Global Oil Prices Face Mixed Projections Amid Shifting Geopolitical and Economic Forces

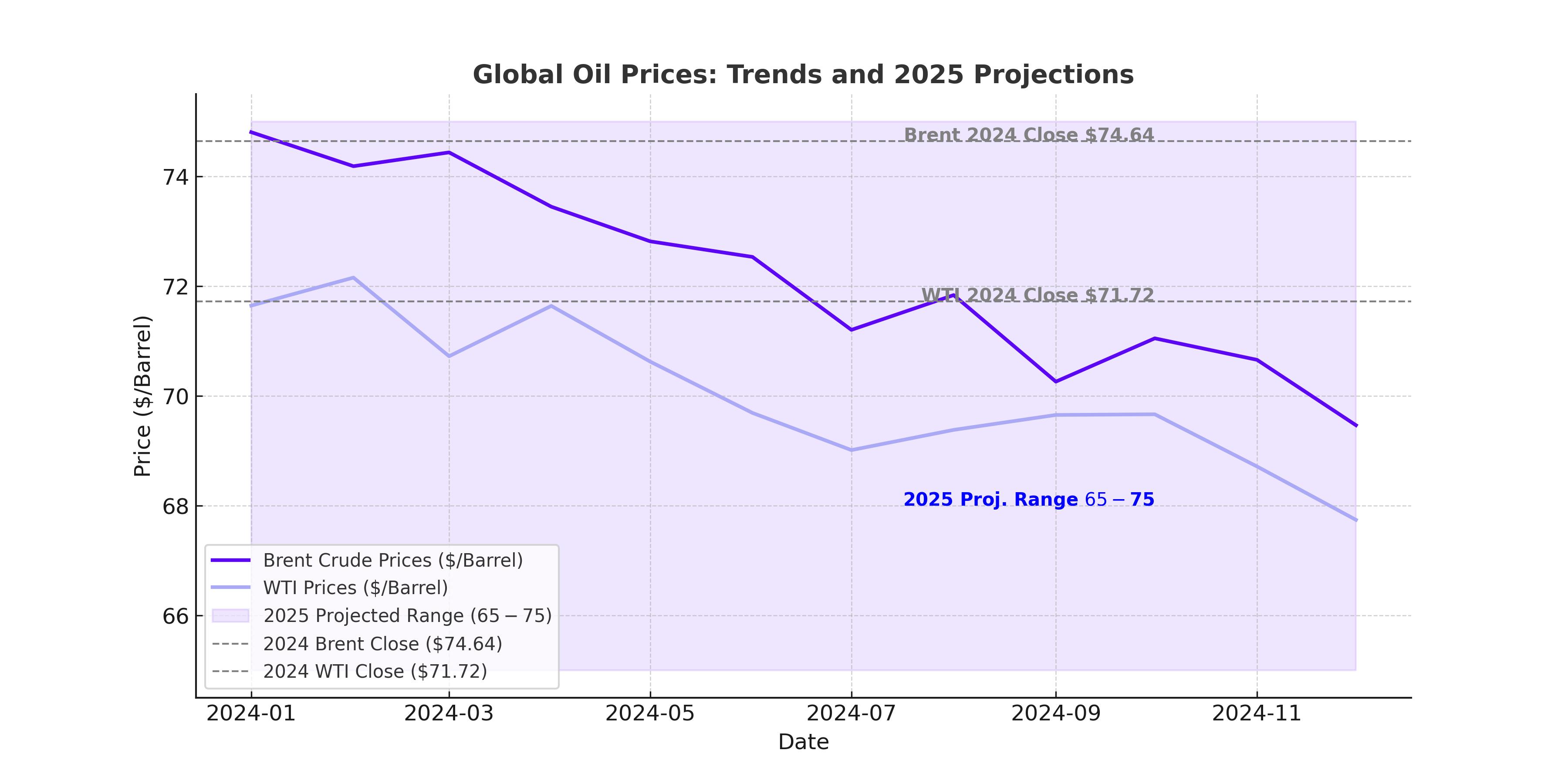

Oil prices, represented by Brent Crude (BZ=F) and West Texas Intermediate (CL=F), have ended 2024 with a 3% decline for the second consecutive year, driven by a confluence of geopolitical factors, global supply shifts, and macroeconomic conditions. Brent crude settled at $74.64 per barrel, while WTI closed at $71.72, reflecting an annual dip of 3% and remaining nearly flat year-over-year, respectively. These subdued levels underscore the challenges faced by the global energy market as it navigates contrasting forces of supply expansion and demand stagnation.

Supply Surges Amid Demand Concerns

The surge in U.S. oil production, reaching a record high of 13.46 million barrels per day (bpd) in October 2024, has significantly influenced the global supply dynamics. This figure is set to climb further in 2025, with projections from the Energy Information Administration (EIA) indicating a new peak of 13.52 million bpd. At the same time, Nigeria has announced plans to boost its national production from 1.8 million bpd to an ambitious 3 million bpd next year. These expansions come as China, traditionally a key driver of global demand, grapples with a slower-than-expected economic recovery and a fading post-pandemic rebound.

China’s manufacturing activity, while showing signs of recovery, expanded at a slower pace in December, raising concerns about the nation’s ability to sustain robust energy consumption. With the International Energy Agency (IEA) revising its global oil demand growth forecasts downward for 2024 and 2025, weak demand from China remains a critical factor weighing on prices. This scenario has prompted the IEA to predict an oversupplied market entering 2025, further complicating OPEC+ efforts to stabilize prices.

OPEC+ Strategies and Market Balancing

OPEC+ has delayed its planned output hikes until April 2025 in response to falling prices, reflecting a strategic pivot to manage an oversupplied market. However, these measures face headwinds from rising non-OPEC supply, particularly from the United States and Iran. Iranian oil exports, which surged under the Biden administration to 3.2 million bpd, face renewed threats as President-elect Donald Trump prepares to reinstate stringent sanctions. Trump’s policies, including a proposed "maximum pressure" campaign, aim to slash Iranian exports and could lead to a tighter oil market.

China’s covert importation of Iranian crude through intermediaries, often bypassing sanctions, remains a contentious issue. The country’s imports of Iranian oil, while substantial, dropped to a four-month low of 1.31 million bpd in November 2024 due to intensified U.S. measures. This has driven up the price of Iranian crude, narrowing discounts significantly. Despite these challenges, the shadow fleet of aging tankers employed for these transfers ensures that China maintains its critical supply chain.

Geopolitical Dynamics and Potential Price Drivers

President-elect Trump’s foreign policy stance, particularly regarding the Middle East and Iran, is expected to play a pivotal role in shaping oil markets in 2025. His calls for a ceasefire in the Russia-Ukraine conflict and proposed tariffs on Chinese goods could introduce volatility into global trade dynamics, indirectly impacting energy markets. Moreover, recent U.S. military strikes on Houthi targets in Yemen, aimed at curbing threats to global oil flows in the Red Sea, highlight the geopolitical risks that continue to underpin market sentiment.

India, meanwhile, emerges as a growing force in global oil demand. For the first time, India’s annual demand growth outpaced China’s in 2024, rising by 180,000 bpd compared to China’s 148,000 bpd. This trend is expected to continue in 2025, with India’s oil demand projected to grow at a rate of 3.2% year-over-year, compared to China’s 1.7%. This shift positions India as a critical market for exporters looking to offset slowing Chinese demand.

Macroeconomic Influences and Market Outlook

The Federal Reserve’s interest rate trajectory for 2025 remains a key variable for energy markets. Lower rates generally stimulate economic activity, boosting energy demand. However, persistently high inflation could delay rate cuts, tempering growth prospects. Trump’s incoming administration is also likely to focus on deregulation, tax incentives, and strategic energy policies, including a potential push for domestic energy independence, which could impact global supply and demand dynamics.

Despite the bearish outlook from some quarters, several factors could provide short-term price support. Escalating conflicts in the Middle East or intensified sanctions on Iran could tighten supply, while improving economic data from China, such as stronger-than-expected manufacturing output, might buoy demand.

Investment Sentiment and Market Volatility

Market sentiment has been increasingly cautious, with bets on WTI growth reaching a four-month high in late 2024, signaling expectations of turbulence ahead. Investors are closely monitoring China’s trade policies under Trump, which could exacerbate existing supply-demand imbalances. Additionally, the role of renewable energy and electric vehicles (EVs) continues to evolve, with China’s aggressive EV adoption expected to curtail its long-term oil demand.

As the market adjusts to these multifaceted challenges, the consensus among analysts points to oil prices remaining range-bound near $70 per barrel in 2025. While this level reflects a balance between abundant supply and moderated demand growth, potential geopolitical shocks and shifts in policy could disrupt this equilibrium.

A Market in Transition

The global oil market in 2025 stands at a crossroads, influenced by a complex interplay of supply surges, geopolitical strategies, and shifting demand patterns. While bearish forces currently dominate the narrative, opportunities for price recovery exist in the form of geopolitical tensions and strategic policy shifts. For investors and stakeholders, navigating this landscape will require close attention to evolving market dynamics and a readiness to adapt to emerging trends.