Is Salesforce (NYSE:CRM) Stock Undervalued?

Examining Salesforce’s $369 Price, AI Growth Potential, and $421 Target | That's TradingNEWS

Salesforce (NASDAQ:CRM): Driving Growth Through AI and Strategic Investments

Salesforce, Inc. (NASDAQ:CRM) has firmly established itself as a leader in the cloud-based customer relationship management (CRM) software market, with a dominant 21.7% market share as of 2023. The company’s strong foothold, fueled by its AI innovations like Agentforce, substantial profitability, and strategic acquisitions, paints a compelling growth narrative. Trading at approximately $369, CRM's valuation is reflective of its robust financial performance, including a projected FY25 non-GAAP EPS of $10.01 and a forward P/E of 34.7.

Record Growth in AI Integration with Agentforce

Agentforce has emerged as Salesforce's flagship AI-powered virtual agent, designed to enhance customer and employee interactions. Within a week of its October 24 launch, Salesforce signed over 200 Agentforce deals, including partnerships with major names like FedEx and IBM. The upcoming Agentforce 2.0, equipped with advanced integrations and the Atlas Reasoning Engine, promises to expand Salesforce’s penetration into the rapidly growing enterprise AI market, expected to reach $560.7 billion by 2034. The platform’s low hallucination rates and integration capabilities with Tableau, Slack, and MuleSoft provide significant differentiation.

Financial Strength and Growing Margins

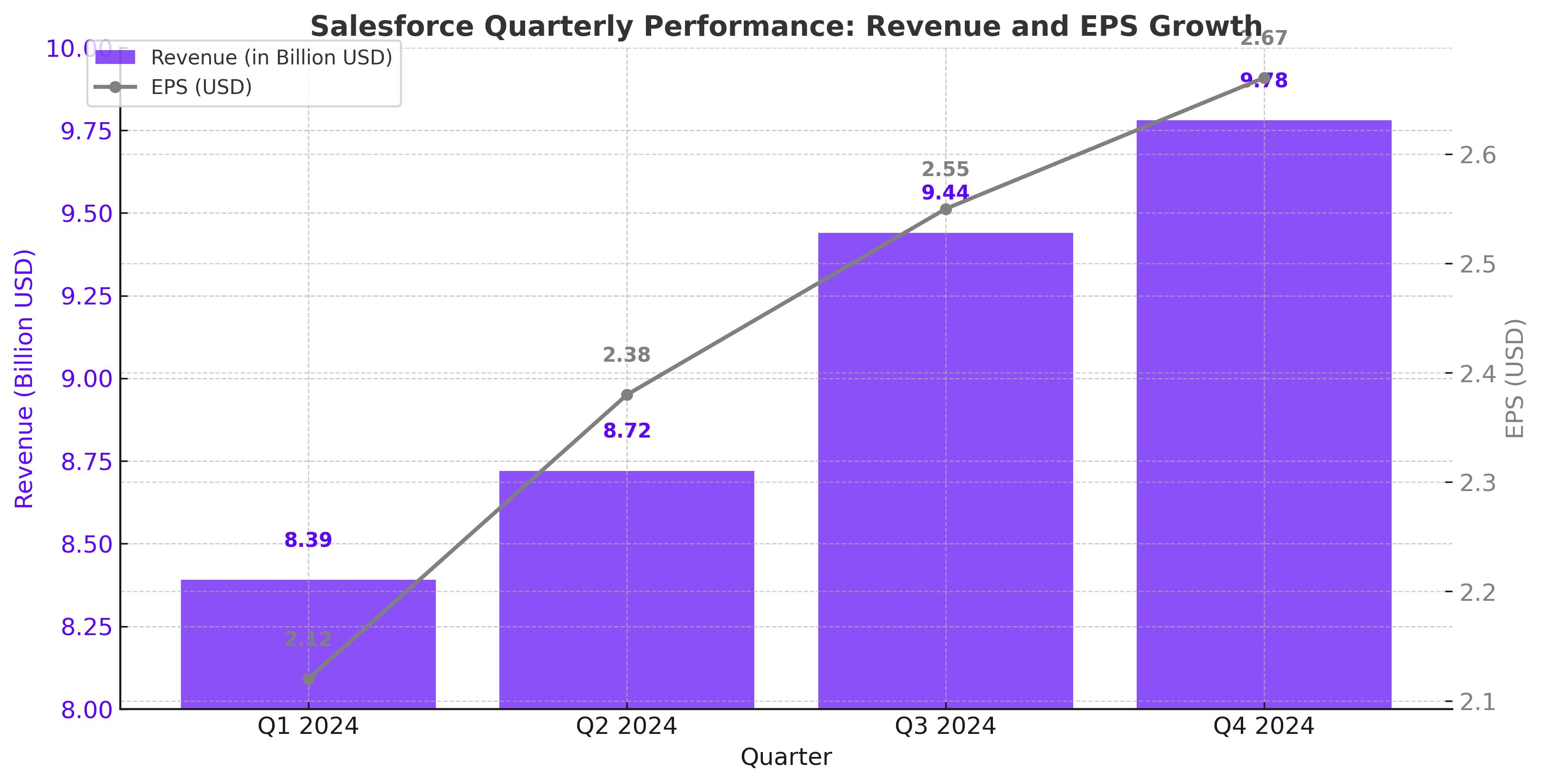

Salesforce reported Q3 revenues of $9.44 billion, an 8.3% YoY growth, with a gross margin improvement from 75% to 78%. This demonstrates the scalability of its AI-enabled products and efficiency in operations. Non-GAAP operating margins reached 33.1%, showcasing solid execution even amidst slowing sales growth. The company's gross profit, up 12% YoY, outpaced revenue growth, underlining its ability to extract higher profitability as it scales.

Strategic Acquisitions Strengthen AI Capabilities

In Q3, Salesforce completed acquisitions of Zoomin and Own Company for nearly $2 billion. These moves enhance CRM's data quality, security, and compliance capabilities, pivotal for scaling enterprise AI solutions. These acquisitions, coupled with a robust $1.3 billion share buyback program in Q3, underscore the company’s commitment to shareholder value without diluting equity.

AI and Enterprise Growth: A Long-Term Catalyst

Salesforce’s emphasis on AI, particularly through its Einstein AI and Agentforce offerings, positions it to capitalize on the surging demand for enterprise AI solutions. The ability to provide a holistic platform with built-in AI capabilities ensures a sticky customer base and a competitive edge over peers like Microsoft (P/E 31.2) and Oracle (P/E 27). CRM’s forward PEG ratio of 2.19 further highlights its growth potential relative to valuation.

Valuation and Forward Outlook

CRM currently trades at $369 with an estimated price target of $421, implying a 22.5% upside. This target factors in 15.8% projected FY26 EPS growth and strong traction for its AI tools. The stock’s forward P/E is in line with peers but justified by its AI-driven growth and profitability improvements.

Valuation and Forward Outlook

Salesforce (NYSE:CRM) is currently trading at $369, with analysts projecting a price target of $421. This represents a potential upside of 22.5% from current levels. The optimistic target is supported by an anticipated 15.8% compound annual growth rate (CAGR) in EPS through FY26, driven by Salesforce’s robust adoption of AI-driven features like Einstein and Slack GPT. At a forward P/E ratio comparable to industry peers, Salesforce's valuation appears justified by its steady profitability improvements and its strong foothold in the enterprise software market. Its AI offerings, which are integrated across its core CRM and emerging verticals like Agentforce, are key drivers underpinning its long-term growth potential.

Key Risks and Considerations

Despite its promising outlook, Salesforce faces challenges that investors must weigh carefully. One significant risk is its high stock-based compensation, which currently accounts for 8.7% of total revenue. This level of dilution could limit shareholder returns if not managed effectively. Additionally, there are concerns about potential demand slowdowns for Agentforce, its AI-driven sales and support automation tool, particularly as enterprises weigh costs in a more cautious spending environment. A broader economic downturn could exacerbate these issues, pressuring margins and tempering growth expectations. Salesforce’s ability to manage these risks will be crucial in maintaining investor confidence and meeting its growth targets.

Conclusion

Salesforce remains a compelling investment for 2025, with its shares currently reflecting a valuation that leaves room for significant upside. The company's leading position in the CRM space, bolstered by strategic acquisitions and rapid progress in AI, ensures it remains at the forefront of enterprise software innovation. The adoption of AI-enhanced tools like Agentforce and its broader suite of productivity solutions places it in a favorable position to capitalize on the growing enterprise AI market. At $369 per share, Salesforce offers a balanced opportunity for investors seeking a blend of growth, profitability, and scalability. For up-to-date market performance and analysis, visit the CRM Real-Time Chart.

That's TradingNEWS

Read More

-

MAGS ETF Price Near $69 High: Mag 7 EPS Surge And AI Cash Flows Drive The $67.55 ETF

29.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $10.69 and XRPR at $15.15 Lead $1B Inflow Wave While Bitcoin ETFs Bleed $782M

29.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Jumps Above $4.60 as Storage Flips to Deficit and LNG Exports Hit Records

29.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Slips Toward 156 As BoJ Hawkish Turn Collides With Fed Cut Outlook

29.12.2025 · TradingNEWS ArchiveForex