Oil Prices Surge: WTI at $74.24, Brent at $76.62 as Stimulus and Supply Crunch Drive Gains

Tightened supply from Russia and Iran, alongside Chinese economic stimulus, propels Brent and WTI crude to multi-month highs, signaling strong momentum in the global oil markets for 2025 | That's TradingNEWS

Oil Prices Gain Amid Supply Concerns and Optimistic Economic Signals

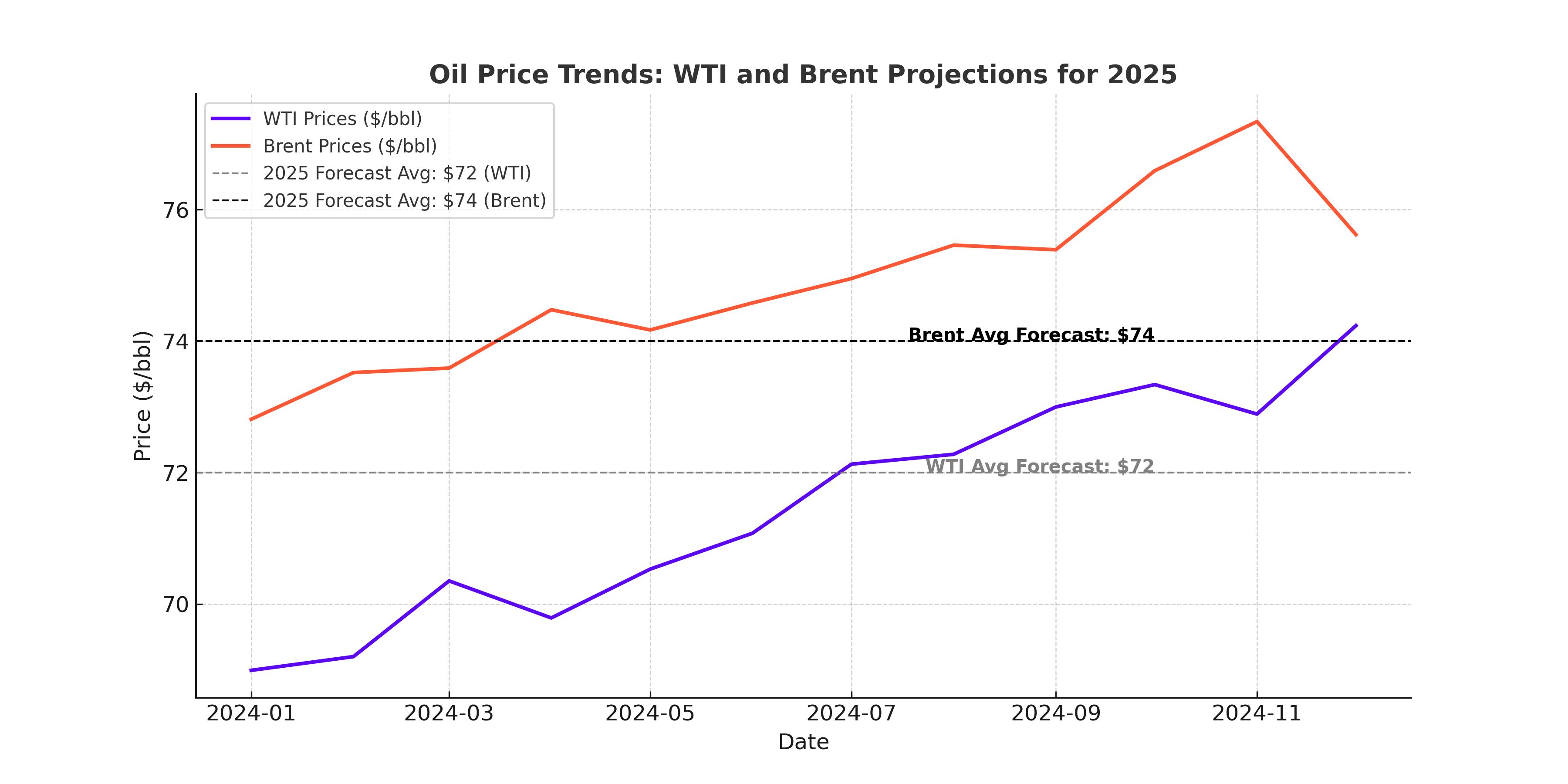

Oil prices are experiencing a notable upswing, with Brent crude (BZ=F) climbing to $76.62 per barrel, marking a 3.3% weekly gain, and WTI crude (CL=F) trading at $74.24, up 5% for the week. These gains are fueled by a combination of geopolitical and macroeconomic factors, including supply constraints from key producers like Russia and Iran, as well as proactive economic measures from major oil-consuming nations such as China.

Impact of Chinese Economic Stimulus on Oil Demand

China, the world's largest importer of oil, is once again the focal point for demand-side support. Recent announcements of expanded economic stimulus, including a 3 trillion yuan ($411 billion) special treasury bond issuance and wage hikes for government employees, have reinforced market confidence in China's ability to drive global oil consumption higher. Additionally, increased import quotas for independent refiners point to stronger buying activity, particularly for Middle Eastern grades like Oman and Dubai crude, which have risen to rare premiums over Brent. This comes amid tighter supply from Russia and Iran, whose shipments have declined due to increased sanctions targeting shadow fleets.

Geopolitical Risks and Supply Constraints Bolster Oil Prices

Geopolitical tensions are adding a significant risk premium to the oil markets. The United States has ramped up sanctions against entities involved in transporting Iranian oil, pushing much of it into floating storage near Southeast Asia. At the same time, Russia faces mounting challenges to maintain its export volumes, with shipments curtailed by sanctions and stricter adherence to OPEC+ production quotas. This has provided Middle Eastern producers, particularly Saudi Arabia and the UAE, an opportunity to reclaim market share in Asia, leading to elevated prices for their crude grades such as Murban.

U.S. Inventory Drawdowns and Market Signals

In the United States, commercial crude stockpiles declined by 1.2 million barrels last week, bringing the total to 415.6 million barrels, according to the Energy Information Administration (EIA). While this drop fell short of expectations for a 2.4 million barrel reduction, it underscores tightening supply conditions. However, gasoline and distillate inventories rose as refineries boosted production, hitting a two-year demand low for fuels. This dynamic, coupled with cold weather across Europe and North America, has supported demand for heating oil, further propping up prices.

Influence of U.S. Economic Policies and Federal Reserve Actions

The U.S. economic outlook also plays a crucial role in shaping oil price trajectories. Anticipated interest rate cuts by the Federal Reserve in 2025, alongside policies expected under the Trump administration, including infrastructure investments and potential deregulation of the energy sector, are likely to stimulate higher oil demand. These measures align with the optimistic performance of the U.S. manufacturing PMI, which reached a nine-month high of 49.3 in December, signaling a potential turnaround in industrial activity that could drive energy consumption.

Technical and Market Analysis of Oil Prices

Technically, WTI crude (CL=F) remains supported above $70, with key resistance levels around $76 and a potential breakout target of $80. Similarly, Brent crude (BZ=F) finds strong support near $75, with bullish momentum indicating a possible climb toward $80-$85 in the medium term. Traders are closely monitoring these levels, as well as broader macroeconomic cues, for indications of sustained upward movement.

Forecasts for 2025: A Strong Outlook for Oil Prices

Looking ahead, oil markets are poised to remain robust through 2025, driven by tightening supply conditions and improving global economic sentiment. Analysts project prices to hover around $70-$80 per barrel, with upside potential dependent on continued demand growth from China and the U.S., as well as any further disruptions to supply from geopolitically sensitive regions. The combination of proactive stimulus measures, inventory drawdowns, and bullish technical indicators provides a favorable backdrop for both Brent and WTI crude.

Investors are advised to keep a close watch on market developments, particularly those tied to Chinese policy initiatives, U.S. inventory levels, and Federal Reserve actions, as these factors will play a critical role in shaping oil price trajectories in the coming months. For now, the oil market appears well-supported, with potential for further gains as the global economic recovery gathers momentum.

That's TradingNEWS

Read More

-

UNG ETF At $12.25: Can Natural Gas, LNG Expansion And AI Power Demand Ignite A Rebound In 2026?

31.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $10.52 and XRPR at $14.90 End 2025 Red as Inflows Hit $1.15B

31.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Slides Toward $3.70 as Warm Forecasts Dominate but LNG Exports Support NG=F

31.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 156.60 as Fed Easing and BoJ Tightening Collide at Year-End

31.12.2025 · TradingNEWS ArchiveForex