Oil Prices Rally: Brent at $72.93, WTI at $69.35 Amid Chinese Growth Push and U.S. Stockpile Swell

Crude Markets See Renewed Optimism as China's Stimulus Boosts Demand Outlook, While U.S. Inventory Data and Middle East Tensions Add Volatility | That's TradingNEWS

Current Trends and Dynamics in Oil Prices

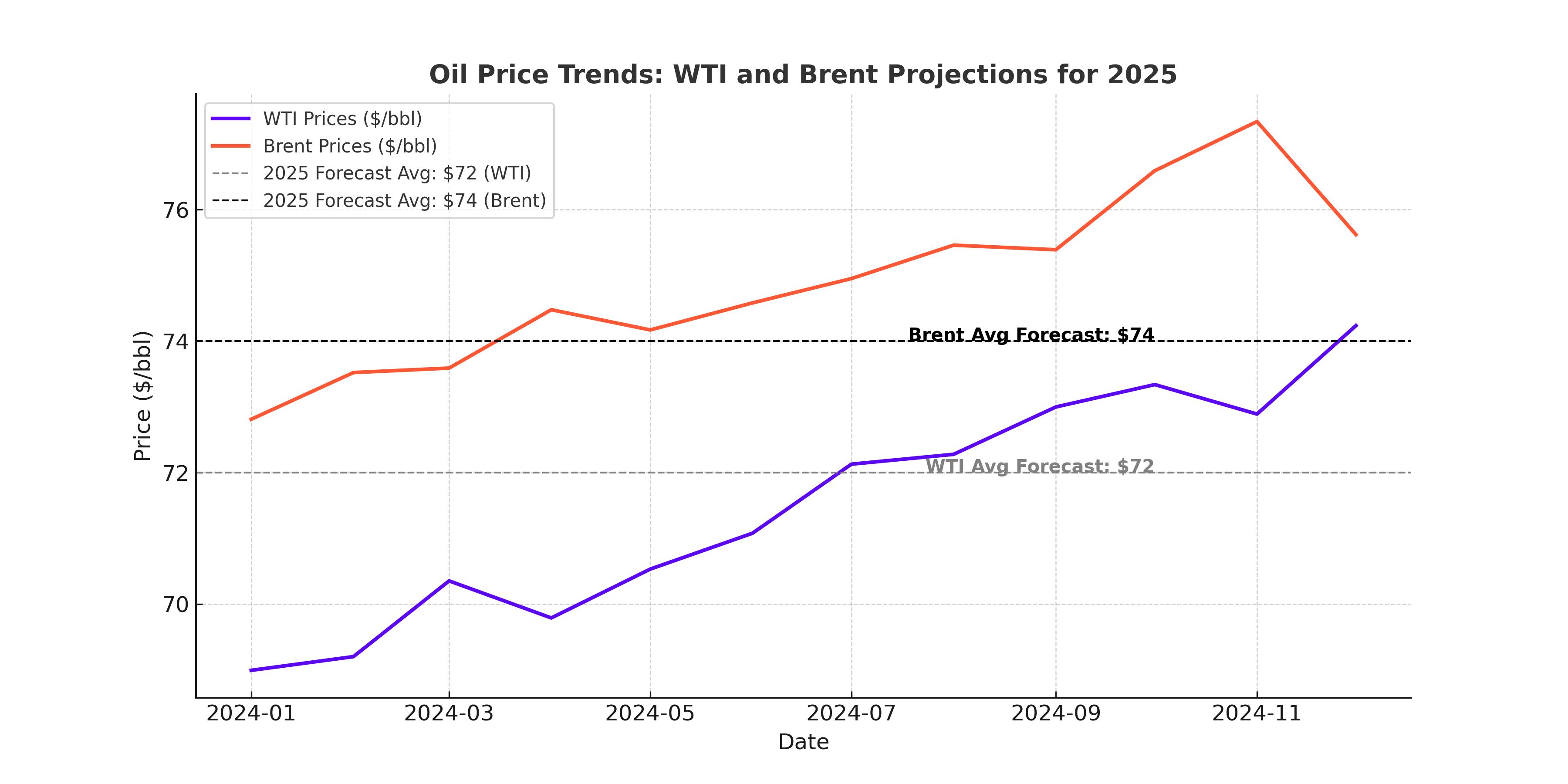

Oil prices have shown moderate gains amidst a complex mix of global economic shifts, geopolitical developments, and seasonal patterns. On Wednesday, Brent crude futures edged up by 0.3% to $72.43 a barrel, while West Texas Intermediate (WTI) crude futures increased by 0.4% to $68.83. Despite these upticks, the market is carefully navigating through pressures such as a strengthened U.S. dollar and a surge in U.S. inventories, as well as geopolitical uncertainties stemming from the Middle East.

The recent decision by China to implement a more accommodative monetary policy has sparked optimism. Announcements of easing measures in 2025 have kindled hopes of increased demand, with Chinese crude oil imports rising by over 14% in November, marking the first annual increase in seven months. These policies aim to reinvigorate China’s economy, with oil consumption expected to benefit from heightened industrial and consumer activity. However, market participants remain cautious, awaiting more concrete steps from Beijing to assess the depth of these measures.

U.S. Inventory Levels and the Dollar's Influence

In the U.S., the latest data from the American Petroleum Institute revealed an unexpected increase of 499,000 barrels in crude inventories for the week ending December 6. This rise contrasts with expectations of a 900,000-barrel decline. Gasoline inventories also surged by 2.85 million barrels, accompanied by a 2.45 million barrel increase in distillate stocks. These numbers underscore the resilience of U.S. supply, bolstered by record-high production levels. As winter approaches, a seasonal tapering in demand may result in further inventory accumulations, adding downward pressure on prices.

The strengthening of the U.S. dollar has also contributed to tempering oil's momentum. With the dollar gaining traction ahead of crucial inflation data, oil prices face challenges due to the inverse relationship between the greenback and commodities like crude. Traders eagerly await the November Consumer Price Index (CPI) data to gain insights into the Federal Reserve's monetary policy trajectory, which could further shape the energy market's outlook.

OPEC+ Actions and Market Implications

OPEC and its allies have continued their cautious approach to supply adjustments. Last week, the group decided to delay reversing output cuts until April 2025, extending the timeline for fully unwinding production cuts to the end of 2026. This decision reflects OPEC+’s anticipation of a supply surplus amid slowing global demand growth, particularly from China, and an uptick in non-OPEC+ production.

Saudi Aramco, the world's largest oil exporter, has responded by lowering its January 2025 crude prices for Asian markets to the lowest levels since early 2021. Despite these adjustments, market expectations of a tightening supply-demand balance in 2025 remain. Analysts at UBS predict demand growth will continue to outpace supply growth from non-OPEC+ producers, suggesting potential upward pressure on prices in the medium term.

Geopolitical Risk Premium and Global Trade Uncertainty

Geopolitical developments in the Middle East have maintained a risk premium in oil prices. This week’s ousting of Syrian President Bashar al-Assad, culminating a 13-year civil war, has raised questions about potential shifts in regional oil production. At its peak, Syria produced over 600,000 barrels per day, and any resumption of substantial output could add supply to the global market. Meanwhile, reports of the Biden administration considering tighter sanctions on Russia's oil trade have further amplified market uncertainty. Such measures could constrain Russian exports, tightening global supplies and driving prices upward.

Adding to the complexity are President-elect Donald Trump’s proposed import tariffs and escalating trade tensions, which could disrupt global trade flows and impact oil markets. These factors, coupled with a half-empty U.S. Strategic Petroleum Reserve, underscore a volatile environment where fundamental and geopolitical factors interplay to shape price movements.

China’s Role as a Demand Driver

China’s evolving economic policies remain a focal point for the oil market. Recent announcements of reforms targeting consumer spending and property markets signal a potential shift in demand dynamics. With crude imports increasing to 11.81 million barrels daily in November, China’s position as the world's largest crude importer is set to influence global balances. The Central Economic Work Conference, commencing this week, is expected to shed further light on the government’s stimulus strategies, which could provide clearer guidance for oil traders.

Despite these positive signals, challenges persist. Chinese policymakers face the dual task of managing domestic growth while navigating external uncertainties, such as heightened trade risks and volatile currency dynamics. These factors will play a critical role in determining the sustainability of China-driven oil demand growth in the coming months.

Seasonal Patterns and Market Outlook

The oil market is entering a seasonally weak period, with historical data suggesting subdued price dynamics during this time of year. Analysts at Standard Chartered Bank note that Brent prices around December 9 have rarely exceeded $77 per barrel in recent years. Concerns about a hard economic landing in major consumer nations and fears of a supply surplus have contributed to a cautious market sentiment.

However, there are reasons for optimism. Analysts at Enverus Intelligence Research point to record global oil demand levels and low crude stockpiles as supporting factors. The organization forecasts increased volatility in 2025, driven by tight inventories, elevated geopolitical tensions, and broader trade uncertainties. A report by Baker Hughes also highlights a rise in U.S. oil and gas rigs, signaling potential increases in production capacity.

The Evolving Role of Midland WTI Pricing

The establishment of the HOU benchmark for Midland WTI crude marks a significant shift in U.S. oil pricing dynamics. In November, a record 20 million barrels of Midland crude were delivered through exchange settlements, highlighting the growing adoption of HOU as a benchmark. Companies like Continental Resources have begun pricing their production off HOU, moving away from traditional WTI Cushing benchmarks. This evolution reflects broader changes in U.S. crude markets, with Midland WTI gaining prominence in global trade flows.

HOU’s integration with major Gulf Coast terminals and its connection to Brent pricing further enhances its appeal. As the only exchange-guaranteed source of deliverable Midland WTI, HOU provides a reliable benchmark for managing price risks across locations and grades. This development underscores the ongoing transformation of oil pricing mechanisms to better reflect market fundamentals.

Final Thoughts on Oil Price Dynamics

Oil prices remain at a crossroads, influenced by a myriad of factors ranging from Chinese economic policies and U.S. inventory levels to geopolitical risks and OPEC+ strategies. Brent’s recent fluctuations around $72 per barrel and WTI’s movements near $69 underscore the market’s sensitivity to these variables. As traders navigate through this landscape, the interplay between short-term market drivers and longer-term structural shifts will dictate the trajectory of oil prices into 2025 and beyond.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex