Riot Platforms (NASDAQ:RIOT), currently trading at approximately $10.87, is emerging as a leading force in the global Bitcoin mining industry. Despite the volatility of cryptocurrencies, Riot’s strategic growth initiatives, innovative operational improvements, and robust financial planning highlight its significant potential for future value creation. With its market capitalization at $4.4 billion, Riot is already the second-largest publicly traded Bitcoin miner, and its ambitious roadmap points to even greater dominance in the years ahead.

A Rapidly Expanding Hashrate: The Cornerstone of Riot’s Growth

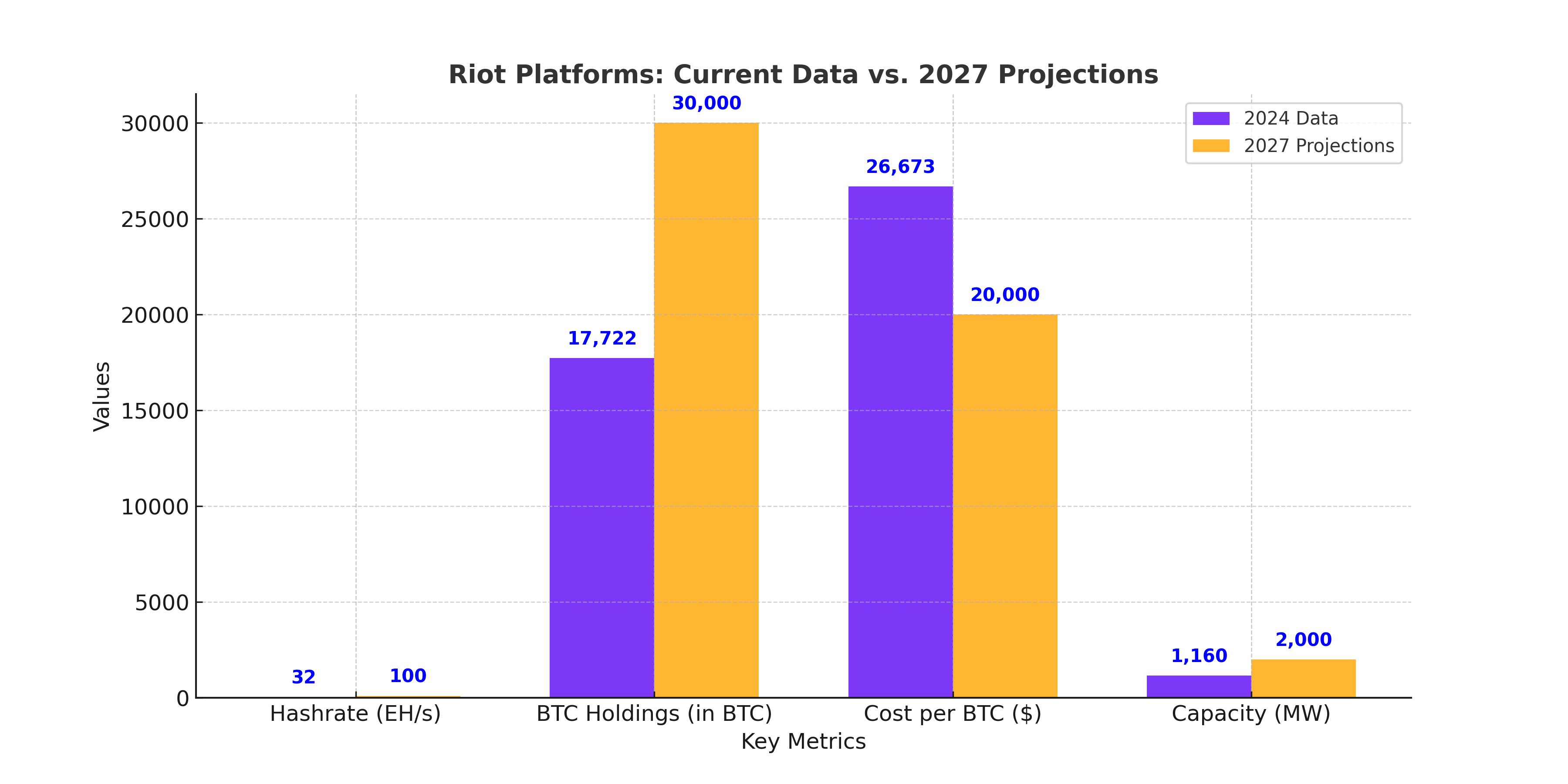

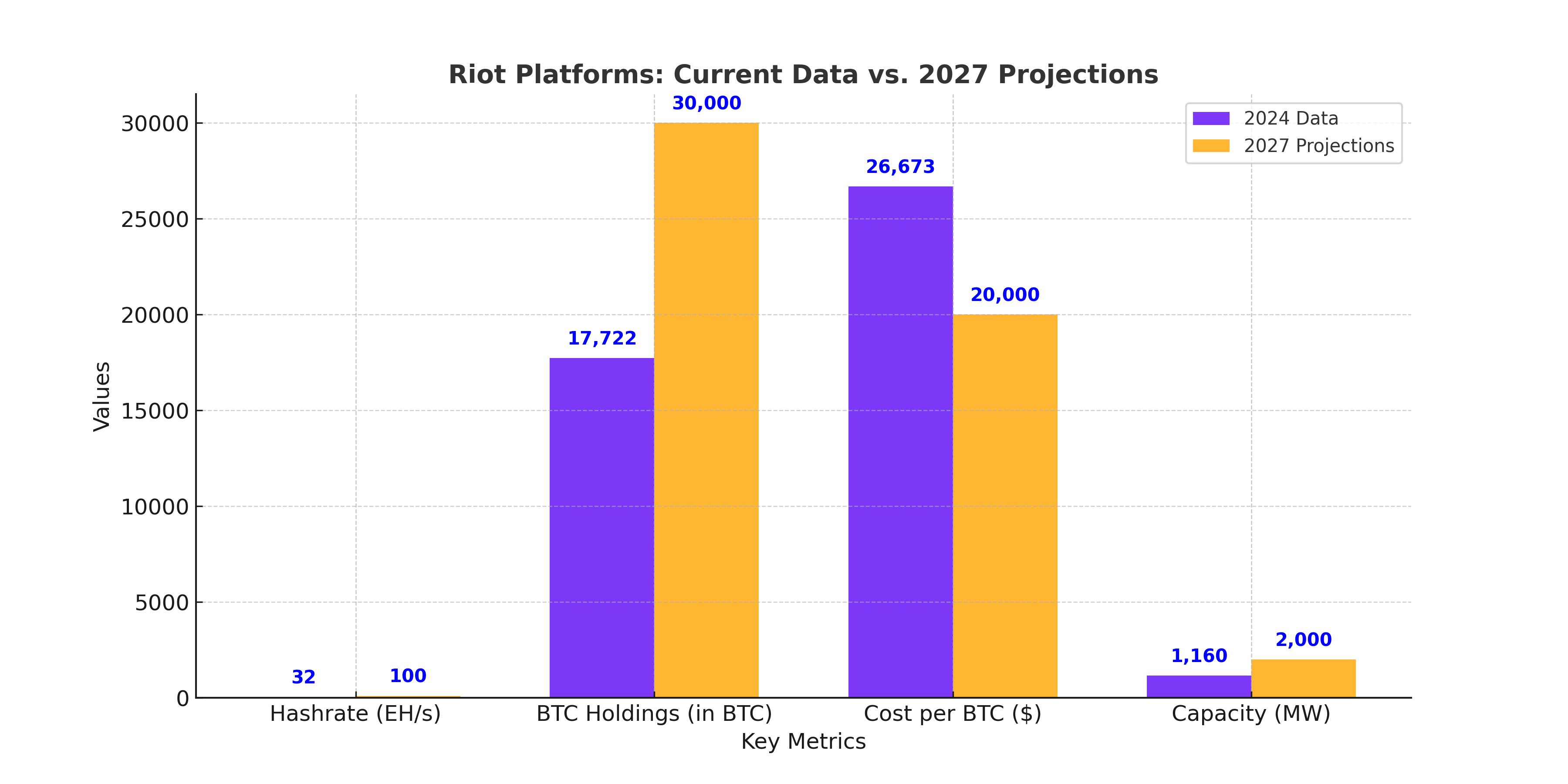

In 2024, Riot Platforms significantly expanded its mining capacity, achieving a 155% year-over-year increase in hashrate, climbing from 12.4 EH/s at the end of 2023 to an impressive 31.5 EH/s by year-end. This represents nearly 4% of the total Bitcoin network. Riot’s rapid scaling not only outpaced the broader network’s growth (up 59% YoY) but also positioned the company as the fastest-growing Bitcoin miner globally. The company’s ambitious target to achieve 100 EH/s by 2027, supported by ongoing infrastructure investments and operational efficiencies, underscores its intention to dominate the mining sector.

A key component of this expansion is Riot’s strategic diversification of its mining operations. While its Rockdale facility in Texas remains the largest Bitcoin mining site in the United States, the company has reduced its reliance on Texas energy grids. Through the acquisition of Block Mining for $92.5 million, Riot added two operational sites in Kentucky, offering a total capacity of 60 MW with the potential to expand to 350 MW. Kentucky’s lower energy costs and participation in energy-saving programs provide Riot with a competitive edge in mitigating electricity expenses, which are the largest operational cost for miners.

Driving Efficiency: The Push for Cost-Effective Bitcoin Mining

Mining efficiency is critical in an industry where margins can be razor-thin. Riot has made strides in improving its fleet efficiency, which now stands at 21.9 J/TH. This is competitive, though slightly behind its peer MARA’s 19.4 J/TH. The company’s partnership with MicroBT to secure advanced mining rigs at a fixed price ensures Riot stays at the forefront of mining technology while managing capital expenditure effectively.

Despite the challenges posed by Bitcoin’s April 2024 halving, which doubled the difficulty of mining, Riot demonstrated resilience. Its cost to mine Bitcoin increased by 80%, from $14,890 per Bitcoin in Q2 2024 to $26,673 in Q3, but remained below the doubling threshold, highlighting Riot’s ability to control costs amid industry headwinds.

The Shift to Bitcoin HODLing: A Game-Changer for Riot’s Valuation

A transformative trend among Bitcoin miners, including Riot, is the adoption of the "HODL strategy," where companies retain mined Bitcoin instead of selling it. Riot’s Bitcoin holdings totaled 17,722 BTC as of December 2024, valued at approximately $1.69 billion with Bitcoin prices at $95,000. This approach not only aligns with long-term bullish sentiment on Bitcoin but also provides Riot with the ability to leverage its holdings for low-cost debt financing to fund infrastructure expansion.

Using innovative valuation methods like premium-to-NAV analysis, Riot’s market cap of $4.4 billion represents a 2.6x multiple on its net Bitcoin assets. This ratio highlights the potential for significant upside as Bitcoin prices rise. For instance, if Bitcoin reaches $200,000, Riot’s implied share price could surge to $27, a 125% increase from current levels.

Innovative Financing and Future Revenue Streams

Riot’s ability to leverage Bitcoin as collateral for financing is unlocking new avenues for growth. This strategy reduces the need for equity dilution and aligns with broader market trends, as seen in companies like MicroStrategy. Furthermore, Riot’s infrastructure is well-positioned for a potential pivot into high-performance computing (HPC) and AI applications, which could generate an additional $37.6 billion in industry revenues by 2027, according to VanEck estimates. Riot’s 1,160 MW capacity could prove to be a valuable asset, with data center valuations often far exceeding those of Bitcoin miners.

The Competitive Landscape: Riot vs. MARA

When compared to its primary competitor, MARA Holdings, Riot exhibits distinct strengths and areas for improvement. Riot’s focus on U.S.-based operations reduces geopolitical risk, while MARA’s global diversification offers other advantages. Riot’s lower debt-to-asset ratio of 0.05 versus MARA’s 0.20 as of Q3 2024 reflects its conservative financial strategy. However, MARA outpaces Riot in Bitcoin yield, producing 62.7% versus Riot’s 39% in 2024. Riot’s future growth will depend on its ability to close this gap through strategic acquisitions and operational enhancements.

Catalysts for 2025 and Beyond

Several macroeconomic and industry-specific trends position Riot for substantial growth in 2025 and beyond. The anticipated easing of Federal Reserve interest rates will lower the cost of debt financing, enabling Riot to expand its operations further. The ongoing institutional adoption of Bitcoin and favorable regulatory frameworks add to the bullish sentiment for cryptocurrency-related assets. Moreover, Riot’s inclusion in innovative financial products, such as Defiance’s 2X long ETF ($RIOX), underscores growing investor confidence in the company.

A Valuation That Demands Attention

Riot’s current price-to-book ratio is among the most attractive in the industry, making it a compelling value proposition. Using power capacity valuation methods, Riot’s infrastructure alone supports a valuation of $5.2 billion, implying a 31% upside from its current market cap. This potential, combined with its Bitcoin HODL strategy and ambitious growth plans, makes Riot a standout opportunity in the Bitcoin mining sector.

Conclusion: A Strong Buy Opportunity for Long-Term Investors

Riot Platforms (NASDAQ:RIOT) presents a unique investment opportunity at $10.87, offering exposure to the rapidly growing Bitcoin mining industry. With its focus on operational efficiency, strategic expansion, and innovative financing, Riot is well-positioned to capitalize on the ongoing Bitcoin bull market. The company’s clear roadmap to achieving 100 EH/s by 2027 and its ability to leverage Bitcoin as a financial asset make it a strong buy for investors with a long-term horizon. For the latest updates on Riot Platforms, visit the real-time RIOT chart.

That's TradingNEWS