Unpacking CrowdStrike's Dominance in the Cybersecurity Market (NASDAQCRWD)

Explosive Growth Amid High-Profile Cybersecurity Threats

The surge in high-profile cyberattacks over the past few years, such as the Colonial Pipeline ransomware attack in 2021 and the Change Healthcare breach in February 2024, has underscored the critical importance of robust cybersecurity measures. CrowdStrike (NASDAQ:CRWD), a leading developer of cloud-based cybersecurity solutions, has been at the forefront of this fight, offering subscription-based security modules designed to protect organizational data, endpoints, and networks.

Stellar Stock Performance and Speculation on a Stock Split

CrowdStrike's stock has skyrocketed over the past 18 months, experiencing a remarkable 264% increase. This surge has taken the stock price from under $100 to nearly $400, leading to speculation about a potential stock split to attract more retail investors. Although CrowdStrike has not executed a stock split since its IPO in 2019, the high stock price and the historical trend of companies splitting their stocks at similar levels could prompt such a move.

Financial Highlights: Impressive Q1 2025 Results

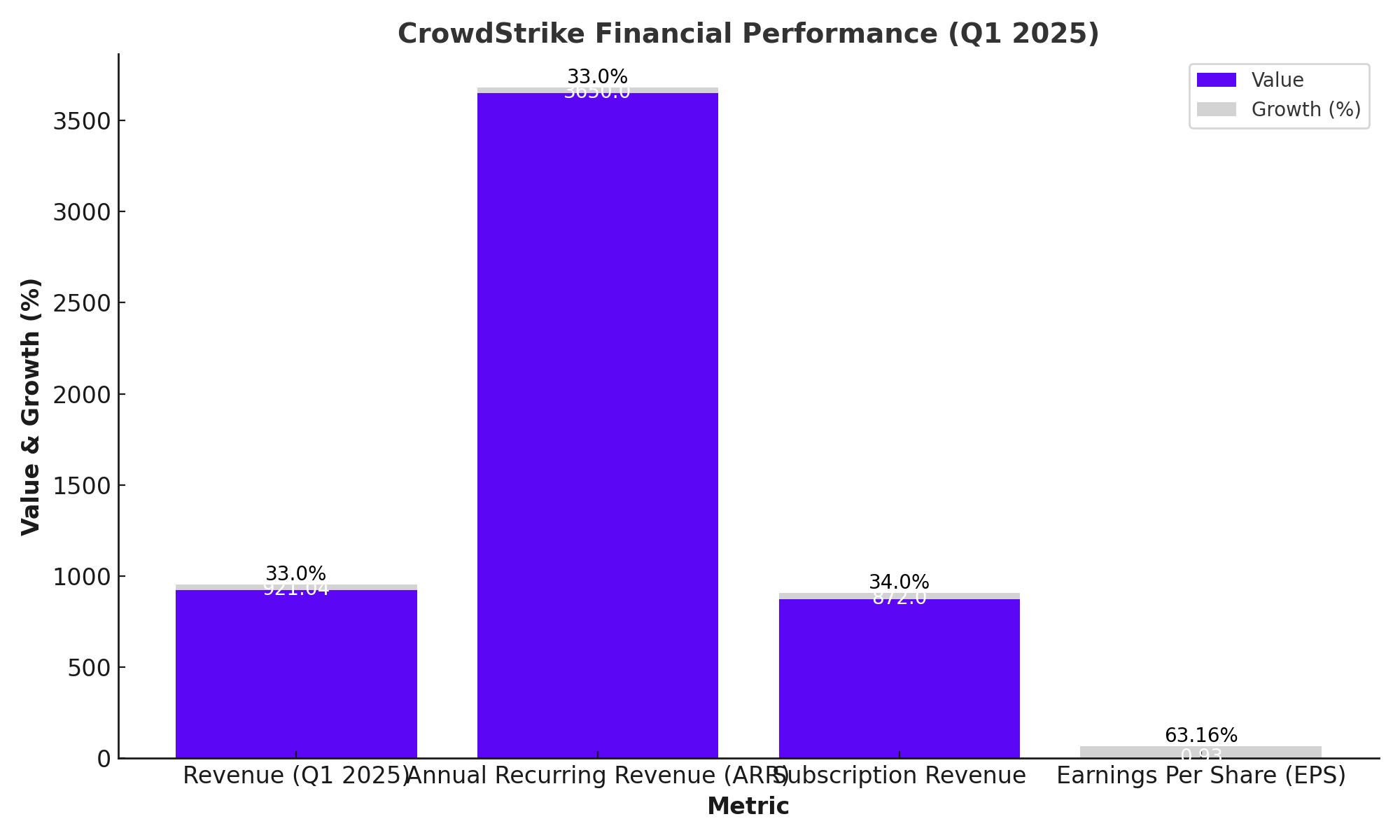

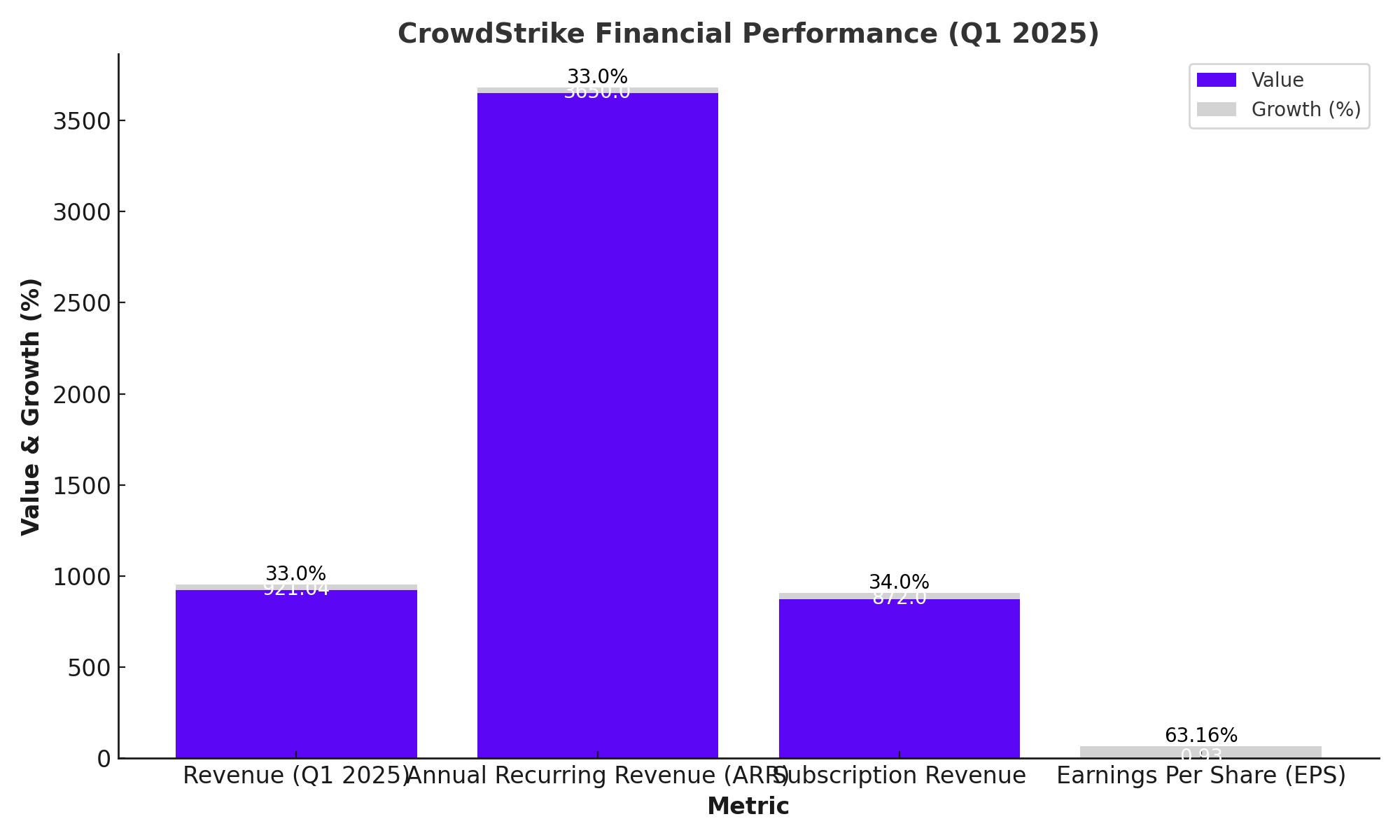

CrowdStrike's financial performance for the first quarter of fiscal year 2025 exceeded expectations, with the company reporting a revenue of $921.04 million, a 33% year-over-year increase, surpassing the consensus estimate of $904.8 million. The total Annual Recurring Revenue (ARR) grew by 33% to $3.65 billion, making CrowdStrike the first pure-play cybersecurity software vendor to achieve this milestone so rapidly. Subscription revenue rose by 34% to $872 million, and Earnings Per Share (EPS) climbed to $0.93, up from $0.57 in the previous quarter.

Strategic Positioning with AI-Driven Solutions

CrowdStrike's strategic focus on AI-powered solutions has been a key driver of its success. The Falcon Flex subscription model and the Charlotte AI, which achieved a 90% Proof of Value (POV) close rate, demonstrate the industry's growing adoption of AI-driven cybersecurity tools. These solutions not only provide comprehensive security but also deliver significant cost savings, enhancing CrowdStrike's competitive edge.

Expanding Module Adoption and Enhancing Customer Value

CrowdStrike's emphasis on expanding its range of security modules has resulted in significant growth in multi-module deals. In the fourth quarter of 2024, deals involving eight or more modules more than doubled year-over-year. This trend continued in the first quarter of 2025, with substantial increases in deals involving cloud, identity, and next-gen SIEM modules. Such expansion is crucial for driving top-line growth and leveraging cross-selling opportunities.

Valuation and Market Position

Despite its strong performance, CrowdStrike's stock trades at a high valuation, with an EV/Sales ratio of 23.6, compared to the cybersecurity peer group average of 9.3. While this premium reflects the company's growth potential and strategic market position, it also suggests caution. The company's robust financial performance, strategic AI integration, and strong operating margins justify this higher valuation. However, potential macroeconomic challenges could impact its stock price.

Future Prospects and Analyst Expectations

CrowdStrike’s inclusion in the S&P 500 and its strong positioning in the AI-powered cybersecurity market signal promising future growth. Analysts are closely monitoring growth in net retention rates and top-line performance, driven by new customer acquisitions and increased adoption of multiple modules. Strategic partnerships with industry giants such as Nvidia, AWS, RedHat, and Google Cloud further bolster CrowdStrike’s growth prospects.

Risks and Market Considerations

Despite its market leadership, CrowdStrike faces risks associated with its high valuation and the competitive nature of the cybersecurity industry. Potential macroeconomic challenges could also affect its stock performance. Investors should carefully consider these factors when evaluating their investment in CrowdStrike.

Investment Thesis: Is CrowdStrike (NASDAQ) a Buy?

CrowdStrike remains a compelling investment in the cybersecurity sector, especially for long-term investors. The company's strong financial performance, strategic AI integration, and market leadership position it well for continued growth. Although the high valuation warrants caution, CrowdStrike's robust fundamentals and growth potential make it an attractive addition to a diversified portfolio.

Detailed Financial Analysis: Key Metrics and Growth Indicators

Revenue and Earnings Growth:

- Revenue: $921.04 million in Q1 2025, up 33% year-over-year.

- Annual Recurring Revenue (ARR): $3.65 billion, a 33% increase.

- Subscription Revenue: $872 million, a 34% increase.

- Earnings Per Share (EPS): $0.93, up from $0.57 in the previous quarter.

Profit Margins and Cash Flow:

- Gross Profit Margin (GPM): 80%.

- Free Cash Flow (FCF) Margin: 35%.

- Operating Margin: 22%, up 5% year-over-year.

Strategic Moves and AI Integration

CrowdStrike’s strategic initiatives, such as the Falcon Flex subscription model and the Charlotte AI platform, have significantly contributed to its success. The Falcon Flex model consolidates various security needs, offering substantial cost savings and enhanced security. The Charlotte AI platform accelerates detection and response times, reducing "alert to resolution" periods from days to seconds. These innovations have driven high customer adoption rates and reinforced CrowdStrike’s market leadership.

Module Expansion and Cross-Selling Success

CrowdStrike’s focus on expanding its range of security modules has led to significant growth in multi-module deals. The company reported that deals involving eight or more modules more than doubled year-over-year in 4Q24. This momentum continued in 1Q25, with substantial increases in deals involving cloud, identity, and next-gen SIEM modules. The adoption of multiple modules enhances customer retention and drives top-line growth, positioning CrowdStrike for sustained success.

Valuation Insights and Market Position

CrowdStrike’s stock trades at a high valuation, with an EV/Sales ratio of 23.6. While this premium reflects the company's growth potential and strategic market position, it also necessitates caution. The high valuation is justified by CrowdStrike's robust financial performance, strategic AI integration, and strong operating margins. However, market conditions and potential macroeconomic challenges could impact its stock price.

Future Growth Prospects and Analyst Expectations

CrowdStrike’s inclusion in the S&P 500 and its strong positioning in the AI-powered cybersecurity market indicate promising future growth. Analysts are closely monitoring growth in net retention rates and top-line performance, driven by new customer acquisitions and increased adoption of multiple modules. Strategic partnerships with industry giants such as Nvidia, AWS, RedHat, and Google Cloud further bolster CrowdStrike’s growth prospects.

Risks and Considerations

Despite its market leadership, CrowdStrike faces risks associated with its high valuation and the competitive nature of the cybersecurity industry. Potential macroeconomic challenges could also affect its stock performance. Investors should carefully consider these factors when evaluating their investment in CrowdStrike.

Conclusion: Is CrowdStrike (NASDAQ:CRWD) a Buy?

CrowdStrike remains a compelling investment in the cybersecurity sector, especially for long-term investors. The company's strong financial performance, strategic AI integration, and market leadership position it well for continued growth. Although the high valuation warrants caution, CrowdStrike's robust fundamentals and growth potential make it an attractive addition to a diversified portfolio.

CrowdStrike's innovative approach, strong financials, and strategic market positioning highlight its potential for sustained growth. Investors should monitor market trends, financial performance, and strategic developments to make informed investment decisions regarding NASDAQ:CRWD

That's TradingNEWS