Oil Prices Plunge as Ceasefire in Gaza Looms and China Demand Falters

Brent Crude Falls Below $78, WTI Slips Under $74 as Markets React to Geopolitical Developments and Economic Uncertainty | That's TradingNEWS

Geopolitical Tensions and Economic Concerns Weigh on Oil Prices

Oil Prices Under Pressure as Geopolitical Risks Ease

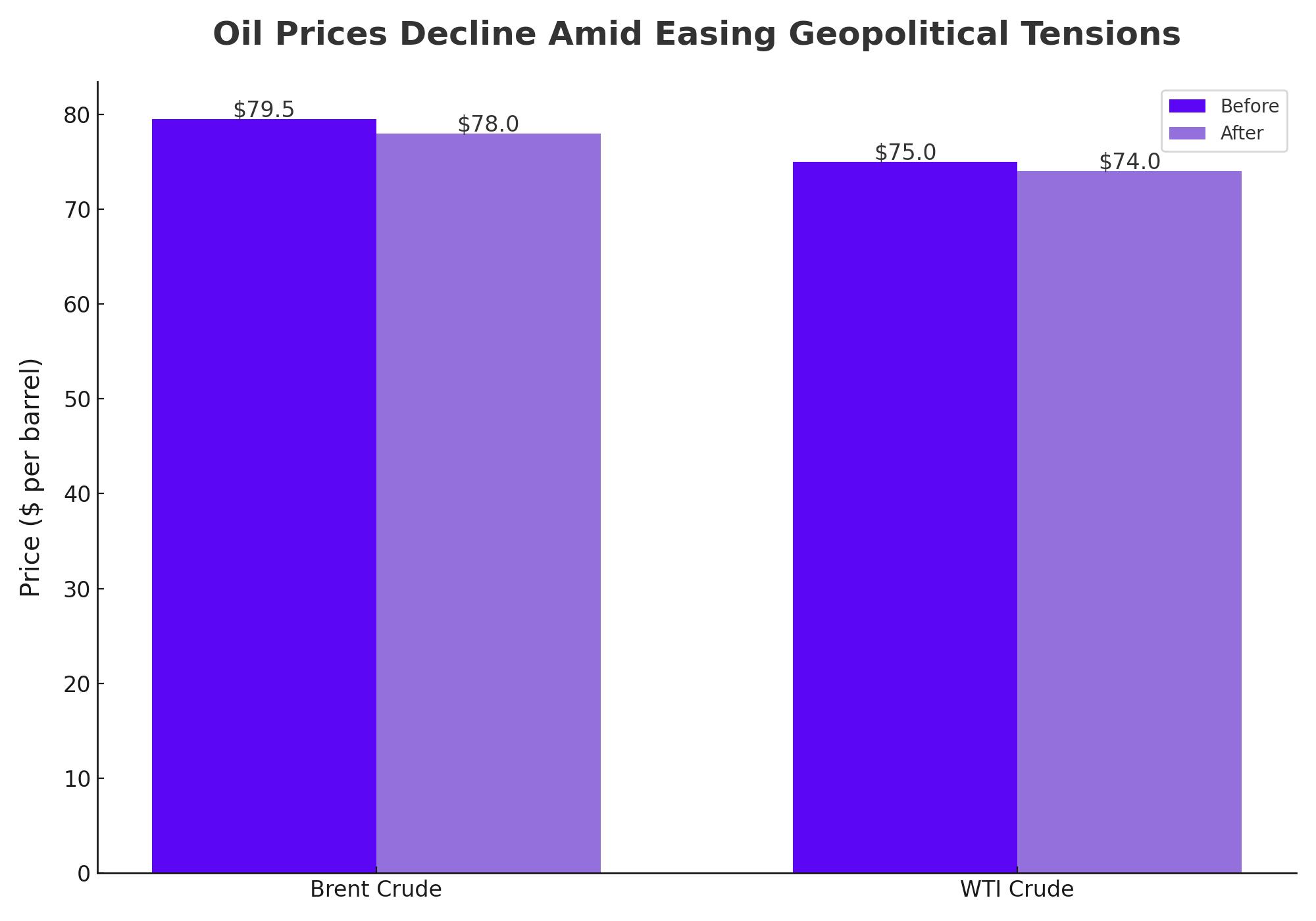

Oil prices have taken a hit recently, driven by a combination of easing geopolitical tensions in the Middle East and persistent concerns over demand from China. Brent crude futures dropped to below $78 per barrel during midmorning Asian trade, while West Texas Intermediate (WTI) slipped below $74 per barrel. These declines signal a market struggling to find support amidst a backdrop of geopolitical developments and economic uncertainties.

Ceasefire Prospects in Gaza and Impact on Oil Supply Fears

One of the key factors contributing to the decline in oil prices is the potential for a ceasefire in Gaza. News that Israel had accepted a proposal aimed at resolving disagreements over a ceasefire has significantly reduced the risk of supply disruptions from the region, a primary concern for oil markets. The possibility of de-escalation has led market participants to reassess the geopolitical risk premium that has been supporting oil prices in recent weeks.

Chinese Economic Data: A Bearish Driver for Oil Demand

Adding to the bearish sentiment, weak economic data from China has raised doubts about the strength of global oil demand. As the world's largest oil importer, China's economic performance is closely watched by traders and analysts alike. Recent reports indicate a decline in both crude oil imports and fuel exports, coupled with softer-than-expected industrial output and other key economic indicators. This has led to growing fears that China's demand for oil may continue to weaken, further pressuring prices.

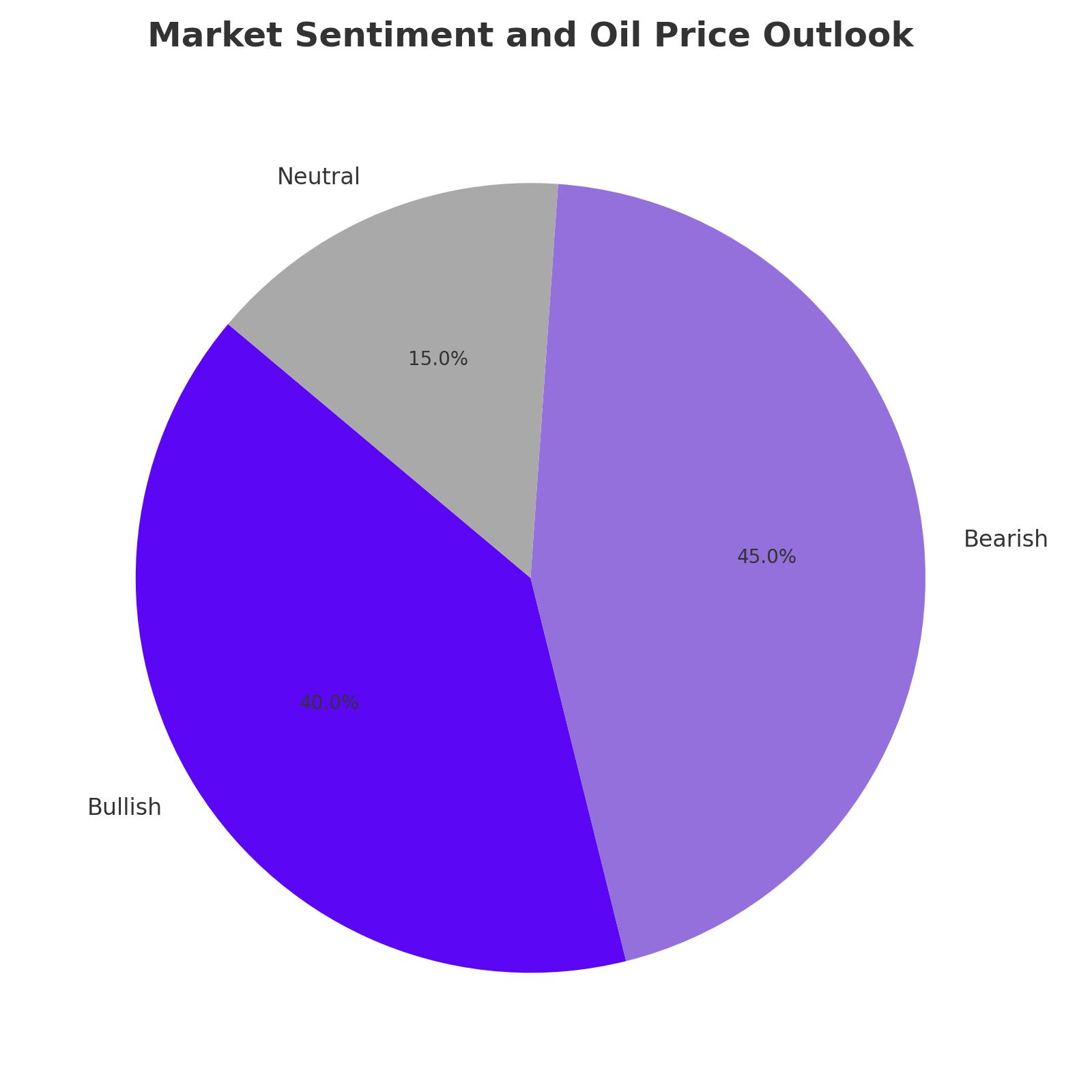

Market Sentiment and Speculative Activity

Speculators remain cautious, with many hesitant to re-enter the market despite expectations of a tighter supply environment later this year. ING’s commodities strategy head, Warren Patterson, highlighted that "speculators continue to be hesitant about jumping into the market, despite expectations for a deficit environment for the remainder of the year." This sentiment underscores the uncertainty that currently surrounds the oil market, with traders wary of both geopolitical developments and economic data.

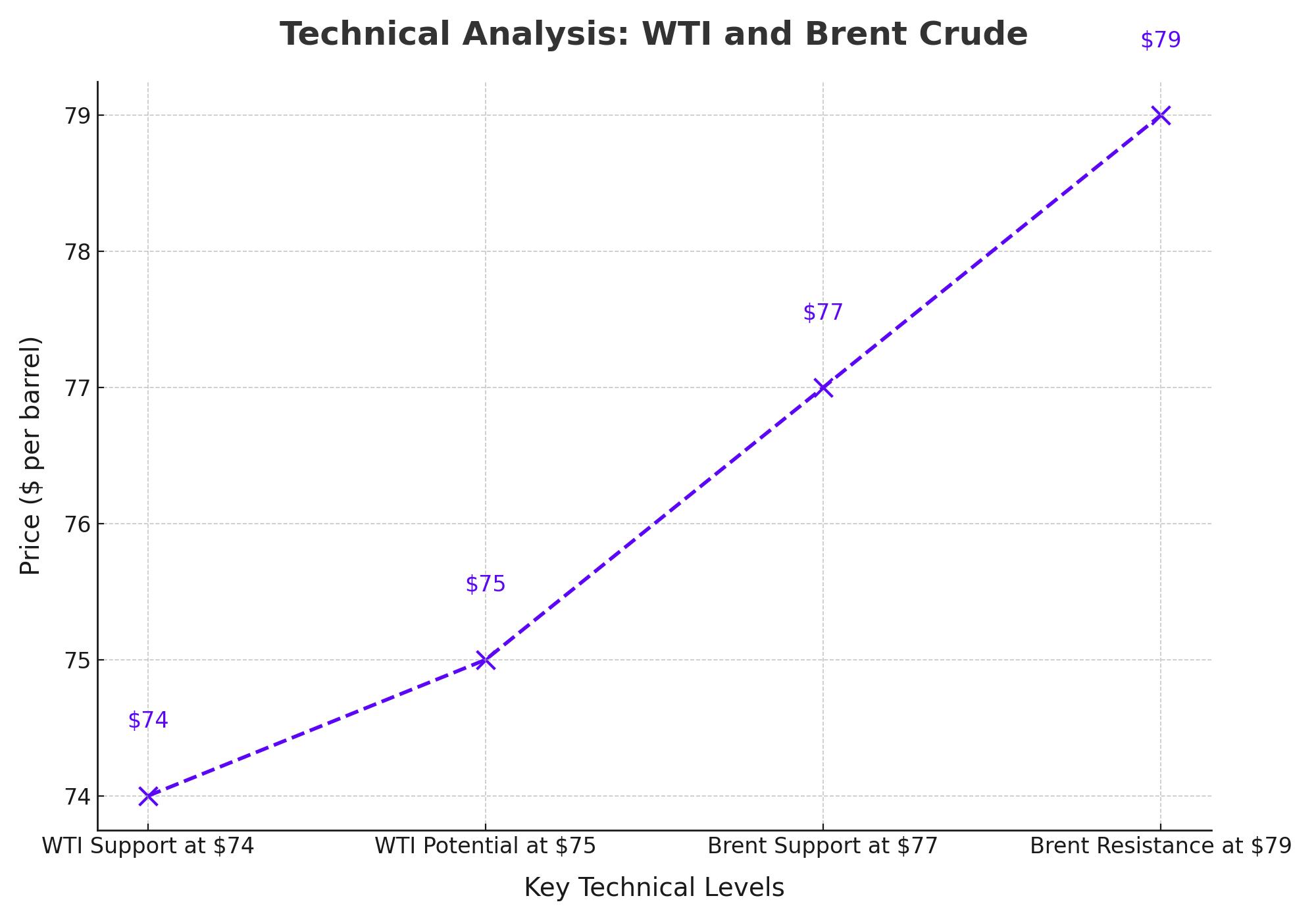

Technical Analysis: WTI and Brent Crude

From a technical perspective, WTI crude has shown signs of building a base around the $74 level, with potential to rebound toward $75 if bullish momentum picks up. However, the market remains vulnerable to downside risks, particularly if economic data continues to disappoint. Brent crude, on the other hand, has managed to break above the $77 level, with the next key resistance around $79. The market's ability to hold above these levels will be crucial in determining the near-term direction of oil prices.

Looking Ahead: Key Factors to Watch

As the market moves forward, several factors will be crucial in shaping the outlook for oil prices. These include the progress of ceasefire negotiations in Gaza, the trajectory of Chinese economic data, and broader global economic trends. Additionally, traders will be closely monitoring the actions of OPEC+ and other major oil producers, as any changes in production levels could significantly impact the supply-demand balance.

Conclusion: Navigating Uncertainty in the Oil Market

In summary, the oil market is currently navigating a complex landscape of geopolitical and economic uncertainties. While the potential for a ceasefire in Gaza has eased some supply fears, concerns over Chinese demand and broader economic risks continue to weigh on prices. As always, market participants will need to stay vigilant, keeping a close eye on developments in both the geopolitical arena and global economic data.

That's TradingNEWS

Read More

-

SCHG ETF Near $33 High As AI Giants Drive 19% 2025 Rally

01.01.2026 · TradingNEWS ArchiveStocks

-

XRP-USD Stuck At $1.87 As XRPI Near $10.57 And XRPR Around $14.98 Despite $1.16B ETF Wave

01.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward Key $3.57 Support As Ng=F Extends 33% Drop

01.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Near 156 As Fed Cuts Meet Boj Hawkish Turn

01.01.2026 · TradingNEWS ArchiveForex