Oil Prices Surge Amid Economic Optimism and Geopolitical Dynamics

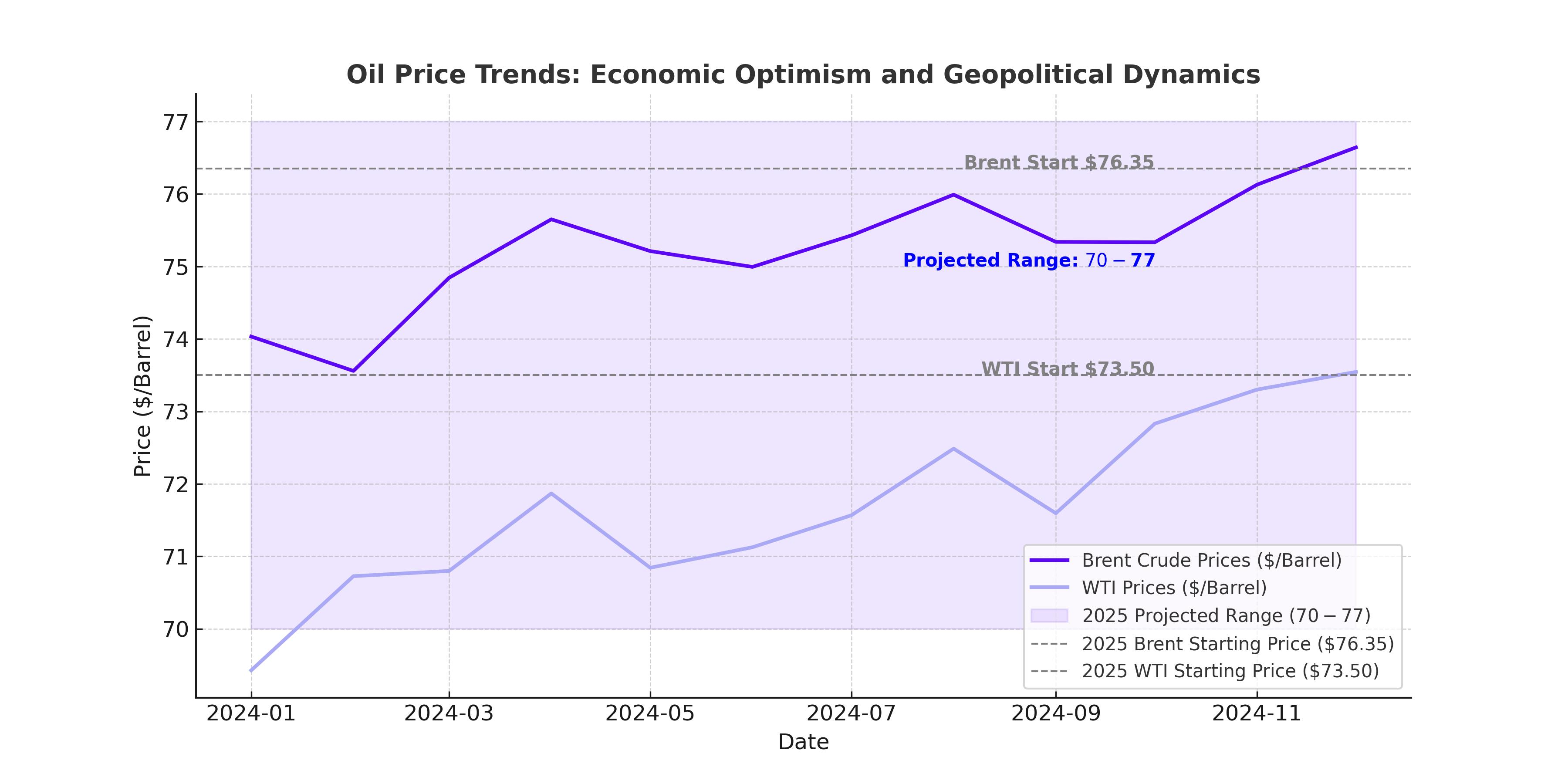

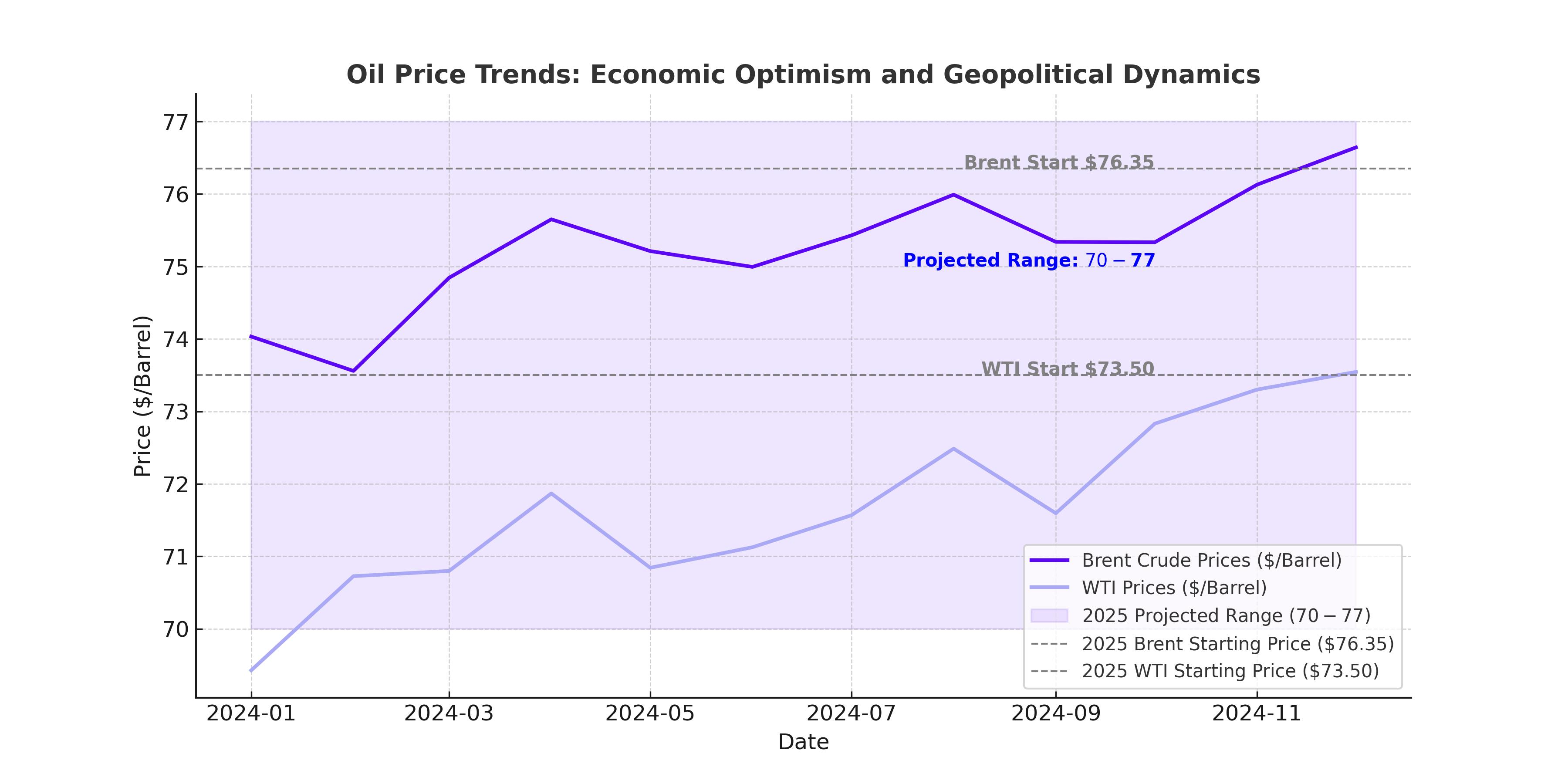

Global oil prices, including Brent crude (BZ=F) and West Texas Intermediate (WTI, CL=F), have entered 2025 with notable gains. Brent crude rose 2.2% to $76.29 per barrel, while WTI climbed 2.4% to trade at $73.47 per barrel. These increases reflect a mix of bullish sentiment driven by China’s economic outlook and fluctuating market fundamentals such as U.S. inventory levels and geopolitical risks.

China’s Economic Stimulus: A Catalyst for Oil Demand Growth

President Xi Jinping’s New Year’s address emphasized China’s commitment to proactive economic growth policies in 2025. This declaration bolstered market optimism, as China remains the second-largest oil consumer globally. Official data showed modest factory activity growth in December, though at a slower pace than expected. Nonetheless, the Caixin/S&P Global survey indicated services and construction sectors are benefiting from policy stimulus. Analysts view China’s economic trajectory as a crucial driver for increased crude oil demand.

While weaker Chinese manufacturing data might appear bearish, some market participants suggest it could prompt Beijing to accelerate its economic stimulus measures. Oil traders are closely monitoring these developments, anticipating that stronger policies could elevate demand and support global prices.

U.S. Inventory Build-Up Counters Market Momentum

Despite optimism from China, U.S. fuel inventories have expanded, tempering oil price gains. The latest data from the Energy Information Administration (EIA) showed a gasoline stock increase of 7.7 million barrels, raising total inventories to 231.4 million barrels. Distillate stockpiles, which include diesel and heating oil, also jumped by 6.4 million barrels to 122.9 million barrels. Meanwhile, crude oil inventories fell by a modest 1.2 million barrels to 415.6 million barrels, underperforming market expectations for a 2.8-million-barrel decline.

This inventory build underscores weak seasonal demand and raises questions about short-term price sustainability. Analysts believe that if U.S. inventory levels continue rising, they could pressure oil prices, offsetting gains driven by geopolitical and economic optimism.

Geopolitical Risks Add Volatility to Oil Markets

Geopolitical tensions remain a wildcard for oil prices. Russia’s halt of natural gas exports via Ukraine on January 1 marked a significant disruption in European energy markets. While Hungary has secured alternative supplies through the TurkStream pipeline, nations like Austria and Slovakia face logistical challenges in diversifying their energy sources. This development has indirectly influenced crude prices, as European nations look to secure stable energy supplies amid colder winter conditions.

Additionally, heightened tensions in the Middle East, including recent drone strikes in Kyiv and escalating conflicts in Gaza, have contributed to increased volatility. Market participants fear that sustained geopolitical instability could disrupt global energy supplies, driving further price spikes.

U.S. Dollar Weakness Supports Oil Prices

The weakening U.S. dollar has also played a role in supporting oil prices. The dollar index fell 0.15% to 108.135, making crude oil cheaper for buyers using other currencies. This development comes as traders anticipate economic policies under the incoming Trump administration. Expectations of increased infrastructure investments and fiscal spending are fueling inflationary pressures, which historically benefit oil prices.

Market Outlook: Technical and Fundamental Indicators

From a technical perspective, WTI and Brent crude are navigating key resistance levels. Brent crude faces resistance near $77, while WTI hovers around $74. Analysts suggest that a breakout above these levels could trigger further bullish momentum. Conversely, a failure to sustain gains could see prices retreat toward support levels of $70 for Brent and $68 for WTI.

The EIA’s earlier reports revealed that U.S. crude demand hit its highest level since the pandemic in October 2024, averaging 21.01 million barrels daily. This strong demand underscores the resilience of the U.S. market, despite headwinds from rising inventories.

Iran and the Role of Sanctions in Global Oil Supply

Iran’s crude oil exports have shown resilience despite U.S. sanctions. Vessel-tracking data from TankerTrackers.com indicates a rebound in shipments during December 2024, particularly to China, Iran’s largest buyer. Iranian exports reached 1.31 million barrels per day in November, though tensions in the Middle East caused disruptions. Market analysts anticipate that further sanctions under the Trump administration could tighten global oil supplies, adding upward pressure to prices.