Oil Market on Edge as Trump’s Sanctions and OPEC+ Moves Reshape the Landscape

Oil markets are experiencing intense volatility as crude prices react sharply to President Donald Trump’s renewed push to drive Iranian oil exports to zero. WTI crude (CL=F) surged to $76.34 per barrel, reversing early-session losses, while Brent crude (BZ=F) rebounded to $79.50, reflecting shifting trader sentiment on geopolitical tensions, trade war risks, and OPEC’s production strategy.

Trump’s “maximum pressure” campaign on Iran is aimed at choking Tehran’s ability to fund regional conflicts, but it also threatens to tighten global oil supplies drastically. Iran is still exporting approximately 1.3 million barrels per day (bpd), mostly to China, but the latest round of U.S. sanctions could cut off those flows overnight if enforced aggressively. The last time Trump took similar action in 2018, oil prices spiked above $80 per barrel as markets priced in lost supply.

At the same time, China’s retaliation against U.S. tariffs has created uncertainty in global oil demand, with the world’s second-largest economy imposing a fresh 10% tariff on U.S. crude oil imports. While China only imported 1.7% of its crude from the U.S. in 2024, this move signals a deepening trade conflict that could weigh on global energy markets.

OPEC+ Holds Firm on Production Cuts as Trump Calls for Lower Oil Prices

Adding another layer of complexity, OPEC+ has decided to stick to its previously agreed production cuts, despite Trump’s pressure on the cartel to pump more oil. The current plan is to maintain output curbs through Q1 2025 before gradually increasing supply from April onward.

Trump has publicly stated that lower oil prices are key to weakening Russia’s ability to finance its war on Ukraine. He has urged OPEC+—particularly Saudi Arabia—to ramp up production to bring prices down. However, Saudi Arabia needs oil above $90 per barrel to balance its budget, making it unlikely they will cave to Washington’s demands anytime soon.

Russia’s oil sales remain strong despite Western sanctions, with Moscow successfully rerouting crude exports to India and China. While the U.S. has imposed price caps on Russian crude, Russia has managed to bypass many restrictions using a shadow fleet of tankers. However, further price declines could start to cut into Russia’s revenues, which are estimated to drop by $17 billion per year for every $10 decrease in oil prices.

Iran Sanctions vs. Trade War: How These Forces Are Reshaping Oil Prices

Crude prices were down sharply earlier in the day following China’s retaliation against U.S. tariffs, but Trump’s escalation against Iran provided a bullish counterbalance. WTI was down nearly 3% earlier, with Brent falling close to 2%, before rebounding sharply as traders priced in potential supply risks.

The renewed Iran sanctions are expected to have a major impact on global crude flows. If Iran’s supply is cut off completely, the global market could lose over 1 million bpd, creating a supply deficit that could send Brent well above $85 per barrel.

However, traders remain skeptical. In the past, Iranian oil has still found ways to reach global markets, through illicit ship-to-ship transfers and loopholes in sanctions enforcement. If these flows continue, the impact on oil prices may be more muted than anticipated.

U.S. Oil Output and SPR Strategy – Can Domestic Production Offset Supply Losses?

With the risk of supply disruptions looming, attention has turned to whether U.S. oil production can fill the gap. The U.S. currently produces over 13 million bpd, but growth has slowed due to capital discipline by shale producers. Despite Trump’s push to boost domestic energy output, analysts warn that the shale industry is unlikely to increase production significantly in the short term.

The Strategic Petroleum Reserve (SPR) is another key factor. Trump has floated the idea of replenishing the SPR after it was drained to historic lows in 2023. However, buying back oil at $75-$80 per barrel would strain government budgets and contradict Trump’s goal of lower oil prices.

If the U.S. decides to halt SPR purchases, it could provide some downward pressure on crude prices. However, the market remains highly sensitive to geopolitical risks, and any escalation in Middle East tensions could quickly erase any bearish sentiment.

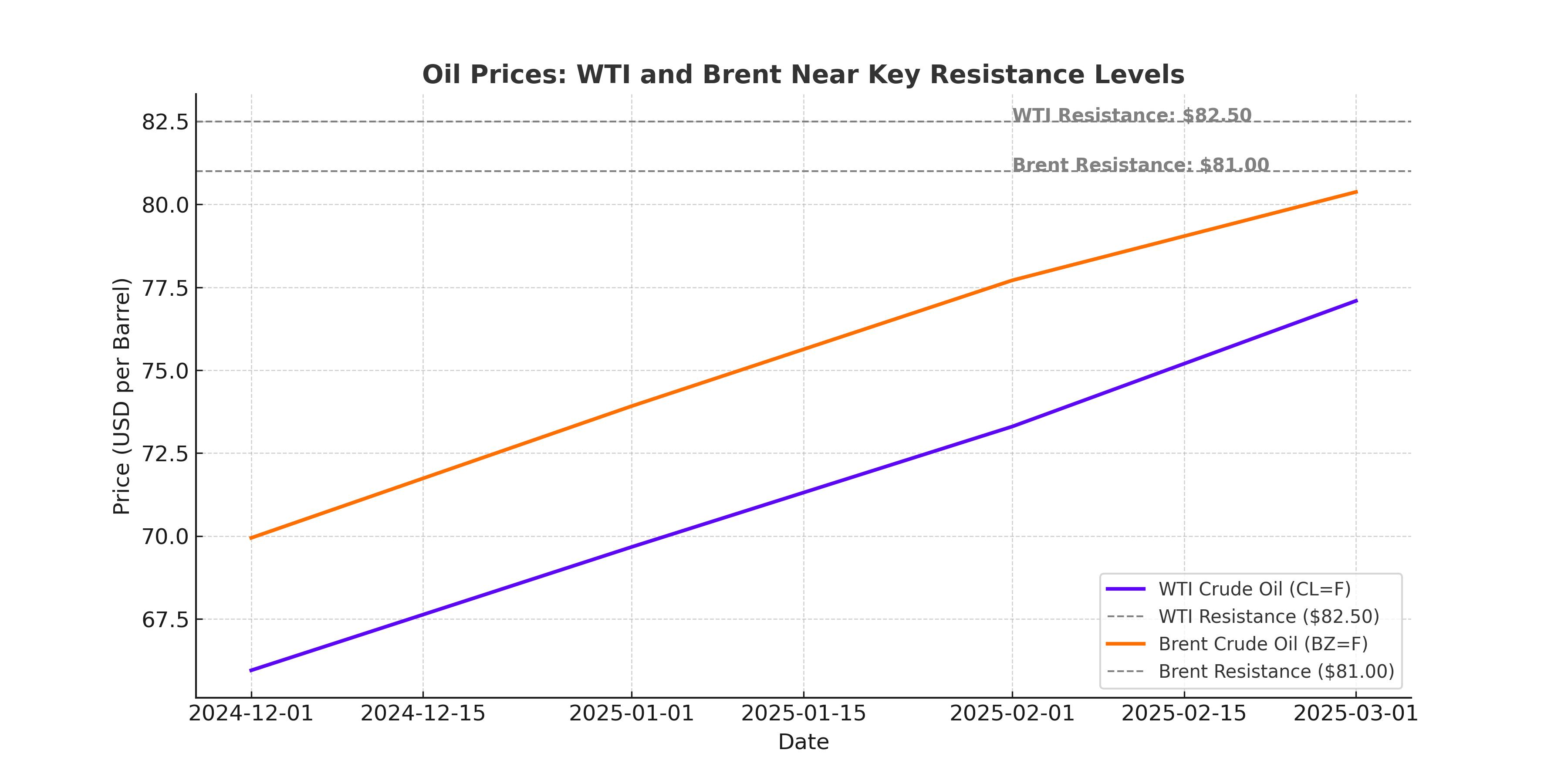

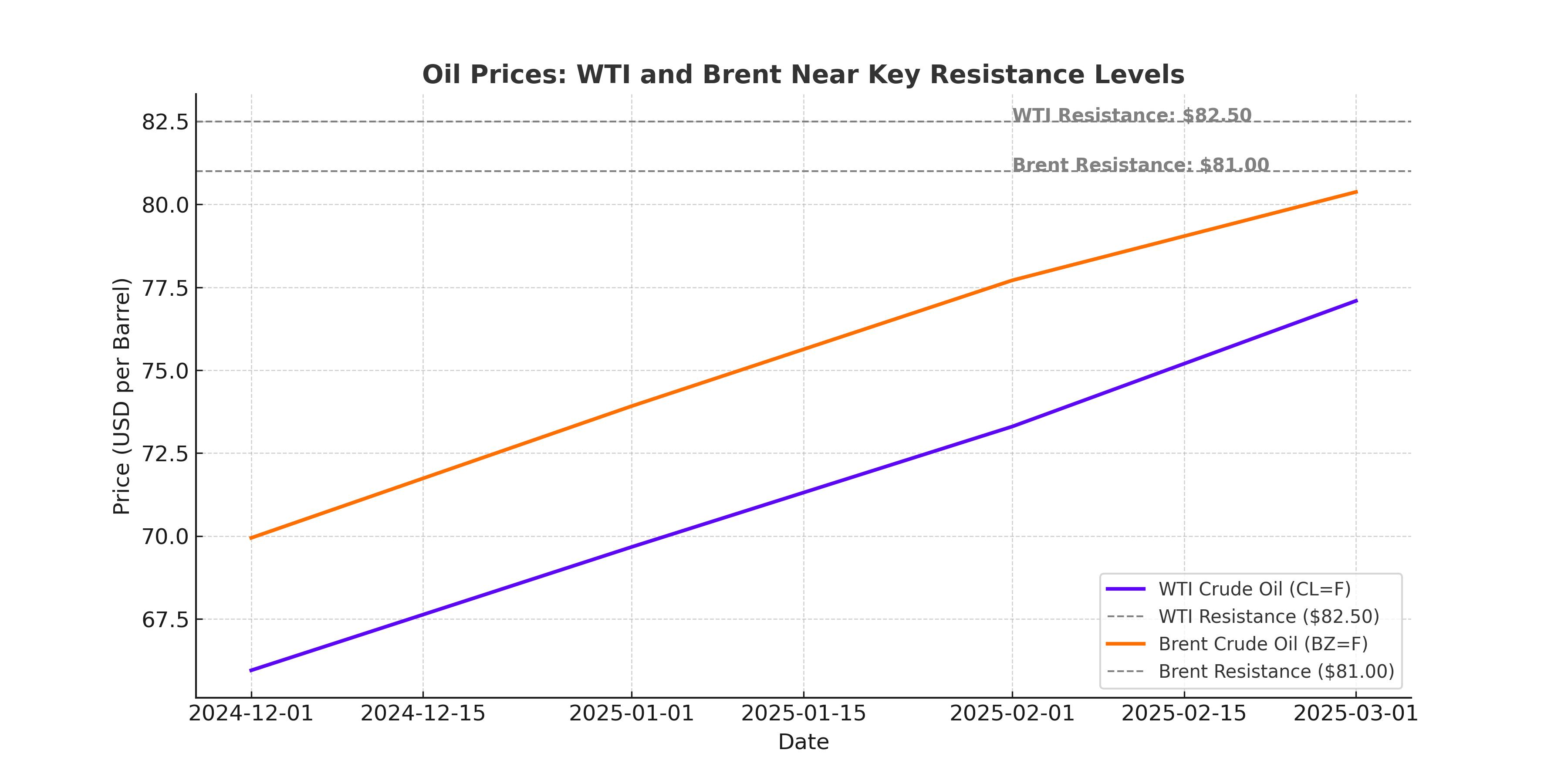

Will WTI Break $80? Key Technical Levels to Watch

From a technical standpoint, WTI crude is testing major resistance at $78, a level that has acted as a cap in previous rallies. If bulls push WTI above $78, the next major target is $80, which would mark a key psychological and technical breakout point.

On the downside, support is seen at $72, a level that provided strong buying interest in recent weeks. If crude fails to hold above $72, a deeper correction toward $70-$68 could be in play.

For Brent crude, the $82-$85 range is the next key target on the upside, while support sits at $75.

Market Outlook – Volatility Remains High as Traders Weigh Supply and Demand Risks

Oil markets are caught between bullish supply concerns and bearish demand risks. The renewed Iran sanctions and OPEC+ supply discipline favor higher prices, while China’s tariff retaliation and global recession fears create downside pressure.

Key factors to watch in the coming weeks include:

- Will Trump enforce secondary sanctions on China to block Iranian oil sales?

- Will OPEC+ adjust its production strategy to counter rising prices?

- How will the U.S. respond to China’s latest tariffs on American crude?

- Can WTI break above $80, or will resistance hold?

With so many forces pulling oil in different directions, volatility is likely to remain elevated. For traders and investors, the next few weeks will be critical in determining whether crude prices continue their climb or face a sharp pullback.

That's TradingNEWS