Palo Alto Networks Stock Soars After Beating Q4 Expectations

Cybersecurity Leader Raises Full-Year Guidance, Fuels Investor Confidence with Strong Growth and Strategic Execution | That's TradingNEWS

Palo Alto Networks (NASDAQ:PANW) Shines with Robust Q4 Earnings and Strong Guidance

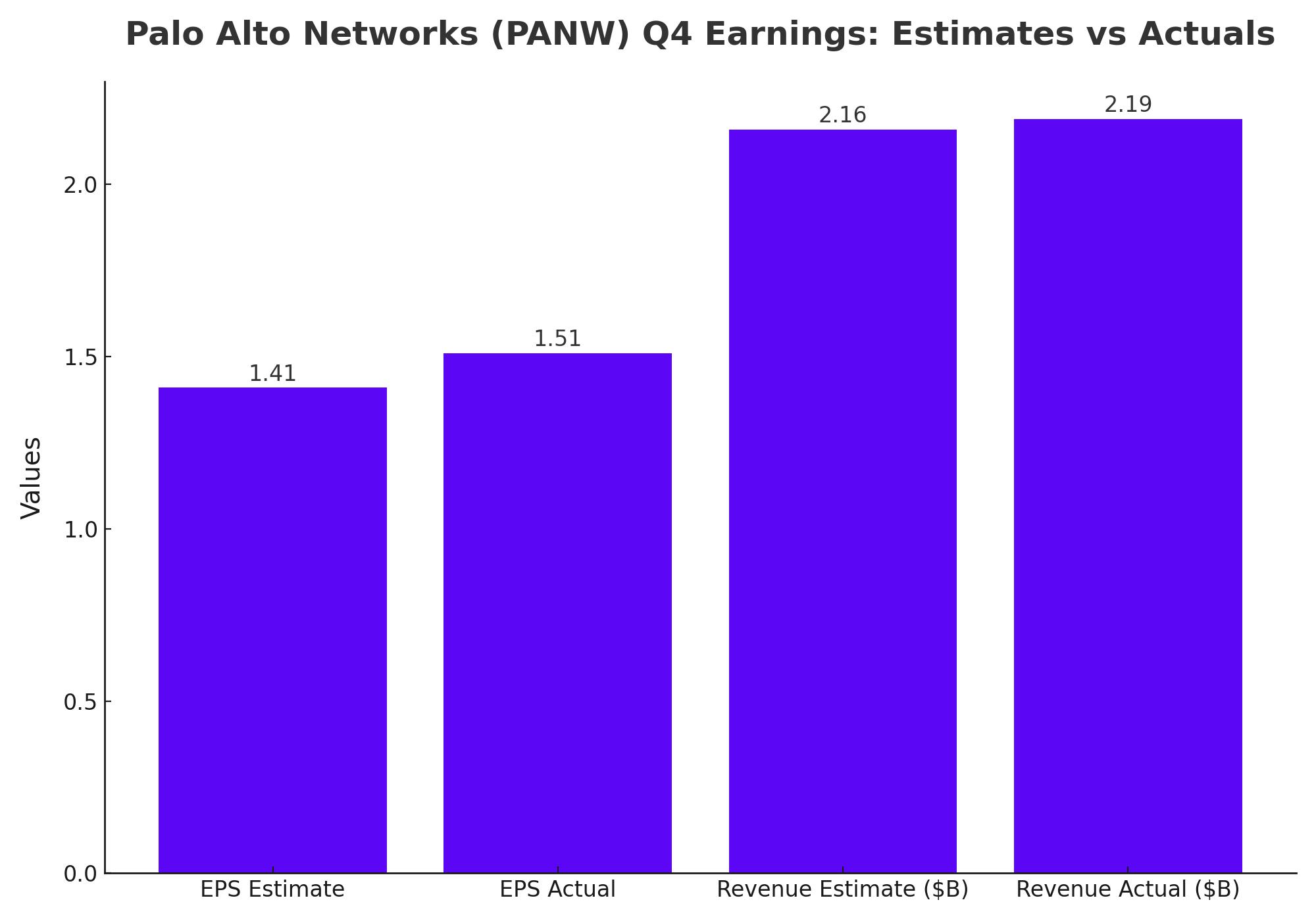

Impressive Q4 Earnings Exceed Expectations

Palo Alto Networks (NASDAQ:PANW) reported an exceptional Q4, showcasing strong financial performance that exceeded Wall Street's expectations. The company posted earnings per share (EPS) of $1.51, beating the consensus estimate of $1.41, and generated $2.19 billion in revenue, surpassing the expected $2.16 billion. This represents a 12% year-over-year increase, highlighting the company's resilience and growth in the competitive cybersecurity market.

Guidance Points to Continued Growth

Looking ahead, Palo Alto Networks raised its full-year guidance, projecting EPS in the range of $6.18 to $6.31, compared to the estimated $6.22. Revenue is expected to land between $9.1 billion and $9.15 billion, slightly above the previous consensus of $9.1 billion. This optimistic outlook has reassured investors, suggesting that the company’s growth momentum will continue into the next fiscal year.

Strategic Focus on Platformization Pays Off

CEO Nikesh Arora emphasized the success of the company's platformization strategy, which has been a point of concern for some investors. The strategy, aimed at encouraging customers to adopt multiple products within Palo Alto's portfolio, has shown positive results. Over 90 customers transitioned from using a single product to multiple products within the platform in Q4, up from 65 in the previous quarter. This shift towards a higher-growth, recurring revenue model is crucial for long-term stability and growth.

Recurring Revenue and Customer Growth

Palo Alto Networks reported that subscription-based recurring revenues accounted for 53% of total fiscal 2024 revenue, with plans to increase this to 64% in fiscal 2025. This move towards a more predictable revenue stream has been well-received by the market. The company’s next-generation annual recurring revenue (ARR) from cloud computing products surged 43% to $4.22 billion, reflecting strong demand and customer trust in Palo Alto's comprehensive security solutions.

Insider Transactions Signal Confidence

A review of insider transactions on Palo Alto Networks' stock profile indicates significant insider confidence. Notably, the company announced a new $500 million stock buyback program, raising its total authorization to $1 billion. This move underscores management’s belief in the company's continued growth and stability.

Market Reaction and Analyst Outlook

Following the earnings release, shares of Palo Alto Networks (NASDAQ:PANW) surged 6.6%, closing at $365.98, marking their highest level since February 2024. The stock, which has gained 24% year-to-date, was the top performer in the S&P 500 on Tuesday, even as the broader index declined.

Analysts remain bullish on PANW’s future, with Wedbush raising its price target to $400 from $375, maintaining an Outperform rating. The strong quarter and forward guidance have solidified the view that Palo Alto’s platform approach in cybersecurity is the right long-term strategy.

Challenges and Market Dynamics

Despite the strong performance, there are challenges ahead. The market for firewall network appliances, a key segment for Palo Alto, has shown signs of slowing. However, the company's shift towards a broader cloud-based security platform is mitigating these risks. The cybersecurity landscape remains highly competitive, with rival firms like CrowdStrike facing their own challenges, such as the recent IT outage that could potentially benefit Palo Alto Networks.

RPO as a New Key Metric

Palo Alto Networks has de-emphasized traditional billings guidance in favor of focusing on Remaining Performance Obligations (RPO), a metric that represents the total value of contracted revenue yet to be recognized. In Q4, RPO grew 20% to $12.7 billion, just shy of expectations. Management believes RPO is a better indicator of future performance, guiding for 19% to 20% RPO growth in fiscal 2025.

Conclusion

Palo Alto Networks (NASDAQ:PANW) continues to demonstrate strong operational execution and strategic foresight, positioning itself well for sustained growth. With robust financial results, a promising outlook, and strategic initiatives like platformization gaining traction, the company is poised to maintain its leadership in the cybersecurity market. While challenges remain, particularly in the competitive landscape, Palo Alto's proactive strategies and strong financial position make it a compelling investment opportunity.

For real-time updates and more detailed stock information, visit the Palo Alto Networks real-time chart and stock profile.

That's TradingNEWS

Read More

-

AMLP ETF (NYSEARCA:AMLP): 8.29% Yield From America’s Midstream Toll Roads

06.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Lift XRPI to $13.12 and XRPR to $18.57 as XRP-USD Price Targets $2.40+

06.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Breaks Down as Henry Hub Spot Hits $2.86 and NG=F Slips Toward $3.00

06.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 While Markets Weigh Softer NFP Risk Against a Hawkish BoJ

06.01.2026 · TradingNEWS ArchiveForex