Oracle Corporation NASDAQ:ORCL Innovation and Investment Caution

A comprehensive analysis of Oracle's market strategy, financial resilience, and emerging challenges in cloud computing and cybersecurity, offering investors a balanced perspective on its future trajectory and investment viability | That's TradingNEWS

Oracle Corporation (ORCL): A Balanced Insight into Future Prospects and Risks

Introduction to Oracle's Position in the Tech Ecosystem

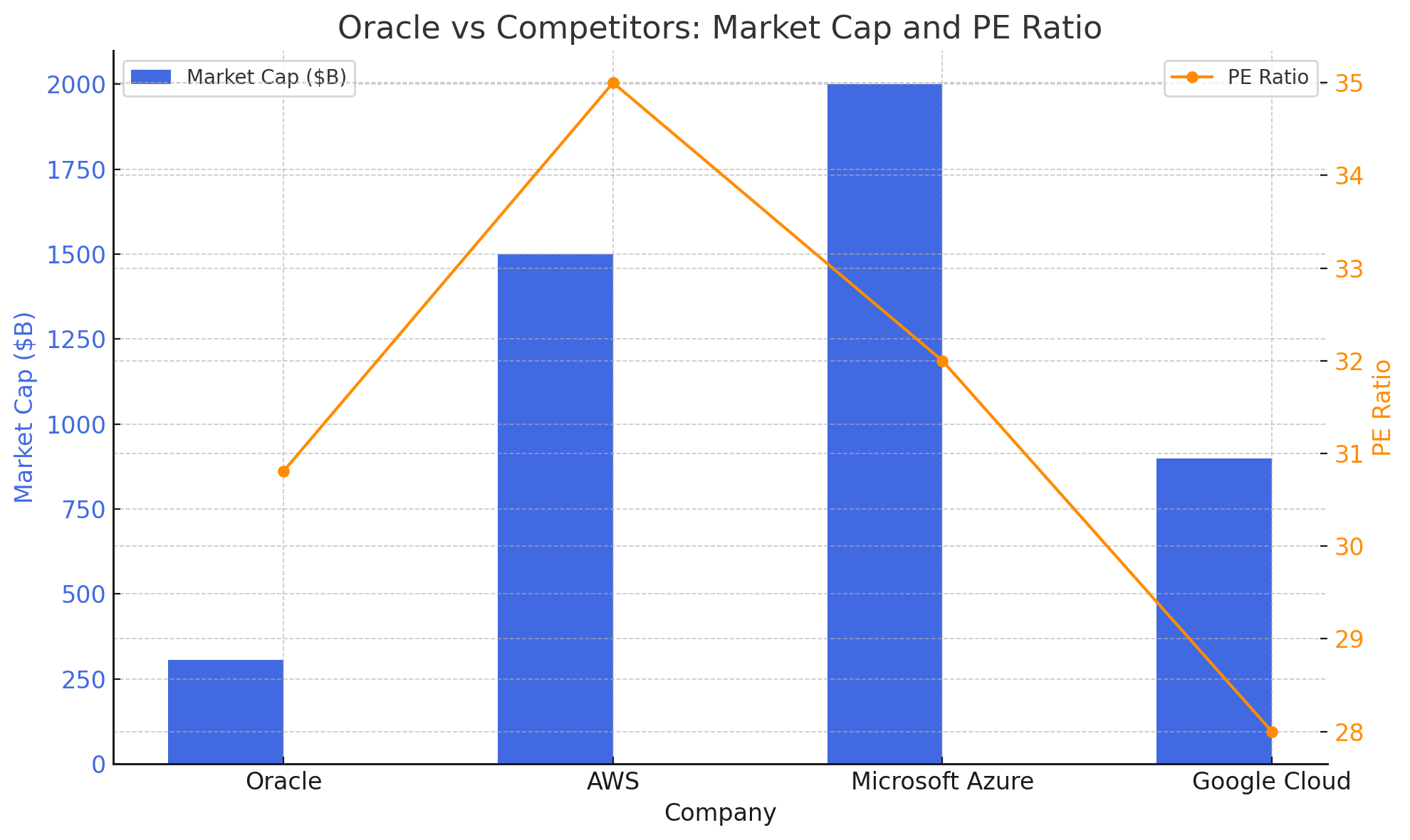

Oracle Corporation (NASDAQ:ORCL), a titan in the technology sector, has marked its presence with a formidable blend of enterprise software products and cloud services. As it stands, Oracle's financial metrics and strategic positioning paint a vivid picture of a company at the intersection of innovation and robust growth. With a market capitalization of $306.587 billion and a PE ratio (TTM) of 30.81, Oracle epitomizes a blend of stability and forward-looking growth in the rapidly evolving tech landscape.

Oracle's Strategic Market Expansion

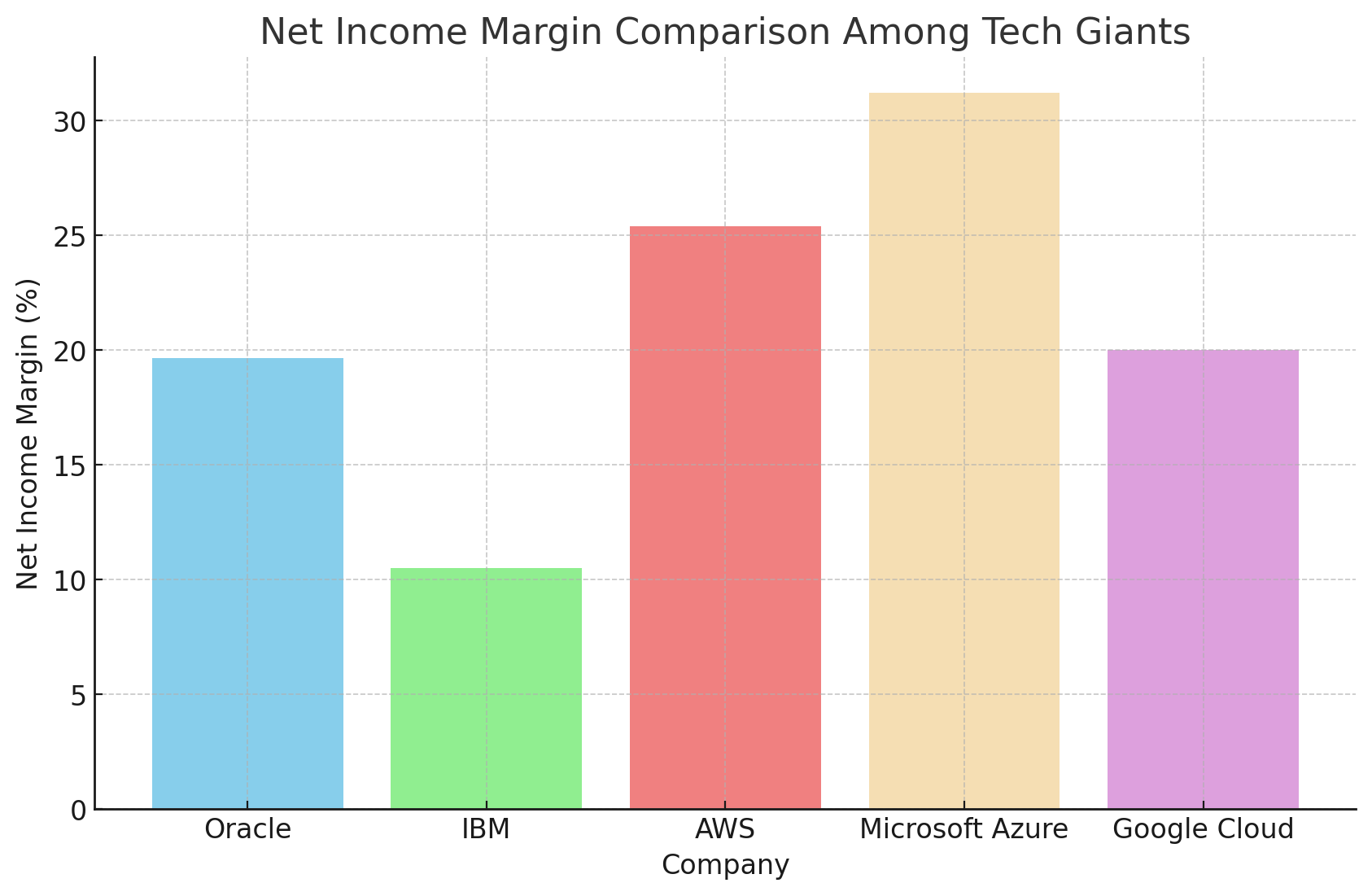

The essence of Oracle's growth strategy is deeply rooted in its cloud computing platform, Oracle Cloud Infrastructure (OCI). With the cloud computing market projected to soar from $569.31 billion in 2022 to $2,432.87 billion by 2030, Oracle is strategically positioned to harness this exponential growth. Despite fierce competition from giants like Amazon Web Services and Microsoft Azure, Oracle's unique offerings in cloud infrastructure and enterprise resource planning (ERP) stand as its competitive edge.

That's TradingNEWS

Read More

-

CGDV ETF at $44.17 Targets $52 as Dividend Value and AI Leaders Drive 2026 Upside

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: $2.20 XRP and $1.6B Inflows Drive 2026’s Hottest Crypto Trade

07.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Rebounds to $3.48 as Market Eyes EIA Storage Shock

07.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.6 as BoJ Hawkish Shift Collides With Fed Cut Expectations

07.01.2026 · TradingNEWS ArchiveForex