Qualcomm (NASDAQ:QCOM): Balancing Growth Opportunities and Risks in a Dynamic Market

Investment Landscape of Qualcomm: Navigating Growth and Headwinds

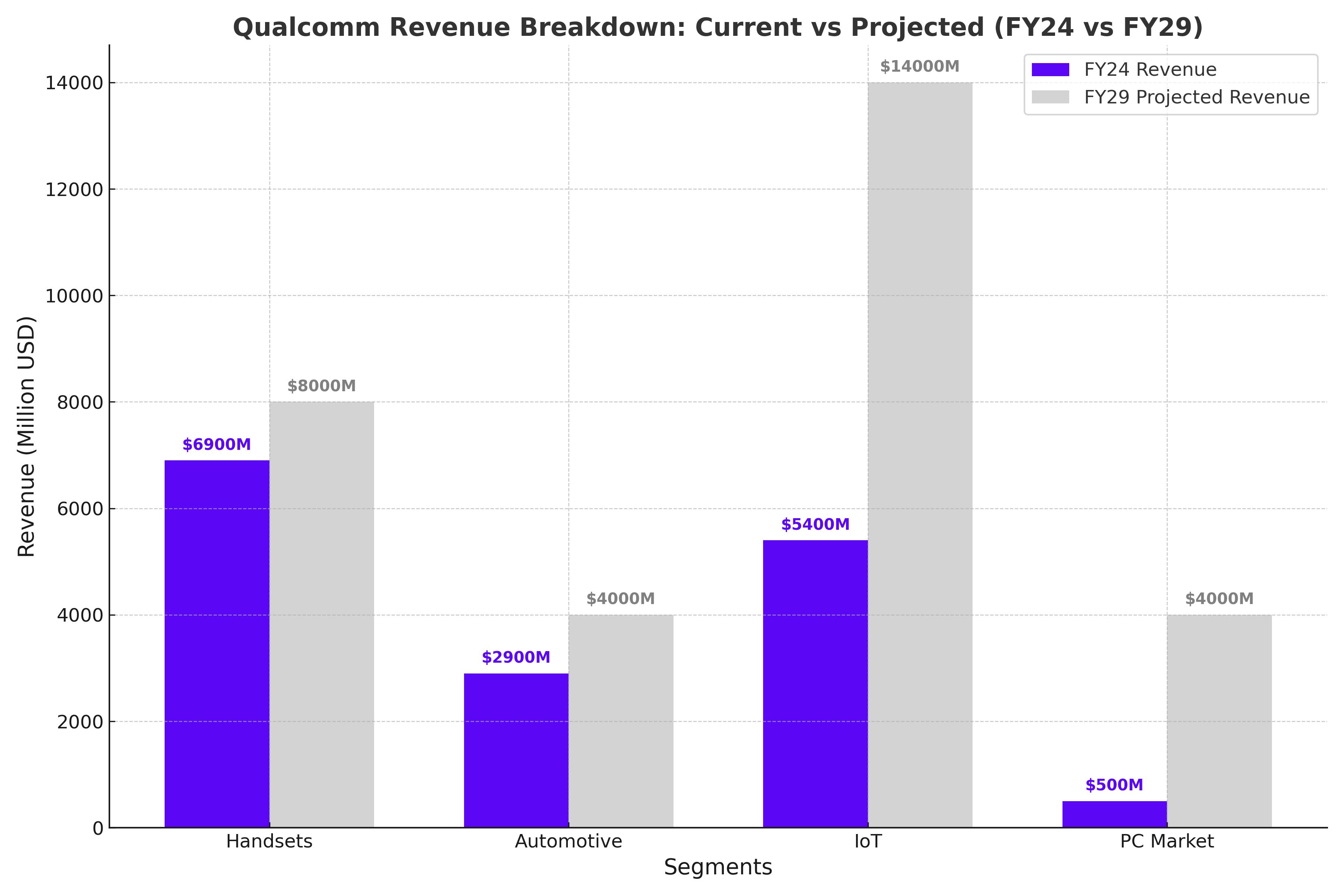

Qualcomm (NASDAQ:QCOM) is strategically positioned in an era of unprecedented demand for connectivity and on-device AI applications. While its traditional mobile handset market continues to contribute significantly to its revenue, Qualcomm is steering toward diversification with robust investments in automotive, IoT, and PC markets. This diversification strategy, if successful, could redefine its revenue mix, which currently leans heavily on handsets. However, this transition is not without risks, particularly given the company’s substantial reliance on the Chinese market and ongoing geopolitical tensions.

Mobile Segment: Resilience Amid Headwinds

Qualcomm's mobile handset segment, which generated $6.9 billion in revenue in Q4 FY24, remains a cornerstone of its business. The normalization of channel inventories has contributed to a resurgence in this market, with premium device demand driving up average selling prices (ASPs). Qualcomm dominates the Android premium-tier market, with revenues exceeding its closest competitor by over 5x. Its newly launched Snapdragon 8 Elite platform has seen rapid adoption among global brands like Xiaomi, OPPO, and Vivo, reinforcing its leadership in high-performance mobile processors.

However, risks linger. The company’s significant exposure to Chinese OEMs, which accounted for over 40% of its handset revenue growth quarter-over-quarter, makes it vulnerable to trade tensions and domestic competition. Huawei's development of its own chipsets adds another layer of complexity to Qualcomm's market dynamics.

Automotive Sector: A Promising Growth Catalyst

Qualcomm's automotive segment continues to be a standout performer, achieving a remarkable 55% year-over-year growth in FY24, with revenues reaching $2.9 billion. The Snapdragon Digital Chassis platform has gained traction among global automakers, offering solutions for connectivity, cockpit systems, and ADAS/AD. Qualcomm’s cumulative automotive design win pipeline has grown to $45 billion, covering 80% of its projected revenue over the next five years. By FY26, the company targets $4 billion in automotive revenue, increasing to $9 billion by FY31.

The ADAS market, a critical area of focus, is expected to experience robust growth in the coming years. Qualcomm's platforms, co-developed with BMW, promise enhanced AI capabilities, positioning the company to capitalize on the transition to software-defined vehicles. Despite these opportunities, the automotive segment faces intense competition and execution challenges that could impact margins and revenue realization timelines.

IoT Expansion: Leveraging AI for Growth

In FY24, Qualcomm’s IoT segment generated $5.4 billion in revenue, with projections to grow to $14 billion by FY29. This expansion is driven by the increasing adoption of connected devices requiring advanced AI and processing capabilities. The newly introduced Qualcomm IQ Series targets diverse applications, including robotics, drones, and industrial automation, underscoring its potential in the highly fragmented IoT market.

The company's success in IoT depends on its ability to scale operations while navigating competitive pressures. Qualcomm’s strategic initiatives, such as the IoT Solutions Framework, aim to accelerate adoption by simplifying deployment for enterprises. However, the path to capturing a significant share of the IoT market remains fraught with challenges.

PC Market: Aiming for Leadership

Qualcomm’s push into the PC market is anchored by its Snapdragon X series processors, which deliver superior performance and battery efficiency. With a projected TAM of $35 billion, Qualcomm targets $4 billion in PC revenue by FY29. Its partnership with Microsoft to integrate Snapdragon processors into AI-enabled PCs positions it to capture a substantial share of this growing market.

However, initial adoption has been modest, with Snapdragon-powered laptops capturing only 0.8% of the AI PC market. Qualcomm must overcome legacy software compatibility issues and expand its ecosystem partnerships to accelerate growth in this segment.

Financial Strength and Valuation

Qualcomm’s financials underscore its resilience, with record free cash flow of $11.2 billion in FY24 and a strong balance sheet. The stock is attractively priced, trading at a forward P/E ratio of 13.6x for FY25, compared to the sector median. This valuation reflects the market’s cautious optimism about Qualcomm’s growth potential amid persistent risks.

Risks: China Dependency and Competitive Pressures

Qualcomm’s substantial reliance on the Chinese market, which generates nearly 50% of its revenue, poses a critical risk to its financial stability. Trade tensions between the U.S. and China could escalate, jeopardizing Qualcomm’s supply chain and potentially leading to revenue disruptions. Domestic competition in China is intensifying, with companies like Huawei aggressively developing in-house chipsets, including the Kirin 9000 series, to reduce dependency on foreign semiconductor providers. This shift threatens Qualcomm’s market share in one of its largest and most lucrative regions.

Adding to the complexity, Qualcomm’s business model depends heavily on licensing agreements with ARM, a relationship that has faced significant challenges. The recent resolution of a licensing dispute with ARM highlights the fragility of such agreements. Any future renegotiations or disputes could lead to higher costs or restricted access to essential technologies, impacting Qualcomm’s ability to innovate and maintain its competitive edge. This dual reliance on China and external licensors underscores the precarious balance the company must navigate to sustain growth.

Conclusion: Is Qualcomm a Buy?

Qualcomm’s diversification strategy positions it to benefit from secular growth trends in automotive, IoT, and PCs, reducing its reliance on the mature handset market. Its Snapdragon platforms are well-suited for the AI-driven future, offering compelling growth opportunities. However, the company’s significant exposure to China and the challenges of scaling new markets introduce uncertainty. At its current price of approximately $150 per share, Qualcomm offers an attractive entry point for long-term investors willing to navigate its risks.