Oil Prices Swing as Trump Tariffs Ignite Global Market Turmoil – Will WTI and Brent Crude Break Support?

WTI and Brent Crude React to Trump’s Tariff Shock – What’s Next for Oil Prices?

Oil markets are reeling as U.S. President Donald Trump’s sweeping tariffs on Canada, Mexico, and China threaten to disrupt global trade and energy markets. WTI crude (CL=F) is trading around $72.47, while Brent (BZ=F) hovers at $75.47, down from earlier highs as traders scramble to assess the impact of these trade policies. The key question now is whether oil prices will continue their descent or rebound as OPEC+ holds firm on its supply strategy.

Trump’s Tariff Impact – Energy Markets Brace for Supply Chain Disruptions

The 25% tariff on imports from Canada and Mexico, coupled with a 10% levy on Chinese goods, has sent shockwaves through the oil market. Canada and Mexico account for nearly 25% of U.S. crude imports, meaning refiners in the Gulf Coast and Midwest will face higher costs. Meanwhile, Trump’s tariffs on Chinese imports add to inflationary pressures, potentially reducing demand.

Energy experts warn that U.S. refiners like HF Sinclair, Phillips 66, and Par Pacific, which rely heavily on Canadian crude, will be hit the hardest. The 10% tariff on Canadian energy imports increases costs for U.S. refiners, with analysts predicting gasoline prices could rise by 5-8% in the coming weeks.

Meanwhile, Mexico’s 25% tariff impact is even more severe. U.S. refiners rely on Mexican Maya crude, a heavy blend crucial for optimal fuel production. With 400,000 barrels per day (bpd) of Mexican crude and another 200,000 bpd of fuel oil at risk, refining margins will tighten, putting further pressure on WTI crude prices.

OPEC+ Holds the Line – Will Production Cuts Keep Oil Prices Afloat?

Despite the market turbulence, OPEC+ has refused to alter its current production policy. The cartel confirmed it would begin gradually unwinding its 2.2 million bpd production cuts in April, a move initially expected to stabilize supply. However, with Trump’s trade war escalating, there is growing speculation that Saudi Arabia and Russia could intervene sooner to prevent a deeper selloff in oil markets.

Russia’s Deputy Prime Minister Alexander Novak has warned that Ukraine’s drone strikes on Russian refineries are further tightening supply, adding another layer of complexity to OPEC+’s production outlook. Ukraine’s latest drone attack on Lukoil’s 300,000 bpd refinery in Volgograd and the Gazprom gas processing plant has reduced Russian crude processing rates, potentially offsetting some of the downward pressure on oil prices.

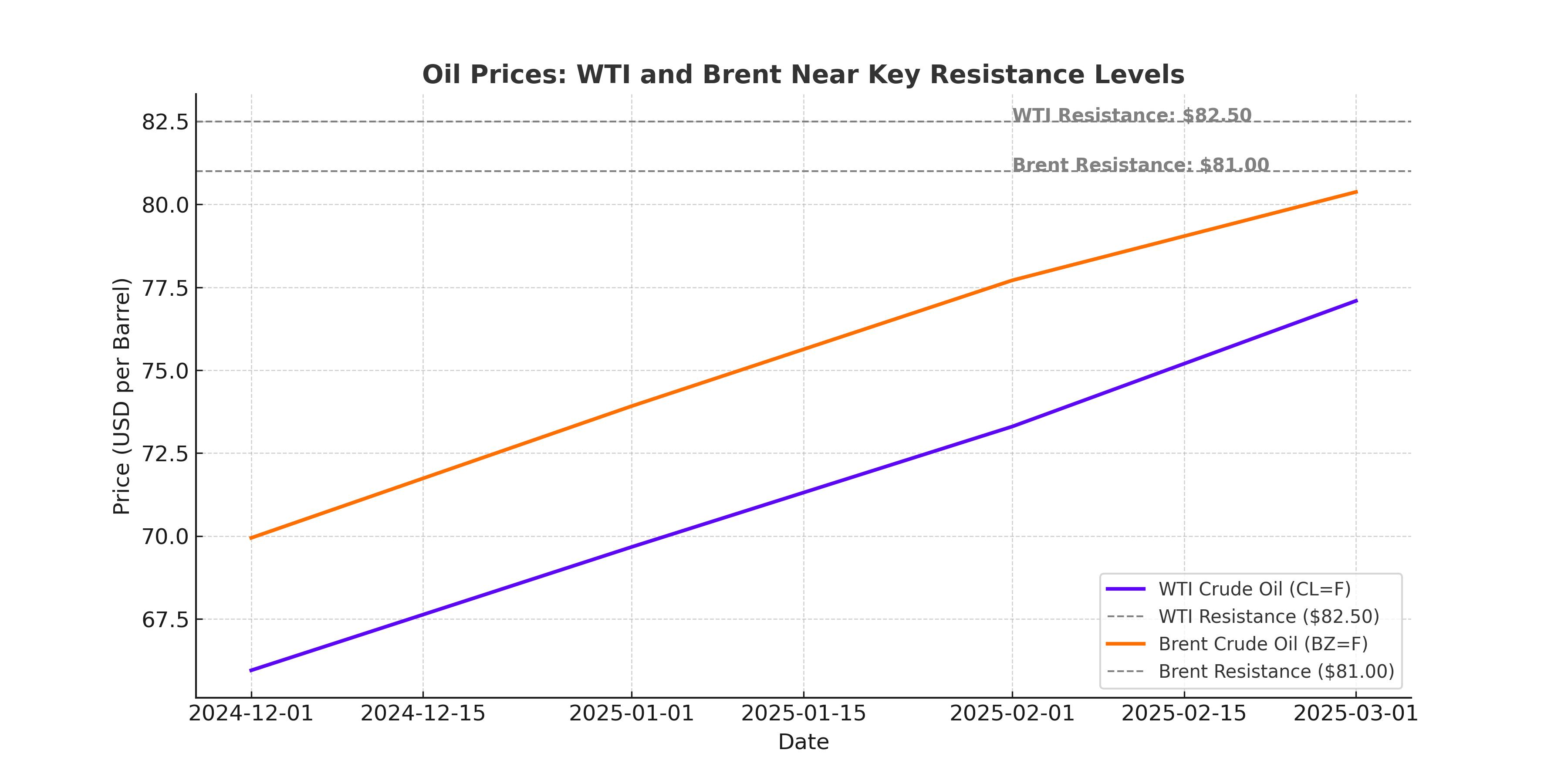

Key technical levels are now in focus for WTI and Brent:

- WTI crude (CL=F) faces major support at $72.50 – if broken, prices could slide toward $70 or even $68.50

- Brent (BZ=F) is testing the $75.50 level – failure to hold could see a move to $73.80

- The 200-day EMA for Brent at $76.20 and for WTI at $74.30 remain key resistance points

Geopolitical Risks and the U.S. Dollar – Can Oil Prices Stabilize?

While Trump’s tariffs dominate headlines, broader geopolitical tensions are also in play. China has hinted at retaliation, which could impact global demand for crude oil. Meanwhile, South Africa is doubling down on coal production, which may alter global energy market dynamics.

Adding to the pressure, the U.S. dollar is surging, with the Dollar Index (DXY) near 109.90. A stronger dollar makes oil more expensive for international buyers, adding a bearish undertone to the market. However, should the Federal Reserve hint at rate cuts, the dollar may weaken, offering potential relief for oil prices.

Market Outlook – Will Oil Prices Recover or Slide Below Key Support?

With WTI and Brent crude hovering at critical price levels, traders are closely watching OPEC+ for any unexpected production adjustments. If Saudi Arabia or Russia signal deeper supply cuts, oil prices could stage a strong rebound. However, if Trump escalates tariffs against the European Union, further economic uncertainty could drive crude prices below key technical levels.

At this stage, WTI and Brent remain under bearish pressure, with the risk of further declines if demand concerns escalate. However, any surprise OPEC+ intervention or weaker U.S. inflation data could trigger a sharp rally. Traders should watch for a potential retest of $70 for WTI and $73 for Brent in the coming days as market sentiment remains fragile.