Oracle’s AI and Cloud Revolution: Is NASDAQ:ORCL a Buy at $176.55?

How Oracle’s AI Investments and Cloud Strategy Propel Growth | That's TradingNEWS

Is NASDAQ:ORCL Still a Buy After a 50% Rally?

Cloud Revenue Drives Oracle’s Growth to New Heights

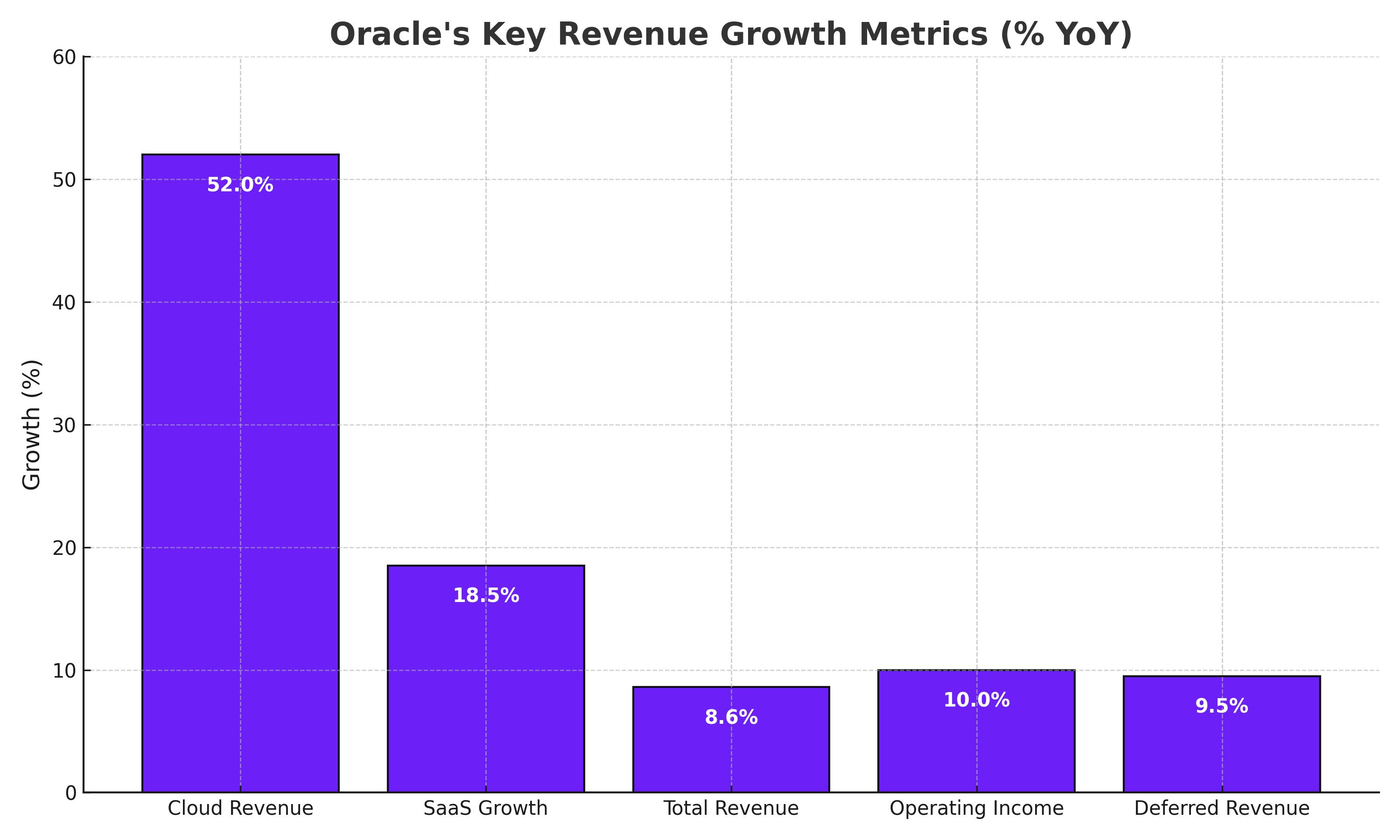

Oracle Corporation (NASDAQ:ORCL) has transformed itself from a legacy database company into a frontrunner in cloud computing and artificial intelligence. Over the past year, Oracle’s stock surged by approximately 50%, trading near $176.55, as of the latest close. This remarkable rally is fueled by a consistent rise in cloud infrastructure revenue, which grew by an impressive 52% year-over-year (YoY) in Q2 FY2024. Cloud services accounted for 42% of the company’s $14.06 billion total revenue during the quarter, reflecting a strategic pivot that has resonated with investors and enterprises alike.

Undervalued Compared to Peers

Despite its recent rally, Oracle trades at an attractive forward price-to-earnings (P/E) ratio of 25.7x—significantly lower than peers such as Salesforce (CRM) and Workday (WDAY). This valuation gap, combined with Oracle’s accelerating revenue growth, positions the company for further upside. While its stock is 15% below its December 2024 high of $190, Oracle’s improving fundamentals suggest it has room to reclaim and surpass those levels by 2025.

AI Infrastructure: A Key Growth Engine

Oracle’s AI-driven investments have become a critical growth catalyst, helping it secure major partnerships and enhance its cloud portfolio. The Oracle Cloud Infrastructure (OCI) is tailored to support high-demand AI workloads, featuring advanced GPUs and high-speed networking that optimize performance and cost-efficiency. The company recently unveiled the world’s largest AI supercomputer, equipped with 65,000 Nvidia GPUs. This infrastructure has already attracted major clients, including Meta Platforms (META), which signed a significant deal with Oracle in Q3 FY2024.

The Multi-Cloud Advantage

Oracle’s multi-cloud strategy is a major differentiator. By enabling Oracle databases to run on competitors' platforms, including Microsoft Azure, Amazon AWS, and Google Cloud, Oracle ensures flexibility for its customers. This approach not only broadens Oracle’s market reach but also secures its relevance in an increasingly competitive cloud landscape. With 17 new multi-cloud regions launched in FY2024 and 35 more in the pipeline, Oracle’s infrastructure capabilities are scaling rapidly to meet global demand.

SaaS Solutions Show Resilient Growth

Oracle’s software-as-a-service (SaaS) business continues to deliver robust performance. Key products like Fusion Cloud ERP and NetSuite Cloud ERP grew by 18% and 19% YoY, respectively. These tools cater to industries ranging from healthcare to retail and integrate advanced AI capabilities to drive efficiency and automation. The SaaS segment is supported by a growing backlog, indicating sustained customer demand and robust future revenue streams.

A Strong Financial Foundation

Oracle reported an 8.6% YoY increase in revenue for Q2 FY2024, reaching $14.06 billion, slightly missing Wall Street’s estimate of $14.12 billion. However, the company’s operating income rose by 10% to $6.10 billion, with operating margins improving to 43.4%. Deferred revenues of $9.5 billion highlight strong customer retention, while the company’s $20 billion in trailing twelve-month cash flow underscores its ability to fund growth initiatives and shareholder returns.

Cloud Infrastructure Leadership: Oracle’s Strategic Edge in AI and Global Expansion

Oracle Corporation’s (NASDAQ:ORCL) dominance in cloud infrastructure transcends traditional scalability, positioning the company as a leader in advanced technological deployment. Oracle’s Oracle Cloud Infrastructure (OCI) has not only redefined cloud efficiency but has also revolutionized how industries like banking, telecommunications, and healthcare approach data management. By leveraging modular data center designs and automated deployment strategies, Oracle achieves rapid, cost-effective expansion while maintaining robust operational capabilities. As of its latest quarter, Oracle's infrastructure revenue surged 52% year-over-year to $2.4 billion, making up nearly 40% of its cloud revenue.

The recent multi-billion-dollar agreement with Meta Platforms (META) underscores Oracle's commitment to AI-driven cloud services. This deal is a testament to OCI’s cutting-edge capabilities, particularly its integration of high-speed networking and powerful GPUs optimized for intensive AI workloads. Oracle’s AI supercomputer—powered by 65,000 Nvidia GPUs—has solidified its status as a preferred partner for enterprises demanding unparalleled performance. With the AI infrastructure market expected to grow at a compound annual growth rate of over 20% through 2030, Oracle’s strategic investments align perfectly with emerging trends. The company’s ability to offer an integrated stack of AI tools, from infrastructure to applications, makes it a compelling choice for enterprises navigating the complexities of digital transformation.

Competitive Risks and Oracle’s Market Resilience

Despite its impressive growth trajectory, Oracle faces intense competition from hyperscale cloud giants such as Amazon (AMZN) Web Services, Microsoft (MSFT) Azure, and Google Cloud (GOOG). These players are aggressively expanding their AI and multi-cloud portfolios, posing a significant challenge to Oracle's market share. For example, AWS’s recent AI initiatives and Azure’s focus on enterprise-grade hybrid solutions continue to attract enterprise customers seeking comprehensive cloud strategies. This competitive landscape could compel Oracle to either lower pricing or increase spending on capital-intensive projects, potentially impacting its margins.

Another potential headwind for Oracle is the evolving pace of AI adoption. While demand for large-scale AI models is surging now, any stagnation or slower-than-expected growth in this sector could dampen Oracle's momentum. However, Oracle’s diversified portfolio, which includes its industry-leading database solutions and robust SaaS applications, provides a buffer against cyclical slowdowns in any single segment.

The company’s multi-cloud approach further mitigates risk by enabling customers to integrate Oracle products with other cloud platforms. This flexibility not only broadens Oracle’s appeal but also ensures its relevance in competitive bidding for major contracts. With 17 multi-cloud regions already operational and plans to launch 35 more, Oracle is effectively countering competitive pressures by expanding its footprint in underserved markets.

Real-Time Market Insights: Tracking NASDAQ:ORCL Performance

Oracle’s stock (NASDAQ:ORCL) has shown remarkable resilience and growth, trading near $176.55 as of the latest market session. Investors can access Oracle’s real-time stock performance and chart to stay informed about intraday price movements and broader market trends.

With its strategic pivot toward AI, a strong financial pipeline, and ongoing global expansion, Oracle remains well-positioned to capitalize on the future of cloud computing and enterprise solutions. The company’s ability to adapt to market challenges while driving innovation underscores its potential to deliver sustained growth and value for shareholders in the years ahead.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex