Oil Prices Struggle as Inventory Surprises Clash with Geopolitical Uncertainty

Unexpected U.S. Inventory Build and Middle East Tensions Drive Oil Market Volatility, Testing Key Technical Levels | That's TradingNEWS

Global Oil Markets: A Tangle of Supply and Demand Dynamics

Oil Prices Under Pressure as Supply and Demand Dynamics Shift

The global oil market has experienced significant fluctuations recently, influenced by a variety of factors, from unexpected inventory changes to geopolitical tensions. Crude oil prices began the trading week in Asia with gains, buoyed by reports of declining inventories and softer-than-expected producer prices, which sparked hopes for a rate cut by the Federal Reserve.

According to the American Petroleum Institute (API), U.S. oil inventories dropped by an estimated 5 million barrels last week, a notable shift following a period of moderate increases. This brings the total inventory gain to about 400,000 barrels since the start of the year. The Energy Information Administration (EIA) is expected to confirm these figures later today, which could further influence market sentiment.

Geopolitical Tensions and Market Reactions

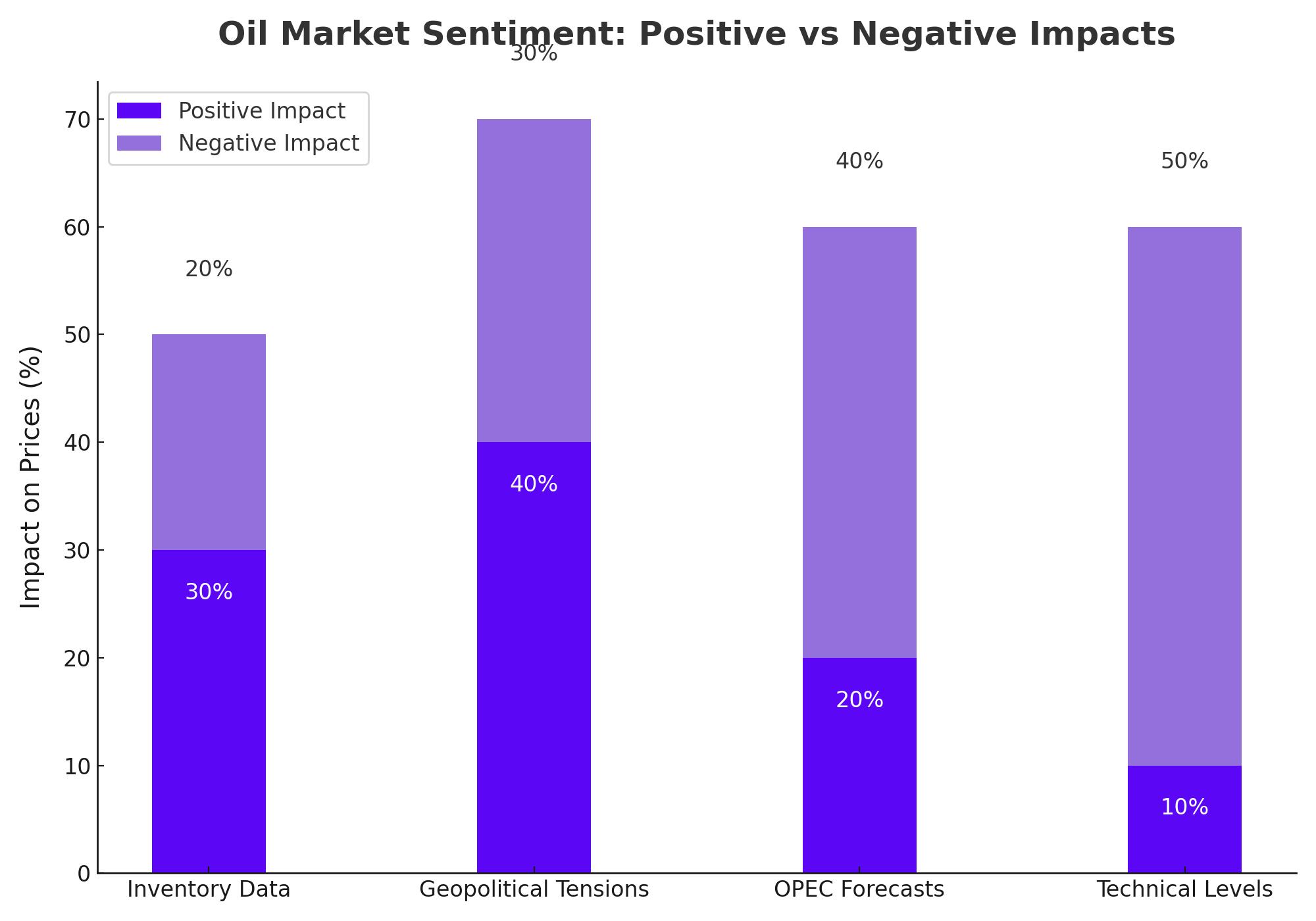

The oil market’s reaction has been closely tied to geopolitical developments. Recently, the conflict between Israel and Hamas, coupled with U.S. military movements in the Middle East, has heightened concerns about potential disruptions in one of the world's major crude-producing regions. Iran's threat of severe retaliation following the killing of a Hamas leader has kept the market on edge, although the situation seems to have temporarily stabilized with ongoing ceasefire discussions.

Impact of Inventory Data on Oil Prices

In the U.S., crude inventories unexpectedly rose by 1.4 million barrels, defying expectations of a 2.2 million barrel draw. This surprise increase has weighed on oil prices, despite earlier support from API's report of a significant inventory draw. The divergence in data highlights the complexity of predicting oil market movements, particularly when juxtaposed against broader economic indicators such as the U.S. producer price index, which saw a minor increase of 0.01% in July.

OPEC’s Revised Forecasts and Market Implications

OPEC's latest forecasts have added another layer of complexity to the oil market. The organization has lowered its demand growth forecast for 2024, citing weaker-than-expected Chinese consumption. This revision follows a series of disappointing economic indicators from China, which have dampened expectations for its economic performance in the latter half of 2024. The International Energy Agency (IEA) echoed similar sentiments, predicting a modest 950,000 barrels per day (bpd) growth in global oil demand by 2025, slightly down from previous estimates.

Technical Analysis: WTI and Brent Crude Oil

From a technical perspective, both WTI and Brent crude oil prices have experienced volatility. WTI crude briefly fell below the $77 mark, with the 100-day Simple Moving Average (SMA) at $78.50 acting as a key resistance level. Brent crude, on the other hand, struggled to hold above the $80 level, with potential support identified at $77.33 if prices continue to decline.

The technical outlook suggests that oil prices could face further downside pressure unless key resistance levels are breached. For WTI, a move above $78.50 could open the door to the $80 mark, while for Brent, a break above $82 might signal a shift towards $84. However, the broader trend appears to be towards the downside, especially given the mixed inventory data and OPEC's revised forecasts.

Conclusion: A Market in Flux

The global oil market is currently in a state of flux, driven by a combination of inventory dynamics, geopolitical tensions, and revised demand forecasts. While short-term price movements will likely continue to be influenced by these factors, the longer-term outlook remains uncertain, particularly as the world grapples with economic challenges and evolving energy policies. Investors and traders should stay vigilant, as the interplay between supply, demand, and geopolitical events will likely continue to drive volatility in the oil market.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex