Strategic Analysis of NASDAQ:QCOM: Qualcomm’s Growth Beyond Smartphones and AI Leadership

Qualcomm Inc. (NASDAQ:QCOM), currently trading at approximately $122 per share, stands as a critical player in the semiconductor and wireless technology industry. With a forward price-to-earnings ratio of 14x, the stock reflects deep undervaluation compared to its peers, particularly given its leading position in AI hardware, automotive innovation, and IoT applications. Qualcomm’s transformation from a smartphone-centric business to a diversified tech powerhouse is reshaping its growth trajectory, offering an attractive opportunity for long-term investors.

Qualcomm’s Financial Resilience and Market Positioning

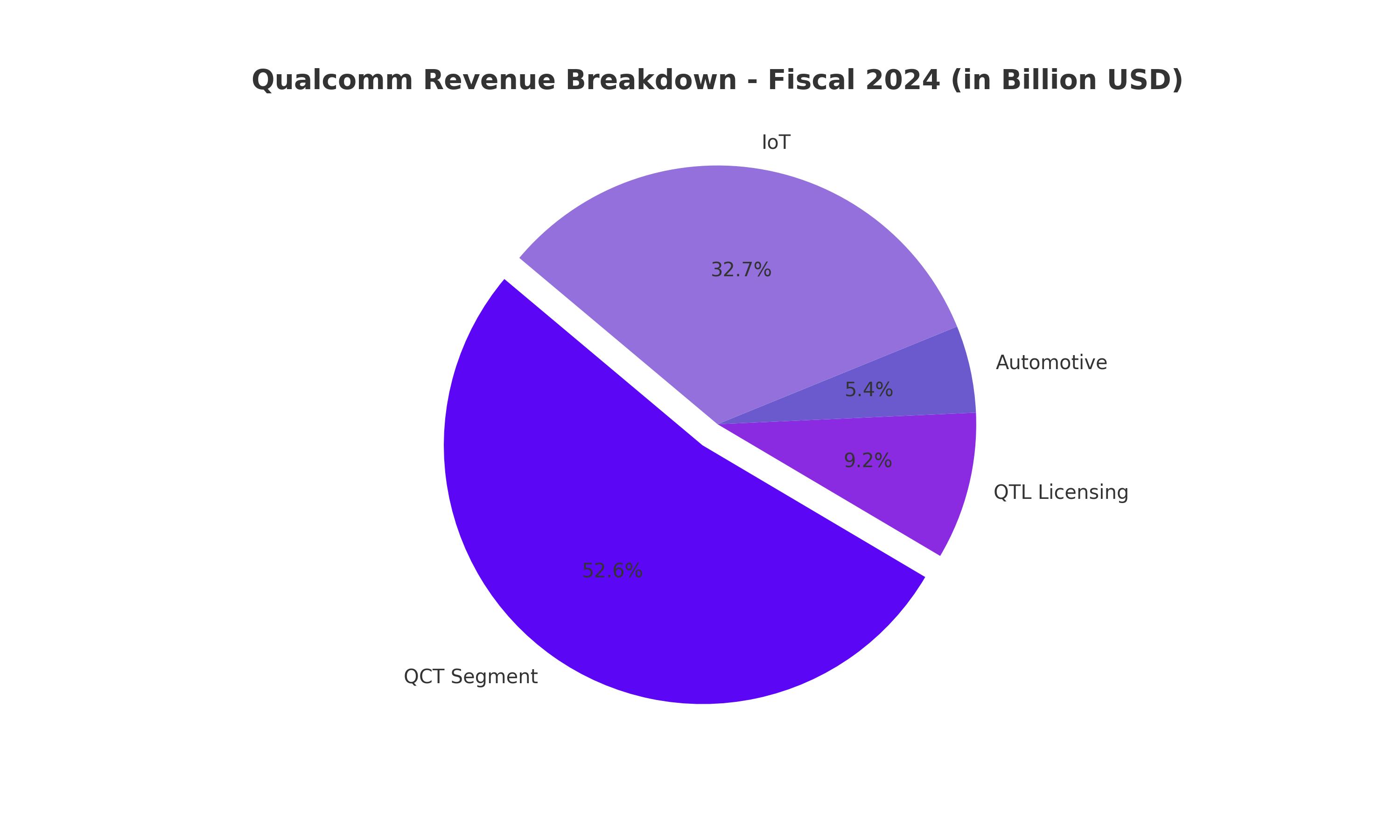

In fiscal 2024, Qualcomm reported $10.24 billion in quarterly revenue, reflecting a 19% year-over-year increase, driven by strong performance across its QCT and QTL segments. The QCT chip division generated $8.68 billion in revenue, up 18% YoY, while the QTL licensing segment contributed $1.52 billion, marking a 21% YoY rise. This robust growth was bolstered by the company’s focus on automotive and IoT markets, which now account for a growing share of revenues.

Adjusted EPS surged to $2.69 in Q4 2024, representing a 33% increase from the prior year and exceeding consensus estimates by over 4%. This performance highlights Qualcomm's operational efficiency and strategic execution in navigating challenging macroeconomic conditions. For the fiscal year, Qualcomm achieved record cash flows of $11.2 billion, demonstrating its strong financial health and capacity to sustain shareholder returns. The company returned $7.8 billion to shareholders in 2024, including $2.2 billion in Q4 alone, through dividends and buybacks, with a new $15 billion repurchase program approved for 2025.

AI Leadership and On-Device Processing

Qualcomm’s Snapdragon platform is at the forefront of AI innovation, offering specialized hardware like the Hexagon NPU and Oryon CPU cores, which enable efficient, on-device AI processing. The company’s Snapdragon 8 Elite platform for smartphones and the Snapdragon X series for laptops have delivered significant performance gains, improving efficiency by over 30% while reducing power consumption. Qualcomm’s focus on integrating AI capabilities into edge devices, such as Meta’s augmented reality devices and automotive systems, positions it as a leader in the real-world application of AI technologies.

In 2024, Qualcomm’s AI-related revenues surged 65% year-over-year to $3.8 billion, and the company projects further growth in this segment for 2025. Partnerships with major tech giants like Meta, Microsoft, and Amazon to deploy AI-powered solutions further solidify Qualcomm’s competitive edge in this rapidly expanding market.

Automotive and IoT: Expanding Horizons

Qualcomm’s automotive segment is a standout growth driver, generating $899 million in Q4 2024 revenue, up 68% year-over-year. The company’s Snapdragon Digital Chassis platform is gaining traction among automakers, enabling features such as advanced driver-assistance systems (ADAS) and connected vehicle technologies. Qualcomm's pipeline of automotive design wins now exceeds $30 billion, with annual automotive revenue projected to surpass $4 billion by 2026. Major partnerships with companies like Mercedes-Benz and Li Auto underscore Qualcomm’s growing influence in the automotive sector.

The IoT segment also rebounded in 2024, contributing nearly $5.4 billion in revenue. Qualcomm’s IQ series for industrial IoT and the Networking Pro A7 Elite platform are driving demand across consumer and industrial applications. The company aims to triple its IoT revenue to $14 billion by 2029, capitalizing on the increasing connectivity of devices across industries.

Risks and Geopolitical Challenges

Despite its diversified portfolio, Qualcomm faces notable risks, including its heavy dependence on the Chinese market, which accounts for nearly half of its revenue. Geopolitical tensions and potential trade restrictions could disrupt Qualcomm’s supply chain and customer base in China. Additionally, the threat of Apple designing its own modem chips remains a concern, potentially impacting Qualcomm’s revenue by approximately $1.75 billion annually. However, Apple’s historical struggles to develop in-house modems suggest that this risk may take longer to materialize, if at all.

Valuation and Investment Opportunity

At its current price of $122, Qualcomm offers significant upside potential. The stock is undervalued by over 28%, with a fair value estimate of $211 per share based on a forward P/E of 18x and consensus earnings growth projections. Qualcomm’s attractive dividend yield of 2.8%, combined with its robust buyback program, provides additional incentives for investors seeking long-term returns.

The resolution of Qualcomm’s legal dispute with ARM removes a major overhang, clearing the path for continued innovation and market leadership. With automotive and IoT markets poised for sustained growth and AI revenues accelerating, Qualcomm is well-positioned to capitalize on emerging opportunities.

Conclusion

Qualcomm’s strategic pivot from smartphones to AI, automotive, and IoT markets underscores its ability to adapt and thrive in a rapidly evolving tech landscape. With a diversified revenue base, strong financial performance, and compelling valuation, NASDAQ:QCOM represents a unique investment opportunity. For real-time updates on Qualcomm’s stock performance, visit QCOM Real-Time Chart.