Snowflake NYSE:SNOW A Deep Dive into Market Position and Financial Health

Unveiling Snowflake's Growth Potential: From Cloud Data Warehousing to AI-Driven Market Leadership | That's TradingNEWS

Analyzing NYSE:SNOW's Market Trajectory and Financial Dynamics

Background and Valuation Metrics

NYSE:SNOW, also known as Snowflake Inc., presents an intricate case for potential investors. Following a tumultuous period that saw the stock decline by 37% from its peak, it still commands one of the loftiest valuations in the market, according to traditional metrics such as price-to-sales (P/S) and forward price-to-earnings (P/E) ratios. Despite this, the company's recent stellar third-quarter earnings for fiscal year 2024 suggest there may still be untapped growth potential.

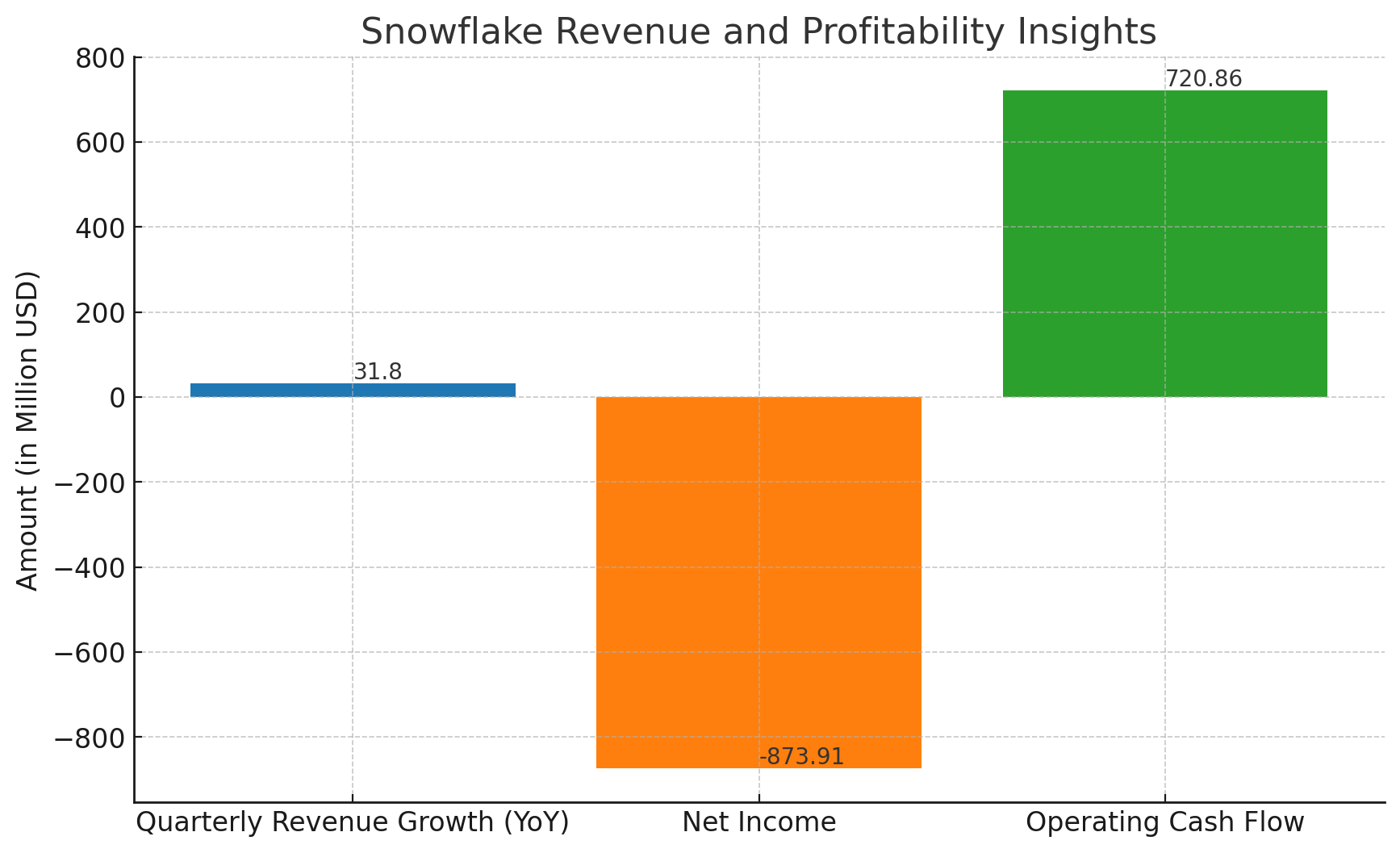

Revenue and Profitability Insights

Snowflake's business model, specializing in cloud-based data warehousing, has captured a significant portion of the market, with particular strength in data management for unstructured data—critical for the burgeoning field of generative AI. Its transition from a data warehouse to a data lakehouse, and now to what it terms a 'Data Cloud', has made it a central hub for business data operations.

Snowflake's financial health can be dissected by examining key figures: an impressive 31.80% year-over-year quarterly revenue growth, a net income available to common stockholders of -$873.91 million, and a robust operating cash flow of $720.86 million. Despite operating at a loss, Snowflake's cash flow dynamics and revenue growth paint a picture of a company investing heavily in its future.

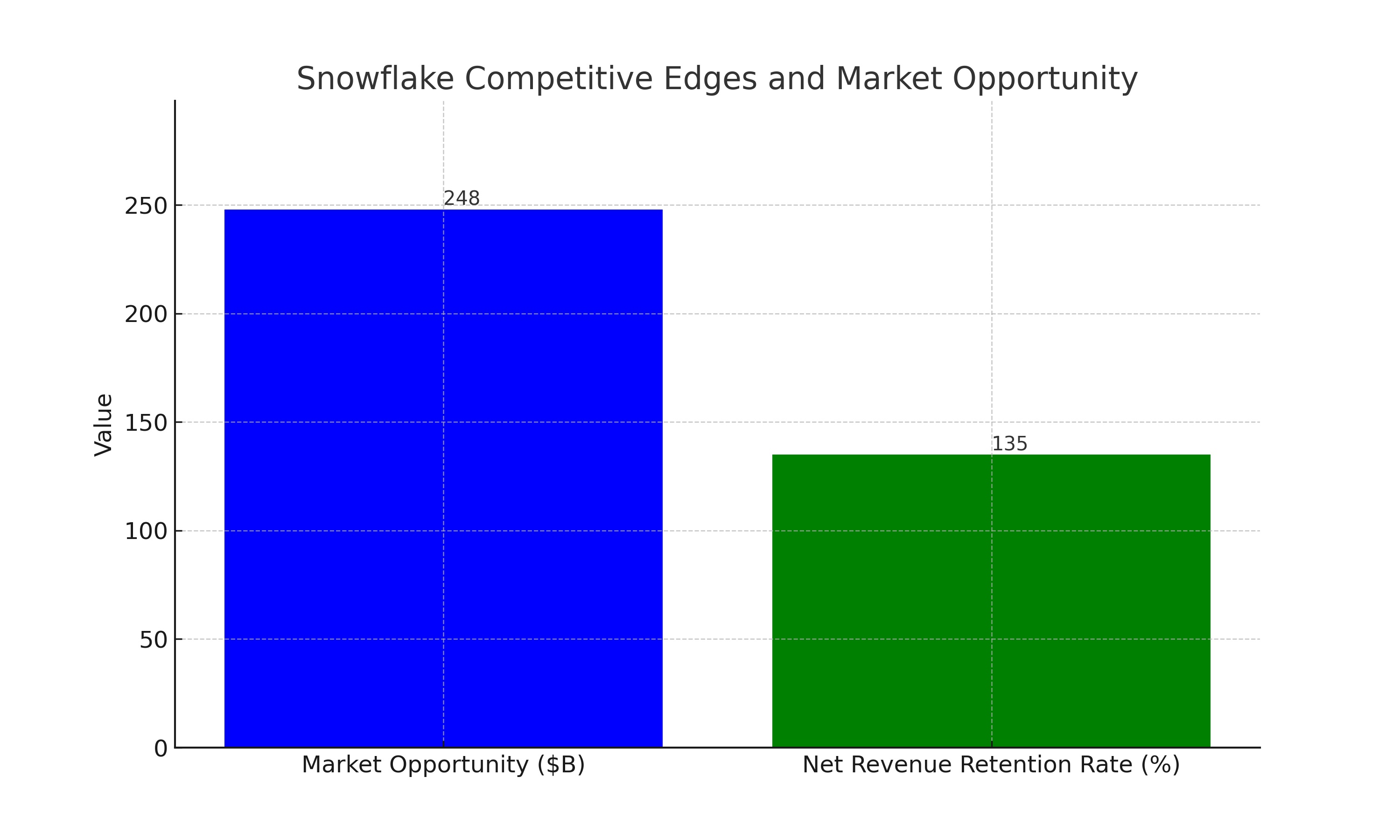

Competitive Edges and Market Opportunity

Snowflake's market opportunity is vast, with management forecasts suggesting a potential market worth $248 billion by 2026. Notably, this estimate predates the generative AI revolution, hinting that the actual opportunity could be even larger.

The company's platform strength is twofold: high switching costs and a burgeoning network effect. The former is evident in its Net Revenue Retention Rate of 135%, while the latter is bolstered by a broad partner ecosystem and an expanding customer base, which includes many high-profile names.

Generative AI and Snowflake's Position

Generative AI substantially increases computing and data storage needs. Snowflake's consumption-based business model is primed to benefit from this increased demand. Its data-sharing capabilities and platform flexibility, allowing operation across major cloud providers, give it an edge in the evolving data management landscape.

Institutional Backing and Insider Sentiments

Institutional investors seem to share a growing confidence in Snowflake, with significant investments from entities such as the National Bank of Canada FI and Moneta Group Investment Advisors LLC. Insider transactions, particularly the recent selling by Vice Chairman Douglas E. Buckminster, though not necessarily indicative of diminished confidence, warrant careful scrutiny alongside other market and financial indicators.

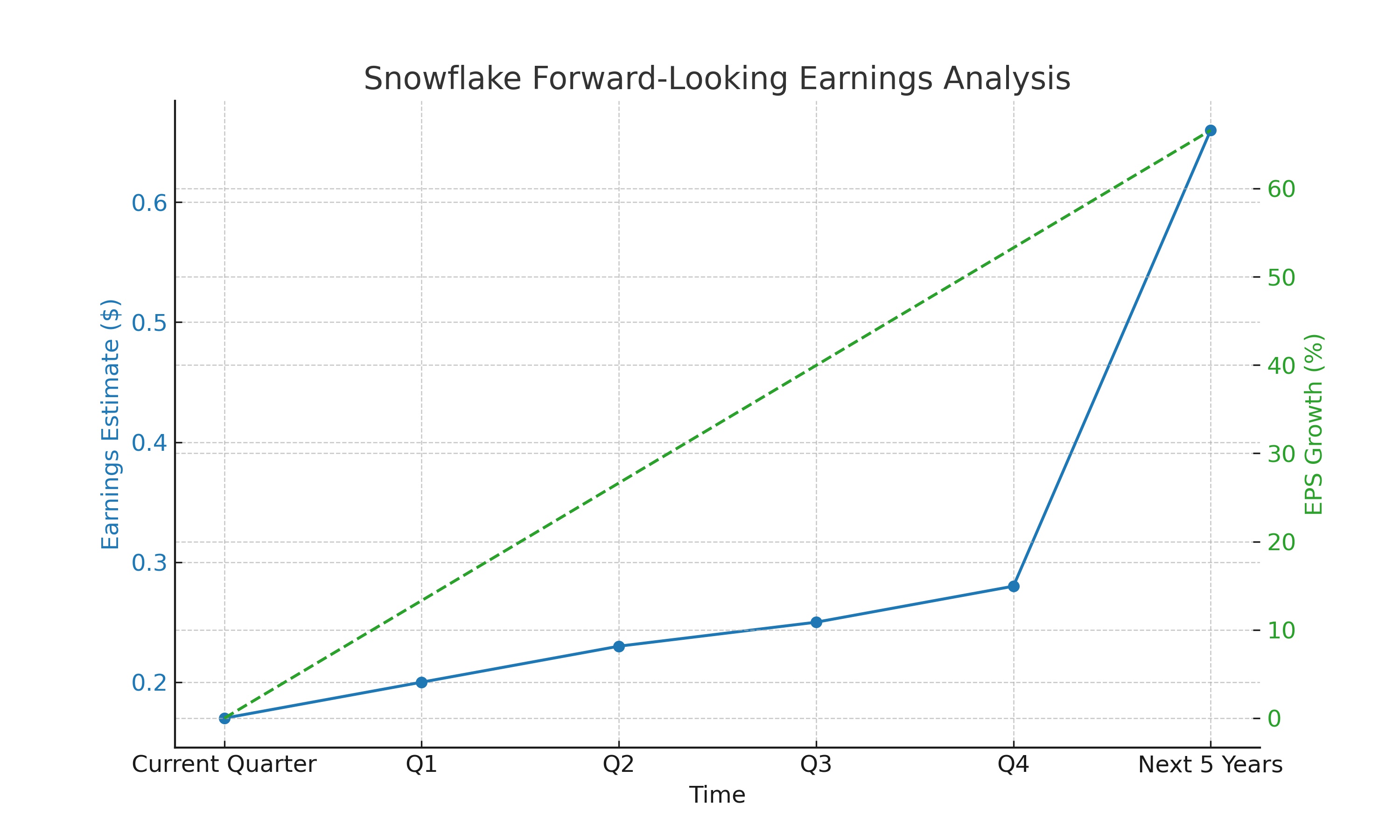

Forward-Looking Analysis

Earnings estimates for Snowflake indicate a positive trend, with a consensus estimate of $0.17 for the current quarter and increasing projections for subsequent quarters. The company's forward-looking revenue estimates suggest a continued trajectory of growth, supported by aggressive analyst forecasts of 66.60% earnings-per-share growth over the next five years.

Market Trends and Sector Dynamics

Snowflake's success can also be attributed to its alignment with broader market trends in cloud technology and data analytics. As businesses continue to migrate to cloud-based solutions for data storage and analysis, Snowflake's offerings are increasingly relevant. The company's ability to provide comprehensive solutions for both structured and unstructured data positions it advantageously in a sector experiencing rapid growth and transformation.

Investor Considerations

For investors, Snowflake represents an intriguing opportunity. The company's strong market presence, coupled with its alignment with key technological trends, makes it a potentially lucrative investment. However, investors should also consider the broader economic environment and market volatility when evaluating the stock. Snowflake's high growth potential is accompanied by valuation concerns and competition in the cloud data market, factors that necessitate a balanced investment approach.

Conclusion: Evaluating Snowflake's Investment Potential

In conclusion, Snowflake Inc. presents a compelling case for investment, especially for those with a focus on technology and growth stocks. The company's forward-looking revenue and earnings growth, combined with its strategic market position, suggest significant upside potential. As with any investment, it's crucial to consider Snowflake within the context of broader market trends and individual investment strategies. Investors are advised to keep a close eye on Snowflake's performance and market movements to make informed decisions. For ongoing updates and detailed insights into Snowflake's financials and market performance, interested parties can refer to TradingNews.com.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex