Salesforce (NASDAQ:CRM): Comprehensive Stock Analysis and Future Outlook

Exploring Salesforce's Recent Earnings, Valuation Insights, and Growth Potential Amid Market Volatility | That's TradingNEWS

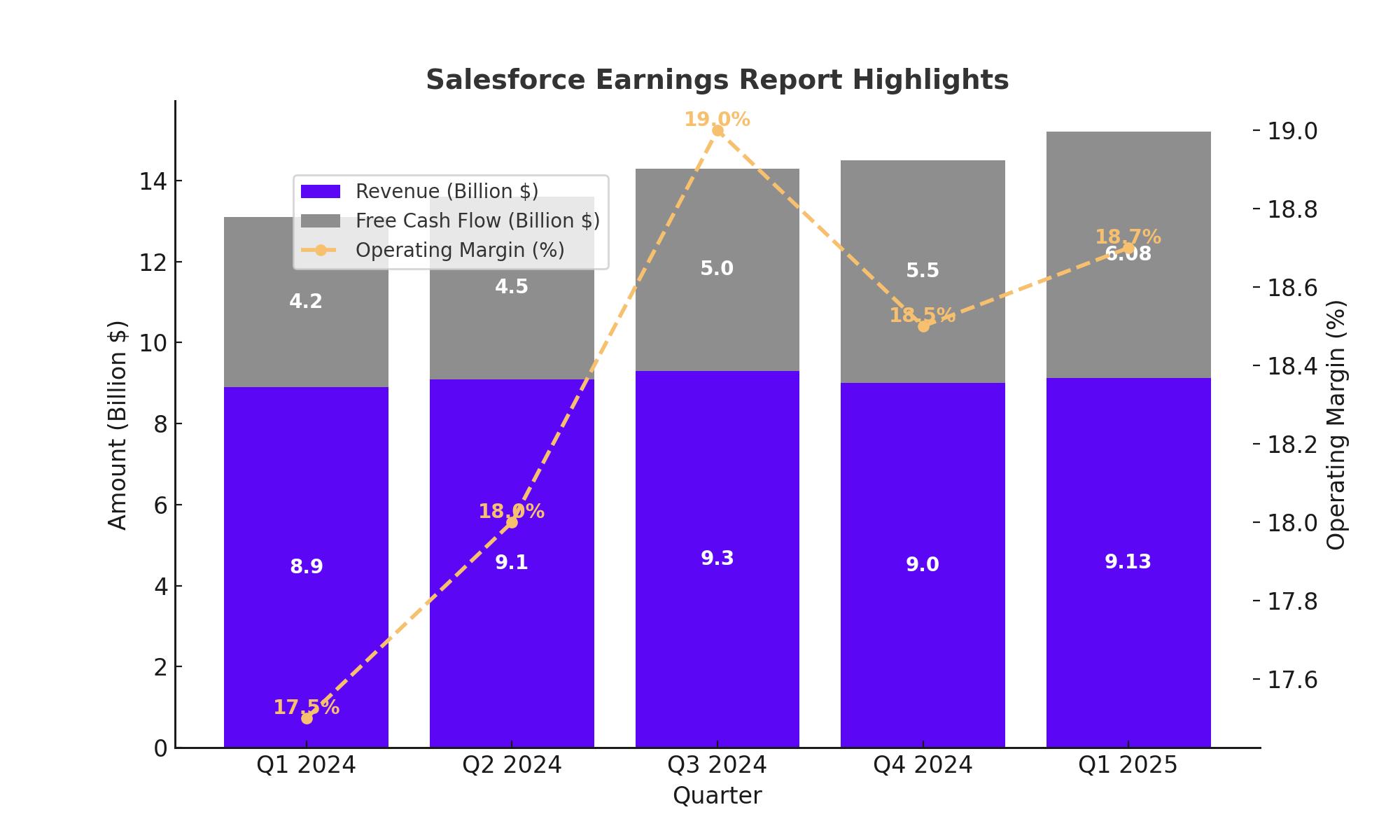

Earnings Report Highlights

Salesforce (NASDAQ:CRM) faced a sharp decline in its stock price following its fiscal first-quarter earnings report on May 29, with shares plummeting by 20% to close at $218.01. The company reported revenues of $9.13 billion, up 11% year-over-year, and GAAP operating margins of 18.7%, with non-GAAP operating margins at 32.1%. Despite these increases, the lowered guidance for the next quarter and fiscal year disappointed investors. The current remaining performance obligations stood at $26.4 billion, marking a 10% increase year-over-year, while free cash flow soared by 43% to $6.08 billion.

Fiscal Year 2025 Guidance

For the second quarter of FY25, Salesforce has provided a revenue guidance of $9.2 to $9.25 billion, implying a growth of 7 to 8%. The company maintained its full-year revenue guidance of $37.7 to $38 billion (an increase of 8 to 9% year-over-year) but lowered its GAAP operating margin forecast to 19.9%, while keeping the non-GAAP operating margin at 32.5%. Salesforce also initiated its first-ever quarterly dividend of $0.40 and repurchased $2.2 billion in stock. The midpoint guidance for non-GAAP EPS for fiscal year 2025 is $9.90, with GAAP EPS at $6.08.

Strong Market Position and Business Model

Salesforce maintains a strong market presence, holding an estimated 21.7% share in the CRM software market. The company’s extensive suite of cloud offerings, including sales, service, marketing, commerce, integration/analytics, and a data cloud, creates a comprehensive ecosystem for businesses. This diverse range of services leads to high customer retention rates, as evidenced by the nearly 48x spending increase from customers since 2007 who expanded from one to nearly six cloud services.

Wide Moat and High Switching Costs

Salesforce’s business model benefits from high switching costs due to the deep integration of its services within its clients' operations. The company’s CRM platform, coupled with offerings like Slack, Tableau, and Mulesoft, creates a sticky ecosystem that is difficult for customers to leave once they are deeply embedded. The introduction of Salesforce’s Einstein co-pilot, which automates workflows and enhances the stickiness of their software products, further strengthens their market position.

Valuation Analysis

Discounted Cash Flow (DCF) Model

Salesforce’s trailing twelve months free cash flow is approximately $11.33 billion. Using a discount rate of 10.5% and a conservative growth rate of 10%, the DCF model yields an implied equity value of around $327 per share, indicating a 35% upside from the current price of $241.76.

Dividend Discount Model (DDM)

With the recently initiated quarterly dividend of $0.40, the annualized dividend for FY 2025 is projected at $1.60. Assuming a 10% growth rate and a discount rate of 10.5%, the DDM suggests a fair value of $352 per share, representing a 46% upside.

Valuation Assuming Zero Growth

Even with zero growth, dividing Salesforce’s TTM free cash flow by the current 10-year US Treasury yield of 4.25% results in an implied firm value of $266.68 billion. Adding back excess cash after paying off all debt provides an implied equity value of $272.4 billion, or approximately $277 per share, indicating a 14.5% upside.

Insider Transactions and Market Reactions

Director Oscar Munoz purchased 2,051 Salesforce shares worth $500,000 at an average price of $243.69 each on June 21, increasing his holdings to 7,026 shares. This insider buying could be seen as a positive signal, reflecting confidence in the company's future prospects.

Strategic Acquisitions and Growth

Salesforce has strategically acquired companies like MuleSoft, Tableau, and Slack, enhancing its comprehensive suite of services. Despite inherent risks associated with acquisitions, Salesforce’s ability to integrate these companies successfully has been reflected in its financial performance. For instance, since their acquisitions, Slack and Tableau have grown revenues by 1.4x and 1.5x, respectively.

Risks and Challenges

Two primary risks for Salesforce are succession risk and integration risk. CEO Marc Benioff's potential departure could disrupt the company's leadership, and the integration of large acquisitions like Slack and Tableau needs continuous monitoring to ensure they contribute positively to Salesforce’s bottom line. Additionally, cybersecurity threats pose significant risks given the sensitive nature of the data Salesforce handles.

Conclusion

Salesforce (NASDAQ:CRM) continues to dominate the CRM market, driven by its innovative approach and comprehensive suite of services. Despite a recent dip in stock price due to lower-than-expected earnings guidance, the company’s long-term prospects remain strong. Valuation models suggest significant upside potential, and insider buying by Director Oscar Munoz indicates confidence in the company's future. With a strong balance sheet, ongoing investments in innovation, and a focus on returning cash to shareholders, Salesforce is well-positioned for sustained growth and value creation for its investors.

For real-time stock information and further details, visit here.

For details on insider transactions, visit here.

Thta's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex