Oil Prices Under Pressure: WTI Drops to $71.60 Amid Rising Inventories and Geopolitical Uncertainty

Crude Inventories Surge, Weighing on Oil Markets

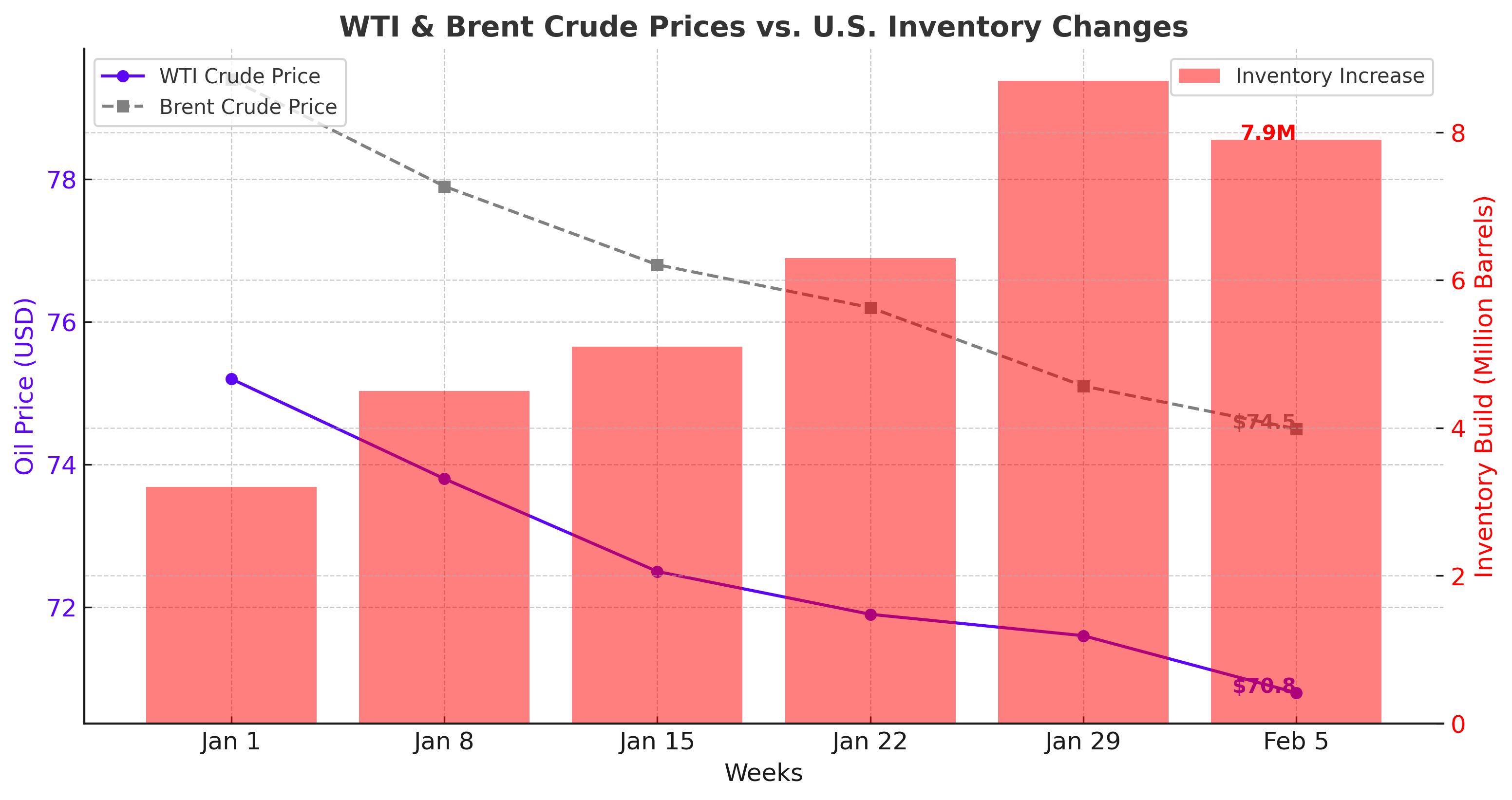

The oil market is facing renewed selling pressure, with WTI crude (CL=F) trading at $71.60 per barrel and Brent crude (BZ=F) at $75.12 per barrel after the U.S. Energy Information Administration (EIA) reported a massive crude inventory build of 8.7 million barrels for the week ending January 31. This increase is significantly higher than the 3.5 million barrel build seen in the previous week, adding to concerns that supply is outpacing demand.

In addition, the API (American Petroleum Institute) reported a 5.025 million barrel rise in crude stocks, alongside a 5.426 million barrel build in gasoline inventories. This suggests weak consumer demand despite the peak winter season, a bearish signal for oil prices.

Gasoline and Distillate Stocks Paint a Mixed Picture

Gasoline inventories rose by 2.2 million barrels, with production averaging 9.2 million barrels per day, slightly below last week’s 9.2 million barrels daily average. This points to soft demand for refined products, which could weigh further on crude prices in the coming weeks.

On the other hand, distillate inventories fell sharply by 5.5 million barrels, reflecting stronger heating oil demand amid colder weather in the U.S. However, this bullish factor is being overshadowed by the sheer size of crude stockpile growth, which is limiting any upside potential for oil prices.

WTI and Brent Under Pressure: Will Prices Hold Above Key Support Levels?

The recent surge in inventories has pushed WTI crude toward key support at $70 per barrel, a level that could determine the market’s next move. A breakdown below this level could accelerate selling toward $68.50, while any rebound would need to clear $73.50 to confirm a recovery.

Brent crude, meanwhile, is facing resistance near $76.50, with downside risks increasing if demand concerns persist. The market is also watching for any potential reaction from OPEC+, which could intervene if prices continue to slide.

Geopolitical Risks and Trade Policies Add to Volatility

Beyond supply and demand fundamentals, geopolitical developments are playing a major role in oil price fluctuations. The Trump administration’s renewed "maximum pressure" campaign on Iran is adding uncertainty, as Washington aims to drive Iranian crude exports to zero. If the U.S. enforces strict secondary sanctions on buyers of Iranian oil, it could remove up to 1.3 million barrels per day from the market, creating a potential supply shock.

Additionally, Trump's planned 25% tariffs on Canadian and Mexican oil imports could disrupt U.S. refinery operations. Canada supplies nearly 4 million barrels per day to the U.S., making it the country’s largest crude supplier. Mexico provides another 500,000 barrels per day, and tariffs on these imports could force refiners to seek alternative sources, further tightening supply and pushing up gasoline prices.

OPEC+ and the Supply Outlook

OPEC+ producers are keeping a close eye on falling prices, with the group set to begin unwinding its 2.2 million barrels per day production cuts in April 2025. The alliance recently delayed the start of the easing from January to April to support prices, but rising U.S. inventories and weaker demand in China could pressure them to take further action.

Saudi Arabia and Russia, the two biggest players in OPEC+, may extend voluntary output cuts if crude continues to slide below $70. However, if Brent crude remains above $75, OPEC+ could stick to its planned output increase, leading to further market volatility.

Wall Street’s Oil Forecasts: Where Are Prices Headed?

Major banks have adjusted their oil price outlooks to reflect recent market shifts. According to a Wall Street Journal survey, Brent crude is now expected to average $73.01 per barrel in 2025, while WTI is forecast at $68.96—both below the $80 level that many traders had expected earlier.

Goldman Sachs maintains a $70-$85 range for Brent, noting that while sanctions on Iran and Russia could push prices higher in the short term, broader economic concerns and high spare production capacity will limit upside in the medium term.

The Fed, the U.S. Dollar, and Oil Demand

Another key factor influencing oil prices is the Federal Reserve’s interest rate policy. The Fed’s decision to keep rates steady instead of cutting them has strengthened the U.S. dollar, making oil more expensive for foreign buyers. This could curb global demand, particularly in emerging markets, further pressuring crude prices.

Moreover, China’s economic slowdown remains a major risk. As the world’s largest oil importer, any continued weakness in Chinese manufacturing and industrial activity could limit crude demand growth, preventing a sustained oil price rally.

Will Oil Prices Recover or Break Lower?

Oil markets are currently at a crossroads, caught between rising U.S. inventories, potential supply disruptions from geopolitical events, and OPEC+ production decisions. If WTI crude breaks below $70, it could trigger a deeper selloff, while a rebound above $73.50 could signal renewed bullish momentum.

Investors should watch upcoming data releases, including U.S. job reports, Chinese economic data, and OPEC+ announcements, as these will determine the next major move in oil prices.

At this stage, WTI crude is a HOLD, as the market waits for clearer signals. A drop below $70 could trigger further losses, while any rally above $73.50 would indicate a potential recovery. Brent crude, meanwhile, could see upside toward $78 if demand stabilizes, but faces resistance at $76.50 in the short term.

With multiple forces at play, oil traders should remain cautious, as the next big move could be dictated by either geopolitical events or fundamental shifts in supply and demand dynamics.