PepsiCo's Strategic Mastery: A Comprehensive Stock Analysis

Dive into PepsiCo's latest financial achievements and strategic initiatives that set the stage for its sustained market dominance and investment allure | That's TradingNEWS

A Strategic Deep Dive into PepsiCo's Financial Fortitude and Market Position

Introduction to PepsiCo's Current Market Standing

In an era where financial stability and growth potential are paramount for investors, PepsiCo, Inc. (NASDAQ:PEP) emerges as a beacon of resilience and strategic foresight. The company's stock, currently navigating the ebbs and flows of the NasdaqGS, presents a compelling case for both seasoned and prospective investors. With a nuanced understanding of its financial health, strategic positioning, and future outlook, we delve into the intricacies that define PepsiCo's journey in the competitive beverage and snack industry.

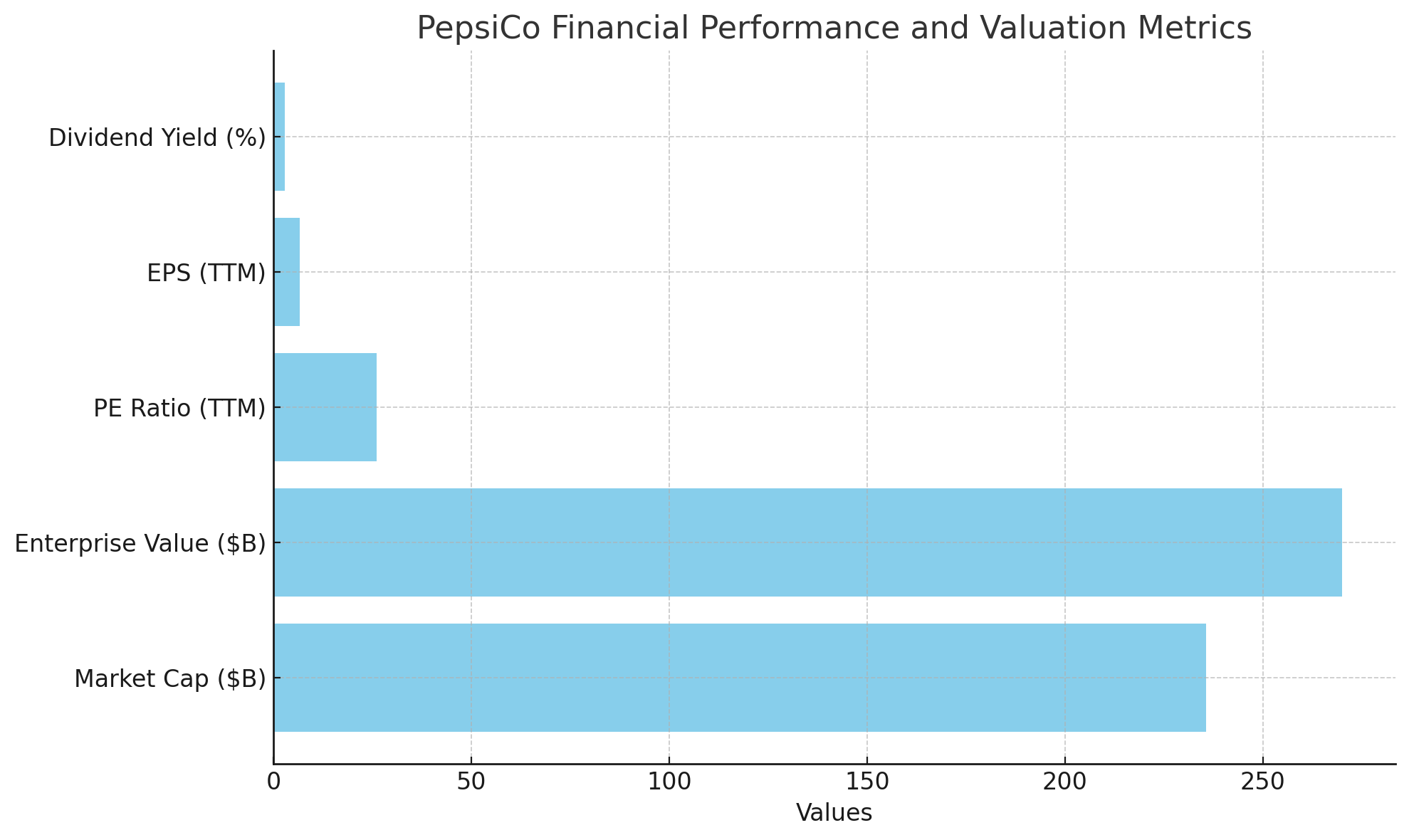

Financial Performance and Valuation Metrics

PepsiCo's stock, as of the latest trading session, reflects a subtle yet positive movement, marking a price increase to $171.45. This adjustment underscores a broader narrative of stability and incremental growth within the company's financial framework. The stock's resilience is further highlighted through its 52-week fluctuation, showcasing a range between $155.83 and $196.88, which not only illustrates market confidence but also indicates a robust foundation capable of weathering market volatilities.

Diving deeper into valuation measures, PepsiCo's market capitalization stands at a formidable $235.632 billion, complemented by an Enterprise Value of $270.03 billion. These figures, in conjunction with a PE Ratio (TTM) of 26.13 and an EPS (TTM) of 6.56, paint a picture of a company that is not just surviving but thriving amidst a challenging economic landscape. The forward dividend yield of 2.95% further accentuates PepsiCo's appeal as a worthwhile investment for those seeking steady returns.

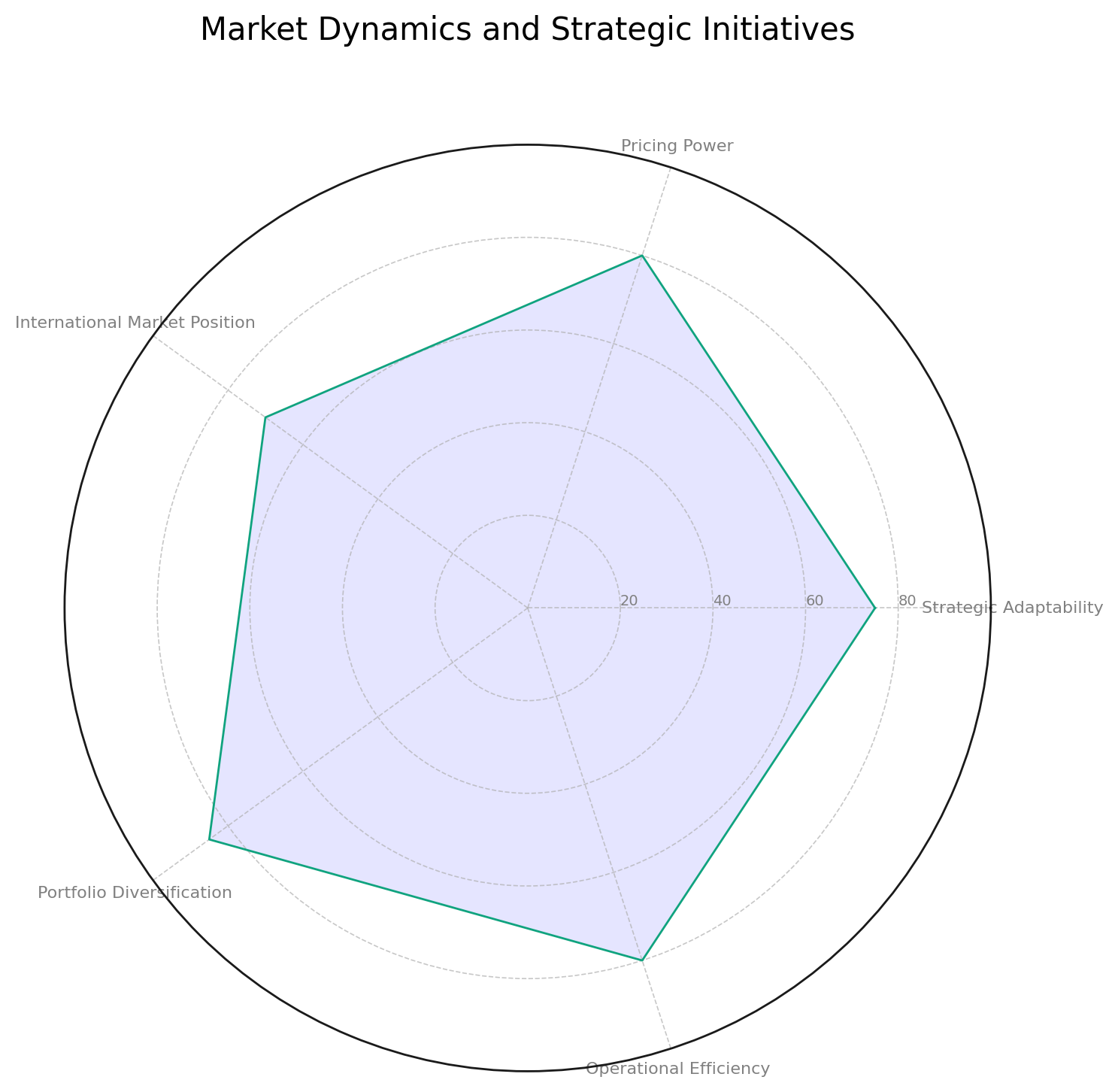

Market Dynamics and Strategic Initiatives

A critical component of PepsiCo's success lies in its strategic adaptability and proactive market positioning. Recent analysis has illuminated a shift in PepsiCo's pricing power, transitioning from a potential vulnerability to a strategic advantage. This evolution is particularly noteworthy in the snacks and beverages segments, where the company has successfully leveraged its diversified portfolio to gain a competitive edge.

Moreover, the international market has emerged as a pivotal growth avenue for PepsiCo, with signs of positive inflection points that have yet to be fully appreciated by the market. This underpricing presents a unique opportunity for investors to capitalize on PepsiCo's expanding global footprint, particularly as the company navigates the complexities of international expansion with strategic acumen and operational efficiency.

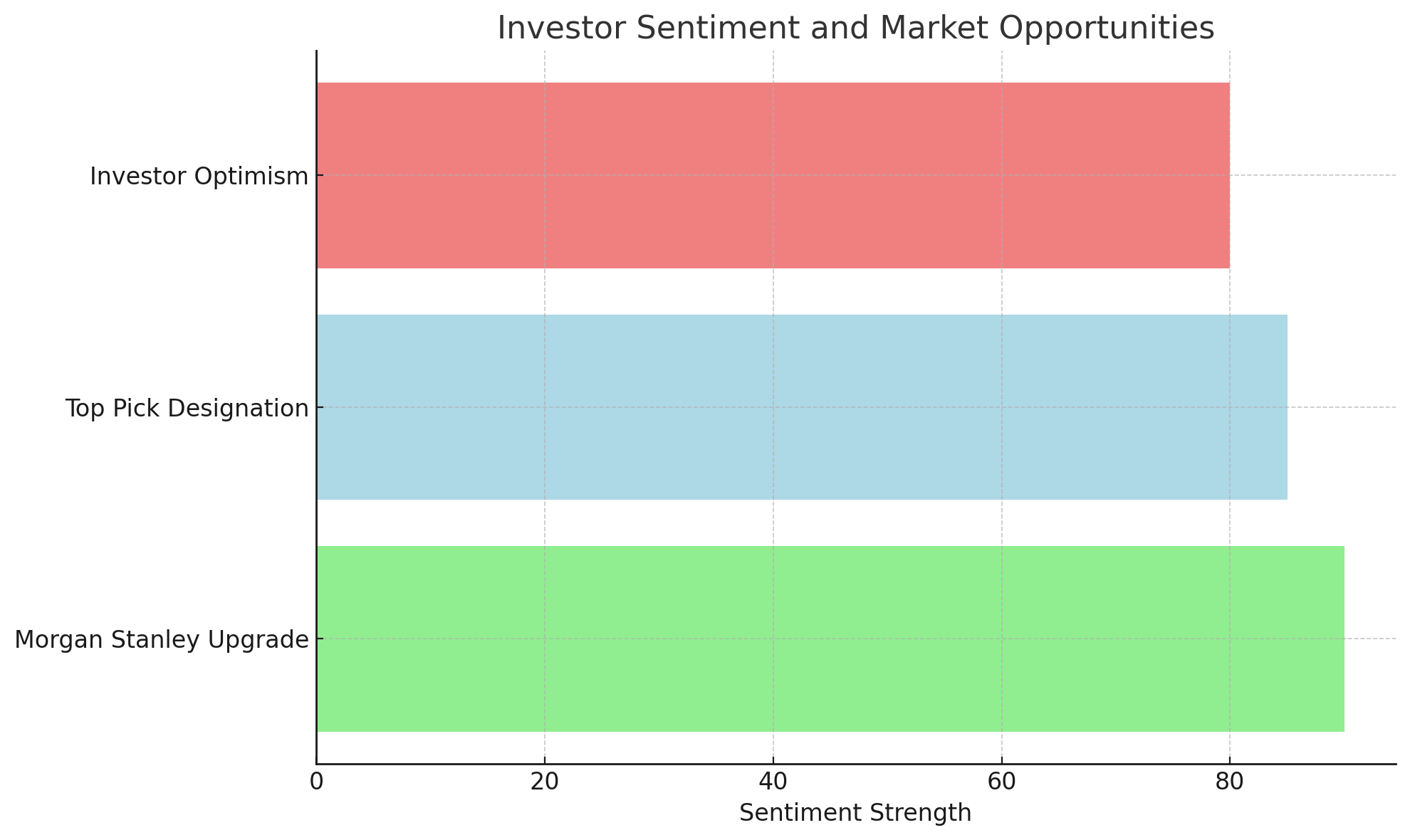

Investor Sentiment and Market Opportunities

The sentiment surrounding PepsiCo's stock is increasingly optimistic, buoyed by Morgan Stanley's recent upgrade to an Overweight rating and the designation of PepsiCo as a top pick within the industry. This endorsement is rooted in a belief in the company's undervalued status, considering its solid business model and anticipated positive trajectory post-Q1 results. Such insights provide a compelling argument for investors to reevaluate PepsiCo's position within their portfolios, especially given its potential for sustained growth and profitability.

Insider Transactions and Institutional Holdings

A closer examination of insider transactions and institutional holdings offers additional layers of insight into PepsiCo's market dynamics. With a modest yet significant insider holding of 0.16% and a substantial institutional ownership standing at 76.95%, the company demonstrates a healthy balance of internal confidence and external investment interest. These metrics, when considered alongside the relatively low short interest, suggest a market consensus that leans towards bullish sentiment and long-term investment potential in PepsiCo.

Conclusion: PepsiCo's Strategic Outlook

PepsiCo stands at a pivotal juncture, with its financial stability, strategic market positioning, and growth potential collectively signaling a promising horizon. For investors, the key lies in recognizing the confluence of factors that make PepsiCo not just a participant but a leader in the global beverages and snacks industry. As the company continues to navigate market challenges with agility and strategic foresight, its stock presents a compelling narrative of resilience, growth, and undeniable investment appeal.

In a landscape marked by uncertainty and fluctuation, PepsiCo's steady march towards innovation, international expansion, and market leadership underscores its potential as a cornerstone investment. As we look towards the future, the strategic initiatives and financial health of PepsiCo affirm its position as a dynamic player poised for continued success and profitability.

For those seeking to delve deeper into PepsiCo's financial nuances and market strategies, further exploration can be facilitated through real-time stock analysis and insider transaction insights available on Trading News and PepsiCo's Stock Profile.

In the evolving narrative of global commerce and investment, PepsiCo's journey is a testament to the power of strategic resilience and market foresight—a narrative that not only captivates but also offers valuable lessons for those looking to navigate the complexities of the modern financial landscape.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex