American Express Stock Performance and Market Position

NYSE:AXP Stock Analysis and Current Performance

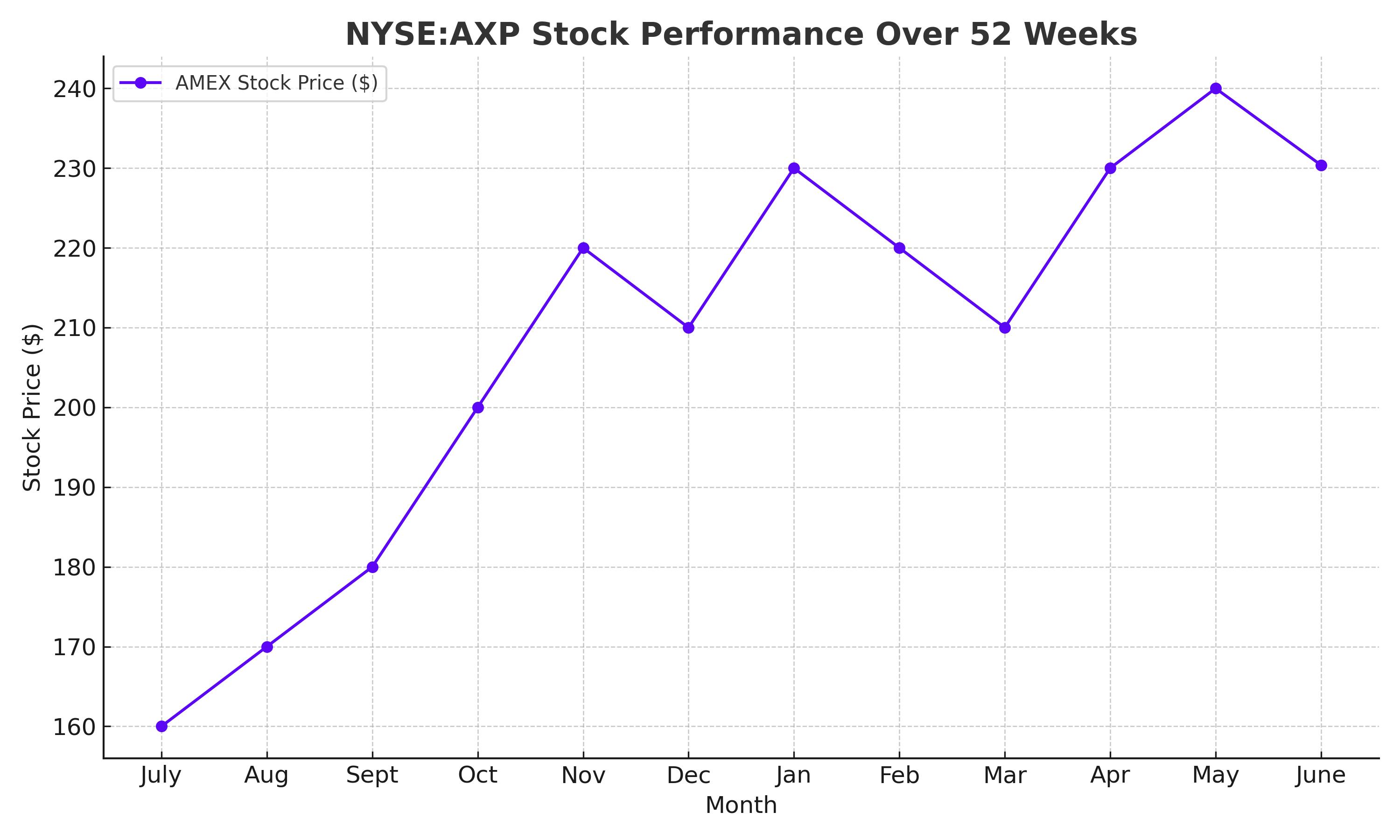

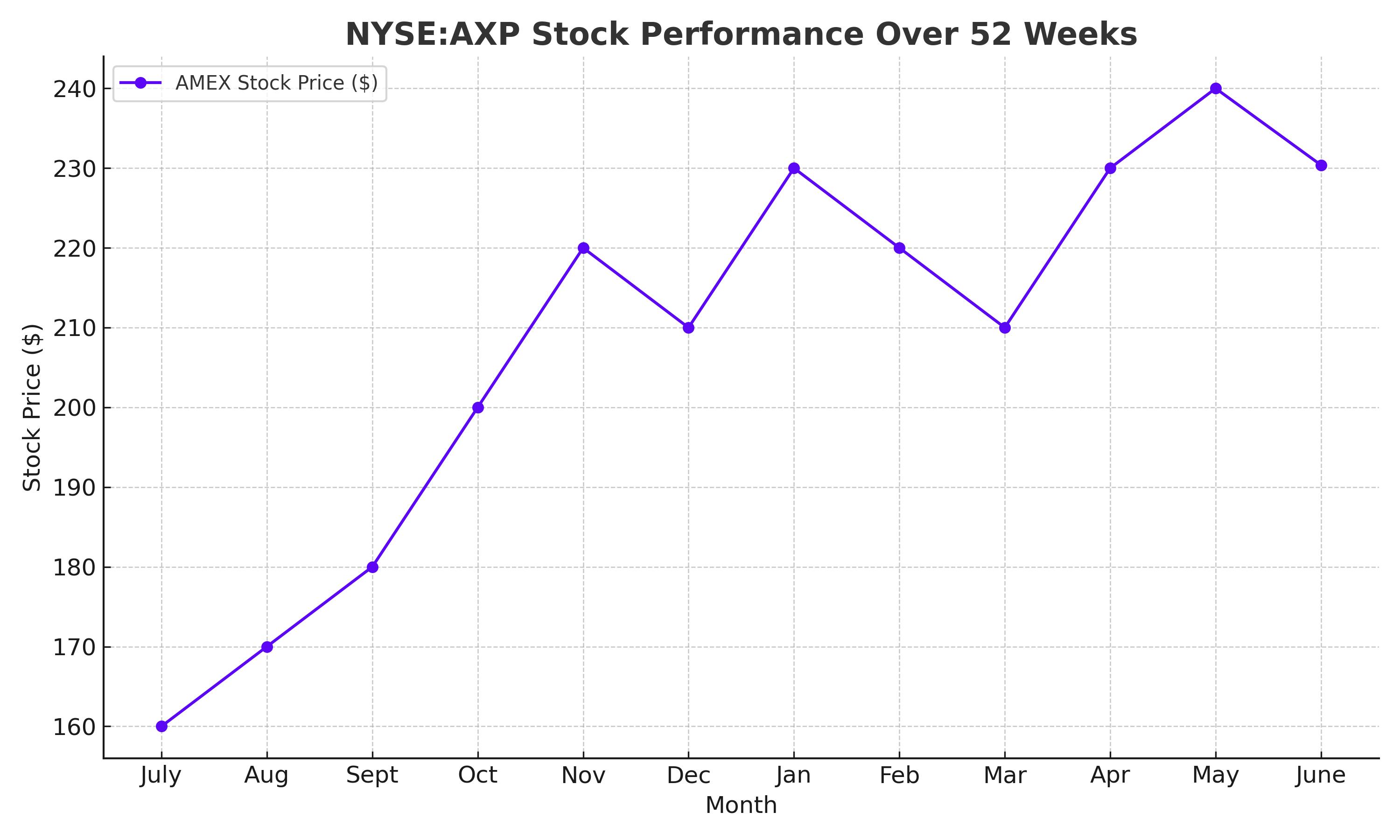

American Express (NYSE:AXP) has shown a notable performance in the market, closing at $230.38 on June 21, 2024, with a slight increase of 0.07%. The stock has seen a 52-week range between $140.91 and $244.41, reflecting its strong market presence and investor confidence. With a market cap of $165.71 billion and a P/E ratio of 18.98, American Express is well-positioned in the financial sector. For real-time updates, visit American Express Real-Time Chart.

Financial Highlights and Earnings Performance

Strong Revenue and Earnings Growth

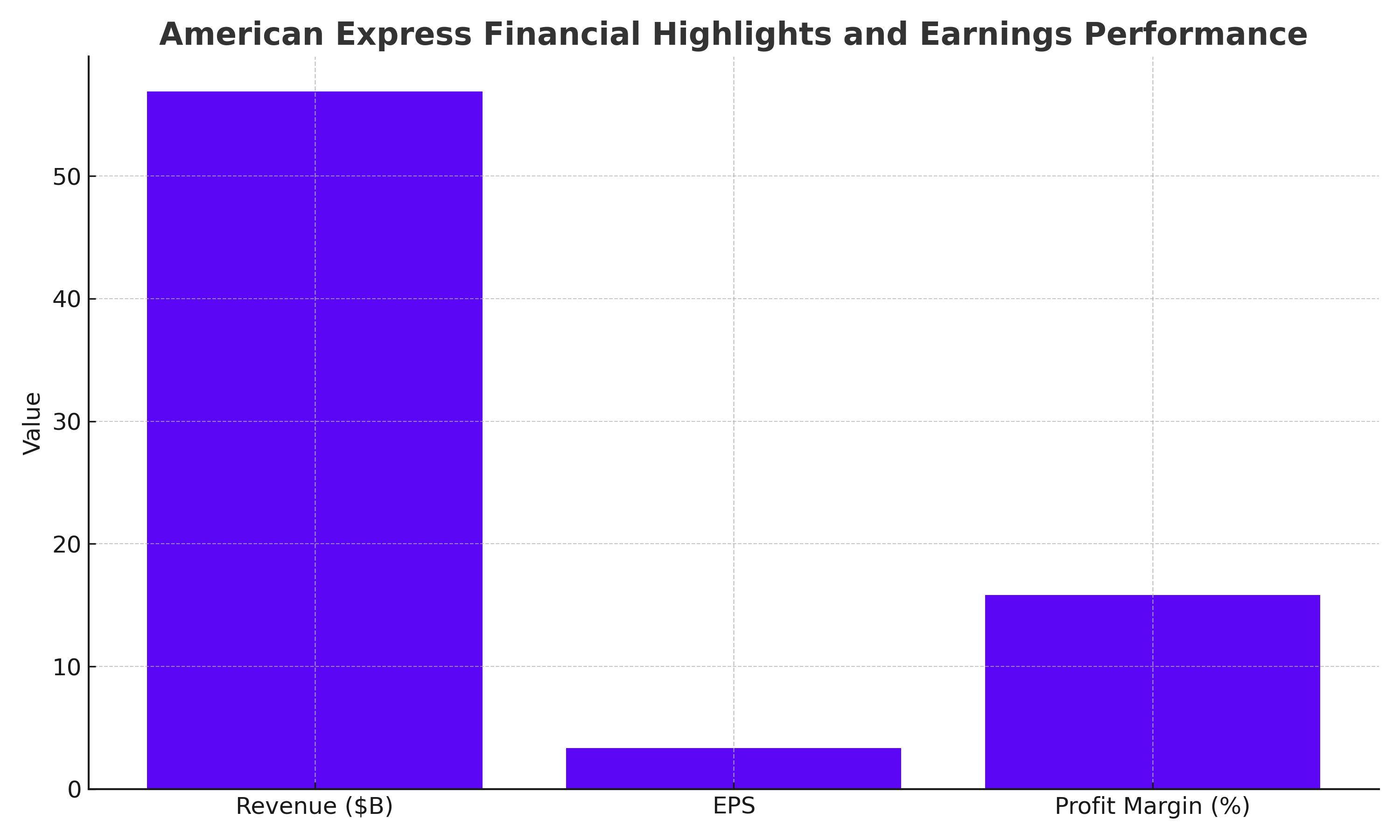

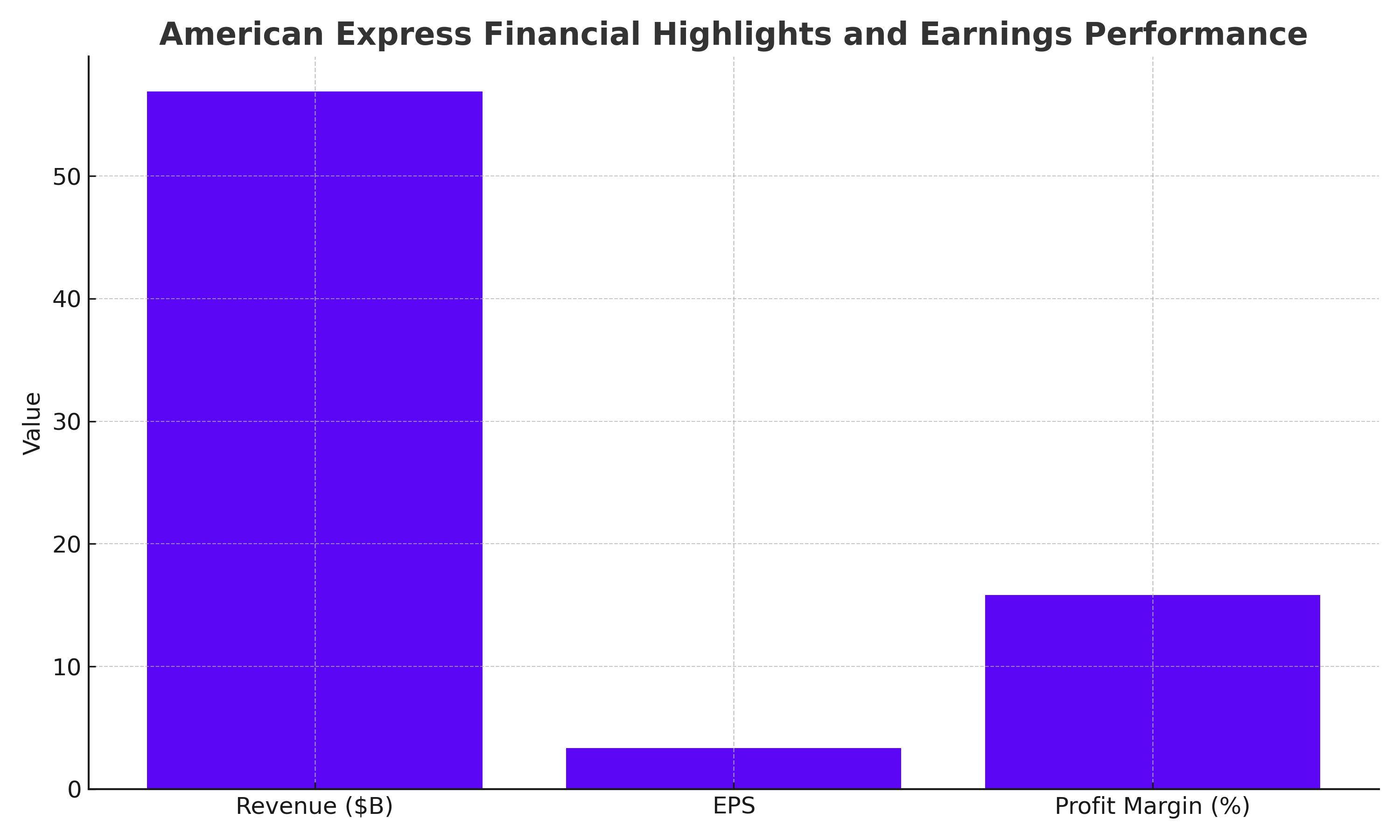

American Express reported a revenue of $56.9 billion over the trailing twelve months (TTM), translating to a revenue per share of $78.00. The company's profit margin stands at 15.81%, with an operating margin of 21.67%. In the first quarter of 2024, Amex’s earnings per share (EPS) rose significantly by 39% year-over-year to $3.33. The company’s focus on attracting high-spending, high-credit quality customers, particularly from the Millennial and Gen Z demographics, has driven this growth. The total cash on hand as of the most recent quarter is $53.78 billion, with a total debt of $50.75 billion, resulting in a debt-to-equity ratio of 176.43%.

Targeting Gen Z: A Strategic Growth Driver

Appealing to Younger Generations

American Express's strategy to attract and retain Gen Z and Millennial customers has been highly effective. Over 60% of new accounts come from these demographics, who value experiences over material possessions. Amex's premium benefits, such as lounge access, Uber credits, and other travel-related perks, align well with the lifestyle preferences of younger consumers. Gen Z's higher spending habits and loyalty further bolster Amex's growth prospects.

Insider Transactions and Shareholder Value

Insider Transactions and Shareholder Insights

Insider transactions have shown significant activity, influencing market perception and investor confidence. For detailed insider transactions, visit American Express Insider Transactions. The consistent growth in shareholder value is evident from the company's robust buyback programs and dividend payouts. The forward annual dividend rate is $2.80, with a yield of 1.22%.

Competitive Position and Market Dynamics

American Express vs. Competitors

American Express's forward P/E ratio of 17.89 compares favorably with Visa's 28.36 and Mastercard's 32.24, indicating potential for growth. The company's ability to maintain a high return on equity (ROE) of 32.85% showcases its efficient use of capital and competitive edge in the market. Despite concerns over rising credit card default risks, Amex’s high-credit-quality customer base provides a strong buffer against potential financial stress.

Q1 Earnings Call Highlights

Insights from Q1 Earnings Call

In the Q1 2024 earnings call, CEO Stephen Squeri emphasized the success in attracting high-spending, high-credit quality customers, particularly from the younger demographics. CFO Christophe Le Caillec highlighted a 15% growth in spending by Millennial and Gen Z customers, driving the highest billed business growth within this segment. The effectiveness of product refreshes and the launch of new benefits were also underscored as key factors in stimulating demand and engagement.

Valuation and Growth Prospects

Valuation Metrics and Future Growth

American Express's valuation appears reasonable with a forward P/E ratio of 17.89, reflecting a balanced risk-reward profile. Analysts forecast a 15% earnings per share growth for 2024 and 2025, indicating a robust growth trajectory. The PEG ratio (5-year expected) of 2.39 suggests that Amex is fairly valued given its growth prospects. If the company continues to expand its market share among Gen Z and Millennials, there is potential for the stock to rise further.

American Express's Resilience in Economic Downturns

Robust Financial Health and Risk Management

American Express’s strong financial health and effective risk management strategies provide a solid foundation to withstand economic fluctuations. The company's profit margin of 15.81% and operating margin of 21.67% indicate efficient operations and robust profitability. Additionally, American Express maintains a high return on assets (ROA) of 3.56% and an impressive return on equity (ROE) of 32.85%, highlighting its ability to generate substantial returns on investments.

Revenue Growth and Market Expansion

Impressive Revenue and Earnings Growth

American Express reported a 9.90% year-over-year increase in quarterly revenue, reaching $56.9 billion over the trailing twelve months. This growth is supported by the company’s strategic initiatives to enhance customer engagement and expand its market share. The company's diluted EPS for the same period was $12.14, reflecting strong earnings growth. Furthermore, the quarterly earnings growth of 34.20% year-over-year underscores the company’s capacity to generate substantial profit increases.

Focus on High-Spending Customers

The company's strategic focus on attracting high-spending, high-credit quality customers, particularly from younger demographics, has been a significant growth driver. Millennial and Gen Z consumers, who account for over 60% of new consumer account acquisitions globally, have contributed to a substantial increase in spending, driving higher revenue and profitability for American Express.

Strategic Initiatives and Product Enhancements

Innovative Product Offerings

American Express has continually refreshed its product offerings to meet the evolving needs of its customers. The introduction of new benefits, such as enhanced travel perks and exclusive access to events, has strengthened customer loyalty and engagement. These product enhancements are designed to appeal to the younger generation's preference for experiences, ensuring that Amex remains competitive and attractive.

Technological Advancements

Investments in technology have also played a crucial role in American Express's growth. The company has leveraged data analytics and digital platforms to enhance customer experience and streamline operations. This focus on technological innovation has enabled Amex to offer personalized services and maintain a competitive edge in the financial services industry.

Shareholder Returns and Dividend Policy

Attractive Shareholder Returns

American Express has a strong track record of returning value to its shareholders through dividends and share repurchases. The company’s forward annual dividend rate is $2.80, with a yield of 1.22%. Additionally, Amex has consistently reduced its share count through buybacks, enhancing the value of remaining shares. Over the years, this strategy has significantly increased earnings per share, providing substantial returns to long-term investors.

Dividend Growth

The company's commitment to dividend growth is evident from its payout ratio of 20.59%, which indicates ample room for future increases. This focus on shareholder returns, combined with robust earnings growth, makes American Express an attractive investment for income-focused investors.

Competitive Landscape and Market Position

Market Leadership

American Express holds a significant market share in the U.S. credit card industry, with a 12.36% share based on outstanding balances. The company’s strong brand recognition and premium product offerings position it well against competitors like Visa and Mastercard. American Express's ability to cater to affluent customers and provide superior rewards and services has enabled it to maintain a leadership position in the market.

Comparative Valuation

In comparison to its peers, American Express is attractively valued with a forward P/E ratio of 17.89. This is lower than Visa’s 28.36 and Mastercard’s 32.24, suggesting that Amex offers better value relative to its earnings growth potential. The company’s PEG ratio of 2.39 also indicates that it is reasonably priced considering its growth prospects.

Future Outlook and Strategic Focus

Growth Opportunities

Looking ahead, American Express is well-positioned to capitalize on several growth opportunities. The company’s focus on expanding its customer base among Millennials and Gen Z, coupled with its innovative product offerings, provides a strong foundation for future growth. Additionally, the company's strategic investments in technology and data analytics will further enhance its ability to attract and retain high-spending customers.

Economic Resilience

American Express's strong financial health and resilient customer base will help it navigate potential economic downturns. The company's strategic focus on high-credit-quality customers and effective risk management practices provide a buffer against rising credit card defaults and other economic challenges.

Conclusion: A Strong Buy Recommendation

Investment Thesis

Based on American Express's strong financial performance, strategic initiatives, and attractive valuation, the stock is rated as a strong buy. The company's ability to attract and retain high-spending customers, particularly from younger demographics, positions it well for continued growth. Furthermore, American Express's commitment to shareholder returns and robust financial health make it an attractive investment for both growth and income-focused investors.

For more detailed stock information and real-time updates, visit American Express Stock Profile.

American Express's strategic focus on premium benefits, innovative product offerings, and technological advancements, combined with its strong market position and resilient customer base, provide a compelling investment opportunity. As the company continues to align itself with the preferences of younger generations and capitalize on growth opportunities, it is well-positioned for sustained success and long-term value creation for shareholders.

That's TradingNEWS