Oil Prices Surge on Russian Pipeline Attack – Will WTI and Brent Keep Climbing or Reverse Course?

Russian Pipeline Attack Disrupts Supply, Lifting WTI and Brent Prices

Crude oil prices surged following a drone attack on a major Russian pipeline that carries Kazakh crude to global markets. The Caspian Pipeline Consortium (CPC), responsible for transporting over two-thirds of Kazakhstan’s crude exports, was forced to cut flow rates after the attack damaged the Kropotkinskaya pumping station. This disruption immediately fueled supply concerns, pushing WTI crude (CL=F) up to $71.26 (+0.72%) and Brent crude (BZ=F) to $75.15 (+0.13%) as traders priced in tighter market conditions.

The damage to CPC infrastructure has led Russian pipeline operator Transneft to estimate a 30% reduction in Kazakh oil transit, with repairs expected to take one to two months. While the market reacted strongly, oil's gains were capped by optimism surrounding Russia-Ukraine peace talks, which could ease sanctions and bring more Russian crude back into the market.

Kazakhstan Oil Disruption vs. Russia-Ukraine Peace Talks: The Bull and Bear Battle

The bullish case for oil remains strong in the short term. Supply-side disruptions, including the Kazakhstan pipeline attack and continued US sanctions on Russian producers, reinforce fears of a tighter crude market. Additionally, geopolitical risks surrounding the Middle East, including Houthi attacks on shipping routes in the Red Sea, add to supply constraints.

On the bearish side, ongoing peace negotiations between the US and Russia in Saudi Arabia could de-risk global energy markets. A breakthrough in talks could lift some sanctions on Russian crude, allowing Moscow to flood the market with more barrels and put downward pressure on prices.

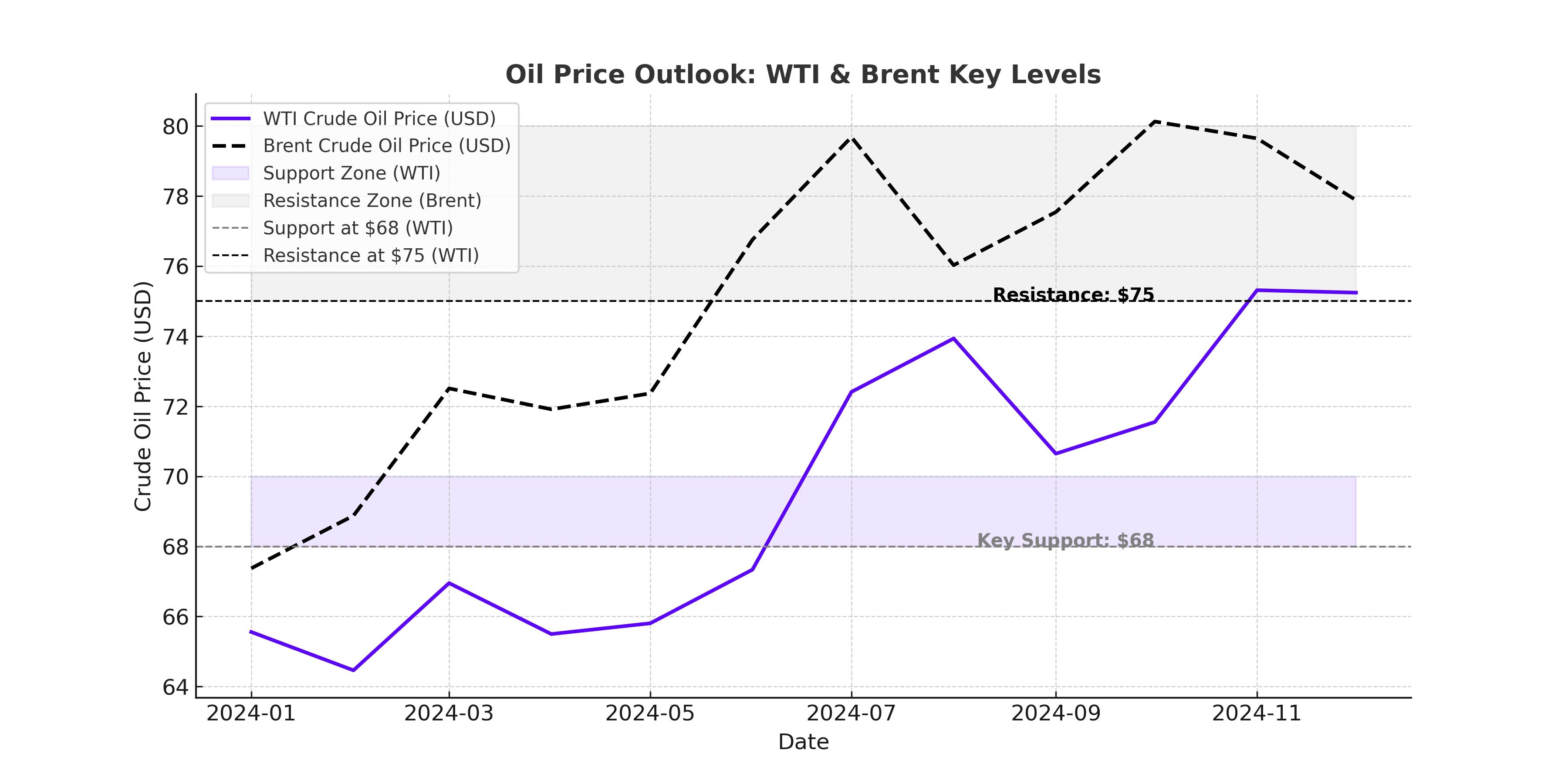

Brent crude has held above key support at $73.99–$73.87, with resistance seen at $75.57 and $77.01, levels closely watched by traders for breakout confirmation.

OPEC+ and the Oil Market: Will Production Cuts Hold?

OPEC+ has been instrumental in stabilizing oil prices through its voluntary output cuts, yet members face increasing pressure to rethink their strategy. Saudi Arabia and Russia, the leading forces behind supply curbs, have kept production 1.3 million barrels per day (bpd) below market potential, but rising non-OPEC supply, particularly from the US and Guyana, threatens their control.

The US is projected to produce 13.2 million bpd in 2025, further pressuring prices as global demand remains uncertain. If OPEC+ signals a softening of cuts, oil prices could struggle to hold current levels, with WTI potentially dipping back toward $68 and Brent toward $72.

US Sanctions and India’s Russian Oil Imports: Will the Market Tighten?

Recent US sanctions on Russian oil exports have started to bite, limiting sales from major firms like Gazprom Neft and Surgutneftgas, which account for 25% of Russia’s crude exports. The latest measures have tripled the number of sanctioned Russian oil tankers, restricting Moscow’s ability to move barrels efficiently.

India, a major buyer of Russian crude, has been forced to scale back purchases, with Russian oil imports dropping 55% year-over-year in November 2024. If these trends continue, Brent and WTI prices could find further upside support due to tightening global supply.

US Shale Production and Demand Outlook: Will WTI Struggle to Break $75?

The US shale industry remains a wild card in oil price projections. Despite rig counts stabilizing around 620, producers have been increasing efficiency, leading to higher output even as capital expenditure remains constrained. The Energy Information Administration (EIA) forecasts US crude production to reach 13.2 million bpd in 2025, keeping global supply robust despite OPEC+ cuts.

Meanwhile, demand uncertainties persist. China’s economic recovery remains weak, with industrial output missing forecasts in Q1 2025. If global demand weakens, WTI could struggle to break the $75 barrier, with downside risk toward $67.50–$68 if supply outpaces consumption.

Technical Outlook: Key Levels for WTI and Brent Crude

WTI crude (CL=F):

- Resistance: $72.50, $74.90

- Support: $70.20, $68.80

Brent crude (BZ=F):

- Resistance: $76.50, $78.30

- Support: $73.99, $72.80

If WTI breaks above $72.50, momentum could drive prices toward $75–$76 in the coming weeks. However, failure to hold above $70.20 could trigger a drop toward $68.50, a key level for bullish defense.

Verdict: Buy, Sell, or Hold?

Oil’s near-term trajectory hinges on geopolitical risk, OPEC+ policy, and US supply growth. Given the current supply disruptions from Russia and Kazakhstan, short-term bullish momentum remains intact, favoring Brent targeting $78 and WTI aiming for $75.

However, longer-term risks from a potential Russia-Ukraine peace deal, increasing US shale output, and weaker Chinese demand could limit upside gains. If OPEC+ signals any weakening of production cuts, oil could struggle to hold its current levels.

Final call: Short-term bullish, medium-term neutral. Buy dips near $70 on WTI and $74 on Brent, but watch for resistance near $75 and $78. If OPEC+ cracks or peace talks progress, expect downside pressure toward $68 for WTI and $72 for Brent.