Oil Prices Teeter as China’s Economic Woes and Middle East Diplomacy Play Out

Market Jitters Grow with Weak Chinese Demand and Easing Middle Eastern Conflicts – What’s Next for Crude? | That's TradingNEWS

Oil Market Sees Volatility Amid Geopolitical Tensions and Demand Concerns

Brent and WTI Crude Prices Under Pressure

Oil prices have experienced significant fluctuations recently, driven by a complex interplay of geopolitical developments, economic indicators, and market sentiment. Brent crude futures, after hitting a high above $82 per barrel earlier this month, have seen a sharp decline, trading at $77.67 per barrel as of the latest session, while West Texas Intermediate (WTI) fell to $73.65 per barrel. This marks a notable drop from recent highs, with Brent shedding approximately 6.2% and WTI losing 7.5% in value over just a few days.

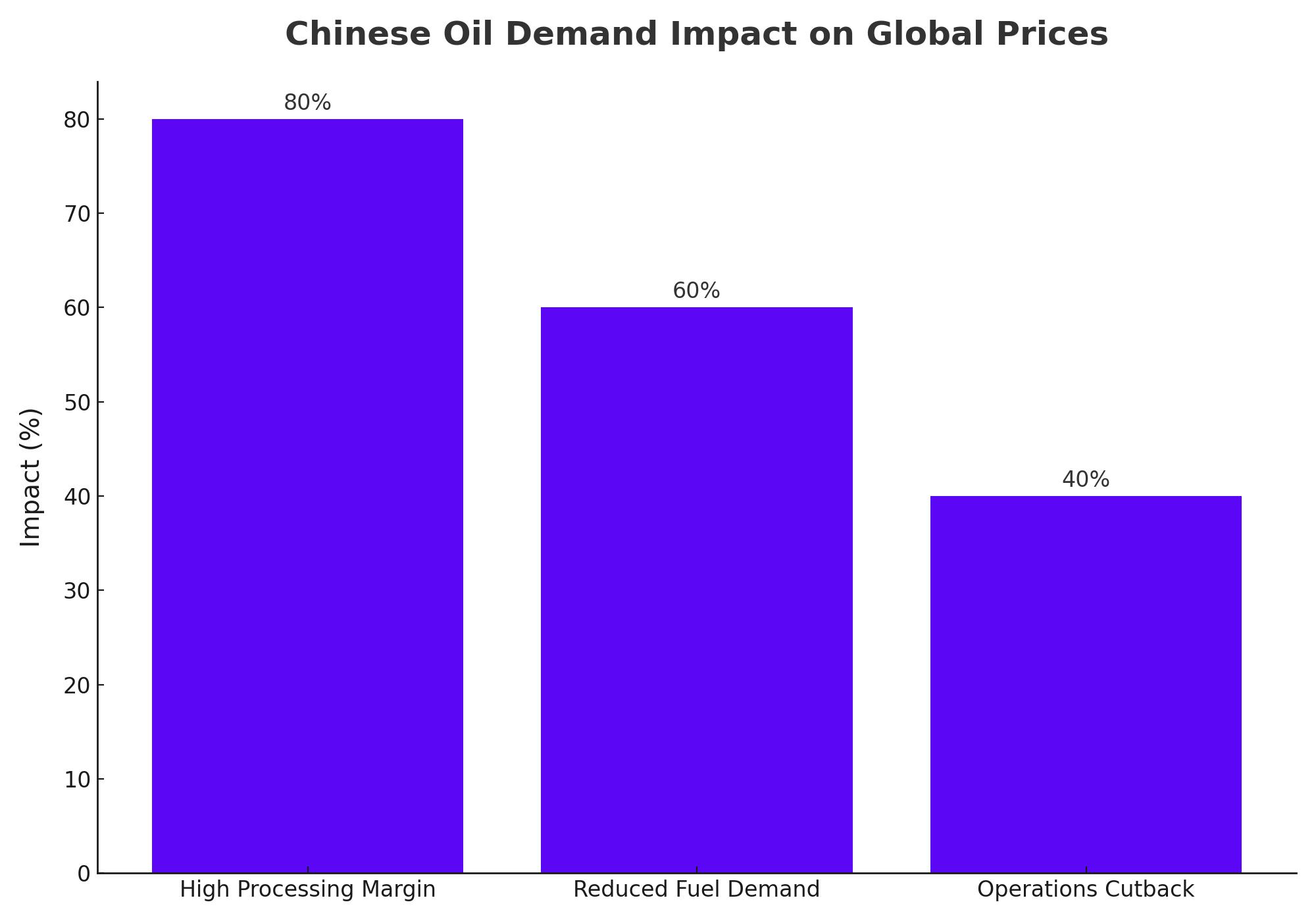

China's Economic Slowdown Weighs on Global Oil Demand

One of the critical factors impacting oil prices is the ongoing economic slowdown in China, the world's largest crude importer. China's economic struggles have dampened processing margins and reduced fuel demand, forcing both state-run and independent refineries to cut back on operations. This decline in demand from such a significant player in the oil market has contributed to the bearish sentiment that has kept prices suppressed.

Middle East Tensions and the Impact on Oil Supply

Geopolitical tensions in the Middle East, particularly the conflict between Israel and Hamas, have also been a focal point for oil traders. While fears of the conflict spreading and disrupting oil supplies have diminished somewhat, the situation remains fluid. U.S. Secretary of State Antony Blinken's efforts to broker a ceasefire in Gaza have been closely watched, with any developments likely to have immediate repercussions on oil prices. ING commodities strategists noted that hopes of a ceasefire, coupled with ongoing demand concerns, have exerted downward pressure on oil prices.

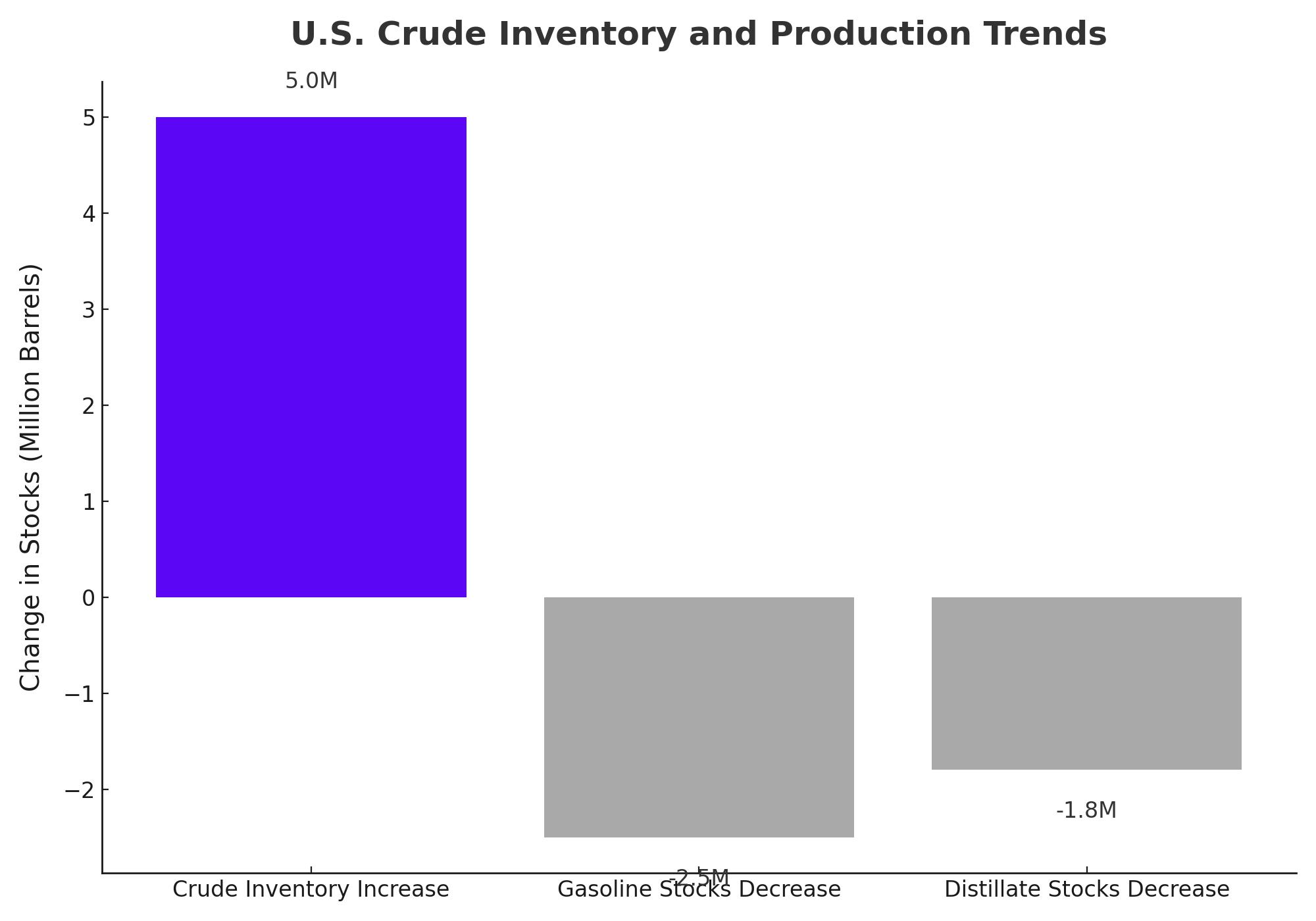

U.S. Crude Inventories and Domestic Production Trends

In the United States, the world's largest oil producer and consumer, crude oil inventories were reported to have risen last week, according to market sources citing American Petroleum Institute figures. While gasoline and distillate stocks fell, the overall increase in crude stocks adds to the supply-side pressure on prices. Official U.S. government inventory estimates, expected to be released soon, will provide further insights into domestic supply trends.

Market Reactions and Analyst Perspectives

Investors have shown early signs of attempting to buck the recent bearish trend, with slight recoveries in both Brent and WTI prices. However, market sentiment remains cautious, as analysts continue to point to decelerating demand growth and reduced geopolitical risks as key factors keeping prices in check. Francisco Blanch, a commodity strategist at Bank of America, highlighted that oil is "really trading on supply and demand fundamentals," with current market conditions suggesting an "air pocket" due to slowing Chinese demand.

Azeri Light Crude and Regional Oil Markets

In Azerbaijan, the price of Azeri Light crude saw a decrease of $3.10, or 3.76%, to $79.35 per barrel. This drop aligns with broader market trends, as regional oil prices react to the same global pressures influencing Brent and WTI. Azerbaijan's state budget for 2024 has set an average oil price of $75 per barrel, reflecting cautious expectations in a volatile market.

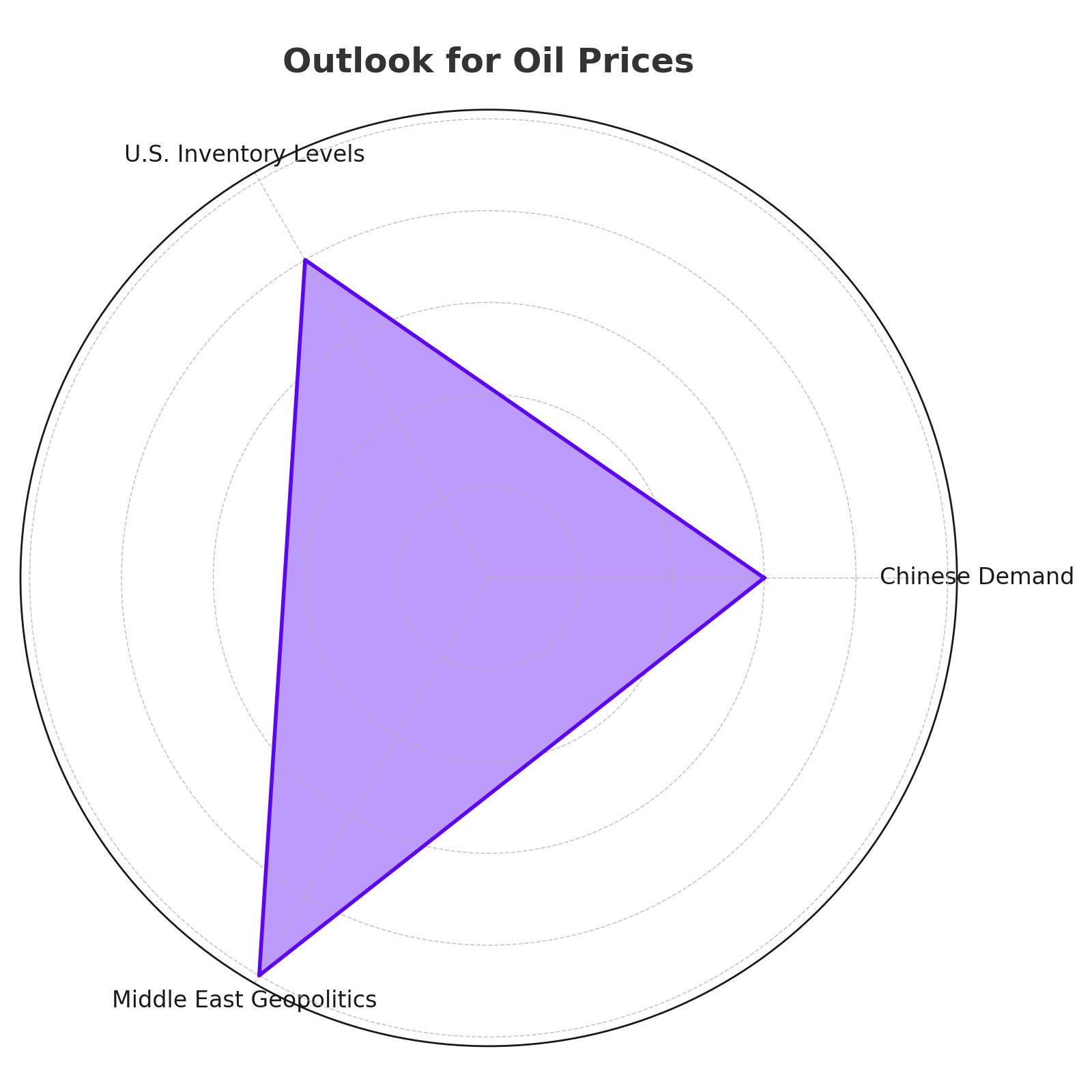

Outlook for Oil Prices

Looking ahead, oil prices are likely to remain volatile, with key factors such as Chinese demand, U.S. inventory levels, and Middle East geopolitics continuing to drive market movements. Analysts will be closely monitoring these developments, along with any shifts in global economic conditions, to gauge the future direction of oil prices.

The market's current state suggests that while there may be opportunities for short-term gains, the overall environment remains challenging, with significant risks on both the supply and demand sides. As always, investors are advised to stay informed and consider the broader macroeconomic and geopolitical landscape when making decisions related to oil and energy markets.

That's TradingNEWS

Read More

-

MercadoLibre (MELI) Stock Price at $2,005 With Street Target Near $2,800

27.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI $10.71 and XRPR $15.19 Ride $1.25B Inflows While XRP-USD Stalls Near $1.86

27.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Jumps Toward $4.29 as Colder Weather and Record LNG Demand Tighten NG=F

27.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Wall Street Stalls Near Records as Gold and Silver Go Vertical

27.12.2025 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Holds Near 156.5 as Intervention Watch, BoJ Shift and Fed Cuts Collide

27.12.2025 · TradingNEWS ArchiveForex