Concerns Over China's Demand Impact Oil Prices

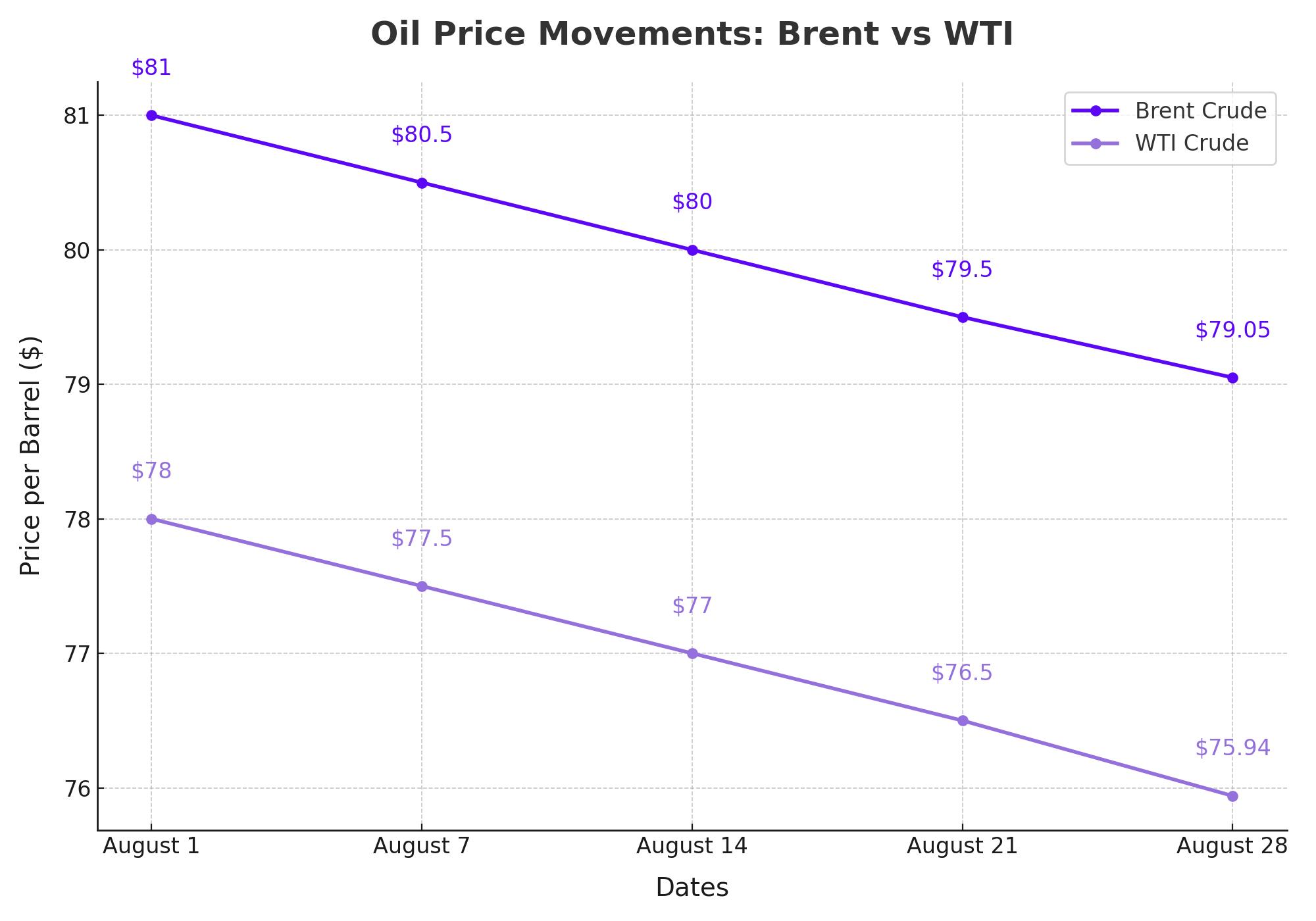

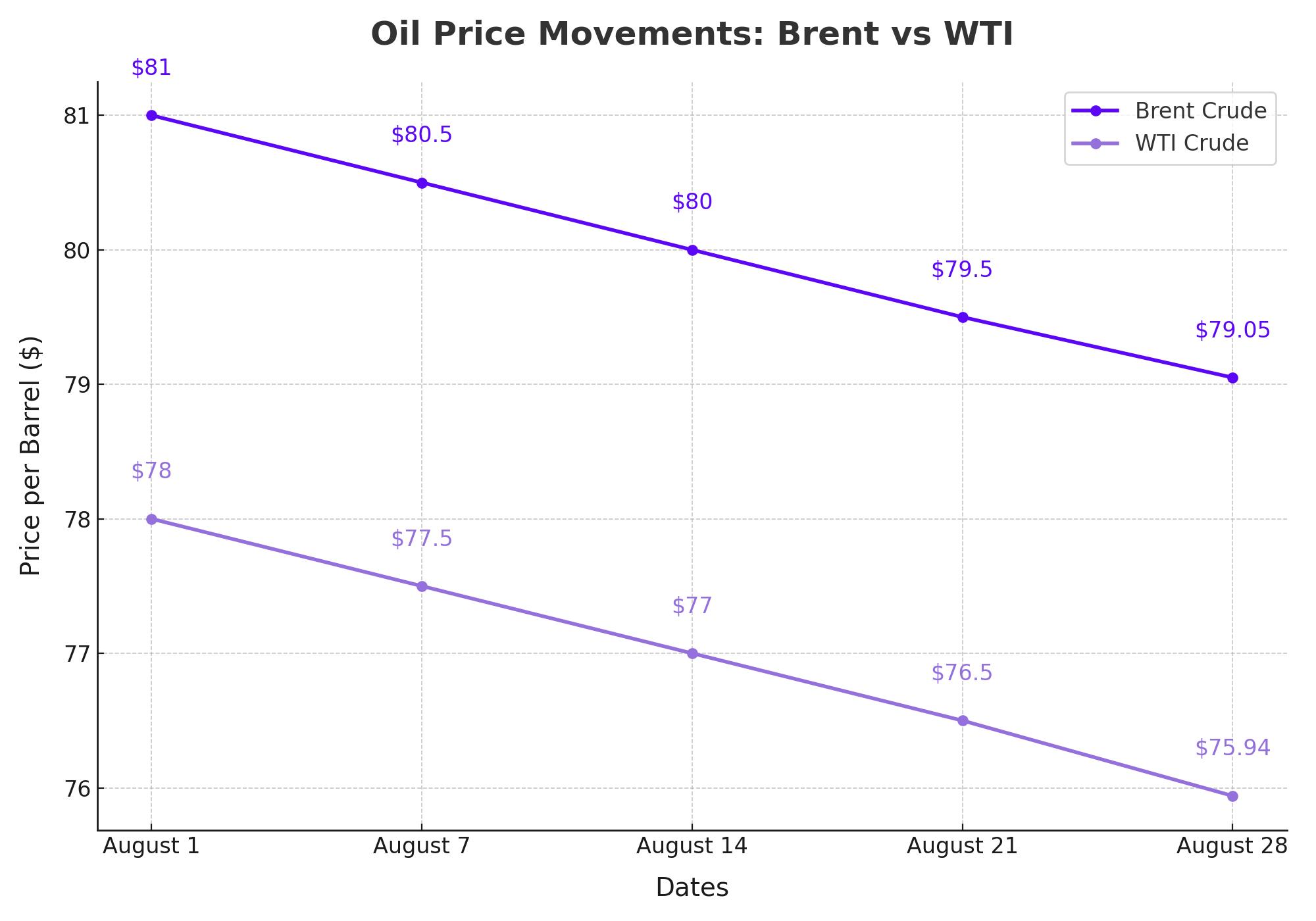

Oil prices have experienced a downturn recently, with Brent crude futures dipping below $80 per barrel, largely due to concerns surrounding China’s demand, the world’s largest oil importer. As of the latest trading, Brent crude dropped 0.8% to $79.05 per barrel, while U.S. West Texas Intermediate (WTI) crude futures declined by 0.9% to $75.94. The market’s apprehension stems from a series of economic reports from China, which have indicated a slowdown in various sectors, leading to reduced demand for oil. China's diesel and gasoline exports in July plummeted, reflecting lower crude processing levels and weak profit margins, further exacerbating fears of a demand slump.

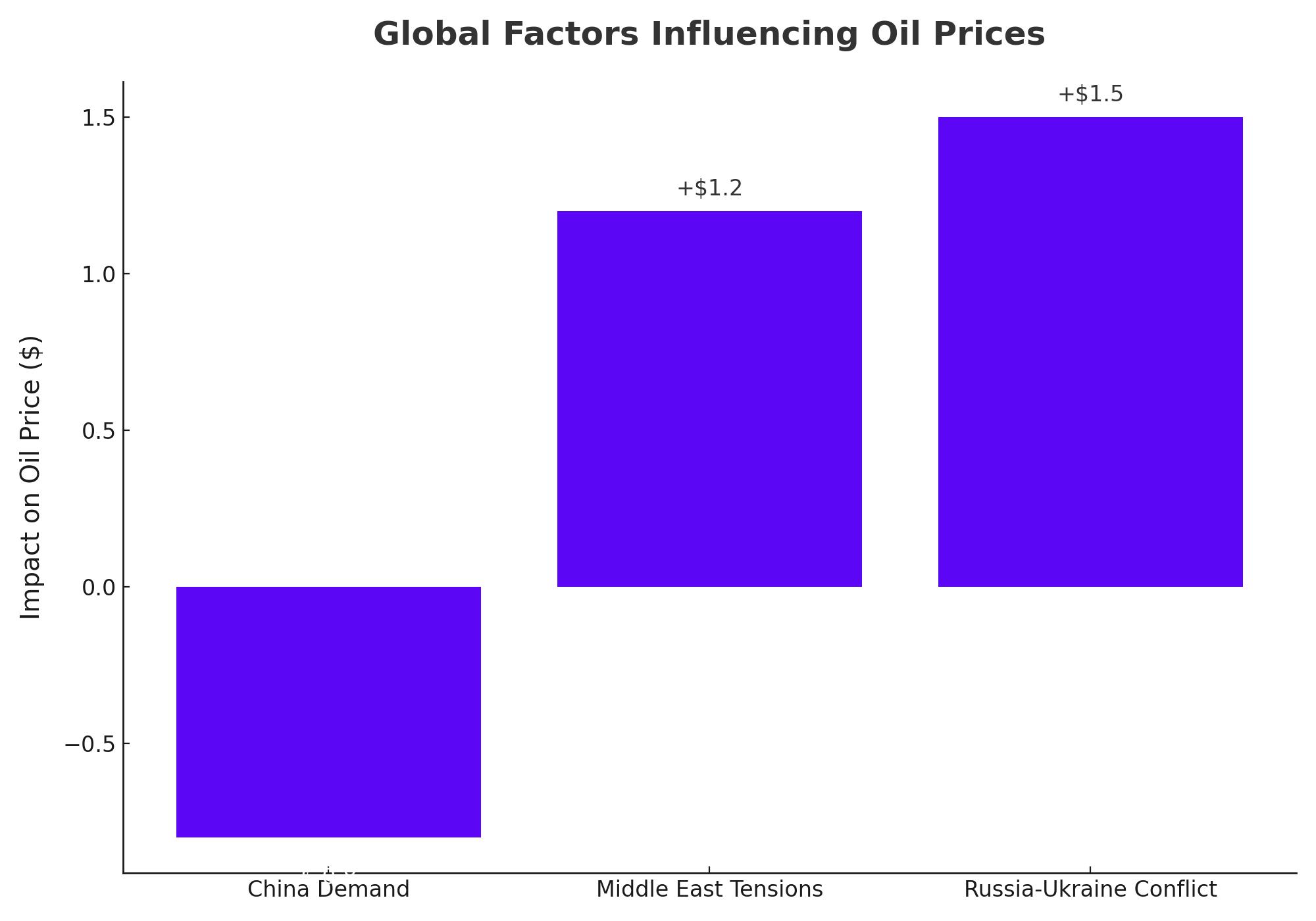

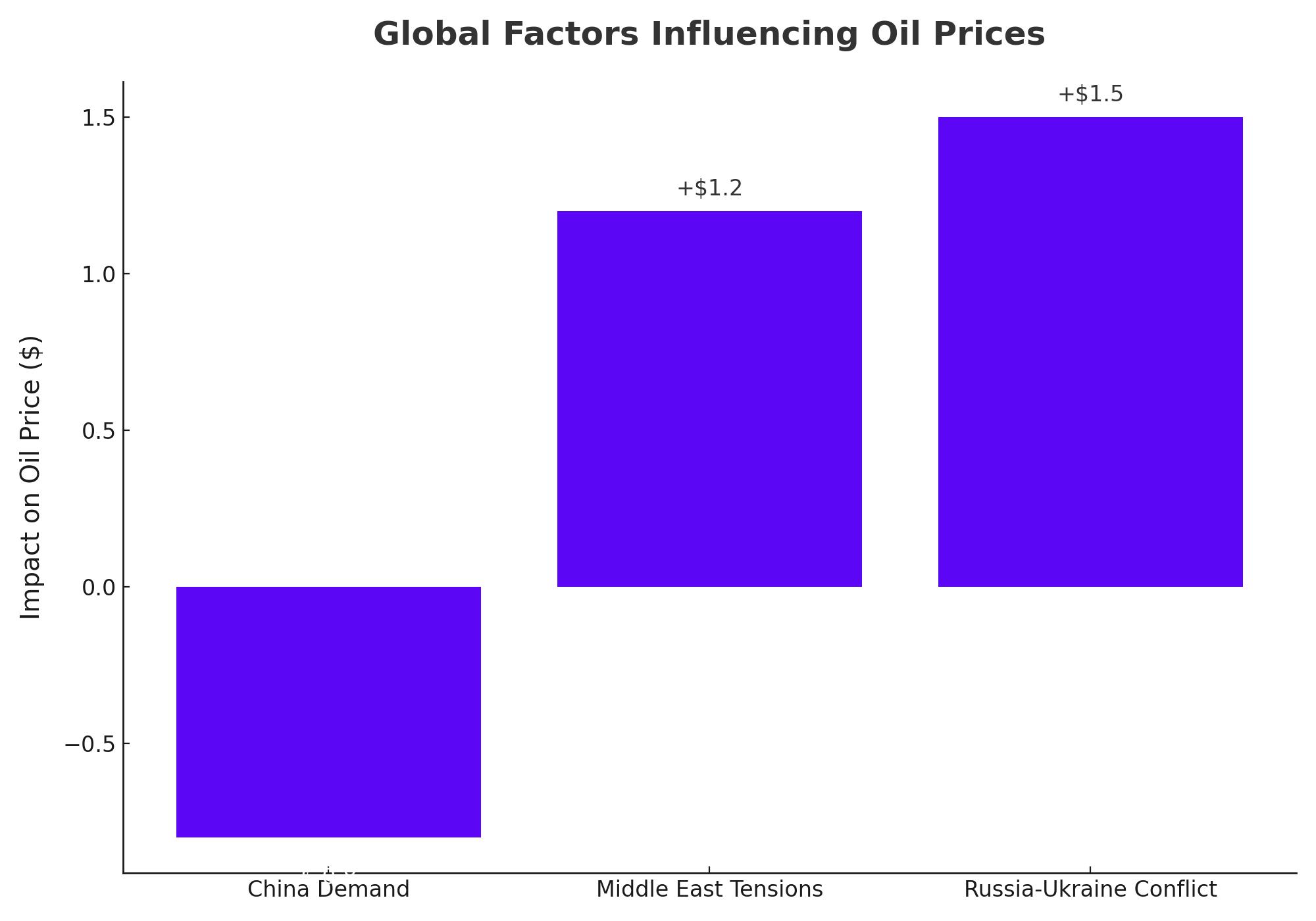

Global Factors Influencing Oil Prices

While China’s economic slowdown is a significant factor, the global oil market is also being shaped by other critical issues. Tensions in the Middle East, particularly involving Israel and Hamas, and the ongoing conflict between Russia and Ukraine continue to pose substantial risks to oil supply, providing some support to prices amidst broader market volatility. The U.S. Secretary of State’s recent visit to Tel Aviv aimed at mediating a ceasefire has yet to yield concrete results, adding to the geopolitical uncertainties that keep oil markets on edge.

Production and Supply Developments

On the supply side, Norway’s Equinor recently shut down its Gullfaks C platform in the North Sea due to a well control problem, reducing natural gas production by 6.6 million cubic meters. Although production from the field remains stable, this incident underscores the vulnerability of supply chains to operational disruptions. Equinor’s position as a significant player in global oil and gas, coupled with Norway’s status as the fourth-largest natural gas exporter, highlights the potential impact of such disruptions on the broader market.

Key Oilfields: Giants Shaping Global Energy

The global oil landscape is dominated by a few massive oilfields that have significantly influenced production and pricing for decades. Saudi Arabia’s Ghawar Field remains the largest, with an estimated 170 billion barrels of original oil in place, followed by Kuwait’s Burgan Field and Iran’s Ahvaz Field, with 70 billion and 65 billion barrels, respectively. These fields have been pivotal in maintaining the global oil supply, and any changes in their output levels can have far-reaching implications for the market.

Strategic Moves in the Energy Sector

In the backdrop of fluctuating prices and geopolitical tensions, countries like Algeria are making strategic moves to support global energy stability. Algeria has recently agreed to supply fuel to Lebanon, which has been grappling with severe electricity shortages due to a lack of fuel for its power plants. This move underscores Algeria’s role in the energy market, not just as a natural gas powerhouse but also as a critical player in oil production, with an average daily output of 1.4 million barrels.

Investment and Future Prospects

Looking ahead, investment in oil and gas development continues to surge. Norway, for instance, is set to reach a record high in oil and gas investments this year, estimated at $24 billion. This increase is driven by rising costs and expansions in existing fields, indicating a robust outlook for the industry despite current market challenges. These investments are crucial for maintaining production levels and ensuring long-term energy security in a volatile global market.

Conclusion: Navigating the Complexities of the OIL Market

The oil market is currently navigating a complex landscape of supply and demand fluctuations, geopolitical tensions, and strategic investments. While the short-term outlook may be marked by volatility, especially with concerns over China’s demand and Middle Eastern tensions, the long-term prospects are supported by significant investments and strategic moves by key players. Investors and stakeholders in the oil sector will need to closely monitor these developments to make informed decisions in a market that is as dynamic as it is essential to the global economy.

That's TradingNEWS