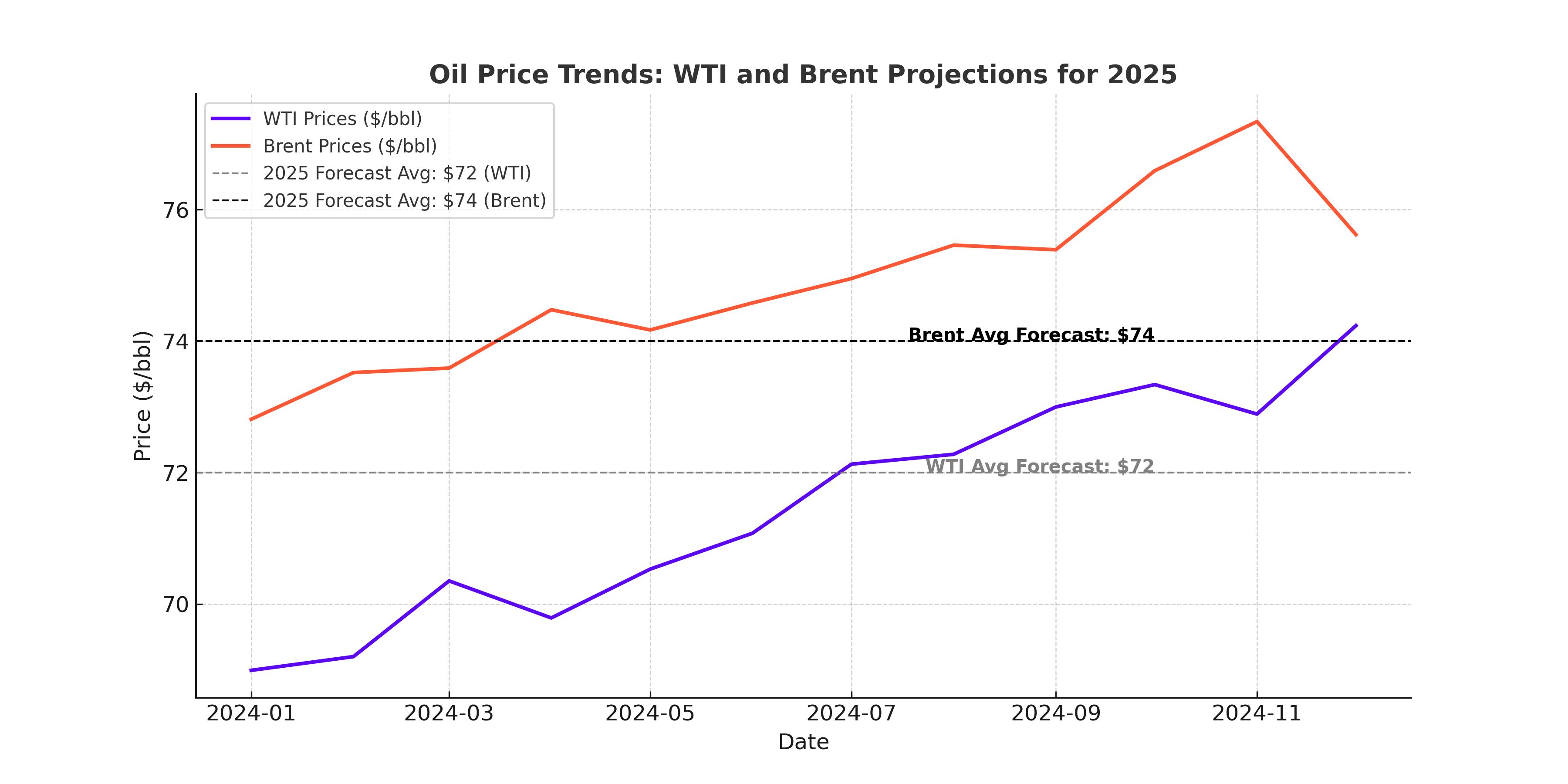

The U.S. Energy Information Administration (EIA) has revised its price forecasts for Brent crude (BZ=F) and WTI (CL=F), signaling a bearish outlook. The EIA now anticipates Brent averaging $80.49 per barrel in 2024, down from previous projections, and $73.58 per barrel in 2025. Similarly, WTI is expected to trade lower, reflecting a subdued demand landscape coupled with increasing inventories.

The EIA attributes price declines to multiple factors, including the ongoing Middle East conflict, OPEC+ production adjustments, and sluggish economic recovery in China. A significant drawdown of 0.7 million barrels per day in global inventories during Q1 2025 is expected to stabilize prices temporarily. However, inventory builds later in the year could exert downward pressure.

Geopolitical Tensions and OPEC+ Production Cuts

Recent OPEC+ decisions to delay production increases until April 2025 have introduced a layer of unpredictability in the supply landscape. OPEC+ members aim to align production targets with a balanced market outlook, yet adherence to these cuts remains uncertain. The group’s decision reflects a delicate balancing act—maintaining prices without stifling demand or losing market share to non-OPEC producers.

The potential escalation of regional conflicts, particularly in the Middle East, continues to pose an upside risk to oil prices. Historical precedents indicate that any significant disruption in supply lines could lead to a sharp spike in both WTI and Brent.

Argentina’s Vaca Muerta Shale Boom: A New Frontier

Argentina’s Vaca Muerta shale formation is emerging as a game-changer in South American oil production. Forecasts by Rystad Energy suggest that production could reach 1 million barrels per day by 2030, up from the current 400,000 barrels. This growth is underpinned by a dramatic increase in well drilling, with 46 new wells completed in September alone.

Argentina’s state-owned YPF is investing heavily in pipeline infrastructure, ensuring the rapid monetization of its vast reserves, estimated at 16 billion barrels of recoverable oil. The rise of Vaca Muerta positions Argentina as a formidable regional competitor, surpassing Colombia in production capacity and solidifying its role as a major supplier to global markets.

U.S. Inventories and Strategic Reserves: Shifting Dynamics

U.S. crude oil inventories, according to the American Petroleum Institute (API), increased by 499,000 barrels for the week ending November 29, while gasoline and distillate stocks saw significant builds. At the same time, the Strategic Petroleum Reserve (SPR) added 0.7 million barrels, bringing its total to 392.5 million barrels—still far below pre-2020 levels.

WTI futures responded with marginal gains, trading at $68.45 per barrel, while Brent remained subdued at $72.06 per barrel. This divergence reflects the market’s focus on regional supply-demand imbalances and the relative stability of U.S. production amidst global uncertainties.

ExxonMobil’s Ambitious Expansion Plans

Exxon Mobil (NYSE:XOM) is charting an aggressive growth trajectory, targeting 5.4 million barrels per day by 2030—an 18% increase from current levels. The company’s focus on low-cost fields, particularly in the Permian Basin and offshore Guyana, underscores its commitment to high-margin growth. Exxon’s Permian production is expected to triple to 2.3 million bpd, while Guyana operations aim for 1.3 million bpd by 2027.

Exxon’s strategic investments, including the $1.23 billion Jaguar FPSO unit, are designed to bolster its production capabilities and enhance its competitive positioning. These moves come as part of a broader industry shift, with major players leveraging advanced technologies and operational efficiencies to maximize output in a cost-constrained environment.

Outlook for Oil Prices: Bullish or Bearish?

The oil market is caught between conflicting forces. On one hand, supply-side interventions by OPEC+, Saudi Arabia’s price adjustments, and new production frontiers like Vaca Muerta signal robust supply growth. On the other hand, demand-side concerns, particularly from China, and geopolitical uncertainties pose significant headwinds.

Brent and WTI prices are likely to remain range-bound in the near term, with Brent averaging around $74-$80 per barrel and WTI trading slightly lower. The trajectory beyond 2025 will depend on the successful execution of production strategies by major players, adherence to OPEC+ cuts, and the resolution of geopolitical tensions.

Investor Takeaway

For investors, the oil market offers both opportunities and risks. Companies like Exxon Mobil (NYSE:XOM) and YPF stand out as strong plays, given their aggressive expansion plans and strategic positioning. Meanwhile, the overall market sentiment remains cautious, with a focus on balancing short-term volatility against long-term growth potential. Crude oil, whether through WTI (CL=F) or Brent (BZ=F), remains a critical asset class, offering insights into global economic health and investment opportunities.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex