Super Micro Computer's (NASDAQ: SMCI) AI-Fueled Growth: Is It the Next Big Stock to Watch?

Amidst market volatility, Super Micro Computer is redefining the AI server landscape. Is now the time to buy into NASDAQ: SMCI? Dive into our in-depth analysis | That's TradingNEWS

Stellar Performance Amidst Market Volatility Super Micro Computer, Inc. (NASDAQ :SMCI)

Super Micro has been one of the most compelling growth stories in the tech sector over the past year. Despite experiencing a significant 123% surge in its stock price, volatility has not spared this AI server specialist, as evidenced by a 37% decline since March. The recent fiscal Q4 2024 earnings miss has further shaken investor confidence, but the company’s strategic moves and impressive revenue growth suggest that there could be more upside in the future.

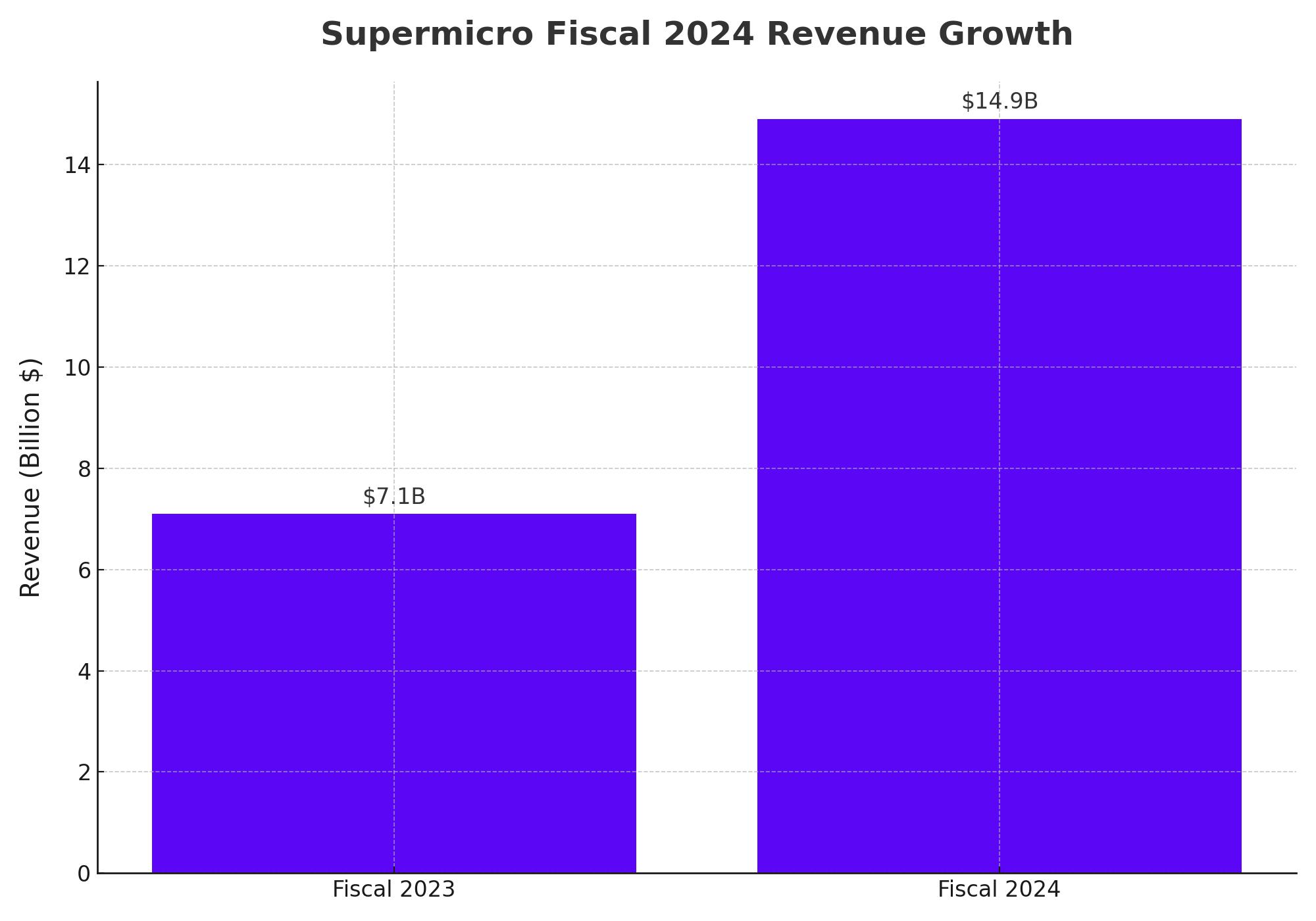

Record-Breaking Fiscal 2024 Performance

Supermicro ended fiscal 2024 with a staggering revenue of $14.9 billion, a 110% increase from $7.1 billion in fiscal 2023. This growth was largely driven by the booming demand for its AI server products, particularly its next-generation air-cooled and direct liquid-cooled (DLC) rack-scale AI GPU platforms, which accounted for over 70% of the company’s revenue. Non-GAAP net income rose to $22.09 per share from $11.81 in the previous year, underscoring the company’s ability to capitalize on the AI infrastructure boom.

Strong Future Guidance Despite Short-Term Setbacks

While the Q4 earnings miss was notable, the company's guidance for fiscal 2025 suggests continued robust growth. Supermicro has projected revenue of $28 billion to $30 billion, with expectations of a record-high backlog propelling it toward the upper end of this range. The new manufacturing facility in Malaysia, set to come online later this year, is expected to alleviate supply chain issues and support the company’s ambitious revenue targets.

Focus on Liquid-Cooled Servers: A Strategic Shift

Supermicro is betting heavily on the growing demand for DLC servers, which are poised to revolutionize data center energy efficiency. The company claims that these servers can reduce energy costs by up to 40% while enhancing computing performance. With predictions that 25% to 30% of new data centers in the next 12 months will adopt DLC technology, Supermicro is positioning itself as a leader in this emerging market. The company is rapidly expanding its DLC server rack capacity, anticipating that liquid-cooling will constitute 33% of the data center cooling market by 2028, up from 13% in 2023.

Market Share and Industry Growth

Supermicro’s growth in the AI server market has been nothing short of impressive. Bank of America estimates that the company’s market share could increase from 10% in 2023 to 17% by 2026. Even more bullish, KeyBanc Capital Markets projects that Supermicro could capture 23% of the AI server market this year. This optimism is supported by market research from TrendForce, which anticipates a 69% increase in AI server sales to $187 billion this year, with continued growth expected in 2025 as industry giants like Nvidia and AMD introduce new data center chips.

Institutional Interest and Insider Transactions

Institutional investors continue to show confidence in Supermicro, with entities like Sumitomo Mitsui Trust Holdings Inc. increasing their positions. As of the latest filings, institutional investors and hedge funds own 84.06% of SMCI shares, reflecting strong belief in the company's long-term prospects. However, insider transactions such as those detailed in SMCI’s insider transactions should be monitored closely, as they provide insights into the company’s internal confidence levels.

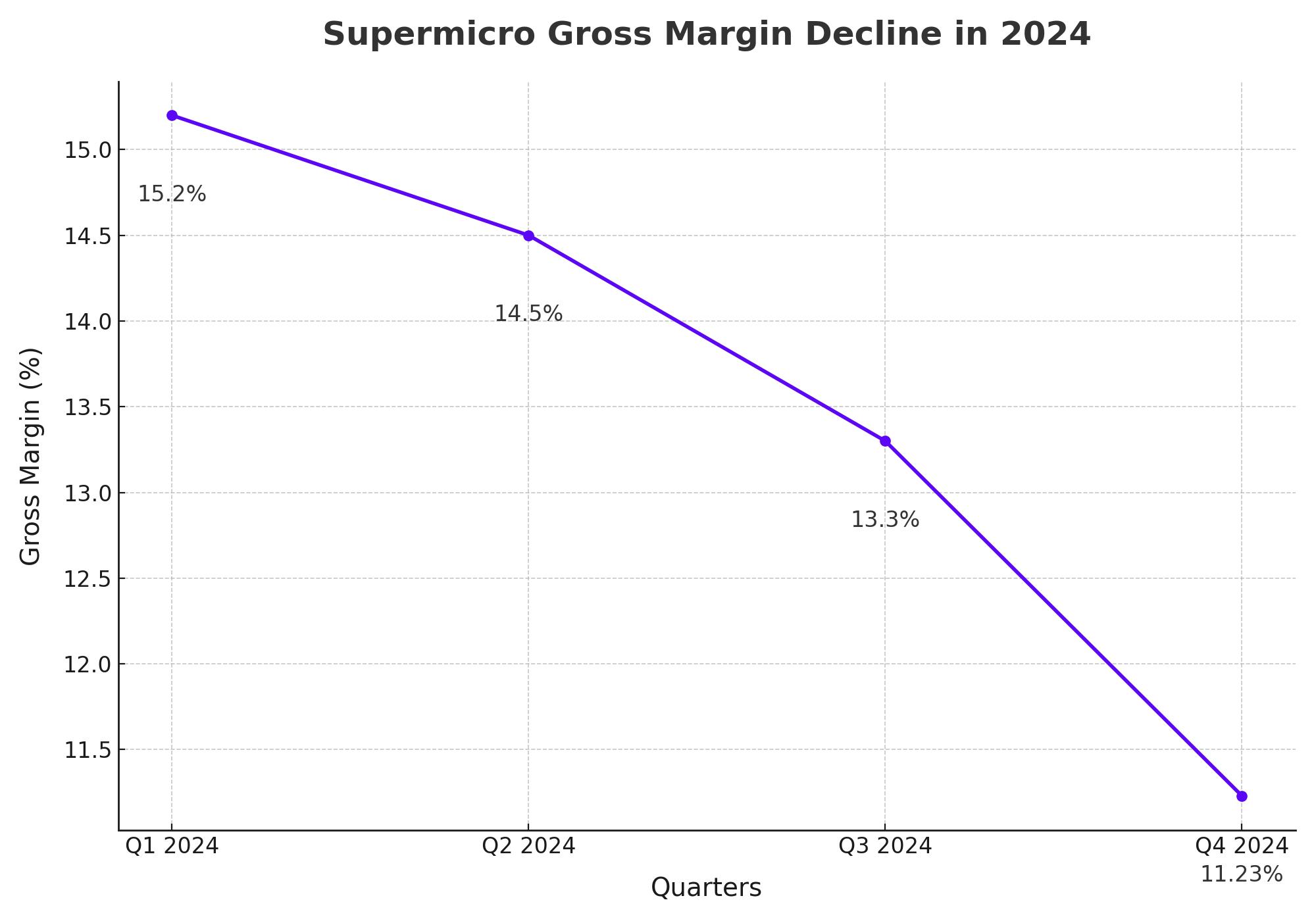

Earnings Impact and Stock Reaction

Despite the impressive top-line growth, Supermicro’s profitability took a hit in Q4, with gross margins falling to 11.23% from a five-year median of 15.83%. The steep drop was attributed to supply chain challenges and increased costs associated with ramping up DLC server production. The stock reacted sharply, dropping 20% after earnings, but this correction presents a potential buying opportunity for investors who believe in the company’s long-term growth story.

Valuation and Market Positioning

Supermicro’s forward P/S ratio of 1.29 is well below the IT sector median of 2.8, suggesting that the market may be undervaluing the company’s future revenue potential. The stock’s PEG ratio of 0.431 further indicates that SMCI is trading at an attractive valuation relative to its growth prospects. If Supermicro can maintain its growth trajectory and improve its margins, the stock could see significant upside, potentially reaching a market cap of $84 billion, a 57% increase from current levels.

Why (NASDAQ: SMCI) Is the Next Big Stock to Watch

Super Micro Computer, Inc. (NASDAQ: SMCI) has emerged as a pivotal player in the rapidly expanding AI server market, demonstrating extraordinary growth and potential. Despite recent volatility, which saw the stock surge 123% before a 37% pullback, SMCI’s strong fundamentals and strategic positioning make it a compelling investment opportunity. The company's record-breaking fiscal 2024 performance, with a staggering $14.9 billion in revenue, underscores its ability to capitalize on the AI infrastructure boom. As SMCI continues to innovate, particularly with its liquid-cooled servers, and capture increasing market share, it is well-positioned to deliver substantial returns in the coming years. This makes SMCI a stock worth watching closely, especially for those looking to invest in the future of AI and data centers.

Final Thoughts on (NASDAQ: SMCI)

Supermicro is at a pivotal moment in its growth story. The company’s aggressive expansion into AI servers and data center solutions positions it well for the future, but the short-term challenges cannot be ignored. Investors looking to capitalize on the AI boom may find SMCI an attractive option, especially at its current valuation. However, the stock’s volatility and the company’s margin pressures mean that it’s best suited for those with a higher risk tolerance.

For real-time updates on SMCI’s stock performance, investors should keep a close eye on upcoming earnings reports and any new developments in the company’s strategic initiatives.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex